● .**Real Estate Tsunami – Seoul Surge, Doom**

Analysis of Real Estate Market Transformation and Future Investment Strategies in the Lee Jae-myung Era

1. Impact of Monetary and Fiscal Policy Shift on the Real Estate Market

The full-scale implementation of interest rate cuts and supplementary budget policies is expanding liquidity supply.This shift in monetary and fiscal policies is profoundly affecting the real estate market as a whole, with both expectations and concerns about real estate investment intensifying.Considering the overall economic flow and investment market prospects, changes in interest rates and fiscal policies are becoming important indicators for investors.It is time to carefully examine the impact of future policy changes on the real estate market structure.

2. Polarization Phenomenon: Seoul·Han River vs. Unsold Supply Dilemma in Provinces

Prime real estate centered around Seoul, Gangnam, and the Han River belt is showing momentum for a rebound.On the other hand, provincial areas, including the five major metropolitan cities, are facing significant difficulties due to unsold inventory and oversupply issues.This regional polarization phenomenon is an important variable to consider when making investment decisions.Attention should be paid to how the details of economic and fiscal policies will affect the polarization phenomenon.

3. Future Investment Strategy: ‘One Smart Home’ Craze and Beyond

With the launch of the new government, a single investment strategy represented by ‘one smart home’ is being highlighted.Experts advise that it is necessary to move away from single-family home investment and build a diverse investment portfolio in the future.Investment strategies based on changes in the overall economy, especially interest rates and fiscal policies, are emerging as key issues, not just real estate.It is time to carefully review the direction of practical investment and practical application methods.

4. Emergence of New Variables: AI, Human Robots, and Changes in Industrial Paradigm

Recent advances in artificial intelligence (AI) and human robot technology have the potential to completely transform existing industrial paradigms.These technological innovations are sending new reorganization signals to real estate demand in the Seoul metropolitan area and are expected to affect the overall economy and investment market.The convergence of technology and traditional industries may bring changes to real estate valuation standards and market structures, requiring investor attention.

5. New Government Response Strategies and Investment Risks from Expert Discussions

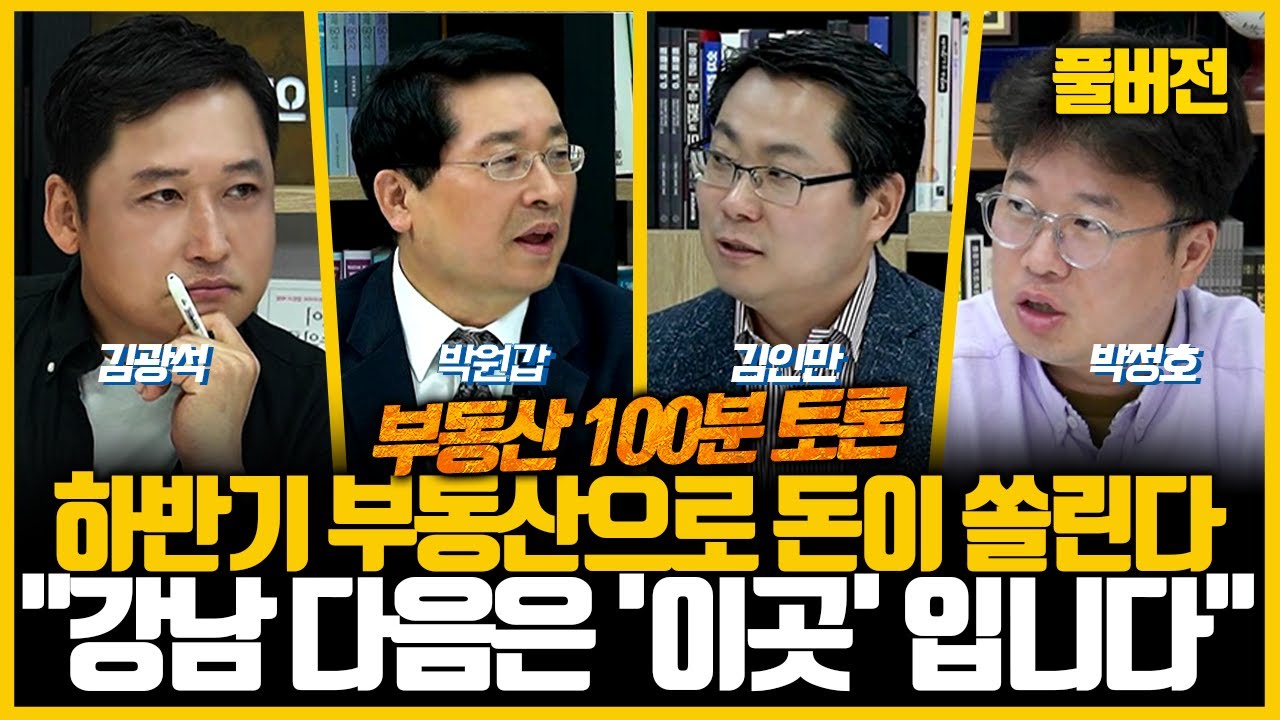

In-depth discussions involving four experts addressed how the new government’s monetary and fiscal policies would restructure real estate investment.Insights from renowned figures such as Kim Kwang-seok, Kim In-man, Park Jeong-ho, and Park Won-gap provide sharp analysis on future real estate rising areas, changes in valuation standards, and policy pitfalls.Investors need to refer to these expert opinions to establish long-term plans and carefully analyze real estate and economic-related risk factors.

< Summary >The shift in monetary and fiscal policy is expanding interest rate cuts and liquidity supply,Real estate rebound in Seoul and Han River areas and the dilemma of unsold supply in the provinces show a polarization phenomenon.A re-evaluation of future investment strategies is needed along with the ‘one smart home’ craze,Technological advances such as AI and human robots are providing new variables to real estate and the economy as a whole.Analyzing the impact of the new government’s policies through expert discussions, investors should focus on risk management and strategy establishment based on this.

[Related Articles…]• Analysis of Interest Rate Cut Effects and Real Estate Investment Strategies• Outlook on Fiscal Policy Changes and Economic Polarization

*YouTube Source: [ 경제 읽어주는 남자(김광석TV) ]

– [풀버전] 이재명 시대 부동산 시장, 판이 바뀐다. ‘똘똘한 한채’ 열풍이 옮겨갈 다음 투자처는? | 부동산 100분토론 (박원갑, 김인만, 박정호, 김광석)