● Trump Trade Collapses – Liquidity Crunch Sparks Tech, Crypto Bloodbath

Exhausting ‘Trump Trade’: A Signal of a Change in Sentiment or a Reallocation of Liquidity?

This article contains the following: five real variables during the period of short-term volatile markets and the December liquidity calendar. It explains how the weakening of Trump’s policy momentum is reversing sector returns. It outlines the fragile link in the funding chain where AI, data centers, and private credit intertwine. It discusses the cross impact of a shift in the dollar on the won exchange rate and the US stock market. It also summarizes a risk management checklist and a cash management recipe that can be used immediately.

News Briefing: This Downturn is Fundamentally About ‘Liquidity’ Rather Than Surface-Level Bad News

The three major indices have been adjusting since their highs at the end of October, increasing fatigue across the US stock market.

The declines were largest according to liquidity sensitivity, with Bitcoin, Ethereum, ARK → semiconductors → Nasdaq/megacaps being hit sequentially.

Comments from Fed officials and minutes from meetings have caused the probability of interest rate cuts to fluctuate on a daily basis, making the market hypersensitive to signals of the “money line.”

The surge in fear-greed indices and put trading volumes shows that investor sentiment has become extremely skewed, suggesting room for a technical rebound at the same time.

The core message can be summarized as follows: this adjustment is not due to individual issues, but rather a re-pricing of liquidity and the expected trajectory of interest rates.

Weakened Trump Beneficiary Stocks: A Reversal in Sector Performance

Stocks categorized as beneficiaries of Trump’s policies – including AI infrastructure, semiconductors, power/nuclear, and cryptocurrency-related companies – have recently shown relative weakness.

Conversely, the healthcare and pharmaceutical sectors, which have long been neglected, have turned to short-term relative strength, indicating a sector rotation.

There are two underlying reasons for this. First, the tangible impact of inflation has increased, and public opinion polls show a deterioration in evaluations of the economy and inflation, weakening policy momentum.

Second, as liquidity tightens, risk is being reallocated from growth and thematic investments to defensive and cash flow-focused assets.

December Liquidity Calendar: Three Major Catalysts

The market’s focus is on three fronts: interest rates, quantitative tightening (QT), and the Treasury’s cash flow.

- With official signals hinting at a reduction or end of QT as early as December, there is a gradual expectation of easing asset market liquidity.

- Following the resolution of shutdown variables, changes in the Treasury’s issuance schedule and cash balances (TGA) will directly affect short-term money market liquidity.

- If the FOMC presents a dovish interest rate path, it will breathe life into risk assets; conversely, if it signals “persistently high rates,” volatility could resurface.

The point is not simply good or bad news, but the direction and pace of liquidity. The net increase in liquidity is more important than interest rate cuts.

The Link Between AI and Private Credit: The Fragile Link in the Funding Chain

At the forefront of the AI infrastructure cycle is data center investment (power, servers, networking).

A portion of this funding has been supplied by private credit and private funds, and recent issues such as delays and suspensions in redemptions by some managers have transmitted stress.

As concerns about the cash flows of companies like Oracle have surfaced, demand for credit default swaps (CDS) has increased, and major managers are also increasing their hedge ratios.

The message is: if the funding line is disrupted, even more than the AI fundamentals themselves, valuations can be shaken significantly. This is a phase where the liquidity premium is contracting.

Crypto-Stock Leverage Loop: A Chain Reaction Among Liquidity-Sensitive Assets

A steep decline in cryptocurrencies triggers margin calls on leveraged accounts, leading to the sale of stocks and ETFs to generate cash in a chain reaction.

This is why drops in Bitcoin often occur in tandem with short-term adjustments in the US stock market.

In a bull market, the liquidity ranking ladder rises from the outer (coins/themes), whereas in a bear market, it crumbles from the outer levels. At present, it is the latter cycle.

Shift in Dollar Direction and the Won Exchange Rate: The Threshold of a Cross Shock

While Trump favors a weak dollar, if the market shifts toward a strong dollar, it could lead to a withdrawal of funds from emerging markets and a contraction of global liquidity.

Recently, even in a phase of a weak dollar, the won has shown relative weakness, so if the dollar rebounds, upward exchange rate risks may increase.

Strategically, review the proportion of dollar-denominated assets and liquid assets. Super short-term US Treasury ETFs like SGOV can be a useful option for managing idle funds.

From the perspective of key keywords, volatility in the US stock market is simultaneously determined by the interest rate path, net liquidity changes, the direction of the dollar, and the perceived inflation.

Political and Calendar Variables: Thanksgiving, End-of-War Rumors, Tariff Easing

Around Thanksgiving, trading volumes are thin, and the impact of policy messages and headlines is magnified.

Rumors of an “end” to the Ukraine-Russia conflict and some tariff easing measures have a positive effect on prices and sentiment, although they are still largely event-driven.

They might create a short-term rebound, but to transition into a sustained trend, clear signals of easing in the three liquidity elements mentioned earlier are necessary.

Investment Strategy Checklist: Positioning to Apply Immediately

- Start with risk management. Reducing leverage, resetting stop-loss levels, and adjusting position sizes should be prioritized.

- For idle funds, opt for dollars or super short-term bonds. A strategy of waiting for opportunities while receiving monthly distributions through SGOV or similar options is effective.

- Sectors: Partially cushion with defensive stocks (healthcare and pharmaceuticals), and approach AI core (megacaps/semiconductors) assets with sound fundamentals gradually.

- Signals: Monitor extreme fear-greed indices, sudden spikes in put/call skew, diminishing crypto volatility, and a peak-out in dollar strength simultaneously. Do not focus on just one.

- Scenarios: If signals confirm easing liquidity, expand risk-on gradually (core → semiconductors → thematic → crypto). Conversely, if credit stress intensifies, strengthen the defensive stance.

Key Takeaways That are Easily Overlooked (Excluding Other Channels)

- When the election calendar and liquidity events (QT, TGA, FOMC) coincide in the same month, the gap between short-term stock “dressing” and real liquidity becomes significant. This gap is usually settled in the following quarter.

- The direction of the dollar is determined more by the “market credit premium” than by policy intentions. A shift to a strong dollar may indicate a weakened policy drive.

- The AI investment cycle is not just about semiconductors, cloud, and power. Private credit is the funding line for data center capex, which is what differentiates this cycle.

- Crypto and stock leverage are connected at the broker level, so margin calls will occur across asset classes all at once. In such cases, “cash” is the only alpha.

- Healthcare is driven by dual factors: reduced policy risk and GLP-1 (obesity drug) performance momentum. It should be seen as an intermediate stop in a structural rotation.

This Week’s (Holiday Week) Checkpoints

- With a market closure on Thursday and early closure on Friday, trading will be thin. Headlines may exaggerate risks.

- Monitor the simultaneous rebound or decline in interest rates, the dollar, and crypto. A deviation in even one can increase volatility.

- Policy messages (tariffs, statements on price stability) and war risk headlines are more sensitive to changes in “sentiment” and “expectation” than to sheer direction.

< Summary >

- The essence of this adjustment is a reallocation of liquidity and a re-pricing of the interest rate path.

- The weakness of Trump beneficiary stocks and the strength of healthcare are the results of a weakening policy momentum combined with a preference for defensives.

- The fragile link in the AI funding chain is “private credit,” and credit stress directly translates into compressed valuations.

- A shift in the dollar’s direction can be fatal to global liquidity and increase upward risks for the won exchange rate.

- The strategy is to increase cash holdings, position idle funds in dollars and super short-term bonds, use a gradual approach with core assets, and re-expand risk-on once liquidity easing is confirmed.

[Related Articles…]

Dollar Strength Shift and Won Exchange Rate: 2025 Investment Positioning Map

AI Data Center Funding Line Check: Private Credit Risks and the Semiconductor Cycle

*Source: [ 소수몽키 ]

– 힘 빠지는 트럼프 수혜주들, 증시 분위기 변화 신호일까

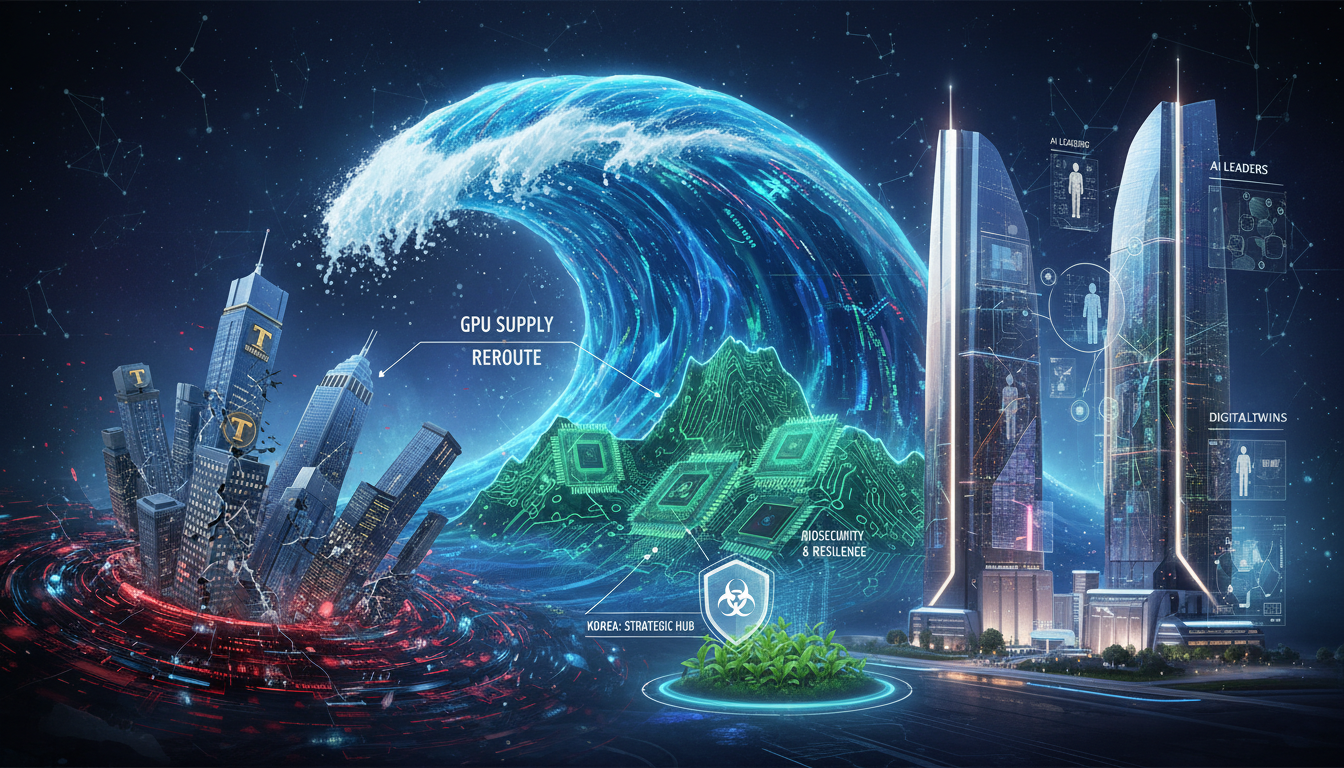

● GPU Tsunami, Korea Crowned AI Powerhouse

Physical AI and Digital Twins, the Butterfly Effect of 260,000 GPUs. The True Reasons Korea Was Chosen and Key Points of the 2026 Global Economic Outlook

Below are the key points you can immediately verify in this article.

– It explains where Physical AI actually generates revenue and how the operation of Digital Twins is connected.

– It reveals why NVIDIA’s “Cosmos WFM” style World Foundation Model becomes the operating system for robots, autonomous driving, and smart home appliances.

– It details the industrial and geopolitical reasons behind Jensen Huang’s choice of Korea using the entire AI value chain.

– It presents actionable revenue models and KPIs in the three major market opportunities (autonomous vehicles, humanoid robots, and smart home appliances).

– It outlines the five major bottlenecks (power, cooling, packaging, personnel, and regulation) along with a roadmap for solutions.

– It clarifies the debate between the AI bubble theory and the supercycle using data center investments and semiconductor supply chain realities.

The global economic outlook and AI trends are interlinked in a news format that is easy to digest.

[News Briefing] 260,000 GPUs and the Physical AI Alliance. What, Where, and How It Will Change

– Headline. NVIDIA has expressed its intention to supply 260,000 GPUs to Korea as a priority, accelerating the Physical AI alliance.

– Background. “Physical AI” has emerged as an official topic at CES and various conferences, with the operational brain provided by “Digital Twins.”

– Why Now. Data center demand has soared to critical levels, and structural shortages in GPUs and HBM have given early adopter nations network effects.

– Korea’s Position. Korea is one of the few countries equipped with a full-stack AI value chain—from HBM-centric semiconductors to telecommunications, home appliances, automotive, robotics, and cloud.

– Company Snapshots. Samsung Electronics (HBM, home appliances, mobile, robotics), SK Hynix (HBM3E), Hyundai Motor (autonomous driving, robotics), Naver (cloud, robotics, digital twins), and the three major telecom companies (edge, 6G preparation) have clearly defined roles.

Data centers, semiconductors, digital twins, and AI trends are all interconnected in one line.

The Operating System of Physical AI: Anatomy of Digital Twins and Cosmos WFM

– Concept. Digital Twins digitally replicate physical systems (factories, cities, vehicles, robots) to enable monitoring, prediction, and control.

– WFM (World Foundation Model). A “world model” that has pre-trained on vast multi-modal data adapts rapidly to on-site sensor and video streams.

– Operating Process. It proceeds from pre-training (general-purpose) → custom fine-tuning (domain-specific) → real-time adaptation (online learning) → physical control (policy execution).

– Technological Points. Simulation-to-real (sim2real), domain randomization, safety policy guardrails, and low-latency interfaces with RTOS/middleware are directly linked to revenue.

– Why NVIDIA. Their GPU computing power, Omniverse simulation suite, and sensor/robot stack combine to create a model that “learns in the twin and earns on the ground.”

Digital Twins are essentially the operating system for Physical AI, and WFM serves as the brain of that system.

Why NVIDIA Chose Korea: Full-Stack AI Value Chain and Geopolitics

– Semiconductor Muscle. Without SK Hynix and Samsung Electronics, which virtually dominate the HBM market, large-scale AI models cannot operate.

– Assembly and Finished Products. Hyundai Motor (vehicles, robots), Samsung/LG (smart homes, appliances), and Naver (cloud, platforms) deliver Physical AI as a “product.”

– Telecommunications/Edge. Korea’s leadership in 5G commercialization and ongoing 6G R&D lay the foundation for low-latency edge inference.

– Data Centers. Korea has significant potential to grow into a hub with expanded power, cooling, land, and submarine cable capabilities, while simultaneously scaling hyper-scale and colocation.

– Geopolitics. Amid U.S.-China technology decoupling, Korea is a reliable allied supply chain and the Asian foothold.

Since Korea offers an unbroken value chain from components to services, it is the most efficient market for “follow-on” opportunities.

The Three Major Industrial Opportunities: Autonomous Vehicles, Humanoid Robots, Smart Home Appliances

– Autonomous Vehicles (pivoting from L2+ to L4).

Revenue Model: ADAS subscriptions, map updates, insurance integration, robo-taxi/last-mile logistics.

KPIs: Reduced intervention rates, cost per kilometer, HD/SD map update intervals, OTA frequency, accident rates.

Challenges: V2X infrastructure, simulation verification, alignment of liability and insurance regulations.

– Humanoid Robots (exponential growth expected post-2030).

Revenue Model: Subscriptions in manufacturing lines/logistics centers (RaaS), facility management, eldercare/service assistance, replacement in high-risk tasks.

KPIs: Task completion rate, MTBF, zero safety incidents, per capita productivity improvement, power consumption per hour.

Challenges: Grip/walking stability, safety standards (ISO/IEC), transfer from simulation to field, unit price convergence into the $20,000–$30,000 range.

– Smart Home Appliances (Korea’s competitive advantage).

Revenue Model: Bundled subscriptions for home appliances + mobile + cloud, energy-saving tariff plans, home robot/security services.

KPIs: ARPU per household, energy savings percentage, automated shopping cart conversion rate, fault prediction accuracy.

Challenges: Interoperability (standards), efficient edge LLM, security and privacy, integration with retail partners.

Smart homes offer the optimal area for generating early cash flow due to a large market size and strong domestic corporate competitiveness.

The Five Real Bottlenecks and Their Solutions: Power, Cooling, Packaging, Personnel, Regulation

– Power. Data center power demand is concentrated at the city level. A mix of PPAs, renewable energy, and nuclear power (large/SMR), alongside an expansion of the transmission and distribution network, is required.

– Cooling. Moving from air cooling to immersion/direct liquid cooling (2-phase/single-phase) is essential, with a target PUE of around 1.1 influencing TCO.

– Packaging. Limitations in CoWoS and HBM stacking yields, as well as packaging capacity, restrict system supply. The domestic packaging ecosystem needs to be advanced.

– Personnel. It is critical to train robotics software engineers, safety engineers, and data/simulation experts. Collaborative labs between industry and academia and simplified international visa protocols are the solutions.

– Regulation. Continuous regulatory sandboxes, clear guardrails for safety and liability, and clearly defined performance milestones are needed to facilitate commercialization.

Bubble or Supercycle? Interpreting Investment Signals

– Bubble Phase. Although GPU prices and some valuations are overheated, the transition to data centers and Physical AI represents a tangible cycle with simultaneous growth in facilities, power, and application ecosystems.

– Demand Support. National AI strategies, corporate automation investments, and ROI from energy optimization, safety, and quality improvements drive repeat purchases.

– Checkpoints. The pace of power and packaging expansion, the balance between edge and cloud, and an increasing share of subscription-based revenue indicate the health of the cycle.

From a global economic perspective, investments in AI infrastructure and energy will likely support growth rates at least until 2026.

[Key Points Often Overlooked by Other Media] The “Operations Layer” of Digital Twins Is Where Real Revenue Lies

– Margins Thicker Than Hardware. Continuous revenue is generated from twin operations, monitoring, simulation, and safety verification subscriptions.

– Korea’s Hidden Asset. With numerous edge devices in home appliances, vehicles, and robots, Korea is well-positioned to accumulate twin operation data, which fuels WFM improvements.

– Integration of Energy and Computing. There is potential to export an integrated “power-cooling-computing” package that combines PPAs, immersion cooling, and heat recycling.

– Standard Leadership. By pre-empting simulation formats and safety log standards, platform power can be amplified through network effects.

Butterfly Effect Strategy: 0-6-12-24 Month Execution Roadmap

– 0–6 Months. Finalize GPU/HBM capacity allocation, launch 10 pilot Digital Twin projects (factories, logistics, buildings), conduct PoC for immersion cooling, and institutionalize continuous regulatory sandboxes.

– 6–12 Months. Launch the smart home bundled subscription, secure commercial contracts for autonomous driving (L2+/robotics RaaS), establish a Twin Operations Center (NOC), and expand PPA agreements.

– 12–24 Months. Export turnkey data centers abroad, globally launch twin operation SaaS, collaborate on 6G test networks and edge solutions, and diversify revenue by standardizing safety standards/verification services.

Companies should pursue a dual-engine approach of “hardware sales + subscription operations,” while governments must simultaneously develop the “power highway + AI highway.”

Corporate, Investment, and Policy Checklist

– Corporations. Set targets for the subscription share of twin operations, establish KPIs for OTA/simulation coverage, evaluate TCO for immersion cooling transitions, and review baseline designs for security and privacy.

– Investments. Diversify portfolios into power, cooling, packaging, and software safety layers; keep an eye on edge memory and low-power accelerators.

– Policies. Prioritize investments in transmission and distribution, develop an SMR roadmap, simplify international personnel visas, establish clear systems for liability and insurance, and implement a “Twin First” criterion in public procurement.

Conclusion: The 260,000 GPUs Are Just the Starting Signal. Digital Twins Are the Backbone of Revenue, and Smart Homes the Cash Cows

The transition to Physical AI is not achieved with a single hardware sale.

Digital Twin operations and subscriptions for smart home appliances generate initial cash flow, while autonomous vehicles and humanoid robots shape the mid- to long-term growth curve.

Korea is unique in its convergence of semiconductors, manufacturing, telecommunications, and data centers.

If power and regulations can be navigated with a butterfly effect strategy, the 2026 AI trend will translate into tangible growth in Korea.

< Summary >

– The brain of Physical AI is the Digital Twin, and the WFM is responsible for adapting on-site.

– Korea is the ideal full-stack nation with HBM, finished products, telecommunications, cloud, and data centers, maximizing the efficiency of the NVIDIA alliance.

– Among autonomous vehicles, humanoid robots, and smart homes, the short-term cash cow is the smart home subscription, while robots/autonomous driving drive long-term growth.

– The bottlenecks are power, cooling, packaging, personnel, and regulation; solutions lie in PPAs, immersion cooling, and regulatory sandboxes.

– A 0–24 month roadmap should be pursued to simultaneously drive twin operations subscriptions and data center exports.

[Related Articles…]

Entering the Era of Physical AI Operations with Digital Twins

HBM Supercycle and the Data Center Power Battle

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– 피지컬 AI 시대, GPU 26만장의 나비효과 : 엔비디아가 주목하고 있는 차세대 비즈니스 – ‘디지털 트윈(Digital Twin)’ [경읽남 220화]

● Biosecurity Law Ignites CDMO Boom, Samsung Biologics Under Fire, Secret Chip Kings Rise

December Variables Overview: Biosecurity Act, Samsung Biologics Checkpoint, and Investment Scenario Covering Candidates for the ‘Next Semiconductor Leader’ in One Read

Key Takeaways from This Article

We have summarized the practical impacts and checkpoints for the bio/CDMO value chain that the passage of the Biosecurity Act in December may bring.

The issues concerning Samsung Biologics’ trading suspension and spin-off listing are examined focusing primarily on performance, order backlog, and exchange rate sensitivity, assuming confirmation through disclosures.

Instead of proposing specific stocks for the “next semiconductor leader that no one cares about,” candidate categories were identified based on technology, order book, and market structure criteria.

An example three-basket portfolio assuming 100 million won and a simple action checklist summarizing how changes in interest rates, the dollar, and the global economic outlook affect the stock market have been organized.

We also separately outlined three hidden variables—policy calendar, CAPEX thirst, and leading indicators—that other news and YouTube channels often overlook.

News Briefing 1: The Passage of the Biosecurity Act in December – The Link Between Bio Production Capacity and Stock Price Resilience

The key issues are regulatory clarity and the criteria for production facility permits and management.

If the law is passed, the scale economies and quality systems of large CDMOs are likely to emerge as relative advantages.

Global big pharma prefers partners with low regulatory risks, so companies with robust CAPA and cGMP certification stacks have an edge in securing orders.

Conversely, during the early phase of the law’s implementation, increased review periods and stricter approval procedures may lengthen the lead times for smaller CMOs.

The investment point is that regulatory clarity may actually raise the entry barriers for large companies.

News Briefing 2: Samsung Biologics – What Should Be Checked and Approached?

Although the original text mentions trading suspension and the spin-off listing on November 24, it is essential to first verify the facts through the Korea Exchange and the company’s disclosures.

The stock price direction of large bio companies can be simplified into three aspects.

First, the CAPA expansion timeline and utilization rate.

Second, the long-term CDMO order backlog and exchange rate sensitivity.

Third, regulatory issues and the stability of internal process quality indicators.

If the Biosecurity Act is passed in December and the trend towards global pharmaceutical supply chain stabilization is strengthened, the valuation premium for large CDMOs may be re-evaluated.

However, the rally in large-cap stocks will accelerate when performance visibility and changes in the macro interest rate regime align.

In other words, as the expectation of rate cuts in 2025 materializes, the potential for multiple expansion increases.

News Briefing 3: Where Will the ‘Next Semiconductor Leader’ Come From – Find It Through ‘Technological Position’ Instead of Stock Names

In the AI server cycle, there are three segments where a new leader may emerge.

1) It involves core equipment and materials of the AI memory value chain, such as HBM, HBM2E, and HBM3E.

The key terms are hot-press bonding, TSV stacking yield, and high-performance packaging materials.

If accompanied by an increase in order backlog, extended lead times, and sustained ASP increases, this is seen as a signal of structural growth.

2) Equipment related to advanced packaging (2.5D/3D, CoWoS, FOPLP, panel-level) is included.

When CAPEX guidance for foundries and OSAT increases and the ramp-up schedule for new lines becomes visible, a multiple re-rating occurs.

3) Components in the bottleneck segments, such as testing, sockets, and interposers.

Difficult sockets and interposers have high customer switching costs, so once market share increases, it does not easily decline.

The “no one cares about” segment is typically during industry troughs or supply transitions.

Signals usually first appear in order backlog and lead times before the YoY recovery in quarterly performance.

Three-Basket Portfolio Example Assuming 100 Million Won (For Idea Purposes)

This is not a recommendation, but an example of a thought framework.

35% in bio CDMO leaders.

45% in the AI semiconductor value chain (equipment, components, materials).

20% in cash and short-term bonds to cushion volatility and respond to event risks.

The checklist before inclusion consists of four items.

1) Whether there is margin improvement in quarterly performance and an increase in order backlog.

2) An upward revision in customer CAPEX guidance.

3) The path of exchange rates and interest rates (a moderation in the strong dollar) is favorable for multiple expansion.

4) Check for any adverse issues in the regulatory/policy calendar.

Connecting the Global Economic Outlook and the Stock Market: Why Interest Rates and the Dollar Matter

When signals suggest that U.S. interest rates have peaked, the multiples of growth sectors that had been suppressed in valuation will recover first.

If the strength of the dollar eases, the pressure from foreign exchange losses on emerging market stock markets and semiconductor export companies will diminish.

The AI cycle accompanies hyper-scale CAPEX, and the greater the upward revision of CAPEX guidance next year, the more the memory, packaging, and testing chains benefit.

In short, when expectations for interest rate easing and AI CAPEX revisions occur simultaneously, both sector beta and alpha emerge.

Fact-Checking and Risks

Be sure to verify the trading suspension and spin-off listing schedule for Samsung Biologics through the Korea Exchange and the company’s disclosures.

During the early stages of regulatory changes, delays in approvals and other trial-and-error issues may lead to increased short-term volatility.

Semiconductors are a cyclical industry, and short-term earnings fluctuations due to inventory adjustments and changes in customer mix are common.

Expanding HBM for AI servers requires a precise process, and yield issues can amplify stock price volatility.

Three Key Points Often Overlooked Elsewhere

1) The policy calendar influences multiples.

The timing of the Biosecurity Act’s conclusion and updates to national pharmaceutical regulatory guidelines can change order preferences.

2) A thirst for CAPEX is the real momentum.

When customer companies’ capital expenditure guidance is revised upward, equipment and component stocks tend to move ahead of their earnings.

3) Incorporate leading indicators.

DRAM spot prices, shipping freight rates, YoY changes in Korean semiconductor exports, and remarks on lead times from major equipment companies provide signals faster than the news.

Action Checklist (Practical)

1) Check the numbers for CAPA, order backlog, and utilization rate in disclosures and IR materials.

2) Manage quarterly updates in customer CAPEX (foundries, memory, hyper-scalers) with a calendar.

3) Set regulatory/policy schedules (like the Biosecurity Act) as event risks and adjust position sizes accordingly.

4) In phases where interest rate and dollar regimes change, adopt a strategy of gradual buying and selling.

Review in Summary with Key Keywords

The passage of the Biosecurity Act is likely to work in favor of raising entry barriers for large CDMOs.

For Samsung Biologics, verify the facts through disclosures and simplify investment decisions based on CAPA, order backlog, and exchange rate.

The next semiconductor leader is most likely to emerge from the bottleneck segments of HBM equipment, advanced packaging, and testing components.

If a peak in interest rates coincides with an upward revision of AI CAPEX, a rally driven by both multiples and profits is possible.

A 100 million won portfolio divided into three baskets—35% bio CDMO, 45% AI semiconductor chain, and 20% cash/short-term bonds—is a rational approach to managing volatility.

Caution

This article does not recommend buying or selling specific stocks, and some claims and dates in the original interview require cross-verification with disclosures and institutional data.

Investments can result in capital loss, and the risks are borne by the individual.

< Summary >

The Biosecurity Act in December has the potential to bring regulatory clarity favorable to large CDMOs.

For issues related to Samsung Biologics, check based on CAPA, order backlog, and exchange rate sensitivity after confirming via disclosures.

The next semiconductor leader is highly likely to emerge from bottleneck areas such as HBM, advanced packaging, and testing components.

When a peak in interest rates coincides with an upward revision of AI CAPEX, the multiples in growth sectors will recover.

A 100 million won portfolio divided into three baskets—35% bio CDMO, 45% AI semiconductor chain, and 20% cash/short-term bonds—is a rational approach to managing volatility.

[Related Articles…]

Semiconductor Supercycle Outlook and CAPEX Checkpoints

The Structural Changes in the CDMO Industry Caused by the Biosecurity Act

*Source: [ 달란트투자 ]

– “지금도 너무 싸다” 아무도 관심 없는 ‘이 주식’. 곧 미친듯 오를 겁니다 | 김동석 운용역 3부