● Tesla Bets on 10-Billion-Mile Breakthrough, Nvidia Platform Blitz Sparks OEM Reset

Why July 2026: The Real Arithmetic Behind Tesla’s “Autonomy Completion” Timeline (10 Billion Miles), the NVIDIA Platform Variable, and the Automotive Industry’s Strategic Choice

This report focuses on three points:

First, Elon Musk’s reference to “July 2026” is framed not as aspiration but as an internal benchmark based on cumulative driving miles.

Second, NVIDIA’s CES narrative around simulation/platforms appears influential, but the competitive dynamics change materially when confronted with the long-tail problem (rare real-world edge cases) emphasized by Tesla.

Third, legacy OEM interest in NVIDIA (e.g., Hyundai) signals less of a simple collaboration and more of a “starting-point reset” in industry positioning.

1) News Briefing: Five Market-Relevant Takeaways

1-1. Musk cites “July 2026” for “full autonomy”

The key is the benchmark implied: the data scale required for safe unsupervised driving is presented as 10 billion miles.

1-2. Autonomy reframed as “demo vs real-world”

The emphasis shifts from sensor/model showcase to real-world long-tail coverage: the highest difficulty is concentrated in extremely rare edge cases rather than frequent scenarios.

1-3. Evidence of ongoing paid FSD subscriptions (USD 99/month)

Despite performance and classification debates (e.g., Level 2), continued payment indicates measurable willingness to pay (WTP), a relevant signal for monetization.

1-4. CES 2026: NVIDIA increases pressure with an autonomy platform (simulation/computing)

Platform demonstrations do not automatically translate into large-scale on-road deployment and operations; the path from demo to scaled product remains distinct.

1-5. Hyundai’s non-public discussions and internal review regarding NVIDIA

This appears less like incremental acceleration and more like resetting the benchmark via external platforms rather than relying solely on internal accumulation.

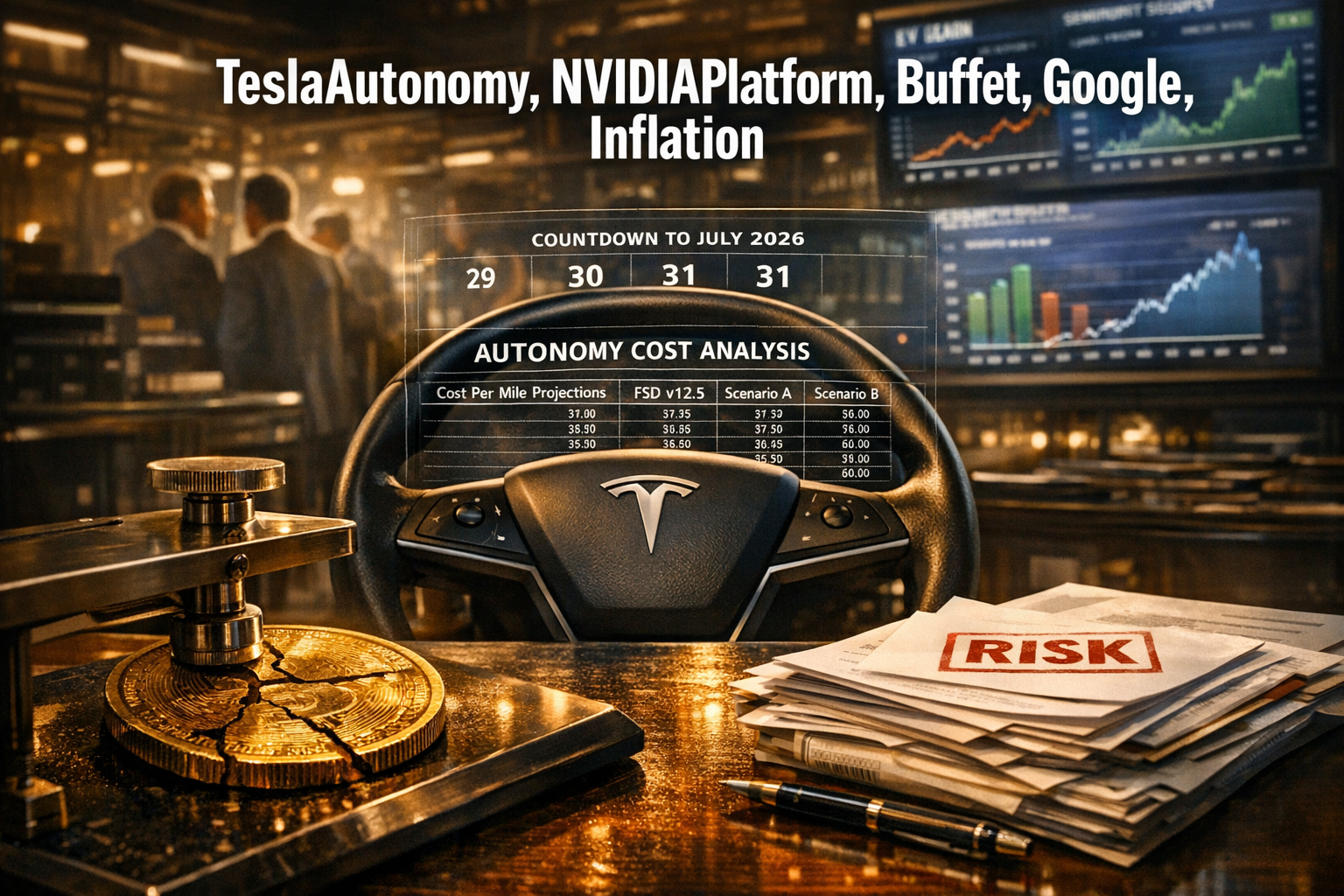

2) Why July 2026: The “10 Billion Miles” Benchmark and Timeline

2-1. Musk’s stated threshold: 10 billion miles

Safe unsupervised autonomy is linked to an approximate data scale requirement of 10 billion miles, prioritizing real-world failure collection and learning.

2-2. Tesla cumulative level: ~7.2 billion miles (as cited)

The cumulative supervised FSD mileage is estimated at ~7.2 billion miles, with a daily increase approximated at ~14 million miles.

2-3. Simple arithmetic implying a target window

Required (10.0B) – current (7.2B) = 2.8B miles.

2.8B miles ÷ 14M miles/day ≈ 200 days.

If the accumulation rate holds, a benchmark-reaching window can be estimated, supporting statements such as “around July 2026.”

2-4. “Completion” likely includes operations, safety, and regulation

Unsupervised capability is constrained by jurisdictional approvals, safety statistics, insurance/liability frameworks, mapping/road infrastructure, and operational rollout scope.

3) The Core Battlefield: “Simulation vs Real-World Long Tail”

3-1. NVIDIA’s core proposition: autonomy as a compute/simulation problem

A platform approach aims to accelerate development and enable OEMs to build on a shared stack.

3-2. Tesla’s counterpoint: simulation cannot fully generate undefined reality

Simulation and synthetic data are effective for reproducing known failure modes, but rare, undefined edge cases remain a critical risk factor.

3-3. Demo and scaled product are structurally different

Autonomy often exhibits an unusually large gap between demonstration and reliable large-scale operation, with implications for market share, valuation, and risk premiums.

4) Why the Industry Is Splitting: Tesla’s “Accumulation Economics” vs OEM “Platform Purchase”

4-1. Tesla approach: data flywheel plus OTA iteration

Daily on-road data capture and continuous software deployment create compounding scale effects over time.

4-2. OEM constraint: limited time to replicate long-tail accumulation

Legacy manufacturers may have strong production capacity but cannot quickly reproduce the time-dependent, fleet-scale learning curve.

4-3. Implication of Hyundai–NVIDIA evaluation

This can be interpreted as a reset of the competitive starting point, reflecting a view that internal accumulation alone may be insufficient to close the gap. This may increase strategic alliances and M&A activity across the global automotive supply chain.

5) (Additional) Why the Musk–OpenAI Lawsuit Is Relevant in the Same Context

5-1. Focus on structure and starting commitments rather than speed

The autonomy narrative emphasizes real-world accumulation over presentation; the legal narrative emphasizes whether founding commitments and governance structures remain intact.

5-2. Broader impact: governance and regulation risk

A jury-driven process implies that non-technical public judgment may influence AI governance debates, potentially affecting policy direction, corporate structure expectations, and sector risk premiums.

6) Key Points Often Underweighted in Coverage

6-1. 10 billion miles functions as a persuasion threshold, not only a technical target

The metric serves as a communication unit for regulators, insurers, and consumers regarding safety credibility.

6-2. NVIDIA platforms may accelerate OEMs, but data ownership remains unresolved

Platform adoption raises questions of who controls driving data and who controls update authority, affecting long-term profit allocation.

6-3. Persistent FSD subscriptions indicate early validation of a recurring-revenue model

Independent of autonomy classification, habitual paid usage supports the view that autonomy can be valued as subscription utility, not only as a one-time product feature.

7) Monitoring Points Through 2026

7-1. Sustainability of FSD cumulative-mile growth

Whether ~14M miles/day is maintained or accelerates versus slows will influence the credibility of the stated window.

7-2. Scope definition of “unsupervised”

Initial rollouts may be limited by geography, weather, road types, and operating constraints.

7-3. Regulatory approval and insurance/liability frameworks

As technical capability improves, bottlenecks may shift to approval, responsibility allocation, and incident attribution.

7-4. Data competition: platform ecosystem vs vertically integrated operators

The competitive endpoint may converge on who can collect, learn from, and deploy improvements from real-world data faster at scale.

< Summary >

The reference to July 2026 is positioned as a rate-based estimate derived from a 10 billion-mile benchmark, current cumulative mileage (~7.2B), and a cited daily accumulation rate (~14M). NVIDIA’s simulation/platform strategy is substantial, but the real-world long-tail challenge remains a differentiator that favors scaled on-road accumulation and rapid iterative deployment. OEM engagement with platforms such as NVIDIA can be interpreted as a reset of strategic baselines, potentially accelerating industry restructuring around partnerships, profit-sharing, and control over data and software.

[Related Links…]

-

Autonomy market: unsupervised FSD and changes in regulatory and insurance frameworks

https://NextGenInsight.net?s=autonomous-driving -

NVIDIA platform strategy: automotive supply chains and data control

https://NextGenInsight.net?s=nvidia

*Source: [ 오늘의 테슬라 뉴스 ]

– 왜 하필 2026년 7월일까? 테슬라가 ���율주행 ‘완성’ 시점으로 이 날짜를 꺼낸 이유는 ?

● Banpo Solo Housewarming Sparks Inflation Shock, Debt Squeeze, Retail Revolution, AI Commerce Surge

Why a Banpo Single-Person “Housewarming” Video Qualifies as Economic Content: 3 Signals of Changing Consumption (Inflation, Household Debt, Retail Innovation) plus AI/Retail Trends

This report covers:1) Why everyday items (e.g., vacuum cleaners, Korean beef steak) map directly to perceived inflation.2) How “KRW 100,000 dining out vs. KRW 30,000 at home” indicates a structural shift in consumption.3) Why group-buying, live commerce, and link-based selling have become a de facto retail standard, and what the next phase implies.4) How interest rates, FX, and global slowdown risks are translated into household-level consumption strategy.5) One key point typically omitted in mainstream coverage.

1) Executive Summary (News-Brief Format)

[Scene 1: Banpo single-person “housewarming” format]

The set depicts a single-person household lifestyle. Core positioning: curated product selection based on direct use and consumption, tailored to single-person needs.

[Scene 2: Lightweight cordless vacuum (Shark) demonstration]

Highlights: one-handed use, articulating head, reduced hair/pet-hair tangling, filter maintenance (monthly). Value proposition centers on reduced maintenance burden and improved usability.

[Scene 3: Korean beef steak, 4 packs in the KRW 30,000 range (limited-time)]

Emphasis on grade, thickness, pre-salting/aging (12 hours), and cooking simplicity. Positions at-home premium dining as a value alternative to restaurant pricing (steak at KRW 100,000).

[Scene 4: Conclusion]

Reinforces frictions specific to single-person dining out and highlights freezer-space efficiency via compact individual packaging. Closes by transitioning back to equity investing, maintaining an “economy channel” tone.

2) Five Macro/Consumer Signals Illustrated by the Content

2-1. Inflation-era consumption pattern: “reduce dining out + premiumize at home”

Repeated references to high prices and grocery basket inflation reflect perceived inflation translating into behavior change.

- Past: dining out = discretionary enjoyment; home meals = cost saving

- Current: dining out = price-sensitive discretionary; home meals = “premium at a controlled cost”

2-2. Under high rates and elevated household leverage, fixed-cost sensitivity fragments discretionary spending

In a sustained high-rate environment, debt-service pressure increases sensitivity to larger discretionary outlays (dining/leisure). Substitution occurs toward lower-ticket “affordable luxuries” consumed at home (e.g., wine + steak).

2-3. Single-person households buy reduction in “friction,” not volume

Key product claims emphasize minimized decision and execution costs: quick thaw/cook steps, pre-seasoning/aging, and simplified cleanup/storage. The same pattern applies to appliances: lighter weight, less tangling, and predictable monthly maintenance.

2-4. Group-buying has evolved from “discounting” to a trust-based retail format

Group-buying is framed as a bundled format combining validation (curation), content-based reviews, scarcity (time/quantity limits), and immediate conversion (links). This shifts perceived trust and quality assurance from traditional retail toward content-led channels.

2-5. FX pass-through re-enters consumer inflation via everyday prices

While not explicitly discussed, repeated “price pressure” framing aligns with FX-sensitive cost components (ingredients, processed goods, appliance parts, logistics). Higher FX volatility tends to raise perceived price variability, prompting households to cut first in high-variance categories such as dining out.

3) AI / Technology Lens: Why This Format Is Likely to Scale Further

3-1. Recommendation systems amplify lifestyle-context selling more than product-only selling

The content packages products within a single-person lifestyle scenario, increasing algorithmic distribution across multiple adjacent interest graphs (cleaning, single living, home cooking, value-seeking consumption).

3-2. Purchase conversion is moving from search to agent-mediated video conversation

Current conversion relies on outbound links; the next stage implies AI shopping agents that compare alternatives in real time and incorporate total cost of ownership (delivery, filters/consumables) through checkout. Competitive advantage shifts from “lowest price” to demonstrable explanation, validation, and usage data.

3-3. Maintenance cost becomes a data layer

Maintenance cadence (e.g., monthly filter care) is a precursor to subscription/consumables commerce. AI can attach reminders, replacement timing, and cohort-based satisfaction metrics.

4) The Most Material Point Typically Understated

Key point:

The primary monetization opportunity in group-buying is not the individual product; it is end-to-end “lifestyle package curation” that designs the operating rhythm of single-person living (cleaning, meals, storage, health).

Bundled scenarios enable rapid adjacency expansion: freezer organization, compact cookware, wine/low-sugar sauces, high-protein meal plans, home fitness devices, and eventually health screening and insurance distribution.

5) Light Investor-Macro Linkages

5-1. Rising global slowdown risk can reinforce “at-home consumption”

In a risk-off environment, households often reduce discretionary spend; however, substitution toward lower-cost premium experiences at home can persist.

5-2. Consumption shifts change channel mix and redistribute profit pools

A given product category can migrate from restaurant-driven demand to home-meal solutions and content-led commerce. This tends to surface in quarterly disclosures via marketing efficiency, logistics costs, and return rates.

5-3. FX volatility influences perceived inflation and accelerates short-cycle purchasing behavior

FX-driven cost pass-through can re-accelerate perceived inflation, increasing preference for shorter decision cycles and immediate, time-bound offers.

6) Keywords for Investor-Facing Tagging

- Single-person household consumption shift

- Dining-out inflation pressure -> at-home premiumization

- Group-buying as trust/validation/usage-data format, not pure discounting

- Appliance purchase drivers: friction reduction and predictable maintenance

- AI era: scenario-based commerce and “lifestyle OS” distribution

Summary

The content appears to be a vacuum cleaner and Korean beef group-buying promotion, but it functions as a consumer macro signal: perceived inflation is driving a substitution away from dining out toward premium at-home consumption. Single-person households allocate spend to friction reduction rather than unit price or volume. Group-buying is evolving into a trust-and-validation retail format, and AI-driven recommendation and agentic commerce are likely to strengthen scenario-based “lifestyle package” distribution.

[Related Links…]

https://NextGenInsight.net?s=exchange%20rate

https://NextGenInsight.net?s=inflation

*Source: [ Jun’s economy lab ]

– 반포에 대충 혼자사는 뉴욕상단 대표 집들이

● Buffett Shock-Buys Google, Cash-Machine Bet Not AI

The Real Reason Buffett Bought “Google” Just Before Retirement: Not AI Technology, but the “Cash-Generating Structure”

This report covers:

1) Why Buffett bought Google after avoiding it for more than 20 years, analyzed through his investment principles.

2) How moats in the AI era are shifting from brand to data, switching costs, and distribution.

3) Practical criteria distinguishing “technology winners” (e.g., NVIDIA, OpenAI) from “business winners” in a Buffett-style framework.

4) A key point often missed by mainstream coverage: the risk of viewing Google only as a “search company.”

1) Key Takeaway (One-Line Summary)

Buffett did not attempt to “pick the AI winner”; he selected a cash-flow engine designed to remain resilient even as AI changes product interfaces.

Alphabet was treated less as a technology trade and more as a durable combination of advertising, platform economics, and cloud recurring revenue.

2) Fact Summary: What Was Buffett’s “Final Message”?

2-1. Retirement Timeline and Signaling Value

Per the source, Buffett steps down as CEO on December 31, 2025.

From 1965 to 2024, Berkshire delivered ~19.8% annualized returns, approximately double the S&P 500 over the long term.

Therefore, any pre-retirement disclosures and purchases are likely to be interpreted as a capstone expression of his investment philosophy.

2-2. The Meaning of a $4.3 Billion Bet (Approx. $6 Billion Equivalent)

The signal is not the absolute amount, but the decision to buy a company he avoided for more than two decades.

Historically, Buffett cited insufficient understanding as a reason for not buying certain large-cap technology names; this move can be read as a reclassification into his “understandable” category.

2-3. The Concurrent Reduction in Apple Exposure

This is the most actionable portfolio signal.

It is more consistent with risk concentration management and a valuation/expected-return reset than with a directional claim that “Apple is finished in the AI era.”

The likely emphasis is valuation discipline and cash-flow durability rather than thematic positioning.

3) Translating Buffett’s 5 Principles for the AI Era

3-1. “Is the business understandable?” → Focus on the revenue formula, not the model architecture

Key questions: who pays, why payments repeat (lock-in), and how unit economics translate into margin.

AI is a capability; the business model is the engine.

3-2. “Is there a moat?” → Moats in the AI era

1) Data-driven network effects

User activity → data → improved models → user growth creates compounding advantages that are difficult to replicate.

2) Switching costs

Once enterprises embed AI systems, migration requires data transfer, retraining, and process redesign, reducing churn.

3) Distribution

Companies with default access to large user bases (hundreds of millions to billions) benefit structurally from embedded channels.

3-3. “Does it earn money now?” → Prioritize repeatable cash flow over pilot revenue

Operating losses are common among AI startups.

The core question: whether the business generates profits today and maintains liquidity to withstand cyclical downturns.

This typically determines survivability under inflation and rate volatility.

3-4. “Can it be held indefinitely?” → Resilience under regulation and platform shifts

The AI era amplifies regulatory exposure (privacy, content governance, copyright) and platform changes (search behaviors, fee structures).

Assess whether the economic core of the business remains intact under these changes.

3-5. “Will it work in 10 years?” → Models change; behaviors persist

Models will be replaced and upgraded.

Human behaviors—searching, viewing, comparing, purchasing—tend to persist.

The framework emphasizes the durability of behavior-driven demand rather than the shelf life of specific technologies.

4) Why Alphabet: A Buffett-Style Rationale in Three Statements

4-1. (Cash flow) Proven, stable monetization today

Search advertising and YouTube advertising are validated cash-flow engines.

Cloud adds a higher share of B2B recurring revenue.

4-2. (Moat) Models can be replicated; “data + distribution” is harder to match

Model performance is likely to converge over time.

Alphabet controls search intent data and YouTube viewing data, supported by Android, Chrome, Maps, Gmail, and other infrastructure-level touchpoints.

This functions as an ecosystem moat rather than a single-product advantage.

4-3. (Durability) Search, video, advertising, and cloud remain structural demand drivers

Search may shift from typed queries to AI-mediated answers, but information discovery demand is persistent.

The investment case aligns more with monetizing discovery traffic than with any specific search interface.

4-4. (Price) High-quality business at an acceptable valuation

While several AI beneficiaries face elevated valuation debate, Alphabet has been viewed as relatively less stretched.

The margin of safety is expressed primarily through price discipline.

5) Investor Checklist: Three Buffett-Style Questions for AI-Related Equities

5-1. “Not revenue, but cash flow—does it exist now?”

Recurring payment structures matter more than topline growth.

Key test: whether the product is a “must-keep” spend in downturns.

5-2. “Even if competitors match the tech, can they match the network?”

Model benchmarking can destabilize conviction.

Accumulated data, distribution channels, and default positioning are more durable.

5-3. “Will usage remain habitual or embedded in workflows in 10 years?”

Differentiate trends from infrastructure-like services.

This distinction often drives long-horizon outcomes.

6) News-Style Summary

[Market] In the AI cycle, equity leadership is not determined solely by “technology exposure”; cash-flow quality and valuation are being repriced concurrently.

[Buffett] The pre-retirement decision signals an emphasis on businesses that monetize AI-enabled demand rather than on predicting specific AI breakthroughs.

[Alphabet] Search, YouTube, and cloud form three reinforcing pillars of data, distribution, and cash flow.

[Implication] Cash-flow-based value frameworks remain applicable in the AI era.

7) Under-Discussed Core Points

7-1. The purchase may reflect conviction in “advertising monetization power,” not optimism about AI

Viewing Alphabet only as a “search company” is incomplete.

Alphabet’s core asset is a traffic-to-cash monetization engine built on auction-based advertising markets.

Even if AI changes search UX, advertisers continue to fund customer acquisition.

AI may change screen composition, but the economic structure of performance marketing budgets is unlikely to disappear quickly.

7-2. In the AI era, winners may be defined by “default position,” not by model quality

High-quality models will proliferate.

However, the default entry point for daily users and the default tool embedded in enterprise workflows materially shifts competitive dynamics.

This aligns with a focus on switching costs and distribution.

7-3. Reducing Apple exposure likely reflects concentration risk and valuation

Interpreting a trim as a negative structural verdict is often incorrect.

The approach is consistent with trimming strong businesses when valuation compresses expected returns and reallocating toward higher expected return opportunities.

This can be influenced by the interest-rate regime and risk premia.

7-4. “AI infrastructure” exposure is effectively exposure to U.S. platform-economy cash flows

Alphabet already captures a significant share of global digital payment flows through advertising and cloud.

The positioning resembles a preference for the deepest, most durable long-duration cash flows rather than a wager on near-term AI leadership.

8) (SEO) Adjacent Keyword Cluster

Value investing / long-term investing / U.S. equities / interest rates / inflation

Even amid AI-driven narratives, the interest-rate and inflation backdrop continues to drive re-evaluation of cash-flow quality.

< Summary >

Buffett’s late-stage Alphabet purchase is better characterized as acquiring a durable monetization structure rather than making a direct bet on AI technology.

In the AI era, moats are increasingly defined by data network effects, switching costs, and distribution—not by standalone model performance.

When evaluating AI-related equities, prioritize (1) current cash flow, (2) defensible networks and distribution, and (3) demand that remains durable over a 10-year horizon.

[Related Links…]

- Buffett Investing Framework: A Cash-Flow Checklist That Remains Relevant in the AI Era

- Alphabet’s Core Competitive Advantages: A Data Moat Built by Search, YouTube, and Cloud

*Source: [ Maeil Business Newspaper ]

– “기술 말고 비즈니스 사라” 버핏이 ‘구글’을 선택한 진짜 이유 | 매일뉴욕 스페셜 | 홍성용 특파원