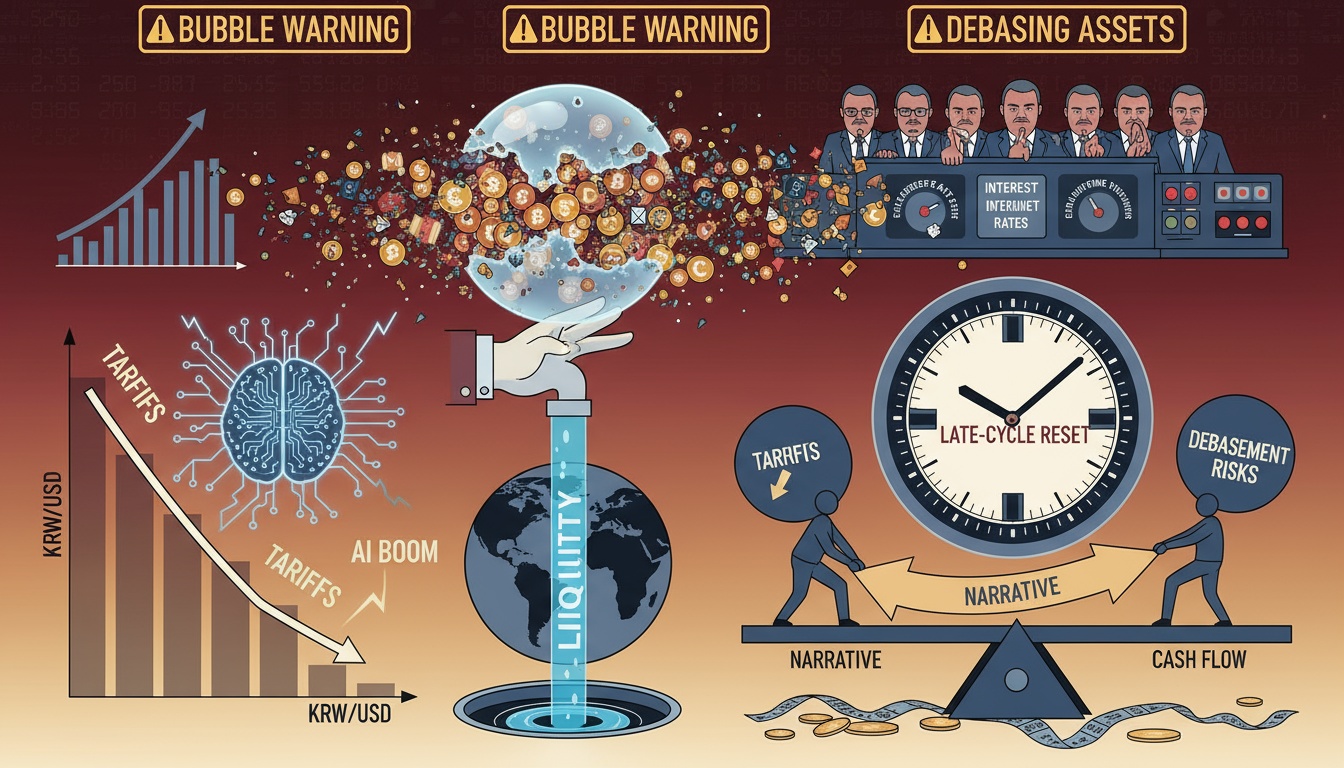

● Liquidity Frenzy Fuels Debasement Rally, Dollar Soars, KRW Buckles, Bubble Risk Mounts

[Immediate Analysis] Comprehensive Overview of the Liquidity Market, Abnormal Exchange Rate Signals, and Bubble Risk: The End of the Everything Rally and the Essence of the Debasement Trade

The key points you can immediately verify in this article are three.First, why the Everything Rally keeps continuing and the precise mechanism of the Debasement Trade.Second, how the “abnormal signal” of the KRW-USD exchange rate emerges, why the experienced exchange rate can feel like it’s in the 1,590 KRW range, and what the checkpoints are.Third, how to translate the warnings of the IMF and Ray Dalio regarding bubble risks into actual investment strategies, along with scenario-based plans.

One-Line News Summary

- The key variable in the global economic outlook is “private available liquidity,” which is the primary factor supporting the Everything Rally.

- The KRW-USD exchange rate is likely to have entered a “perceived overvaluation” phase due to a combination of structural and short-term factors, with the NDF-spot divergence and strong dollar phase as the key clues.

- Some valuation and credit indicators resemble those during the dot-com bubble; however, the AI investment cycle and productivity improvements are functioning as a “buffer” to delay a bubble collapse.

(1) Everything Rally and Debasement Trade: The Reason Why Everything is Rising

-

Definition and Current Driving Forces.The Everything Rally refers to the simultaneous rise in multiple assets including stocks, bonds, gold, commodities, and crypto.

The Debasement Trade is a phenomenon where the dilution of currency value (due to falling real interest rates and fiscal expansion) reinforces a preference for tangible and scarce assets.

The key drivers are expectations of interest rate cuts, excess private liquidity, constant fiscal deficits and debt ceilings, and growth expectations from AI infrastructure investments. -

The Role of Interest Rates and Real Liquidity.A nominal interest rate cut alone does not trigger the rally.

Bank reserves, reverse repo balances, the timing of government bond issuance/redemption, and the net changes in major central banks’ balance sheets determine “private available liquidity.”

When this indicator turns positive and money flows in, a debasement pattern often emerges with risk assets and gold rising simultaneously. -

The Market’s Overlooked Point.The “speed (slope)” and “composition (who holds it)” of liquidity have a more direct impact on yields than its sheer “size.”

Even with the same amount of liquidity, changes in the balance sheet structure of institutions/individuals result in different beta responses.

(2) Abnormal Exchange Rate Signal: Understanding the “Perceived 1,590 KRW Exchange Rate”

-

The Framework for Interpreting Numbers.Market participants sometimes refer to a “perceived exchange rate” by reflecting the real effective exchange rate (REER), differences in prices and wages, the pass-through rate of import prices, and the NDF (forward exchange) premium.

This language explains the fear of record levels, but it does not correspond one-to-one with the officially announced exchange rate.

Therefore, the claim of a “perceived exchange rate in the 1,590 KRW range” should be understood as a figurative number explaining the overlapping factors of a strong dollar and a weak won. -

Why is the Won Weak?Structural factors: Korea’s expansion of overseas investments, increased outbound remittances for dividends and interest, pension fund rebalancing, and export volatility caused by the reorganization of the global value chain.

Cyclical factors: The U.S. dollar’s strong phase, mismatched timing of interest rate cut expectations, policy changes in Japan and Europe, and synchronized weaknesses in emerging market currencies during China’s economic slowdown.

Technical factors: Despite robust exports in semiconductors and AI, increased hedging in futures and NDFs could paradoxically weaken the physical market supply. -

Five Checkpoints.1) Changes in the KRW 3- and 6-month NDF-spot divergence and basis adjustments.

2) A sudden surge in foreign currency demand during trade and service balance, and dividend season.

3) Whether there is a match between the directional movement of U.S. real interest rates and the dollar index.

4) Cross/carry unwind due to policy changes (interest rates/topping of government bond yields) in Japan.

5) The correlation between foreign positions in KOSPI futures and the won.

(3) Will the Bubble Burst? Translating IMF and Ray Dalio’s Warnings into Investment Strategy

-

Bubble-like Indicators.A concentration in big tech, a reduction in the equity risk premium in stocks, an increased appetite for risk in IPOs/convertible bonds, and a tilt toward certain themes (especially AI) are reminiscent of the dot-com era.

However, since AI is accompanied by actual sales, profits, and capital expenditures (CapEx), even if valuations are similar, the intrinsic growth rates could be higher. -

Ray Dalio’s Debt Warning and Practical Points.The U.S. long-term fiscal deficits and high rollover demands create a policy bias that favors either high nominal growth or high inflation.

This may mean that even if interest rates are cut, real interest rates might not fall significantly, or a strong “debasement” pattern involving gold and commodities could be reignited. -

Hard Landing vs. Soft/No-Landing Scenarios.Hard landing: Sharp earnings declines, a sudden widening of credit spreads, and an ultra-strong dollar phase with concurrent adjustments in risk assets.

Soft/no landing: Gradual interest rate cuts, continuous productivity improvements, and expanding AI-related revenues, which could allow high-growth stocks to remain overvalued for a while.

The key is whether upward revisions in EPS can “dilute” the overvaluation over time.

(4) The Impact of Interest Rate Cuts on Different Asset Classes

-

Stocks.

Gradual interest rate cuts are favorable for the DCF of long-term growth stocks, but short-term real interest rates and the speed of liquidity are more significant variables.

If profit momentum slows, rotations between growth and value stocks could become turbulent. -

Bonds.

In a regime of disinflation certainty, duration is advantageous; however, fiscal deficits and expanded supply can increase volatility in long-term bonds.

Be mindful of the risk of a curve steepening. -

Gold/Commodities.

Gold is a pure beta for debasement.

If real interest rates fall, the dollar reaches its peak, and geopolitical risks persist, repeated attempts to test record highs in gold could occur. -

Foreign Exchange.

Currencies in regions where interest rate cuts occur early are likely to weaken.

The KRW-USD exchange rate is influenced not only by the interest rate differential between the U.S. and Korea but also by hedging costs and supply-demand events.

(5) Practical Strategy: Playbook by Asset Class

-

KRW-USD Exchange Rate.Short term: Manage short-cover/squeeze risk when the NDF-spot divergence widens.

Medium term: In a phase of a weak won, monitor the increase in export revenues from exchange rate conversion for export-oriented companies, while being selective with sectors that have high foreign debt loads and a high proportion of raw material imports.

Hedging: Gain exposure to the dollar index, implement partial currency hedges (3–6 month rolling), and use options to cover tail risks. -

Gold/Silver/Copper.Gold: Consider as a core hedge for debasement, allocating 5–10% of the portfolio.

Silver/Copper: Adjust position sizes by taking into account their beta relative to AI/infrastructure expansion and economic sensitivity. -

Stocks.Approach baskets focusing on AI infrastructure (semiconductors, memory, power equipment, cooling systems, data center REITs) and companies benefiting from AI adoption (software, automation).

In Korea, while the memory upcycle combined with a weak won is favorable, be cautious of margin pressures and signs of CapEx overheating during cycle peaks. -

Bonds.Utilize a duration barbell strategy (short-term + intermediate/long-term) to diversify curve risk.

If there is a risk of inflation repricing, consider increasing the weight of inflation-linked bonds. -

Crypto/Stablecoins.While debasement expectations may fuel a crypto rally, sensitivity to regulatory and liquidity contractions can be extreme.

For stablecoins, it is essential to check issuance principles, reserve transparency, and on-chain liquidity.

(6) The Secondary Effects of the AI Trend on Macroeconomics and Exchange Rates

-

Bottlenecks in Power and Equipment Affect the Inflation Path.Supply constraints in GPUs, power, cooling, transformers, and sites can cause a persistent “service + energy” inflation.

This may slow down the pace of interest rate cuts or limit the extent of the decline in real interest rates even after cuts. -

A Korea-Specific Path.While a robust semiconductor and AI chip cycle could improve the trade balance, proactive hedging by export companies might neutralize the physical won supply.

The global dollar settlements for large-scale AI CapEx might stimulate dollar demand, potentially creating mild upward pressure on the KRW-USD exchange rate. -

Investment Points.Focus on areas at the early part of the “adoption curve” such as power equipment, data centers, cooling systems, high-efficiency semiconductor processes, HBM/packaging, and optical communication components.

AI-adopting companies that lower their dependency on GPUs through algorithms, lightweight designs, or on-device strategies are better positioned to improve productivity and profitability.

(7) The Core Points That Other YouTube/News Outlets Rarely Address

-

Who Controls the Liquidity is Important.The movement of private available liquidity (bank reserves + reverse repo balance changes + the timing of net government bond issuances) affects prices more than the total amount held by central banks.

In particular, the speed of fund movements from institutional money market funds is a practical variable that explains simultaneous strength/weakness in stocks and crypto. -

The AI Power Cycle is a Structural Inflationary Pressure.Due to the long lead times for power, transformers, and transmission networks, the pace of disinflation may be slower than in previous cycles.

Even with interest rate cuts, inflation expectations may not easily settle below 2%. -

Structural Changes in the Won’s Supply and Demand.The expansion of overseas assets, outbound dividend payments, and increased export hedging have weakened the conventional “current account surplus = won strength” formula.

Therefore, the KRW-USD exchange rate should be viewed as anchored by both fundamentals and supply-demand dynamics.

(8) An Immediately Actionable Checklist

- Dollar/Interest Rates.U.S. real interest rate (10y TIPS), confirmation of the dollar index peak, and the U.S. Treasury’s refunding schedule.

- Exchange Rates.Monitor the KRW 3- and 6-month NDF-spot, option skew, and domestic dividend/overseas investment supply-demand calendar.

- Stocks.EPS revisions, AI CapEx guidance, changes in the top 10 market weightings, and market breadth.

- Bonds/Inflation.Core service ex-shelter, wage indicators, and long-short curve steepening.

- Commodities/Power.Lead times for copper, silver, and power equipment, and the new power capacity of data centers.

Risk Management Principles

- Adopt a scenario-neutral positioning: “participate in the upswing, survive the downswing.”

- Reduce exposure if there are signs of a slowdown in liquidity speed, and gradually increase the proportion of gold/cash-like assets.

- Shorten hedging durations and monitor rolling costs during periods of heightened exchange rate volatility.

- Prioritize the three indicators of liquidity, earnings, and supply-demand over news headlines.

Conclusion

The liquidity market will not easily end as long as there is no clear sign of a slowdown in “speed.”

The abnormal signal in the KRW-USD exchange rate is likely the result of overlapping structural supply-demand changes and short-term events.

While the logic behind a bubble collapse is valid, the real investment cycle created by AI through CapEx and productivity improvements makes the “timing” of the collapse the key variable.

Investors should prepare portfolios that correspond to scenarios where interest rate cuts and the Debasement Trade coexist, keeping an eye on the three axes of liquidity speed, real interest rates, and exchange rate supply-demand.

< Summary >

- The Everything Rally is driven by “private available liquidity” and debasement expectations.

- The perceived overvaluation of the KRW-USD exchange rate results from a combination of REER, hedging, and supply-demand factors; prioritize monitoring the NDF-spot divergence.

- The bubble warnings are valid, but AI CapEx and productivity improvements delay the timing of a collapse.

- Even with interest rate cuts, inflationary pressures may only gradually subside due to constraints in power and equipment.

- In practice, the key is to respond with hedges by monitoring the three indicators of the dollar, real interest rates, and liquidity speed, along with asset-specific strategies.

[Related Articles…]

- The Real Causes Behind Sudden KRW-USD Exchange Rate Fluctuations

- The Relationship Between the Liquidity Market and Interest Rate Cuts

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– [LIVE] (1)유동성 장세 (2)환율 이상신호 (3)버블 붕괴되나? 유동성 장세 계속 갈까? [즉시분석]

● Tariff Shock, Crypto Bloodbath, Fear Contagion

Shocking Friday: Tariff Shock, Leverage Liquidation, Fear Contagion, Next Week’s Market Scenario and AI/Semiconductor Investment Checklist

Key Points First: The ‘Really Important Points’ Covered in My Article

This article concisely summarizes how the tariff shock is shaking up the inflation and interest rate trajectory, dollar strength, and exchange rate volatility.

It explains why cryptocurrencies fell before the Nasdaq by analyzing the mechanism of leverage liquidation and the liquidity ladder.

It specifically addresses how China’s Hito controls and semiconductor supply chain risks could impact the KOSPI and the AI investment cycle.

It provides a checklist for the AI investment frenzy, highlighting often overlooked risks such as the ‘lack of a revenue model’ and electricity bottlenecks.

It offers a portfolio playbook with next week’s events, key figures, and strategic actions that you can apply immediately.

News Briefing: What Happened

A 100% possibility of tariffs mentioned from the US headlined the news, triggering a sharp sell-off across risky assets.

The Nasdaq led with an early decline, widening the correction among tech stocks, and after a time lag, cryptocurrencies plunged amid massive leverage liquidations.

In particular, altcoins, being at the outermost edge of liquidity, experienced extreme volatility, with market capitalization evaporating by hundreds of trillions of won within a short period before rebounding partially.

China played the Hito card, reigniting US-China trade tensions and increasing concerns over the semiconductor and AI supply chain.

Over the weekend, as the tone of remarks from both sides fluctuated, uncertainty remained high, increasing the likelihood of a gap-down and heightened volatility on Monday.

Key ‘Essentials’ Highlighted Elsewhere

Liquidity Ladder: From altcoins → Bitcoin → stock market (Nasdaq) → real estate → bonds → dollar, liquidity shocks propagate in this order.

This time, the collapse started at the outermost edge (altcoins), and that signal could trigger a contraction of the overall risk budget of risky assets.

Leverage Plumbing: When a directional shock occurs amid high futures, margin, and funding fees, a chain reaction of ‘forced liquidation → order book gaps → additional liquidations’ can occur.

Electricity = AI’s Hidden Price Determinant: The surge in power demand from AI data centers is leading to higher electricity prices, connection delays, and capacity constraints, which ultimately determine the costs, margins, and pace of AI businesses.

Asymmetry of Tariffs and Inflation: Rising import prices can push up headline inflation, but weakening demand and slowing growth clash with downward core inflation pressures, rendering the interest rate path even more uncertain.

Chain Effects of Exchange Rates: A strong dollar and a weak won encourage valuation discounts on the KOSPI and trigger foreign fund exits, counterbalancing expectations of improvements in the semiconductor sector.

US-China: ‘Chess vs. Go’ Framework: Differences in Policy Paths

Trump-style Chess: Negotiation tactics based on rapid moves and reversals frequently create headline risks, but there is also a high possibility of abrupt policy reversals.

Chinese-style Go: Once a move is made, it is hard to retract, and the path-dependent nature of retaliation and counter-retaliation increases significantly.

This time, China made its move first, and if the pace of reversal is slow, the market’s uncertainty premium could remain elevated for an extended period.

Impact Paths and Focal Points by Asset Class

Altcoins: They are at the liquidity end and experience extreme volatility.

Monitoring open interest, funding fees, and forced liquidation heatmaps is essential, and minimizing leverage is fundamental.

Bitcoin: It is supported by structural demand (spot ETFs, institutional inclusion), but if there is a short-term capitulation, a strategy focusing on spaced-out spot buying could be effective.

US Tech Stocks/Nasdaq: Key factors include the rebound in interest rates, valuation de-rating pressure, and the tug-of-war with AI momentum.

Differentiation based on EPS revisions and sensitivity to interest rates is expected.

Semiconductors/Equipment: Supply chain premiums may arise due to Hito controls on materials and equipment.

It is necessary to check for potential bottlenecks in the HBM, advanced packaging, and power semiconductor chains.

Gold: Given the re-entry demand for geopolitical and inflation hedges, its upward beta can be active during periods of volatility.

Dollar/Exchange Rates: A resurgence in dollar strength may heighten the risk premium for emerging markets and Korea.

Bonds/Interest Rates: It is a tug-of-war between tariff-driven upward price pressures and growth slowdown, where the re-steepening of short- and long-term rates is key to stock market valuations.

AI Trend Deep Dive: The ‘Revenue Model Void’ and ‘Electricity Bottleneck’

Timing of Profitability: CAPEX expenses such as GPUs, electricity, and real estate occur immediately, but the cash flow (CAC recovery and ARPU increase) of generative AI takes longer to materialize.

If the transition from free to paid is slow, revenues may appear while free cash flow remains negative.

Cloud Economics: CSPs act as midfielders that purchase GPUs and provide AI services.

If demand falls short of expectations, depreciation, electricity, and operating expenses can pressure margins.

Open Source/Competition: Large capital can catch up with model training, so maintaining product differentiation is critical.

Clear practical value in areas like RAG, domain specialization, and agent automation is needed to establish pricing power.

Electricity Bottleneck: Constraints in power supply contracts and electricity pricing, rather than data center expansions, present the bigger challenge.

Companies that defend costs through PPAs, self-generation, high-efficiency chips, and cooling solutions become relative winners.

Supply Chain Points: Bottlenecks in the HBM memory, packaging, power semiconductors, cooling, and switch/optical module chains can determine ROIC.

In summary, AI investments hinge on the dynamics among equipment, electricity, memory, and cloud (‘B vs. A’ dynamics) as well as the speed at which customers transition to paid services.

Next Week’s Macro Calendar Check (It Is Recommended to Reconfirm the Final Schedule on a Weekly Basis)

US CPI/PPI, speeches by the Federal Reserve (including Powell), and retail sales/housing indicators will determine interest rate expectations.

In semiconductor and big tech earnings/guidance, pay close attention to the sustainability of AI CAPEX, order backlogs, and updates on power plans from key companies.

Chinese industrial production/retail sales, briefings related to Hito controls and export-import regulations, and the flow of the yuan will influence risk sentiment among assets.

For Korea, semiconductor-centric exports, the won/dollar exchange rate, and foreign futures positions will determine the short-term direction of the KOSPI.

Portfolio Playbook: Action Strategies by Timeframe

0~48 Hours (Maximized Volatility): Intentionally increase your cash position, and consider buying into oversold stocks in installments only after confirming peaks in VIX, interest rates, and the dollar.

Use options with call spreads and put protection to control costs, and adjust hedge intensity for stocks with inverse or sector rotation strategies.

1~2 Weeks (Headline War): Track the tone of tariff levels and China’s responses; when news weakens, trading volume decreases, and leading indicators stabilize for three consecutive sessions, the risk of bottoms being reached is reduced.

1~3 Months (Reframing): Prepare for a re-steepening of short- and long-term interest rates if inflation re-ignites. In such a scenario, reduce the weight on high PER growth stocks and favor companies with stable cash flows, dividends, and potential for repricing.

Checklist for Crypto Investors

The principle is keeping leverage at zero or low, watching for surges in open interest (OI), and managing counter risks when funding fees become overheated.

It is essential to monitor forced liquidation heatmaps, order book gaps, and the net inflow/outflow of stablecoins, as well as on-chain realized profits and losses.

For Bitcoin, focus on spot positions and cash management; for altcoins, approach events on a short-term basis and refrain from swings.

Key Points for Korean Investors: KOSPI, Semiconductors, Exchange Rate

The won/dollar exchange rate is the first line of defense.

If the strong dollar persists, significant exits of foreign funds from both spot and futures markets may occur, so managing volatility is a priority.

For semiconductors, differentiate between beneficiaries and bottlenecks in HBM, advanced packaging, and power semiconductors for each stock.

While export momentum remains, if global demand weakens due to tariff variables, it is essential to proactively adjust profit estimates.

Signs When Risk Transmits as ‘Fear’

In a down market, if price reactions to negative news become excessively strong and reactions to positive news diminish, it becomes palpable.

If trading volumes decrease while the depth of declines increases, along with a disappearance of bargain buying and accelerated reduction in credit balances and leverage, consider switching to a defensive mode.

The Current Market Reading Framework (Conclusion)

The tariff shock simultaneously intensifies the risks of reignited inflation and slowing growth, rendering the interest rate path uncertain.

The crypto plunge is interpreted as a typical liquidity collapse triggered by leverage liquidations, serving as a signal for a contraction of the risk budget across risky assets.

While AI investment is a long-term mega-trend, in the short term it must overcome real-world hurdles such as confirming revenue models and overcoming electricity bottlenecks.

Therefore, it is rational to maintain a defensive flexibility while selectively increasing risk when data-confirmed transition signals (interest rate peak-out, dollar weakness, earnings upgrades) appear.

Checklist: Final Check Before Buying

Confirm whether the direction of interest rates (US 10-year Treasury, real interest rates) and the dollar index have turned lower.

Check if the VIX has stabilized downward after a sharp rise and if the credit spreads have concluded their widening phase.

Monitor whether the intensity of the tariff/Hito news is easing and if there are any signals from official negotiation tables.

For AI-related stocks, check the timing of power/CAPEX guidance and the resolution of bottlenecks in HBM/packaging.

For cryptocurrencies, confirm whether trading volumes have normalized after forced liquidations and whether overheated funding fees have subsided.

Risk Disclosure

This article is for informational purposes only and does not constitute investment advice.

Market conditions and data are subject to significant fluctuations, so please reconfirm the latest disclosures and indicators, and the final decisions and responsibilities lie with the investor.

< Summary >

The tariff shock has shaken interest rates, the dollar, and exchange rates, spreading fear across risky assets.

The crypto plunge was triggered by leverage liquidations, causing the outer end of the liquidity ladder to collapse first.

Semiconductors and AI face key risks from Hito controls, electricity bottlenecks, and delays in confirming revenue models, necessitating defensive flexibility until data-based transition signals are confirmed.

Next week, events such as CPI releases, Fed speeches, and the tone of China’s responses will be pivotal. Consider increasing your exposure to risky assets when an interest rate peak-out, dollar weakness, and earnings upgrades occur together.

[Related Articles…]

How the Tariff Shock Impacts Inflation and the Interest Rate Trajectory

AI Data Center Electricity Crisis: Investment Checkpoints

*Source: [ Jun’s economy lab ]

– 충격의 금요일, 공포가 전염되면 증시에 벌어질 일

● Beijing on Edge, South Asia Erupts, Markets Rattle, AI Clampdown

Beijing Tensions Rising, Ripple Effects Spread from South Asia Anti-China Protests: A Comprehensive Recap Covering Global Economic, Geopolitical Risks, Supply Chain Restructuring, and AI Trends at a Glance

This article distills the core points of how Nepal’s massive protests and the shifting public sentiment in China are interconnected, and why they are directly impacting the global economy, financial markets, supply chains, and AI innovation trends right now.

It covers issues such as the risk of retrieving investments under China’s Belt and Road Initiative, the flows of the Renminbi and Dollar, supply chains for rare earths and solar energy, the shock of halted remittances caused by SNS and messenger blockages, and the double-edged effects of generative AI and surveillance technologies.

It also separately addresses core issues such as the ‘debt-secured structure’ and the ‘economics of censorship costs,’ which are seldom covered by other news outlets.

[News Briefing] A Glimpse of Recent Developments

Following the collapse of the Nepal Communist Alliance regime, the previously pro-China leadership was ousted, and protests have rapidly escalated, mainly among the younger generation.

Controversies over SNS boasting and messenger blockages have fueled anger, and concerns over disruptions in remittances from abroad (estimated to account for about 25% of Nepal’s GDP) have directly translated into rising everyday hardships.

In South and Southeast Asia—including Sri Lanka (2022), Bangladesh, and Indonesia—anti-corruption and anti-elite sentiments are spreading, intensifying the cross-competition between pro-China and pro-India factions.

Within China, sporadic regional protests occur; however, due to a dense surveillance network, early crackdowns, and strict information control, the likelihood of nationwide spread is largely seen as limited.

Nonetheless, if separatist sentiments rise in sensitive regions such as Tibet and Xinjiang (Uyghur areas), there is a strong possibility of both a harsh crackdown and a re-ignition of human rights issues simultaneously.

Seven Global Impacts of China and South Asia Risks on the Global Economy

1) Rising Geopolitical Risk Premium

The spread of anti-China protests in the region increases the possibility of cracks in China’s peripheral strategies (Tibet as a buffer, the Pakistan corridor, Nepal as a strategic outpost).

This could lead to a decline in global investment sentiment and a discounting of riskier assets.

2) Ripple Effects in Financial Markets

In countries heavily laden with Belt and Road Initiative (BRI) loans from China, regime changes may trigger frequent debt renegotiations and payment deferrals.

Research institutions have cumulatively estimated China’s overseas lending exposure to be around 1 trillion dollars, with some pointing out that many contracts are based on ‘hidden debt’ and secured agreements.

This could trigger volatility in emerging market sovereign bonds and CDS spreads, a resurgence of a strong dollar, and downward pressure on offshore Renminbi (CNH).

3) Reemergence of Supply Chain Risks

Regulatory, sanction, and social compliance risks are increasing in areas such as Xinjiang-origin polysilicon and cotton, rare earths and battery materials, and overland logistics via Pakistan and Nepal.

Global companies are diversifying from a “China+1” strategy to a “China+N” approach, accelerating the shift to countries like India, Vietnam, and Mexico.

4) Flows of Commodities and Energy

Xinjiang is integral to China’s core value chains for oil, coal, gas, and solar energy.

If regional instability deepens, the price volatility of strategic materials such as copper, aluminum, and polysilicon could widen.

5) Shock to Tourism and Service Balances

The demand for mountain and trekking tourism in Nepal, Tibet, and western China may experience rapid falls and surges due to political unrest and visa or border control measures.

Local service industries, small hospitality businesses, and transportation services could face significant cash flow fluctuations.

6) Exposure of Countries Dependent on Digital Remittances and Fintech

For countries like Nepal that heavily rely on remittances from overseas workers, SNS and messenger blockages effectively become a direct blow to the real economy by hampering household cash flows.

This underscores the need for securing multiple channels (satellite internet, alternative messengers, cross-border fintech) for financial inclusion and micropayment infrastructure.

7) Rising Costs in Trade, Sanctions, and Compliance

Stricter forced labor regulations, export controls, and enhanced due diligence on human rights can drive the ‘political premium’ into corporate costs.

In global supply chains, the cost of verifying the origin of raw materials from Xinjiang is becoming a constant factor.

The Double-Edged Nature of Generative AI and Surveillance Technologies: Spread vs. Suppression

1) Citizen Networks Amplified by AI

Translation and summarization models accelerate the spread of protest messages, and open-source LLMs explosively boost the production of content in regional languages.

Satellite internet and messaging networks have emerged as key channels for circumventing censorship.

2) Enhanced Control through AI

Real-time video search, facial and gait recognition, network analysis, and generative summarization shorten the cycle from reporting to blocking to arrest.

State-led LLM “safety guardrails” recalibrate online discourse through banned word filtering and narrative alignment.

3) The Growing ‘Censorship Cost’ in Economic Terms

Sophisticated filtering and real-time monitoring incur enormous cloud and labor costs, tying down model performance to safety norms and potentially hindering productivity gains.

If AI innovation’s net benefits are suppressed, a structural side effect could be a reduced potential growth rate of the domestic digital economy.

4) Corporate Risk Points

Content platforms, gaming services, and community services face surging real-time moderation costs.

Multinational companies must proactively build compliant infrastructure, including data residency measures, cross-border data transfer permissions, and model audit log retention.

Three Scenarios and Their Respective Probabilities

Scenario A: A phase of “managed unrest” characterized by recurring localized disruptions and swift crackdowns persists.

Market impacts would be largely limited to event-driven volatility, though the geopolitical risk premium remains elevated.

Scenario B: A domino effect of regime changes in neighboring countries leads to a spread of BRI debt restructuring, reigniting a phase where a weak Renminbi and a strong dollar dominate.

Emerging market external debt stress may intermittently surface.

Scenario C: A deepening of separatist unrest (with low probability) triggers a sharp upward surge in trade, sanctions, and compliance risks, which may accompany accelerated major supply chain shifts and soaring raw material prices.

Investment and Business Checklist (From an Execution Perspective)

Financial Markets

Simultaneously monitor the Dollar Index, offshore CNH, and EM CDS, and adjust the proportions of gold, US Treasuries, and short-term cash equivalents flexibly when event risks arise.

A defensive approach—shortening duration exposure—could be effective for Chinese high-yield bonds, construction, and local government financing vehicles (LGFV) with significant regional exposures.

Supply Chains

Automate the tracking of origin for Xinjiang-related materials, polysilicon, and apparel value chains, and expand multi-sourcing strategies to India, Vietnam, and Mexico.

Design redundancy into ports, railways, and overland corridors to eliminate “single gateway risks.”

Technology and Data

Invest in AI moderation and compliance automation, and strengthen log retention and audit traceability.

Establish a robust business continuity plan (BCP) that includes satellite internet, proxy services, and end-to-end encrypted communication.

ESG and Regulations

Standardize forced labor and human rights due diligence reporting systems, and incorporate social stability indicators into supplier evaluations.

Include a political force majeure clause in contracts for regions with elevated risks.

Fact-Checking and Cautions

Figures such as the casualty count from Tiananmen Square and rumors regarding specific individuals’ privacy and assets vary significantly across sources, making official verification challenging.

This article is based on publicly available data and the common denominator gleaned from multiple expert interviews, and controversial claims have been separated into ‘possibilities’ and ‘scenarios’ for clarity.

Policy and market responses should primarily rely on your own decision-making process, tailored to the latest data and your risk tolerance.

Real Core Issues Rarely Covered Elsewhere

1) The Paradox of Debt-Secured BRI Contracts

Loans secured by assets such as ports, resources, and land-use rights pose a political dilemma—‘asset takeover vs. default’ in the event of a regime change—which prolongs anti-China sentiment in neighboring countries.

While China emphasizes asset recovery, its counterparts stress sovereignty and public sentiment, leading to prolonged negotiations.

2) The Invisible Tax of Censorship Costs on Productivity

Sophisticated AI censorship guardrails and real-time monitoring costs can reduce the marginal productivity across the digital economy.

This structural issue may simultaneously slow potential long-term growth rates and the pace of technological innovation.

3) Macroeconomic Impact of Remittance and Messenger Blockages

In countries dependent on remittances from overseas workers, blocking messengers and SNS not only controls public opinion but also cuts off household cash flows, directly affecting the real economy.

Securing multiple pathways for digital finance infrastructure becomes a new macroeconomic stabilization measure.

4) The Backlash to the Renminbi Bloc

The strategy of expanding the Renminbi’s share in cross-border settlements could backfire during periods of geopolitical instability in neighboring countries, leading to a resurgence of dollar reliance.

One-Line Summary: Key Indicators to Monitor Immediately

Keep an eye on offshore CNH, EM CDS (for Nepal, Pakistan, Sri Lanka), prices of copper and polysilicon, the pace of U.S. import regulations related to Xinjiang risks, FDI inflows to India and Vietnam, and the estimated AI moderation costs of big tech companies.

These five pillars collectively illuminate the directions of the global economy, financial markets, supply chains, and AI innovation.

Context and Reinterpretation of Perspectives

Although the possibility of a major systemic shift within China in the short term is low, regime changes in neighboring countries and the spread of anti-China sentiment are creating persistent frictions in both the real economy and financial markets.

Companies would benefit from recognizing the ‘political premium’ as a structural cost and adopting strategies that maximize redundancy and optionality in supply chains, data management, and capital allocation.

Since AI is accelerating both proliferation and suppression simultaneously, designing a balanced system that considers moderation, auditability, and service continuity is key to gaining competitive advantage.

Keyword Notes (SEO)

Track trends centered on the global economy, geopolitical risks, financial markets, supply chains, and the 4th Industrial Revolution/AI innovation.

Each keyword is connected with concrete examples throughout the text.

< Summary >

The anti-China protests in South Asia and the rising tensions within China are interconnected through links to BRI debt, Renminbi flows, supply chains and raw materials, digital remittances, and AI censorship costs.

While localized disruptions and swift crackdowns form the baseline scenario, a domino effect of regime changes and widespread debt restructuring in neighboring countries could heighten volatility in financial markets.

Companies must rapidly implement strategies for moving towards a “China+N” model, enhancing data and AI compliance, and internalizing risk pricing.

[Related Articles…]

China’s Belt and Road Debt Trap and Global Supply Chain Restructuring

AI Censorship and Satellite Internet: Authoritarianism vs. Technological Innovation

*Source: [ 달란트투자 ]

– 역대급 시위에 초토화된 중국 베이징이 발칵 뒤집혔다 | 강준영 교수, 이춘근 박사, 김정호 교수 특집