● Trump Surrenders, Market Bottom Deja Vu?

Trump’s Tariff Changes and Market Rebound: Latest Global Economic Trends

[1] Key News and Tariff Policy Announcements During the Week and Weekend

Trump announced a 90-day tariff suspension during the week.

Over the weekend, news of mutual tariff exemptions for smartphones, PCs, and semiconductors came as a surprise.

The market interprets this policy change as having a positive impact on short-term rebounds.

In this news, the key aspects are the expansion of production within the United States and the conditions for tariff exemptions.

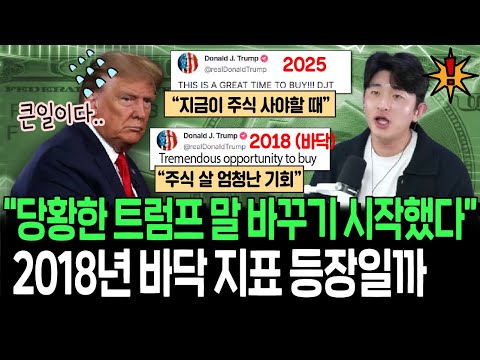

[2] Historical Comparison with 2018 and Trump’s Negotiation Skills

The case of Tim Cook negotiating with Trump in 2018 to secure tariff exemptions is being repeated.

At that time, tariff reductions were implemented on the condition of expanding production in the United States by major companies like Apple.

In a similar structure, the expansion of manufacturing in the United States and tariff exemptions are once again the key issues.

Trump has had a significant impact with just a few words, influencing market sentiment, stock price rebounds, and triggering Trump puts.

[3] Stock and Bond Market Reactions and Financial Stability

Stocks started with a 3% rise in the NASDAQ following the tariff suspension and exemption news.

After Trump’s remarks, a V-shaped rebound momentum appeared in the stock market along with a record rebound.

At the same time, concerns about a crash in the US bond market and a sharp rise in interest rates have been raised.

The bond crash is intertwined with changes in the holdings of foreign countries such as Japan and China, and institutional selling movements.

[4] Background of Tariff Policy Changes and Personnel Changes

A shift from hardliners to moderates is visible within the Trump administration.

Market-friendly figures such as Treasury Secretary Bencent are emerging, reshaping their role in tariff negotiations.

At the same time, signs of a somewhat more moderate atmosphere are emerging in trade negotiations with major counterparts such as China.

The market is forming expectations for a move to limit tariff imposition to specific countries instead of indiscriminate tariffs.

[5] Future Outlook and Investment Strategy

In the short term, technology, semiconductor, and big tech stocks are expected to rebound, buoyed by tariff exemption news.

The Fed’s liquidity supply and the start of earnings season may act as factors in forming a bottom for the stock market.

However, concerns about bond market instability, rising global interest rates, and the stability of US bonds remain variables.

Investors should approach with cautious strategies such as dollar-cost averaging, along with a long-term investment perspective.

< Summary >

Summary

Key News

Trump announced a 90-day tariff suspension and tariff exemptions for smartphones, PCs, and semiconductors.

Historical Comparison

The process is proceeding under similar conditions to the case of negotiating with Tim Cook in 2018.

Market Reaction

Stocks are fluctuating with V-shaped rebound momentum, while bonds are fluctuating with concerns about rising interest rates.

Policy Background

The shift from hardliners to moderates and the rise of market-friendly figures such as Treasury Secretary Bencent are prominent.

Prospects and Strategies

Along with expectations of a short-term rebound, attention should be paid to Fed liquidity, earnings season, and global interest rate variables.

Keywords: US-China Trade, Trump, Tariffs, Rebound, Bond Market

< Summary >

[Related Articles: Latest Tariff Negotiation News, Rebound Prospects Analysis]

*YouTube Source: [소수몽키]

– 약점 들킨 트럼프 결국 항복? 2018년 증시 바닥 지표 데자뷰일까