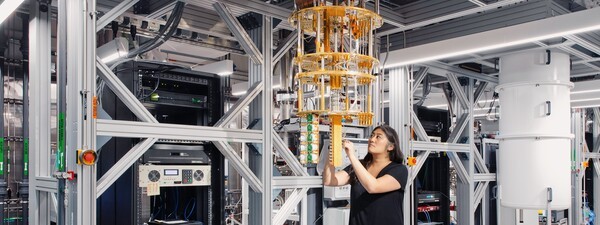

● JPMorgan Signals Quantum Gold Rush Ion Trap Stocks Explode Ahead of Fault-Tolerant Breakthrough

The report recently released by JPMorgan goes beyond a simple market forecast; it is highly likely to be the signal flare for a ‘quantum jump’ that will reshape the map of wealth over the next 10 years.

In particular, this article will analyze in great detail the true meaning of ‘Fault-Tolerant’ technology, which cannot be understood just by reading news headlines, why the ‘Ion Trap’ method is drawing attention at this specific point in time, and the decisive investment points that we must not miss.

If you want to read the flow of not simply “quantum computers are rising,” but specifically which companies with technological moats will monopolize the market, please read the content below to the end.

JPMorgan’s Prophecy: By the End of the 2020s, the Market Landscape Flips

1. Securing ‘Fault-Tolerance’ is the Key to Commercialization

Just as the AI market was completely reorganized by ChatGPT, the quantum computing market also stands before a massive inflection point.

The core point of the JPMorgan report is precisely the arrival time of the ‘Fault-Tolerant Quantum Computer’.

The ‘Qubit’, the calculation unit of a quantum computer, has a fatal flaw where errors easily occur due to minute noise or heat from the surrounding environment.

While the focus has been on increasing the number of qubits until now, securing the ability to self-correct errors and stably continue calculations, or ‘fault tolerance’, has now become the rule of the game.

JPMorgan predicted that a 200-qubit quantum computer equipped with fault tolerance will emerge by the end of the 2020s.

The moment this technology is secured, ‘Quantum Supremacy’, solving problems in mere seconds that would take existing supercomputers tens of thousands of years, becomes a reality.

The fact that related stocks like Quantum Computing (QUBT), Rigetti, and IonQ skyrocketed on the New York Stock Exchange as soon as this report was released is evidence of how much the market has been waiting for this technical milestone.

2. Winner-Takes-All Scenario: The First to Plant the Flag Takes Everything

The most chilling part of this report is the ‘Winner Takes All’ outlook.

Now that Moore’s Law in the traditional semiconductor market has reached its limit, quantum technology is an innovation that destroys existing R&D schedules.

The company that commercializes the fault-tolerant quantum computer first will go beyond simply leading the market to monopolize the standards and rules of innovation.

This means building a ‘technological moat’ that latecomers will find difficult to catch up with.

This is exactly why specialized companies like IonQ and Rigetti, as well as big tech companies like Google and IBM, are competing with their lives on the line.

Ultimately, it is no exaggeration to say that future hegemony, which will influence the global economic outlook, depends on who gets their hands on this quantum technology first.

3. Tech War: Superconducting vs. Ion Trap, What is JPMorgan’s Choice?

Currently, quantum computing development methods are largely divided into the ‘Superconducting’ method of the Google/IBM camp and the ‘Trapped Ion’ method of the IonQ camp.

Here, JPMorgan’s report appears to raise the hand of ‘Ion Trap’ technology slightly.

While the superconducting method has fast calculation speeds (gate clock), it has the fatal restriction of error correction being very tricky and requiring massive cooling facilities.

On the other hand, the Ion Trap method manipulates ions suspended in the air, so the error rate is low and the calculation accuracy (fidelity) is very high.

Also, in terms of scalability (Scale-up), Ion Trap is evaluated as a more mature technology.

JPMorgan stated, “While we cannot confirm that any one method is superior, Ion Trap is one of the most mature and scalable approaches.”

This becomes a very important hint for investors pondering the direction of future technology investment.

4. Hidden Battleground: It’s Not Just Hardware, ‘Software’ Hegemony

While many people focus only on hardware, the real lucrative competition is taking place in software platforms.

We must remember that the secret to Nvidia dominating the AI chip market was not just hardware, but thanks to a powerful software ecosystem called ‘CUDA’.

Currently, there is no absolute ruler in the quantum software market, but IBM’s ‘Qiskit’ is aiming for that spot.

At the point of transitioning from physical qubits to logical qubits, the company that dominates the software standards to control this hardware and write algorithms will become the second Nvidia.

5. Opportunities for Domestic Companies: Golden Time is the Next 3-5 Years

Amidst this huge flow, we must also pay attention to the moves of the domestic company, Mobis.

Mobis is forming partnerships with global companies like IonQ based on superconducting coil control technology.

In particular, it is showing quick movements, such as aiming to enter the control system supply and cloud service (QCaaS) market, and bringing quantum experts into the management team.

Experts emphasize that the remaining 3 to 5 years until commercialization is the last golden time for domestic companies to settle into the global supply chain (value chain).

This is an important opportunity for us to ride the wave of the 4th Industrial Revolution rather than being swept away by it.

< Summary >

- JPMorgan Forecast: Prediction of the emergence of a ‘fault-tolerant (error-correctable)’ 200-qubit quantum computer by the end of the 2020s.

- Market Reaction: After the report release, related stocks like Quantum Computing and IonQ rose sharply in unison, and market expectations exploded.

- Winner Takes All: Due to high technological difficulty, the company that succeeds in commercialization first will set market rules and monopolize.

- Tech Trend: Fast ‘Superconducting (IBM, Google)’ vs. High accuracy ‘Ion Trap (IonQ)’. JPMorgan highly evaluates the scalability and maturity of Ion Trap.

- Key Battleground: Beyond hardware competition, the competition for ‘software platform’ standards to run quantum computers is fierce.

- Domestic Opportunity: The golden time for domestic companies like Mobis to enter the value chain through global partnerships is the next 3 to 5 years.

[Related Articles…]

- Global Quantum Report: The Second ChatGPT Momentum is Coming

- Mobis, Nuclear Fusion and Quantum Computing Double-Drive Technology Highlighted

*Source: https://www.the-stock.kr/news/articleView.html?idxno=31829