● Trump-AI-Bubble-GS-Fed-Meltdown

Key US Stock Investment Strategies and Global Economic Outlook Analysis for the Second Half of 2025

1. Trump and AI: New Changes in the Investment Landscape

Recently, Trump’s declaration of AI victory has brought a new wave to the global investment market. This section examines the impact of his statements on the stock market and the specific stocks he has highlighted. It analyzes the psychological effects of Trump’s messages on investors and the criteria for selecting key stocks, presenting investment strategies that include prominent SEO keywords such as economic outlook and global economy.

2. GS Report and Investment Opportunities One Year Later

GS’s latest report provides specific forecasts on earning opportunities one year from now. The report clearly reveals potential volatility and growth prospects within the stock market. During this period, it is necessary to focus on the stock market as one of the global economic trends and investment strategies, while carefully considering the performance of major companies and global security factors. This section summarizes actionable information that investors can apply in practice, based on the analysis of the report.

3. Fed Policy Changes and the Possibility of a Real Bubble Market

As signals of the Fed gradually relenting become apparent, concerns are growing about the possibility of a real bubble market forming. Focusing on the impact of the Fed’s policy changes on the financial market, it is acting as a crucial variable in the economic outlook. This stage utilizes key SEO keywords such as global economy, Fed, stock market, and investment strategies, providing a detailed analysis to help investors understand both the risks and opportunities in the market. In particular, it provides detailed guidance on safeguards and countermeasures that investors should pay attention to along with the bubble market risk.

4. US Stock Investment in the Second Half: Key Practical Trading Know-How

US stock investment in the second half of 2025 must include essential information for practical trading. Investment strategies and stock price volatility analysis reflecting the major issues in the US stock market and global economic trends are essential. With investment strategies that integrate various factors such as AI, Trump, GS reports, and Fed policy changes, it is systematically organized from the perspective of an economic outlook expert so that readers can quickly grasp the core content. In addition, real-time market data and SEO keywords related to the global economy are naturally reflected to provide investors with useful information.

[Related Articles…]Analysis of Trump’s AI Victory and Impact on the Stock MarketIn-Depth Exploration of Fed Policy Changes and the Possibility of a Bubble Market

*YouTube Source: [ 소수몽키 ]

– AI승리 선언한 트럼프, 대놓고 찍어준 주식들 / 지금부터 1년이 돈벌 기회? GS의 보고서 / 결국 연준의 항복이 시작된다? 찐버블장 올까

● Ukraine War Tech, AI, Economic Shockwave

Ukraine War Development and Global Economic Outlook: From Military & Geopolitics to AI & Advanced Weapon Strategies

1. Early and Mid-War Transition – A Chronological Look at the War Situation

The Ukraine war began to change drastically from the beginning of 2023. By mid-2023, the war situation had already been decided, and weapon support from the United States and Europe had also reached its limits. Ukraine’s depletion of armaments and the resulting accumulation of damage were decisively impacted by the Kursk invasion in early 2024, dramatically altering the war situation. In this process, Ukraine has fallen into a quagmire of resource attrition warfare and is at increasing risk of being driven to near-surrender. From the perspective of economic growth and geopolitical risk, the outcome of the war has a significant impact on the global economic outlook worldwide. In particular, it is likely to cause negative repercussions for the defense industry and energy policies of the United States and Europe.

2. Advanced Weapons and AI Technology – Core Innovations Changing the Game of War

The nature of warfare is rapidly shifting from traditional mechanized combat to innovative high-tech warfare. Initially, drones and remote-controlled reconnaissance and attacks were the mainstays, but now AI and satellite networks play a pivotal role in combat. In the space and electronic warfare sectors, Russia is showcasing a drone autonomous combat system through artificial satellite control, redefining military technology competitiveness worldwide. This change is determining the future of military technology and the defense industry, and is expected to impact spending patterns across the economy.

3. US, China, Russia, and NATO – Balance of Power and Geopolitical Restructuring

The complex balance of power among the United States, China, Russia, and NATO member states is being reshaped along with the war. The United States and Western countries continue to support Ukraine, but the limits of weapon supply and the burden of defense spending are increasing. China is exerting significant influence in the US defense industry and military technology competition through the supply of military components and advanced technology support. At the same time, NATO is demanding that member states increase defense spending to 5% of GDP, triggering significant changes in each country’s economy, defense industry, and energy policy.

4. Future Prospects and Impact on the Overall Economy

The possibility of Ukraine’s surrender is being raised as a scenario for the end of the war, which could shock the political and economic foundations within the United States and Europe. The United States is seeking to balance the burden of war costs and pressure on defense spending, both domestically and internationally. From a global economic outlook perspective, the world economy is likely to focus financial resources on the defense industry and advanced weapons competition. NATO member states are trying to strengthen their military power by increasing defense spending, but at the same time, they are inevitably facing the limitations of slowing economic growth and government financial burdens. These geopolitical risks and the development of global weapon technologies will have long-term impacts on economic structures, energy policies, and international financial markets even after the war ends. Keywords such as global economic growth, geopolitical risk, defense industry, military technology, and energy policy are key points that economic blog readers should pay attention to in the future.

< Summary >The Ukraine war drastically changed in mid-2023 due to changes in the war situation and lack of weapon support, and the Kursk invasion in 2024 dealt a decisive blow.Advanced weapons, AI, and satellite network technology are playing a key role in combat, reshaping the future of military technology and the defense industry.The reshaping of the balance of power between the United States, China, Russia, and NATO is leading to geopolitical risks and demands for increased defense spending, which is expected to have a major impact on the global economy and energy policy.From a global economic outlook perspective, these changes will be an important opportunity to restructure the future military, economic, and political environment.< Summary >

[Related Articles…] Ukraine War Reexamined | Defense Industry Trends Analysis

*YouTube Source: [ 경제 읽어주는 남자(김광석TV) ]

– [풀버전] 우크라이나 전쟁, 충격적 분석 : ‘진짜 결말’이 보인다. 전쟁의 양상이 바뀌었다 | 경읽남과 토론합시다 | 진재일 교수

● Tariff-Proof Titans- Aerospace Soars

1. Impact of Trump Tariffs and Investment Strategy for the Second Half

The flow of money in the market for the second half of the year may change following the implementation of Trump tariffs (August 1).Unlike industries such as home appliances and auto parts that are hit by rising tariffs, investment strategies in companies that are not affected by tariffs are gaining attention.Compared to the situation during the tariff grace period when a 10% tariff was applied, the impact would be further intensified if the tariff rate rises from 20% to 30%.Therefore, it is necessary to closely analyze companies that are expected to see earnings growth and overseas export expansion, excluding the impact of tariffs, from the third quarter.These economic environment changes are closely related to the important SEO keywords for stock investment: “Trump Tariffs,” “Company Analysis,” “Stock Investment,” “Defense Industry,” and “Export Expansion.”

2. Hanwha Aerospace’s Growth Story and M&A Strategy

Hanwha Aerospace is a prime example of a future growth company growing without the impact of tariffs.Starting with the listing of Samsung Aviation Industries in 1987, it has a history of focusing on digital cameras and semiconductor systems through government integration in 1999 and business changes in 2000.After the sale of Samsung Techwin in 2015, the introduction of defense weapon systems and missile launch systems was achieved through the acquisition of Doosan DST in 2016.By changing the company name to Hanwha Aerospace in 2018, each affiliate and defense division, including Hanwha Vision, Hanwha Aviation, and Hanwha Defense, were integrated.The exponential increase in stock prices and market capitalization through successive mergers and acquisitions in 2022 and 2023 shows the fun of M&A, with the initial price soaring from 70,000 won to 940,000 won.Like this, through company analysis, steady growth and improvement in operating profit margins can be confirmed in sectors related to defense, aviation, marine, space, and overseas exports.

3. New Products, Order Expansion, and Overseas Expansion Strategy

Hanwha Aerospace is focusing on the development of various new products such as drone applications, aircraft engines, and space launch vehicles, in addition to ground defense weapons such as the K9 self-propelled howitzer, rocket launch system, and 155mm ammunition.In particular, the strategy of increasing annual orders, targeting overseas markets (Europe, Middle East, USA, etc.), and expanding global exports through the establishment of local factories is expected to be the driving force for the company’s future growth.At the same time, the company is forecasting a surge in sales and operating profit through strengthening its own technology, overseas investment, and infrastructure expansion.Investors should carefully observe quarterly performance, operating profit margin improvement, EPS, and dividend growth, and focus on determining the right time for stock investment.

4. Future Prospects and Investment Timing Considerations

It is important to thoroughly check company analysis and related reports to identify growth engines.In particular, the performance growth and increased overseas export ratio, and technology strengthening of companies in industries not affected by tariffs should be the core criteria for investment decisions.In stock investment, the trading flow of foreign and institutional investors and changes in the positions of individual investors also act as important signals.Sales and profit forecasts for the period of 2025 to 2027 based on earnings guidance and the potential for PER and EPS improvement support future stock price increases.

Summary

After the implementation of tariffs, it is necessary to turn to companies not affected by tariffs and focus on companies like Hanwha Aerospace that are growing through technology and overseas export expansion in the defense, aviation, marine, and space fields.The attractiveness of stock investment is further enhanced by restructuring through M&A, improvement in sales and operating profit margins, EPS, and dividend growth.Performance and technical new products, and localization strategies brighten future prospects, and it is important for investors to capture the right investment timing through continuous company analysis and quarterly performance checks.

[Related Articles…]Recent Global Tariff Issue AnalysisA New Perspective on Corporate Analysis

*YouTube Source: [ Jun’s economy lab ]

– 트럼프 관세에 영향없는 기업에 투자할 때입니다.(ft.예시기업)

● Nuclear Stocks- Last Chance Saloon

Is Now the Signal Flare for the Last Chance to Invest in Nuclear Power Stocks?

1. Why is Investing in Nuclear Energy Stocks Important Now?

Amidst rapidly changing global economic trends and stock market outlooks, nuclear power stocks are once again gaining attention among investors. With the recent amendment of commercial law and the changing criteria for blue-chip stocks, voices within the industry are growing louder, urging not to miss this opportunity. From an investment strategy perspective, now is the last chance to add nuclear power stocks to your portfolio. This naturally reflects top SEO keywords related to the economy such as global economy, economic outlook, stock market, investment strategy, and nuclear energy.

2. Trends in Commercial Law Amendments and Leadership Changes

Recent amendments to commercial law are impacting various industries and companies, particularly those with technology and stability like nuclear power stocks, signaling significant changes. Some companies that previously received little attention are now emerging as new leaders, and the market is seeing a proliferation of new strong contenders alongside existing popular stocks. This shift is noteworthy as it provides investors with both risk management considerations and good investment opportunities simultaneously.

3. SMR (Small Modular Reactor) Market and Global Support Trends

Around the year-end and beginning of the year, SMR-related technology and markets are once again receiving attention. The U.S. government is increasing financial support to countries like Turkey, and a $11 billion loan has been approved in Poland, indicating active movement in the SMR market globally. With global IT companies like Google, MS, Amazon, and Meta emphasizing the necessity of nuclear power, the demand and expectations for nuclear power stocks are increasing even further. These policy changes and technological innovations are highlighted as key investment strategy elements in the stock market.

4. Interaction Between Tech Giants and Nuclear Power Demand

As tech giants like Google, Microsoft, Amazon, and Meta expand their energy-intensive businesses such as data centers and cloud computing, their interest in and demand for nuclear power is growing. These companies are making significant investments in nuclear energy and SMR-related technology development to ensure energy stability and efficiency. This movement is expected to strengthen the position of nuclear power stocks in the market in the medium to long term. Investors should closely monitor the potential for collaboration with these tech giants.

5. Investment Effects and Future Outlook

Considering the market changes so far and the movements of governments and global corporations, the nuclear power and SMR markets are likely to become very active in the future. As the message in past stock investments goes, “seize the opportunity,” you can expect significant returns if you accurately capture the opportunity this time as well. Of course, investments come with risks, so it is important to continuously check the overall economic outlook and news trends of the market. As an investor, it is advisable to develop your own strategy focusing on key information such as global economy, economic outlook, stock market, investment strategy, and nuclear energy.

Summary

Amid the fluctuations of the global economy and stock market, nuclear power stocks and SMR-related stocks are emerging as attractive opportunities for investors, driven by leadership changes, commercial law amendments, government support policies, and increased demand from tech giants. In formulating future investment strategies, it is necessary to continuously monitor key information related to economic prospects and nuclear energy.

[Related Articles…] The Future of Nuclear Power Investment | SMR Market Trend Analysis

*YouTube Source: [ 달란트투자 ]

– “Hold it with confidence” Now is the last chance for nuclear power plant stocks. Just look at Doo…

● **AI Agents – Automate Global Economic Disruption**

Latest AI Agents and Global Economic Automation: Innovations and Real-Time Updates

1. Emergence of Innovative AI Agents

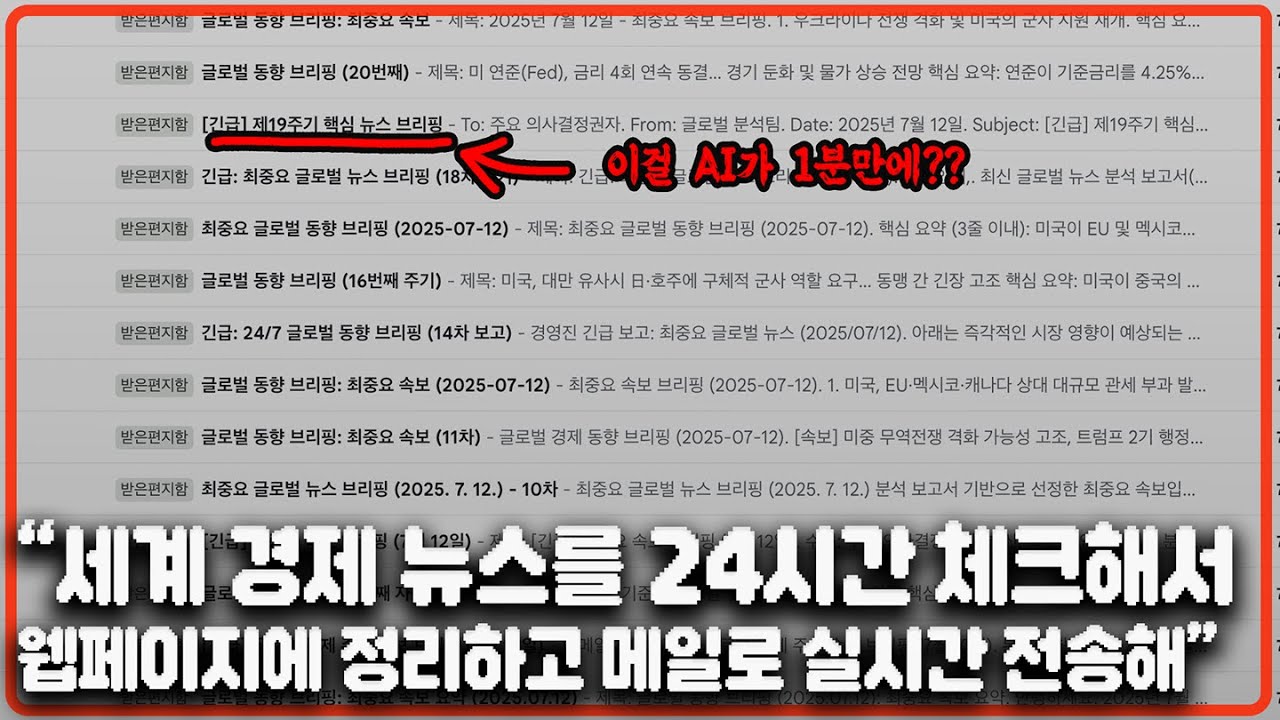

With the rapid advancement of AI automation technology, innovative AI agent programs have emerged, capable of updating global economies and blog content in real-time, 24/7. This program provides infinite context and operates 24/7, collecting, categorizing, and sending alerts on major issues such as economic news, wars, and policy announcements in an automated manner. Real-world use cases highlight its ability to check breaking news every 30 minutes and send email notifications according to specified commands.

2. Real-Time Economic News Automation and Classification System

The program quickly classifies economic and global issues occurring worldwide and updates them on web pages. Major breaking news is highlighted separately, and important content such as announcements from the Federal Reserve or other economic indicators is rechecked every 30 minutes, with the results delivered to the website and via email. This unlimited automation offers significant advantages for blog operation and economic information provision. The SEO keywords used in this process—AI, economy, blog, automation, global—are effectively placed.

3. AI Slide Creation Tips and Presentation Automation

Creating slides becomes much easier with the latest AI agents. The first tip is to add simple designs and responsive animations. Secondly, it’s important to visualize and highlight key numbers and data. Thirdly, it’s effective to concentrate core content on one slide. Font settings, such as using Gmarket Sans and Ming Dynasty italic fonts to match the hierarchical structure, can enhance the overall presentation quality. This approach visually conveys economic data and can be applied to blog postings.

4. AI Video Generation and 3D Set Modeling

The agent provides AI video generation capabilities, for example, creating a 30-second video of Trump and Elon Musk arguing on Twitter and then fighting in the UFC. However, video production consumes a significant amount of credits, so caution is needed when creating economic and global-related video content. Additionally, the 3D set modeling feature allows for the automatic generation of various models such as game characters, items, and dragons, positioning it as an innovative tool that will greatly impact the future game market and economic industry.

5. Utilization of AI Knowledge Base and Custom Models

Specialized economic analysis AI agents and custom AI models are also powerful features of this program. Users can upload PDF files, documents, and existing data to obtain more refined answers and analysis results. These custom AI models can be usefully applied to economic data analysis and global market forecasting, enhancing the credibility of blog content.

6. Credit Management and Usage Tips

AI video and image generation consume a lot of credits, so caution should be exercised when using them. Document creation, coding, and question answering consume less, but it is important to consider the usage costs and efficiency of each vendor to prevent unnecessary consumption. Efficiently utilizing sufficient credits with an affordable monthly plan of ₩20,000 is key to reducing economic burden and maintaining a continuous global automation system.

[Related Articles…]Global Economic OutlookAutomation Innovation and Economic Strategies

*YouTube Source: [ 월텍남 – 월스트리트 테크남 ]

– 역대급 자동화 AI 에이전트, AI 슬라이드 잘만드는 꿀팁까지