● Rate-Cut Dilemma

Latest Global and Korean Economic Outlook: Interest Rate Cuts, Economic Slowdown, Real Estate and AI Challenges

[Interest Rate Trends and Central Bank Policies]

It is becoming difficult for the U.S. to lower its benchmark interest rate.

On the other hand, Japan is likely to raise interest rates and may increase them several times.

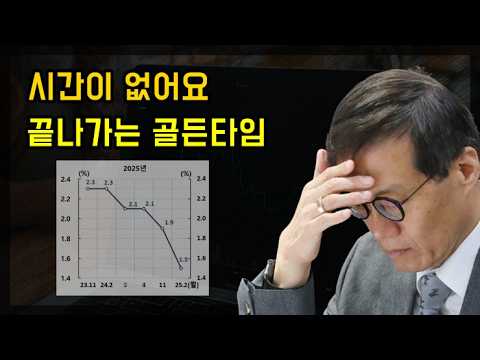

Korea has already implemented a 2.75% rate cut, which is an emergency measure to stimulate domestic demand and prevent economic slowdown.

Economic experts predict that Korea’s interest rate policy is only a short-term stabilization measure amid the unusual movements of the U.S. and Japan.

[Decline in Economic Growth Rate and Crisis in Major Industries]

The recent growth rate has plummeted from 1.9% to 1.5%.

Major Korean industries such as semiconductors, automobiles, home appliances, smartphones, batteries, chemicals, oil refining, construction, and shipbuilding are all experiencing difficulties.

In particular, China’s recession and oversupply are severely impacting Korean export industries.

With only a few industries earning foreign currency in the trade structure between the U.S. and China, further interest rate cuts will be inevitable in the future, but their effects may be limited.

[Asset Bubble and Domestic Demand Recovery Issues]

The government expects to recover employment and consumption through interest rate cuts, loan expansion, and asset price increases.

However, if the asset bubble intensifies, the government may respond with regulations and interest rate hikes.

In reality, consumer prices have been steadily rising since February, and inflation higher than the economic growth rate is read as a sign of recession.

The increase in M2 growth rate and exchange rate also reflects the reality that the economy is not properly recovering even with money being released.

[Real Estate Policy and Regional Investment Changes]

The government is intervening in the real estate market by lifting the land transaction permit system, causing apartment prices in the Gangnam 3 districts to surge in the short term.

In the provinces, it is attempting to stimulate domestic demand by supporting the purchase of 3,000 units of distressed unsold properties.

However, the impact of real estate price increases on the real economy may be limited.

These drastic measures may help boost the economy in the short term but carry the risk of weakening long-term fundamentals.

[AI Competitiveness and Future Economic Structure]

In the global economy, competition in new industries centered on AI technology is intensifying.

While the U.S. and China are already leading in AI competition, Korea is facing difficulties in initial response.

Lack of corporate investment and support, and AI regulations are weakening the competitiveness of core industries such as semiconductors.

It is essential to supplement the current inadequate AI research system to establish a position in the global economy and AI innovation.

[Long-Term Outlook and Challenges for the National Economy]

Due to low birth rates and aging population, long-term financial burdens such as the depletion of the National Pension are expected to increase.

If the economic growth rate falls short of the inflation rate, real purchasing power will weaken and domestic demand will continue to contract.

In this situation, the government and businesses must overcome the crisis with multifaceted policies such as interest rate cuts, asset price stabilization, and AI innovation.

The public needs to recognize the current situation not as a short-term bottleneck but as a preparation stage for the future.

[Comprehensive Summary and Response Strategies]

Amid changes in the central bank policies of the U.S. and Japan and the global trade environment, Korea is trying to prevent a crisis by cutting interest rates and releasing money.

However, simply supplying liquidity has limitations in terms of economic growth and real income recovery.

Strengthening the competitiveness of key industries, expanding investment in AI technology, and effectively managing real estate policies must be achieved together.

It seems that laying the foundation for long-term growth in the face of global economic uncertainty will be a task for everyone.

< Summary >

The entire economy is fluctuating due to the U.S.’s high interest rates, Japan’s interest rate hikes, and Korea’s rapid interest rate cuts.

A sharp drop in growth rate, stagnation in major industries, concerns about real estate bubbles, and a lack of AI competitiveness are emerging as major problems for the Korean economy.

The government is attempting short-term recovery through loan expansion and real estate policies but must also prepare for long-term financial burdens such as low birth rates and aging population.

The key is to strengthen industrial competitiveness and maintain balanced interest rate management in line with the global economy and the AI innovation era.

[Related Articles…]

Recent Interest Rate Cut Outlook

Real Estate Market Trend Analysis

*YouTube Source: [Jun’s economy lab]

– 왜 한국만 금리를 내려야 했던 걸까?

● Musk Triggered Mass Layoffs Recession Incoming

Key Trends and Investment Insights from Monday’s US Stock Market

1. Overall Stock Market Trends on Monday

The overall atmosphere was sluggish as soon as the market opened on Monday.

The Dow showed a slight increase and a weak bullish momentum, while the S&P 500, Nasdaq, and Russell 2000 all closed in the red.

In particular, the Nasdaq, which is heavily weighted towards technology stocks, fell by more than 1%, leading to a contraction in investor sentiment.

These market movements are important signals that affect the global economy and the stock market as a whole.

2. Key Corporate Earnings and Stock Price Fluctuations

Nvidia, a key player this week, fell by more than 3%.

Tesla also fell by about 1.5%, adding to the anxiety in technology stocks.

Data center-related stocks in the same industry also fell by around 2-3%.

On the other hand, Berkshire Hathaway’s stock price showed a strong rally of nearly 4-5% after its earnings announcement last Saturday.

The portfolio reflecting Buffett’s investment strategy led to overwhelmingly strong performance.

3. Buffett and Portfolio Strategy Analysis

Berkshire Hathaway is composed of various large companies that symbolize the American economy.

With strong earnings and rising stock prices, the entire portfolio operates like an index.

Looking at past statistical data where Buffett net sold and the market rose again, it shows strong resilience even amid volatility.

Investors are paying attention to these moves by Buffett and should consider an aggressive investment strategy and a calm portfolio rebalancing.

4. Technology Stock Investment Strategy and Market Outlook

Despite the slump in technology stocks, there are still opportunities in high-quality large technology stocks.

Even amid rising interest rates and global economic uncertainty, software-oriented technology stocks are less swayed by external factors than hardware.

As AI-related technologies continue to grow, investors should seek continuous technological innovation and new investment strategies.

The above encapsulates the key SEO keywords in the modern stock market: global economy, stock market, investment strategy, technology stocks, and the US stock market.

5. Labor Market Instability and Government Policy Trends

With news of federal government contract worker reductions, attention should be paid to new unemployment claims indicators.

Coupled with Tesla’s layoff news related to autonomous driving technology, downward pressure on the job market is expected.

Careful investment decisions are needed as short-term employment instability due to economic uncertainty can affect the overall market.

6. International Political Issues and Major Corporate Investment Plans

At meetings between major international political figures such as Trump and Macron, issues related to increased European defense spending and Ukraine were highlighted.

Apple announced plans to invest $500 billion over the next four years and create more than 20,000 jobs, actively responding to changes in the global investment environment.

Along with this, economic and political trends between the US and Europe are expected to have a direct impact not only on the US stock market but also on investment markets around the world.

Summary

The US stock market fell overall on Monday, closing with anxiety in technology stocks.

With the decline in Nvidia and Tesla stock prices, Berkshire Hathaway showed strength, highlighting Buffett’s portfolio strategy.

While there is market resilience, there are downside risks such as labor market instability and federal government workforce reductions.

Global economic and stock market variables are gaining attention, including international political issues and Apple’s large-scale investment plans.

Key SEO keywords: global economy, stock market, investment strategy, technology stocks, US stock market

[Related Articles…]

Buffett Strategy Analysis

Trump Meeting Issues

*Source : [Maeil Business Newspaper] [홍장원의 불앤베어] 머스크발 정부 해고 최대 100만명, 침체를 부를 것. 하루만에 주가 4천만원 오른 버크셔해서웨어