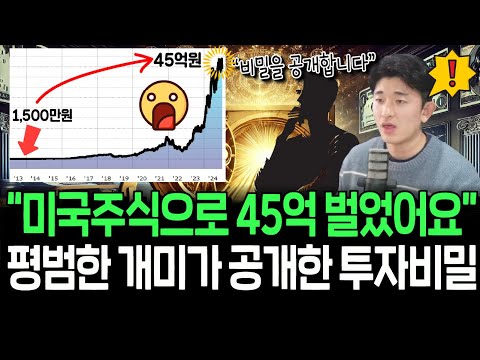

NVIDIA Long-Term Investment: How a 15 Million KRW Investment Became 4.5 Billion KRW

1. 11 Years of Investment Journey

- January 2013: A Japanese retail investor invested approximately 15 million KRW in NVIDIA.

- January 2025: The investment has grown to approximately 4.5 billion KRW.

- Despite numerous crises and sharp declines during the investment period, the investor did not sell the stock.

2. Why It's Necessary to Endure Crises

- Major Downturns:

- 2016: -25%

- 2018: More than halved

- 2020: -37% (COVID crash)

- 2022: -66%

- 2024: -27%

- Many investors sell stocks or consider taking profits during these downturns.

- However, enduring these crises is key for long-term success.

3. 4 Success Secrets of a Retail Investor

3.1. Separating Accounts by Purpose

- Long-term investment accounts are not checked daily.

- This strategy provides psychological stability and prevents being swayed by short-term volatility.

3.2. Choosing an Investment Style That Suits You

- The investor tried day trading, leverage, and all-in investments but realized they were not suitable.

- Shifted to long-term investing: Finding an investment style most suitable for their personality.

3.3. Not Being Swayed by Trends

- Avoided investments after an issue became popular.

- The success was possible because they entered before the market cooled down.

3.4. Investing Only in Stocks You Understand

- The investor worked in a NVIDIA-related industry, gaining a deep understanding of the company.

- They could feel the core business model and growth potential of the invested company firsthand.

4. Lessons Learned: Investment Habits That Lead to Failure

4.1. The Risk of Leverage

- Leverage can maximize returns but makes recovery difficult in a bear market.

- Especially, leverage is often liquidated if the drop is more than 30%.

4.2. Psychological Burden of All-In Investments

- Putting all funds into a specific stock -> significant stress during declines.

- To maintain an appropriate proportion, it is advisable to limit the weight of one stock to 30% or less.

4.3. Investing in Stocks That Are Difficult to Withstand Volatility

- Examples: Highly volatile stocks like Tesla and NVIDIA experience an average drop of -30%~40% annually.

- Those who cannot withstand this volatility should consider low-volatility stocks (e.g., Microsoft).

5. Key Points of Long-Term Investing

- Necessity of Long-Term Investment Accounts: Ignoring short-term volatility and looking at the long-term value of the company.

- Diversification: Not putting all-in on one stock but diversifying into about 20.

- Continuous Learning: Increasing understanding of the companies you plan to invest in and strengthening access to information.

< Summary in English >

NVIDIA Long-Term Investor: Turning 15 Million KRW into 4.5 Billion KRW in 11 Years

1. Investment Journey (2013-2025)

- Invested 15 million KRW in NVIDIA stock in January 2013.

- Grew to approximately 4.5 billion KRW by January 2025.

- Survived multiple downturns but held the stock through all volatility.

2. Core Challenges

- Major declines:

- 25% in 2016,

- 50%+ in 2018,

- 37% in 2020,

- 66% in 2022,

- 27% in 2024.

- Long-term patience and conviction were critical to overcoming these downturns.

3. 4 Key Success Strategies

- Separate accounts: Long-term accounts left untouched to reduce stress from market fluctuations.

- Matched investment style: Avoided short-term trading and leveraged bets in favor of long-term focus.

- Ignored the hype: Avoided buying stocks that were trendy at the moment.

- Deep understanding of the stock: Familiarity with NVIDIA’s business as an industry insider.

4. Pitfalls to Avoid

- Leveraged products: Risk of liquidation during market drops.

- Single stock concentration: Exceeding 30% allocation in one stock increases risk and stress.

- Inappropriate volatility tolerance: Avoid high-volatility stocks (e.g., Tesla, NVIDIA) if dips are intolerable.

5. Key Takeaways

- Diversify investments and maintain 20 or fewer stocks in a portfolio.

- Focus on companies you understand deeply.

- Long-term success requires ignoring short-term noise and trusting in the company’s fundamentals.

- Crafted by Billy Yang

- [Related Post at Next-Korea.com]

NVIDIA Success Analysis and Investment Appeal

Top 3 Long-Term Investment Success Strategies

*YouTube Source: [소수몽키]

– 1,500만원으로 45억 벌었다? 평범한 개미가 알려주는 투자성공 비결

[Korean Summary]

[소수몽키]

“1,500만원으로 45억 벌었다? 평범한 개미가 알려주는 투자성공 비결“

1. 11년 동안의 투자 여정

- 2013년 1월: 일본인 개미 투자자, 엔비디아에 원화로 약 1,500만 원 투자.

- 2025년 1월: 현재 투자금이 약 45억 원으로 성장.

- 투자 기간 동안 수많은 위기와 급락 구간에도 불구하고 주식을 매도하지 않음.

2. 위기를 버텨야 하는 이유

- 주요 하락 구간:

- 2016년: -25%

- 2018년: 반토막 이상 급락

- 2020년: -37% (코로나 폭락)

- 2022년: -66%

- 2024년: -27%

- 많은 투자자들이 이런 하락 구간에서 주식을 매도하거나, 수익 실현(익절)을 고민하게 됨.

- 하지만 장기적인 성과를 위해 이런 위기를 견디는 것이 핵심.

3. 개미 투자자의 성공 비결 4가지

3.1. 계좌 용도별 분할

- 장기 투자를 위한 계좌는 매일 보지 않는다.

- 심리적인 안정감을 얻고, 단기 변동성에 휩쓸리지 않기 위한 전략.

3.2. 자신에게 맞는 투자 스타일 선택

- 초단타, 레버리지, 몰빵 투자를 시도했으나 이는 자신과 맞지 않음을 깨달음.

- 장기 투자로 방향 전환: 자신의 성향에 가장 적합한 투자 스타일 찾기.

3.3. 유행에 휩쓸리지 않기

- 이슈가 된 뒤에는 오히려 투자를 피함.

- 시장의 열기가 식긴 전에 들어갔기 때문에 가능한 성과.

3.4. 이해하는 주식에만 투자

- 엔비디아 관련 업종에서 일하면서 기업을 깊이 이해.

- 투자한 기업의 핵심 비즈니스 모델, 성장 가능성을 피부로 느낄 수 있었음.

4. 반면 교사: 실패를 부르는 투자 습관

4.1. 레버리지의 위험성

- 레버리지는 수익률을 극대화할 수 있지만 하락장에서 복구가 어려움.

- 특히, 하락폭이 30% 이상이면 레버리지가 청산되는 경우가 다수.

4.2. 몰빵 투자의 심리적 부담

- 특정 종목에 자금 몰빵 -> 하락 시 큰 스트레스.

- 적정 비중을 유지하려면 1개 종목 비중은 30% 이하로 제한하는 것이 바람직.

4.3. 변동성을 견디기 어려운 종목 투자

- 예: 테슬라, 엔비디아 같은 고변동성 주식은 평균 -30%~40% 하락을 매년 겪음.

- 이 변동성을 견디기 어려운 사람들은 저변동성 주식(예: 마이크로소프트)을 고려.

5. 장기 투자의 핵심 포인트

- 장기 투자 계좌의 필요성: 단기 변동성을 무시하고 장기적인 기업 가치를 바라봐야 함.

- 종목 다각화: 한 종목에 올인하지 않고 20개 내외로 분산 투자.

- 꾸준한 학습: 투자하려는 기업에 대한 이해도를 높이고, 정보 접근성을 강화해야 함.

< Summary in English >

NVIDIA Long-Term Investor: Turning 15 Million KRW into 4.5 Billion KRW in 11 Years

1. Investment Journey (2013-2025)

- Invested 15 million KRW in NVIDIA stock in January 2013.

- Grew to approximately 4.5 billion KRW by January 2025.

- Survived multiple downturns but held the stock through all volatility.

2. Core Challenges

- Major declines:

- 25% in 2016,

- 50%+ in 2018,

- 37% in 2020,

- 66% in 2022,

- 27% in 2024.

- Long-term patience and conviction were critical to overcoming these downturns.

3. 4 Key Success Strategies

- Separate accounts: Long-term accounts left untouched to reduce stress from market fluctuations.

- Matched investment style: Avoided short-term trading and leveraged bets in favor of long-term focus.

- Ignored the hype: Avoided buying stocks that were trendy at the moment.

- Deep understanding of the stock: Familiarity with NVIDIA’s business as an industry insider.

4. Pitfalls to Avoid

- Leveraged products: Risk of liquidation during market drops.

- Single stock concentration: Exceeding 30% allocation in one stock increases risk and stress.

- Inappropriate volatility tolerance: Avoid high-volatility stocks (e.g., Tesla, NVIDIA) if dips are intolerable.

5. Key Takeaways

- Diversify investments and maintain 20 or fewer stocks in a portfolio.

- Focus on companies you understand deeply.

- Long-term success requires ignoring short-term noise and trusting in the company’s fundamentals.

- Crafted by Billy Yang

- [관련글 at Next-Korea.com]

엔비디아의 성공 분석 및 투자 매력

장기 투자 성공 전략 TOP 3*유튜브 출처: [소수몽키]

- 1,500만원으로 45억 벌었다? 평범한 개미가 알려주는 투자성공 비결