● US Economy Faces Shocking Contraction Is Recession Imminent

1. PC News and Changes in Consumer Spending – Latest Figures and Questions Raised

In PC-related news, PC indicators reportedly rose 2.5% YoY.

It showed a 0.3% increase compared to the previous lineup, a 2.6% annual increase based on the core, and a 0.3% increase compared to the previous month.

The previous month’s Eco index rose slightly from 2.8 to 2.9%, raising suspicions in the market.

Meanwhile, inflation-adjusted consumer spending fell 0.5%, recording the largest drop in about four years.

In particular, the decrease in automobile purchases and recreational goods had a major impact.

Although prices have slowed, the stability of economic growth is questionable if the decline is due to a contraction in consumption.

2. Bond Market and Interest Rate Trends – Signals of Economic Slowdown Detected

The 10-year Treasury yield showed a downward trend after initial conflicts, recording fluctuations averaging below 4%.

Concerns about an economic slowdown are growing in the bond market.

As a result, expectations for interest rate cuts are growing in the market, and the stock market is also reacting positively to interest rate cut news.

3. GDP Now Indicator Update and the Aftermath of Trade Disputes

The recently updated GDP Now data shocked with a prediction that the U.S. first-quarter GDP will grow by -1.5%.

GDP is composed of consumption, investment, government spending, and net exports, and net exports have a negative impact on the overall growth rate.

The fact that the consumption growth rate fell from 2.3 to 1.3, and the insufficient effect of Wall Street’s tariff policy had a significant impact on the GDP outlook.

Expectations for interest rate cuts at the end of the year are increasing, and the stock market is showing a shift away from conflict and towards a positive direction.

4. Diplomacy and Tariff Issues – Trump’s Diplomatic Warfare and Ukrainian Negotiations

A heated debate took place between President Trump and Ukrainian President Zelensky over the signing of a mineral agreement during their meeting.

Trump claimed that he wanted peace and emphasized the burden of U.S. trade disputes and tariff policies.

Zelensky demanded a realistic solution that could guarantee Ukrainian security, and the conversation developed tensely, with him ultimately refusing to sign.

At the same time, Trump’s diplomatic strategy is showing an increasingly complex aspect in conjunction with the tariff effects expected by the U.S. government.

5. Agriculture and Food Prices – Tariff Effects and Agricultural Sector Deficits

As the U.S. food import ratio has increased significantly compared to the past, the agricultural trade deficit is expected to reach a record high of $49 billion.

Problems have been pointed out, such as increased imports of coffee, sugar, avocados, and orange juice, and lagging behind in wheat export competition.

The U.S. agricultural sector is turning its eyes to high value-added industries such as ethanol, but there are concerns that tariff imposition will increase pressure on food price increases.

In particular, rising food prices are likely to directly affect the prices of shopping baskets, increasing the burden on the lives of ordinary people, and posing a challenge to the U.S. government’s fiscal policies.

We have examined the latest trends in the global economy as a whole.

We have detailed the rise in PC-related indicators and the decrease in consumer spending, interest rate trends seen in the bond market, and concerns about economic slowdown due to the U.S. GDP Now indicator update.

Various issues such as diplomatic warfare between Trump and Zelensky, tariff effects and trade disputes, and rising food prices due to agricultural sector deficits are having a complex impact on the economic outlook.

Major global economic keywords such as economic outlook, interest rate trends, trade disputes, and fiscal policy are included in this analysis, which will help you understand future economic trends.

Analysis of the Latest Global Economic Trends and Economic Outlook

This article summarizes the latest trends in the global economy, economic outlook, interest rate trends, trade disputes, and major issues related to fiscal policy.

PC News and Consumption Indicators

A rise in PC indicators and a decrease in consumer spending were observed simultaneously.

Bond Market and Interest Rate Trends

Fluctuations in the 10-year Treasury yield and concerns about economic slowdown in the bond market are detected.

GDP Now Update and Trade Disputes

Analyzes the impact of the U.S. GDP’s negative growth forecast and tariff effects on the overall economy.

Diplomatic Warfare, Tariffs, and Agricultural Sector Deficits

Explains the impact of conflict between Trump and Zelensky, tariffs, and agricultural sector deficits on food prices.

[Related Articles…]

The Other Side of Trump’s Diplomatic Warfare and Tariff Policy

GDP Negative Growth, Warning of Economic Outlook

*Source : [Maeil Business Newspaper] [홍장원의 불앤베어] 미국 경제, 충격의 1분기 마이너스 성장 예측. 관세가 미국을 침체로 몰고가나. 금리인하 기대감 상승에 증시는 반전.

● Stock and Coin Apocalypse? (Trump Factor)

Economic Outlook and Stock Market Analysis

1. The Night Watchman and NASDAQ’s Rapid Changes

From the role of a watchman monitoring the market until dawn,

I witnessed NASDAQ briefly stabilizing

before plummeting after a certain point.

In fact, the NASDAQ fell by approximately 2.78% the previous day,

with a significant drop centered around technology stocks.

These movements are important signals in terms of

financial market outlook and investment strategies that affect the overall global economy.

2. Contrast Between Traditional and Tech Stocks, and Safe Assets

Companies with traditional business models, such as the Dow Jones,

experienced smaller declines compared to tech stocks.

On the other hand, tech stocks, especially overvalued companies,

saw their stock prices fall significantly from their peaks.

Additionally, risky assets like Bitcoin also

fell below the important support line of $80,000,

showing a sharp decline.

This phenomenon indicates the extent of volatility in the stock market

and what kind of response strategies investors should establish.

3. Bitcoin Volatility and Investment Psychology

Assets with a structurally inherent risk of a 70% or greater decline, like Bitcoin,

can impose a psychological burden if held in excessive proportions.

Since there have been multiple cases of declines exceeding 70% from previous peaks,

investors should always keep volatility in mind.

In other words, investment strategies should be established

by managing risk with a small proportion.

4. Trump’s Tariff Policy and Stock Market Volatility

Uncertainty stemming from President Trump’s tariff policies

has played a major role in the recent stock market decline.

In particular, the news of a 25% tariff on Canada and Mexico

and an additional 10% tariff on Chinese products

has further destabilized the market.

However, it is unlikely that the stock price will fall excessively

due to the tariff issue alone,

and an adjustment similar to the situation in the 2018 stock market

is expected.

5. Bond Preference and Stock Market Stabilization Efforts

In situations where uncertainty is increasing,

investors are shifting funds to safer bond assets.

Liquidity across the market is being adjusted

along with rising bond yields.

In times like these, it is necessary to focus on

corporate performance and long-term investment strategies

rather than short-term stock price volatility.

6. Future Outlook and Investment Considerations

Although the tariff implementation date is approaching,

it is expected that Trump’s policy direction will have

some flexibility as there is still time left.

Companies with strong performance have high stock price defense,

but companies with high multiples may be

vulnerable to volatility.

Ultimately, the overall stock market will be

influenced by various factors such as the global economic trend

and the Fed’s interest rate hikes,

and investors should

re-establish their investment strategies

by comprehensively considering all these factors.

< Summary >

Focusing on the outlook for the global economy and financial markets,

the rapid decline in NASDAQ and

technology stocks is intensively analyzed from the perspective of a watchman who monitored the stock market until dawn.

It comprehensively covers the contrast between traditional and tech stocks, Bitcoin volatility,

market instability factors due to Trump’s tariff policies,

and the preference for safe assets such as bonds.

As the stock market may be adjusted

depending on various variables such as future tariff implementation and policy changes,

and the Fed’s interest rate hikes,

investors should consider performance and long-term investment strategies.

Key SEO Keywords: Global Economy, Financial Market Outlook, Investment Strategy, Stock Market, Economic Trends.

[Related Posts…]

*Source : [내일은 투자왕 – 김단테] 주식, 코인 멸망인가? (ft. 트럼프)

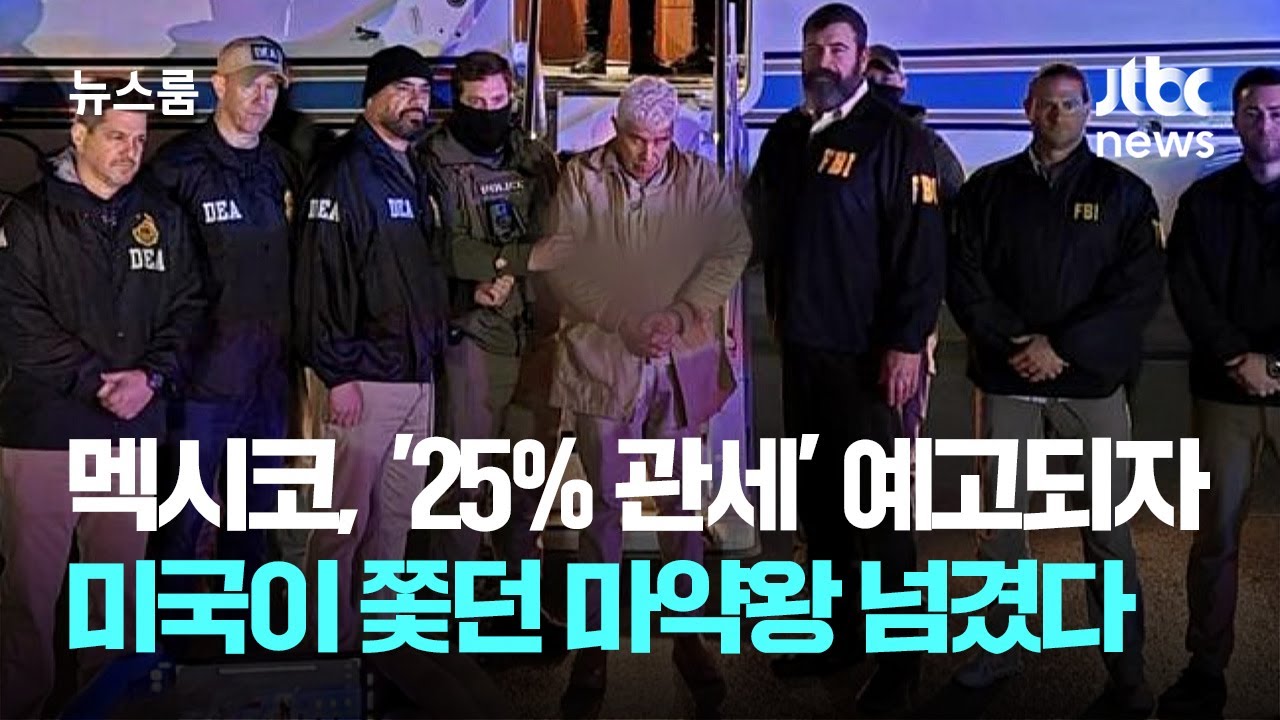

● Drug Kingpin Delivered Amid Tariff Threat

U.S.-Mexico Trade Dispute and Drug War: Economy, Law Enforcement, Global Outlook

1. Tariff Notice and Development of Trade Dispute

The U.S. has warned Mexico of imposing a 25% high tariff, demanding efforts to resolve the drug problem as a condition for suspending the tariff.

As President Trump threatened a tariff bomb, the Mexican government proceeded to arrest a drug kingpin who had been tracked for 40 years as a countermeasure.

This action is predicted to be an important variable in U.S.-Mexico trade negotiations.

From the perspective of economic news and global economic outlook, the repercussions of the trade dispute may affect global market trends.

2. Drug Cartel Investigation and Law Enforcement Process

The U.S. has offered a huge reward of 20 million dollars, or more than 26 billion won, and has been searching for drug kingpin Quintero for 40 years.

During the tariff negotiations, the Mexican government extradited Quintero and eight high-ranking cartel members to the U.S. to resolve the drug problem.

Quintero was arrested for torturing and murdering a U.S. Drug Enforcement Administration agent in 1985, but was released in 2013 by a Mexican court ruling.

The helicopter crash that occurred during the arrest, which resulted in 14 deaths, remains a major issue.

The U.S. Department of Justice has announced strong measures against Quintero, who could face the death penalty or life imprisonment.

3. Mexican Government’s Response and International Negotiations

The Mexican government’s efforts to resolve the drug problem have emerged as a major diplomatic negotiation task in conjunction with President Trump’s tariff policy.

Attention is focused on how economic relations and trade negotiations between the two countries will develop depending on the outcome of the negotiations.

These events are expected to have a significant impact on major SEO keywords related to the economy, such as the U.S. economy, the global economy, and trade disputes.

4. Repercussions on Economic and Global Market Trends

This case goes beyond simple law enforcement and opens a new phase in the U.S.-Mexico trade dispute.

As tariffs and drug wars proceed simultaneously, the repercussions on global market trends and economic news are expected to be significant.

In particular, international investors are likely to react sensitively to policy changes in the two countries, so it is necessary to pay attention to the global economic outlook.

It is time to continue to pay close attention to detailed information along with the U.S. economy and market trends, and economic news.

< Summary >

– A trade dispute broke out as the U.S. warned Mexico of imposing a 25% high tariff.

– As a condition for tariff negotiations, Mexico extradited a drug kingpin and cartel members who had been wanted for 40 years to the U.S.

– 14 people died in a helicopter crash during the arrest of Quintero, and the U.S. Department of Justice responded strongly.

– This incident is expected to have a major impact on diplomatic and trade negotiations between the U.S. and Mexico and the global economy.

– SEO keywords such as economic news, the global economy, the U.S. economy, trade disputes, and market trends are important.

[Related Articles…]

*Source : [JTBC News] ‘25% 관세’ 예고되자…미국이 40년간 쫓던 마약왕 넘긴 멕시코 / JTBC 뉴스룸