● Musk’s Political Gamble- Tesla Stock Plummets

The Intersection of Wall Street and Politics: Analyzing Tesla’s Stock Plunge and Political Risk

1. Introduction to Political Involvement and Tesla’s Stock Crash

The recent plunge in Tesla Stock reflects not only corporate issues but also Elon Musk’s political engagement and the resulting anxieties of Wall Street investors.Tesla’s stock fell by 6.79% after Elon Musk’s announcement of forming a new political party, indicating that investors are more concerned about political risks than the company’s technological prowess.This article analyzes, chronologically, how Elon Musk’s entry into politics has affected Tesla Stock, along with the reactions from Wall Street and the U.S. political sphere, and the economic outlook.Key economic SEO keywords such as Tesla Stock, Elon Musk, Wall Street, economic forecast, and political risk are comprehensively integrated throughout this analysis.

2. Financial Market and Wall Street Reaction

Tesla’s stock, which plummeted as soon as the U.S. stock market opened, serves as a warning sign for both short-term and long-term investors.Wall Street analyst Dan Ives pointed out Musk’s excessive involvement in politics as a problem, stating that it increases the uncertainty surrounding Tesla Stock.This situation is expected to negatively impact not only short-term stock prices but also investment sentiment towards important economic policies such as the federal roadmap for autonomous driving.Investors should adopt a cautious investment strategy, considering the risks associated with political instability and regulatory changes.

3. Elon Musk’s Political Moves and Investment Risks

Elon Musk’s declaration of forming an independent political party and expressing his intention to run for office entails both corporate image and political risks.Reactions from Washington’s political circles and conservative figures like Trump have already been made public, which could directly impact the political divisions and economic policies within the U.S.In particular, the potential for changes in federal government policies related to autonomous driving technology adds uncertainty to the future outlook of Tesla Stock.Investors should be mindful that political involvement carries the risk of diluting the company’s inherent technological strength and innovative value.

4. Impact of International Affairs and the Chinese Market

China plays a crucial role in Tesla’s global market.However, political conflicts between Musk and Trump could signal negatively to the Chinese government, potentially dealing a direct blow to Tesla Stock’s competitiveness in overseas markets.Maintaining a balanced relationship with China is becoming a key task not only for technological competitiveness but also from an economic forecast perspective.Investors need to closely monitor international affairs and the political and economic trends between the U.S. and China.

5. Future Outlook and Investment Direction

Over the next 6 months to a year, Tesla Stock’s volatility is likely to be heavily influenced by political risks and policy changes from the federal government.If Elon Musk were to step back from the political stage to some extent and focus on the company’s core businesses such as technological innovation and autonomous driving, there is room for recovery in investor sentiment.However, in the current situation where politics and economics overlap, short-term volatility could be extreme, and a cautious approach is needed for long-term economic forecasts.Investors should carefully analyze the current situation and develop an investment strategy based on technological innovation, while also establishing political risk management measures.

[Related Articles…]

Background of Tesla’s Stock Decline

Analysis of Elon Musk’s Political Moves

*YouTube Source: [ 오늘의 테슬라 뉴스 ]

– Stocks plummet a day after the party’s launch! Why are Wall Street and the Republican Party tryin…

● Tariff Tsunami Looms – Market Braces for Impact

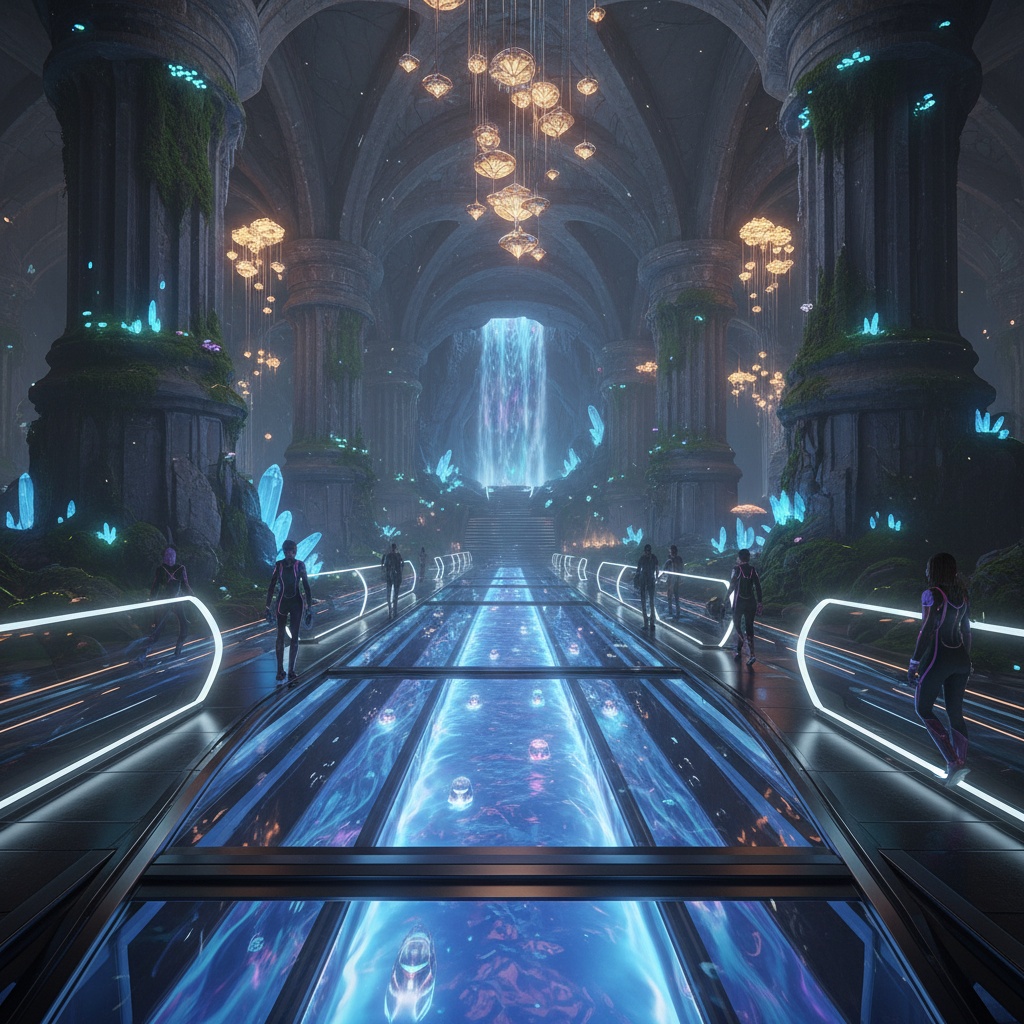

Outlook for the Korean Economy and Stock Market After the Implementation of 25% Reciprocal Tariffs: Investment, Economy, US Stocks, Global Markets, Tariff Analysis

Immediate Market Reaction and Initial Short-Term Effects (Early July to August)

Immediately after the announcement of the U.S. imposing a 25% reciprocal tariff on Korea, the stock market showed stability without a significant drop.The fact that the stock market did not fall by even 1% suggests that investment sentiment has become resilient due to the previous shock experience in early April.Due to the U.S.’s reciprocal tariff measures on 14 countries, Korea and Japan are subject to the same 25% tariff, while other countries range from 25% to 36%.In particular, some Southeast Asian countries with potential for transshipment tariffs maintain levels up to 40%, implying that tariff differentiation with China may affect the market.This period requires both short-term investors and US stock investors to pay attention to easing initial shocks and exchange rate fluctuations.

Mid-Term Outlook and Competition Among Industries and Countries (August to October)

Fluctuations in import and export prices due to rising U.S. inflation and changes in the CPI will play a crucial role in the mid-term economic development.In particular, the period after inventory depletion and shipment between August and October is likely to create upward pressure on prices and the CPI.In the case of Japan and Korea, changes in competitiveness are expected due to tariff rate differences, and exchange rate factors such as a strong yen may affect real export competitiveness.At the same time, tariff conditions and retaliatory tariff disputes in China and other competing countries may act as variables across tariff policies.Investors should consider adjusting their mid-term portfolios through analysis of the global economy and US stocks, especially interest rates and exchange rate trends in the U.S.

Long-Term Outlook and Linkage with the Global Economy (After October)

After October, as tariffs are fully implemented, it is necessary to closely monitor the international trade environment and economic transition due to changes in the U.S. CPI and interest rates.There is a possibility of price increases due to U.S. consumer sentiment and the transfer of burdens to importers, which could have a ripple effect on the global market in the long term.Experts analyze that if the U.S. economy remains robust, exporting countries are likely to continue trading even if they have to accept price increases.This situation implies both positive and negative impacts on long-term economic growth prospects, US stocks, and the global investment environment.It is necessary to carefully monitor exchange rates, interest rates, and global economic indicators and review investment strategies.

Key Variables and Additional Considerations

● In addition to tariffs, excise taxes and additional tariff adjustments for specific industries (automobiles, steel, etc.) may be highlighted.● The possibility of retaliatory tariffs between the U.S. and major trading partners and changes in Chinese tariffs will have a major impact on future developments.● Although short-term shocks are gradually reflected in the market, there is a possibility of rising U.S. CPI and subsequent interest rate hikes in the medium to long term.● Investors should comprehensively consider not only single tariff factors, but also various economic indicators such as the global economic atmosphere, US stocks, and exchange rate fluctuations.

< Summary >

After the U.S. imposed a 25% reciprocal tariff, the Korean stock market showed resilience without a major shock, but attention should be paid to inventory depletion, rising commodity prices, CPI, and interest rate changes in the initial, medium, and long-term perspectives.As various variables such as global market changes, exchange rates, and retaliatory tariffs between competing countries are likely to act, investors need to continuously monitor information related to investment, economy, US stocks, global markets, and tariffs and reorganize their strategies.

[Related Articles…]Summary of US Tariff Impact AnalysisKey Points of Global Economic Outlook

*YouTube Source: [ Jun’s economy lab ]

– What will happen after the 25% reciprocal tariff imposed on Korea?

Leave a Reply