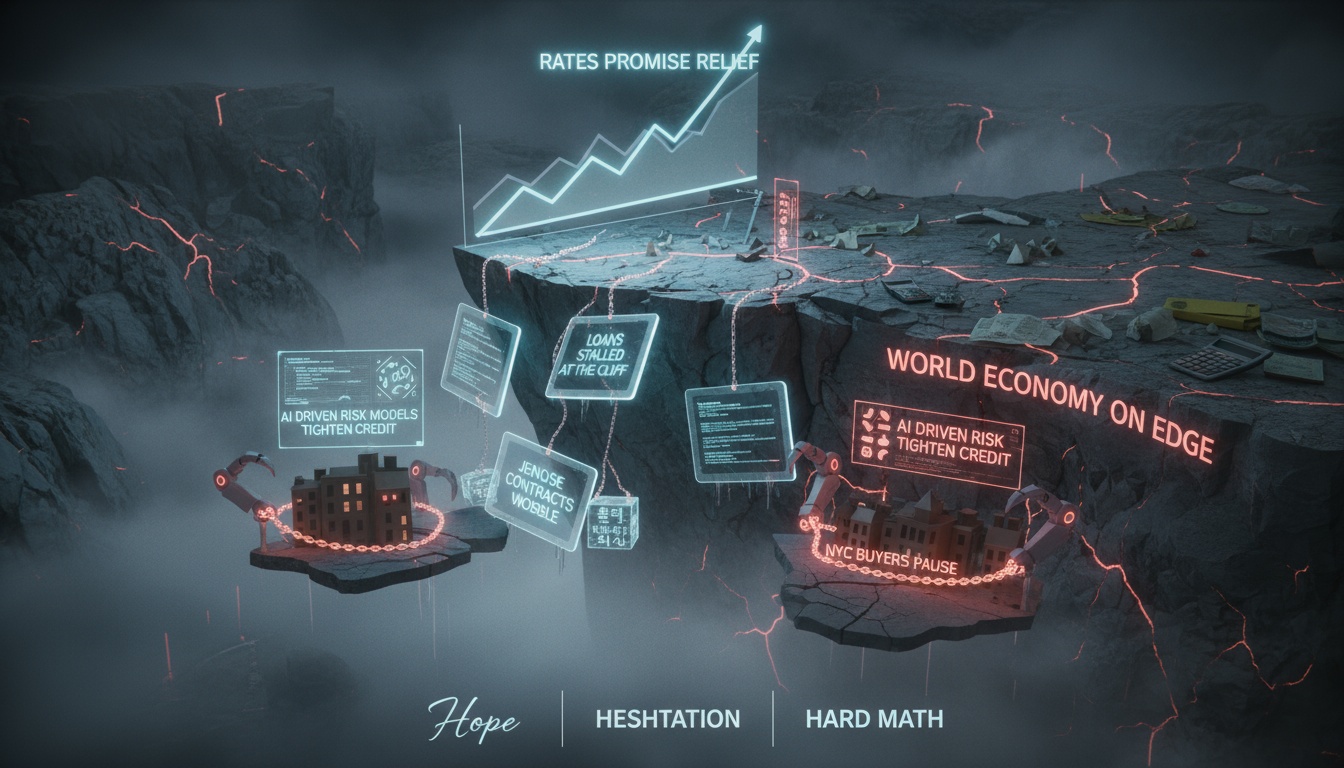

● Rate Cut Mirage, Loan Squeeze

Why Are Loans Blocked Even Though Interest Rates Are Falling: The Trap of Illusory Cuts, the True Impact of DSR Tier 3, a Scenario of Reduced Jeonse Loans, Risk from Exchange Rates and International Interest Rates, and Even the Signal That the Liquidity Rally Is Ending

This article includes the reality behind the illusion of interest rate cuts, the mechanism of credit volume regulation, the ripple effects of reducing jeonse loans on the rental and sales markets, the constraints that exchange rate and global interest rate differentials impose on policies, and checkpoints to determine whether the current market rise is a “liquidity rally” or a “genuine recovery.”

It even covers “changes in credit allocation” and “the shadow regulations of guarantee and premium interest rates” that other media tend to overlook.

It summarizes the latest trends quickly and clearly in a news format centered on key keywords such as global economic outlook, interest rates, inflation, real estate outlook, and AI trends.

[News Briefing] Key Summary

- Although expectations for a base rate cut are high, loans are being blocked by overall volume, limits, and premium interest rates.

- Although DSR Tier 3 has been introduced, there are exceptions such as group loans so that a “cliff” has not occurred, yet the effective limits have clearly been reduced.

- As guarantees and limits for jeonse loans are gradually being reduced, there is growing pressure for jeonse to transition to monthly rent or for a move toward home ownership.

- The current market rise has a strong “liquidity illusion” character. As credit shifts from real estate toward the corporate and production sectors, purchasing power is diminished.

- With exchange rate and external interest rate factors, the scope for base rate cuts is limited, and loan rates are sticky due to premium rates and risk management.

Illusory Interest Rate Cuts vs. Total Loan Volume Regulation: Why Perceived Rates Aren’t Falling

- While the market prices in a base rate cut, banks adjust credit demand by raising premium interest rates or reducing limits to meet overall volume and sector-specific requirements.

- A combination of supervisory indicators (RW and risk weights), expanded DSR application, and borrower- and product-specific caps has reduced the “total amount that can be borrowed.”

- The government’s direction in credit allocation is shifting toward “productive finance.” Even with the same liquidity, the share flowing into real estate is decreasing.

- External factors also impose constraints. If the exchange rate and global interest rate differential are large, the magnitude of base rate cuts is limited, and loan rates move slowly due to funding costs, credit spreads, and risk management by banks.

- In conclusion, a paradox occurs where “interest rates are falling, but the perceived rates feel much tighter.” This is the core illusion of the liquidity rally.

DSR Tier 3: Psychological Restraint Is Certain, but Exceptions Prevent a Cliff

- Since July, the expanded application of DSR Tier 3 has been implemented, but exceptions such as group loans ensure that the funding for scheduled pre-sale and occupancy units is not entirely cut off.

- However, individual borrowers’ actual borrowing capacity has decreased, and certain policies/products with “overall amount/limit (e.g., a cap in the hundreds of millions)” directly dampen sentiment and demand.

- While an immediate collapse is not expected, the resilience of leverage-dependent demand is gradually weakening.

The Ripple Effects of Jeonse Loan Regulation: Transition from Jeonse to Monthly Rent, and Increased Ownership Pressure

- Jeonse loans function as a mechanism that amplifies leverage from tenants to landlords.

- As guarantee institutions and banks gradually adopt more conservative guarantee ratios and underwriting criteria, limits, guarantee coverage, and eligibility requirements are reduced and differentiated.

- When jeonse loan restrictions tighten in segments involving ownership transfer, initial jeonse prices for new complexes may be adjusted downward and the proportion of conversions to monthly rent may increase.

- Landlords are also affected. If securing funds for the jeonse deposit becomes difficult, the cash flow required for maintaining ownership is disrupted, forcing a choice between selling, converting to monthly rent, or injecting additional equity.

- In the medium to long term, there is a high likelihood that the trend of “reduced jeonse scale → lower jeonse price ratios → increased shift toward monthly rent” will continue. Although the pace is gradual, the direction is clear.

Liquidity Rally or Genuine Recovery: Checkpoints for Differentiation

- Credit Flow: Check whether the growth rate of corporate loans surpasses that of household loans. A reduction in funds flowing into real estate results in a loss of price elasticity.

- Jeonse Price Ratios: In regions with abundant occupancy, declining jeonse price ratios can weaken sales support. If jeonse loan reductions coincide, downward pressure may accelerate.

- Delinquency and Guarantee Incidents: Trends in balance loan delinquency rates, jeonse guarantee incidents, and rates of vacancies or non-payments serve as early indicators of leveraged fatigue.

- Interest Rate Spreads: If premium interest rates on new housing loans, as well as spreads on corporate bonds and CPs, widen, the perceived interest rates become stickier and purchasing capacity diminishes.

- M2 and Liquidity: If prices increase despite a slowdown in broad money (M2) growth, it may be an illusion caused by “narrow liquidity.”

Regional and Product-Specific Impacts

- Prime Locations and New Constructions: Demand for “gap investment” remains within the range of available loans, but increased limits and rising premium rates have raised entry barriers.

- Outskirts and Large Apartment Complex Areas: Jeonse loan restrictions may lead to lower jeonse prices, increased vacancy risks, and higher rates of conversion to monthly rent, with sales following the downward trend in jeonse prices.

- High-Priced Segments: Reduced leverage for high-value jeonse demand may heighten ownership burdens, leading to an increase in selective selling or conversion to monthly rent.

Policy Scenarios: Gradual Regulation vs. Hardline Regulation

- Basic Scenario: A gradual reduction in jeonse loans and guarantees, borrower- and product-specific limit management, and strengthened promotion of productive finance. This approach is likely to disperse market shocks.

- Stress Scenario: In the event of heightened exchange rate and global interest rate uncertainty, the scope for base rate cuts would be limited, household loan management tightened, and high-risk borrowers and products subject to selective regulation.

- Easing Scenario: If economic slowdown intensifies, some easing measures might be introduced, but it will be difficult to roll back the frameworks of total volume and risk management.

Points Overlooked by Other Media

- Changes in credit allocation create the gravitational pull on prices. Even with the same liquidity, if the share allocated to real estate decreases, upward momentum is weakened.

- Indirect regulations through guarantee and premium interest rates elevate perceived borrowing costs, thereby controlling loan demand. Focusing solely on the base rate can lead to a misinterpretation of the market.

- The reduction of jeonse loans not only impacts tenants but also directly affects landlords’ cash flows. A secondary shock based on ownership can take time to emerge.

How AI Trends Could Impact Credit and Real Estate

- As AI-based credit assessments become more sophisticated, cash-flow underwriting may become more widespread, potentially further limiting leverage for borrowers with volatile incomes.

- If profit and risk prediction models reflect jeonse-to-monthly rent yields and vacancy risks in real time, banks’ determination of premium interest rates and limits may become more dynamic yet conservative.

- With AI integrated into appraisal and collateral valuation, risk pricing by region and product will become more granular, enhancing “precision targeting” over blanket easing or tightening.

- Ultimately, AI trends could act as a catalyst to quickly dispel the liquidity illusion by enhancing the selectivity of leverage and differentiation of prices.

Checklist for Investors and End-Users

- Review DSCR and debt service burden using stress interest rates, and secure cash flows for 6–12 months prior to loan maturity.

- In regions where jeonse price ratios begin to decline, conduct simultaneous checks on both sales and jeonse conditions. Consider occupancy supply, timing of ownership transfers, and the feasibility of obtaining a jeonse loan.

- Manage negotiations by considering premium interest rates, limits, and guarantee conditions as variables alongside the base rate. Compare the total costs, including guarantee fees and other charges, even if the base rate is similar.

- For prospective buyers of pre-sale or occupancy properties, verify the scope of exceptions for group loans and assess potential changes in DSR and guarantee requirements that could affect balance loans.

Data Calendar: When to Check

- Monitor the reactions of exchange rates and interest rate differentials following the Bank of Korea Monetary Policy Committee and the US FOMC meetings.

- Keep an eye on bank delinquency rates, interest rates on new loan disbursements, jeonse guarantee incident statistics, and data on unsold or unoccupied properties.

- Track trends in M2, credit indicators, corporate bond and CP spreads, and monthly trends in jeonse price ratios.

< Summary >

Despite high expectations for lower interest rates, loans are being restricted by overall volume, limits, premium interest rates, and guarantee regulations.

While DSR Tier 3 includes exceptions that prevent an outright collapse, borrowers’ effective limits have been reduced, and the reduction in jeonse loans is leading to increased transitions to monthly rent and heightened ownership burdens.

External constraints from exchange rates and global interest rates limit the extent of base rate cuts, and the current market rise is more indicative of a liquidity illusion than a genuine recovery.

As credit shifts from real estate to the production sector, purchasing power weakens and price differentiation increases.

AI trends are expected to further refine risk pricing, thereby enhancing the selectivity of leverage.

[Related Articles…]

Link between Reduced Jeonse Loans and Declining Jeonse Ratios in the Capital Area

AI-Based Credit Assessment Transforming Real Estate Loans: 2025 Outlook

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– 금리는 내리는데 대출은 막힌다? 착시 인하의 실체와 대출 막히면 상승장은 끝난다 | 경읽남과 토론합시다 | 박은정 감정평가사 2편

● Hilton Boom, NYC Airbnb Crackdown Fuels Price Power, AI Supercharges Margins

New York Covered by the ‘H’ Sign, Hilton’s Franchise Power and Stock Momentum: A Comprehensive Look at NYC Hotel Demand, Airbnb Regulations, and AI Pricing Strategy

Today’s article covers the surge in New York travel demand along with Hilton’s earnings recovery, its franchise-centric “asset-light” model, and AI-based revenue management, all in one piece.

It summarizes, from an investment perspective, topics that are rarely covered elsewhere, such as the impact of New York’s short-term rental regulations, real interest rate sensitivity, and the effect of exchange rates on tourism demand.

It extracts only the key points on how the hotel and tourism industries are capitalizing on opportunities amid global economic forecasts, U.S. stock market trends, and the variables of interest rates and inflation.

[News Summary] Why the ‘H’ Sign in New York is Shining Even on the Stock Market Now

Hilton’s various brands are located at key prime sites in downtown New York, and reservations are filling up densely on weekends and peak seasons.

Post-pandemic, as global tourism demand recovers, Hilton’s revenue per available room (RevPAR) has shown a slow yet stable annual growth trend for 2024.

Its portfolio of brands (from luxury to midscale) and franchise/management fee-centric structure reduce volatility risk while strengthening cash flow.

Tighter short-term rental regulations (e.g., stricter registration and host residency requirements) in New York City have reduced the supply alternatives to hotels, creating an environment favorable to higher average daily rates (ADR) and occupancy.

The introduction of mobile check-in, digital keys, and AI-based revenue management improves efficiency, while loyalty memberships provide a safety net for demand.

Hilton’s Business Structure: Asset-Light, Multi-Tier Brands, Global Diversification

Since its inception in 1919, Hilton has evolved with an asset-light strategy that focuses on “brand and operations” while minimizing asset ownership.

It operates and franchises thousands of hotels worldwide, aggregating over one million rooms, with direct ownership kept to a minimum.

By segmenting into over 20 brands ranging from luxury to midscale, it broadens the range of price points and tastes available, strengthening its resilience to demand fluctuations.

Its portfolio is diversified with stable domestic demand (in New York, California, Texas, etc.) and growth drivers overseas (Europe, Asia, and the Middle East).

A robust development pipeline, along with strategies to improve capital efficiency through renovations and brand conversions, is proving effective.

The Reality in New York: Location, Demand, and Regulations Create Pricing Power

Locations adjacent to Manhattan’s Midtown, Times Square, and Central Park feature “walkability,” which directly translates into strong persuasion for higher ADR.

A cyclical mix of weekday business, weekend leisure, and group/convention demand helps reduce vacancy risks throughout.

Following New York City’s tightened short-term rental regulations (e.g., stricter registration and host residency requirements), the reduced alternative supply from Airbnb has resulted in a migration of demand to hotels.

This combination of suppressed supply and recovering demand positively impacts hotels’ pricing power and RevPAR stability.

The recovery in tourism and the increase in stays within the city have also led to a tangible recovery in ancillary sales, such as food & beverage and events.

Performance and Value Points: Sophistication in Revenue Management and Shareholder Returns

RevPAR has transitioned from a recovery phase post-pandemic to stable growth, driven by normalization of the mix of urban, resort, and group meeting demand.

A high proportion of franchise and management fees helps keep fixed cost burdens low, resulting in relatively moderate cash flow volatility even during cyclical downturns.

A clear shareholder return policy through share repurchases and dividends, combined with transparency in net profit and free cash flow, supports a stock premium.

Compared to its peers like Marriott (MAR), Hyatt (H), and IHG, Hilton (HLT) displays strengths in “brand expansion and conversion” and “membership lock-in.”

Unlike REITs (e.g., HST, PK), HLT’s operations and fee-based model allows it to relatively avoid the deleveraging shock on asset values due to rising interest rates.

AI and Digital Transformation: Hilton’s Hidden Margin Leverage

Mobile check-in and digital keys reduce front desk processing time and labor costs, while also enhancing a consistent customer experience.

AI-based demand forecasting and dynamic pricing (Revenue Management) optimize ADR and RevPAR in real time by reflecting variables such as seasons, events, weather, and flight schedules.

Leveraging loyalty data alongside generative AI recommendations personalizes room sales, upsells, food & beverage, and rate plans, thereby boosting additional revenue.

Implementing IoT and energy management optimizes in-room air conditioning and lighting, simultaneously reducing costs and carbon emissions from an ESG perspective.

This digital and AI transition contributes to structural efficiency improvements that help defend margins even during economic slowdowns.

Macro Variables Check: The Signals That Interest Rates, the Dollar, and Inflation Send to Hotel Stocks

Rising interest rates put pressure on disposable income for travel, but a moderation in the strong dollar can conversely cushion the recovery of international travel demand.

A slowdown in inflation reduces pressures on wages, food, and utility costs, and when balanced with the ability to pass on price increases (ADR), enhances operating leverage.

In phases when the U.S. stock market re-evaluates the themes of resilient consumer spending and service sector recovery, hotel and travel-related stocks are likely to be re-rated.

If the global economic outlook settles into modest growth and easing inflation, further momentum can be expected from the normalization of convention (MICE) and group demand.

Exchange rates act as a double-edged sword; while they may create offsetting effects between European and Asian demand, diversified chains like Hilton help dilute such volatility.

Risks and Defensive Points: Supply, Labor, Channel Costs, Regulations

A rapid increase in new hotel supply during a supply cycle could weaken the negotiating power for ADR.

A tight labor market can lead to increased housekeeping and food & beverage labor costs, pressuring margins.

High dependency on OTA (online travel agency) commissions can raise channel costs, making an increased share of direct sales and enhanced membership lock-in crucial in response.

Local regulatory and tax changes may stimulate real estate costs, while strikes and security issues could affect demand for urban stays in specific districts.

The defensive points lie in strong brand power, extensive loyalty networks, an asset-light structure, and sophisticated AI revenue management.

Practical Investment Guide: What, When, and How to Monitor

What to buy: Diversify among HLT with its operations/fee-based model, peers in the same industry (MAR, H, IHG), and hotel REITs (HST, PK) if seeking exposure to real estate leverage.

When to invest: Look for signals such as declining real interest rates, a moderation in the strong dollar, and the reopening of MICE/international travel demand, as these may trigger a re-rating of multiples.

What to monitor: Keep an eye on trends in RevPAR/ADR, the mix of group vs. leisure demand, advanced indicators such as flight and OTA search volumes, the pace of share repurchases, the proportion of conversions/renovations in the pipeline, and the performance of AI/digital transformation initiatives.

Risk management: In an economic slowdown, focus on chains with a high proportion of franchise/management fees, while avoiding highly leveraged physical asset owners.

Long-term rationale: A robust loyalty ecosystem, AI-driven revenue management, and ESG efficiency will act as structural competitive advantages throughout economic cycles.

On-Site Insight Memo: How Price, Experience, and Trust Encourage Repeat Visits

In New York’s prime locations, the prices of lounges and food & beverage are not excessively high compared to neighborhood alternatives, and the standardized quality control across the chain ensures a “predictable experience.”

Travelers value a balanced mix of location, safety, cleanliness, and price, and Hilton consolidates this balance through “brand trust” to encourage repeat visits.

When selling an “experience” that goes beyond just a stay, reviews and word-of-mouth directly translate to higher booking conversion rates.

This element is the intangible asset that supports Hilton’s stock premium.

[Key Takeaways Not Often Mentioned Elsewhere] 5 Investment Insights for Immediate Application

The effect of tighter Airbnb regulations in New York could structurally support ADR beyond just a temporary surge in demand.

Hilton’s earnings per share (EPS) growth is driven more by “net unit growth + brand conversion + share repurchases” than by RevPAR alone.

Hotel stocks are more correlated with real interest rates than nominal rates, making a decline in real interest rates during periods of easing inflation favorable for multiple expansion.

The network effect of a loyalty membership base (amounting to hundreds of millions) reduces reliance on OTAs, thereby structurally lowering marketing costs.

The more mature the AI revenue management becomes, the better the RevPAR defense during economic slowdowns, marking the breakeven point for outperformance compared to peers.

Positioning in Keywords for Today

If global economic forecasts suggest modest growth and stable prices, the profit sensitivity of the hotel and tourism industry is positioned to trend upward.

In the U.S. stock market, stocks related to consumer services and travel offer significant visibility into earnings, with potential for multiple recovery once interest rate peaks are behind us.

Easing inflation lowers cost pressures, and a moderated exchange rate accelerates the recovery of international travel demand.

Structural growth in the tourism industry combined with Hilton’s franchise model and the AI trend solidify its long-term competitive edge.

In conclusion, Hilton leverages a “triangular strategy of brand power + data/AI + asset-light” to navigate cycles and ultimately outperform them.

< Summary >Hilton in New York has strengthened its pricing power due to prime locations, regulatory impacts, and recovering demand.

Hilton’s asset-light strategy, multi-tier brands, loyalty, and AI-based revenue management contribute to stable margins and cash flows.

A decline in real interest rates, a milder dollar, and a recovery in MICE provide additional momentum.

Risks include supply, labor, and OTA costs, but these are countered by brand strength, data capabilities, and digital transformation.

Investors should monitor RevPAR, pipeline developments, share repurchase activities, and the progress of AI implementation.

[Related Articles…]

- Hilton: Investment Points in Franchise Power and the Loyalty Ecosystem

- Hilton Stock Momentum Checklist: RevPAR, Share Repurchases, and AI Revenue Management

*Source: [ Maeil Business Newspaper ]

– [어바웃 뉴욕] 여행 명소 곳곳에 켜진 H 간판, 주가도 빛난다? | 길금희 특파원

● City Chaos – Homeless Tide, Fentanyl Flood, Gun Surge

US ‘War on Homelessness’ Talk, Fentanyl Spread, Economic Impacts of Gun Violence, and AI Solutions All in One Summary.

US metropolitan cities are witnessing soaring rental prices and surging homelessness, which can reignite inflation and interest rate hikes.

We separate policy scenarios from the practical feasibility surrounding former President Trump’s “war on homelessness” remarks.

It explains, with examples, the structural causes behind the spread of fentanyl and synthetic drugs through the healthcare system and their impacts on the labor market and economic growth.

It links the secondary impacts of gun violence risks on commercial real estate and local finances to global supply chains and recession probabilities.

Finally, it provides a checklist of AI trends and investment points for urban safety and welfare.

Key Briefing: What is Happening on the Ground in the US Right Now

The video was shot on October 2, and subsequent policies and indicators may change.

Former President Trump expressed a firm stance against the surge in homelessness by mentioning a “war,” but this remains at the level of rhetoric or campaign promises, and there has been no confirmation of deploying troops or a unified federal enforcement.

In major cities including New York, the monthly rent for a one-bedroom apartment reaches approximately 5–6 million KRW, with clear pathways from medical expenses, accidents, or involuntary job loss leading to homelessness.

The US drug crisis began with prescription opioids and transitioned to fentanyl and synthetic drugs, with the healthcare system and regulatory gaps serving as conduits for spread.

Although exposure to gun violence differs by region, perceptions of personal safety consistently rank Korea as overwhelmingly safer.

Data Check: Direct Impacts of Housing, Drugs, and Public Safety on Economic Indicators

Rent and Inflation.

- Soaring rental prices in major cities reinforce the downward rigidity of service costs, supporting core inflation.

- Given the high weight of housing costs in CPI, without a gradual easing in housing expenses, the pace of interest rate cuts may be delayed.

Homelessness and Labor Market.

- Transition into homelessness is accompanied by declines in health, mobility, and credit, reducing labor supply and undermining economic growth through prolonged unemployment and lower productivity.

- A deepening mismatch in urban service sector labor contributes to increasing income polarization.

Fentanyl and Healthcare Cost Shock.

- Addiction and overdoses surge emergency medical expenses and strain public healthcare budgets, pressuring local government finances.

- The chronic nature of these conditions can reduce labor force participation, thereby lowering potential growth rates.

Public Safety Risks and Commercial Real Estate.

- A decline in perceived urban safety reduces pedestrian traffic and retail sales, worsening office vacancy rates and rental income.

- Adjustments in commercial real estate values can exacerbate credit crunches and recession risks through regional bank exposure.

Local Finances and Interest Rate Spreads.

- Expanded budgets for welfare, public safety, and healthcare lead to increased issuance of municipal bonds and wider spreads, impacting private investment rates.

- Persistently high interest rates raise recession probabilities and transmit uncertainty to global supply chains and demand.

Policy Scenarios: ‘Warfare’ Style Tough Response vs. Housing First

Tough Response Scenario.

- Discussions include the removal of illegal homeless tent encampments, enhanced public order measures, and potential mobilization of some federal resources.

- While immediate improvements in perceived safety may be seen, without concurrent strategies addressing housing, healthcare, and addiction treatment, recidivism is likely.

Housing First Scenario.

- Combining housing first initiatives with individualized treatment and job training increases the possibility of rehabilitation and labor re-entry.

- Streamlining permits and floor area regulations, distributing modular and prefab housing, and expanding both public and private rental voucher programs accelerate positive outcomes.

Healthcare and Drug Response.

- Strengthened management of prescription opioids, expanded access to fentanyl tests and antidotes, and community-based treatment networks are key.

- Integrating justice, healthcare, and welfare data for early intervention in high-risk groups proves effective.

AI Trends: The Technological Roadmap Transforming Urban Crisis Management

Urban Safety AI.

- Video and audio-based anomaly detection, gunshot and hazardous gas detection, and crowd density prediction shorten police and fire department response times.

- Predictive policing models require explainability, audit trails, and a human-in-the-loop to address issues of bias and human rights.

Healthcare and Addiction Treatment AI.

- Virtual coaches, CBT chatbots, and medication adherence monitors help reduce relapse rates, with expanded reimbursement potential when connected to Medicaid and insurance.

- Wearable devices and smartphone sensor data monitor sleep, stress, and activity levels, issuing alerts for high-risk individuals.

Optimization of Housing and Welfare Operations.

- Digital twins forecast demand in homeless shelters and enable real-time allocation of beds, healthcare, and security personnel.

- Privacy-preserving data integration and zero-knowledge proof methods are effective in preventing voucher fraud and ensuring transparency in resource allocation.

Urban Financial Infrastructure.

- AI-driven risk scoring stress tests portfolios of commercial real estate and municipal bonds.

- Linking real-time performance data feeds to ESG and impact bonds can help design structures that reduce interest rate spreads.

Market and Investment Checklist: 6 Key Points

- REITs and Commercial Real Estate. A conservative approach is required, particularly for downtown areas with high medium-to-long-term vacancy risks.

- Security and Urban Infrastructure. Demand for cameras, sensors, integrated control centers, and cybersecurity is structurally expanding.

- Digital Health. Monitor the insurance coverage expansion for enterprises involved in addiction treatment, remote mental health, and wearable data.

- Modular and Prefab Housing. Regions with simplified permits offer significant revenue leverage.

- Data Governance. Solutions for privacy-preserving data analytics and model risk management remain robust due to regulatory demand.

- Municipal Bonds and Credit. Considering widening spreads in regions with surging welfare and public safety costs, focus on duration and geographic diversification.

Implications for Korea: Balancing Safety and Growth

- The nighttime economy in dining, retail, and tourism sectors gains directly from a “safety premium,” making proactive investment in urban lighting, CCTV, and rapid response systems highly valuable.

- Housing stability for young people and low-income households is critical to labor supply and productivity, necessitating structured packages for public rental housing, lease deposit guarantees, and modular housing supply.

- Early intervention in drug and mental health issues should be enhanced through digital screening and anonymous counseling channels in schools and workplaces.

- Increasing demonstrations of urban safety AI through regulatory sandboxes and elevating human rights and privacy guidelines to global standards is essential.

This is the Key Point: Overlooked Aspects

- Hidden Costs in Insurance Premiums and Public Procurement. Rising urban risks of crime and fire push up commercial facility insurance premiums, potentially causing secondary inflation through increased rents and consumer prices.

- Systematic Restructuring of Municipal Bond Spreads. With permanent changes in fiscal structures due to ongoing welfare and public safety costs, borrowing costs in certain states and cities may remain structurally high, transferring upward pressure to private interest rates.

- Regulation-Driven Growth in AI Demand. The mandatory compliance for urban safety and healthcare data will lead to stable public demand for AI governance and privacy technologies.

- The Cost-Benefit Tipping Point of Housing First. The social return, recouped through reductions in re-hospitalization and judicial costs rather than merely shelter operating expenses, becomes the tipping point attracting private impact capital.

Fact and Risk Note

- This issue varies greatly by region and cannot be generalized across the entire US based on single instances.

- Former President Trump’s remarks should be distinguished between rhetoric and confirmed policy paths, as the implementation route may vary significantly depending on timing and political circumstances.

- It is advisable to regularly check official statistics from HUD, CDC, BLS, and other sources for the latest figures and detailed policies.

Roadmap for the Next 12 Months

- Interest Rates. A slow easing in housing costs may lead to a gradual pace of interest rate cuts.

- Labor Market. Addiction and housing instability could perpetuate labor shortages in specific sectors.

- Urban Economy. Expanded budgets for safety and welfare alongside adjustments in commercial real estate are likely to occur simultaneously.

- AI Trends. Demand for urban safety, digital health, and data governance solutions is expected to expand, spurred by regulations and budgets.

< Summary >

- Soaring rental prices in metropolitan areas, homelessness, fentanyl, and deteriorating public safety send a chain reaction impacting inflation, interest rates, and growth rates.

- Trump’s “war” remarks signal a tough approach, but practical solutions combine housing first with integrated healthcare, public safety, and data systems for greater effectiveness.

- AI enhances efficiency in urban safety, addiction treatment, and welfare operations, while the privacy and ethics compliance market experiences parallel growth.

- Investors should focus on managing risks in commercial real estate and municipal bonds as well as opportunities in security, digital health, and data governance.

[Related Articles…]Key 5 Points on US Federal Reserve Interest Rate Path and 2025 Economic Outlook

Changing Urban Safety with AI: The Current State and Future of Predictive Policing and Privacy Technologies

*Source: [ 달란트투자 ]

– ‘노숙자와 전쟁’ 선포한 트럼프. 완전 난리난 미국 현지 상황 | 김상조 교수 2부