● **US Asset Grab – War Prep**

1. The Phenomenon of Gold, Copper, and Bitcoin Inflow into the U.S.: A Move in Preparation for War

Last week, a distinct trend emerged in the U.S.: the concentration of gold, copper, and Bitcoin within the country. Due to changes in foreign trade policies and the Trump administration’s abrupt imposition of a 50% tariff, copper prices in the U.S. have become significantly higher than in the UK market. This has resulted in the movement of copper holdings from the UK to the U.S. Gold is also being transferred to the U.S. due to trust in the country and preference for safe assets. Furthermore, since the introduction of Bitcoin ETFs, overseas investments have led to the purchase and storage of Bitcoin within the U.S. Under the assumption of war preparation, these actions can be interpreted as an economic strategy to gather domestic assets. Moving forward, the increasing value of gold, copper, and Bitcoin, along with the growth of reserves within the U.S., are expected to act as crucial variables in global economics, investment, and market trends.

2. Political Instability within the U.S. and Tension in the International Financial Sector

Political uncertainty is growing within the U.S., with concerns being raised about the possibility of civil unrest. In particular, former President Trump’s strong rhetoric and actions aimed at the financial sector and IT power structures are foreshadowing turmoil in the American political arena. Conflicts between Trump and the IT industry surrounding figures like Chairman Powell, a symbol of the financial sector, pose significant challenges to the traditional financial powerhouse paradigm. These political upheavals are expected to significantly impact the international economy, investment, and global economic outlook, providing uncertainty and new investment opportunities for financial markets and investors worldwide.

3. Global Talent War: China’s Engineering Focus vs. Korea’s Medical Dominance

China is investing vast sums in engineering and natural sciences, implementing strategies to strengthen national competitiveness. In contrast, South Korea is predominantly focusing on the medical field. These differences highlight the disparities in talent cultivation, research and development environments, and investment approaches between the two countries. China’s large-scale support for engineering research has the potential to reshape the global market landscape in terms of future technological innovation. On the other hand, South Korea’s policy of concentrating on medical schools can be seen as a strategy to maximize the strengths of traditional medicine and the beauty industry. These strategies, as they build different growth engines, are expected to directly and indirectly affect global economics, investment, technology, and talent competitiveness.

4. Advancement of AI Technology and Evolution of Connected Devices

AI technology is rapidly advancing, and its application methods are also changing. The interactions between AI and humans, as portrayed in the recent movie ‘Her,’ suggest how AI can be integrated into our lives. The development of new devices capable of voice recognition and connectivity, beyond smartphones, has the potential to completely reshape consumer experiences and market trends. These new AI devices are reaffirming global technology trends and the technological competitiveness of major countries like the U.S., Korea, and China, and are expected to establish themselves as a crucial driver of investment, market prospects, and economic growth.

5. The Emergence of New Economic Giants: APR and Innovation by Young Entrepreneurs

Emerging companies are surpassing traditional large corporations. The example of APR surpassing the market capitalization of LG Household & Health Care in just 16 years demonstrates the need for innovation facing established giants. Young entrepreneurs are presenting new standards from a global economic competitiveness and investment perspective through aggressive marketing strategies and shareholder-friendly policies. Their success highlights the gap between the conservative management practices of traditional conglomerates and the innovation pursued by startups, attracting significant attention from domestic and international investors.

Summary

Under the assumption of war preparation, the U.S. is concentrating assets such as gold, copper, and Bitcoin within its borders. Simultaneously, political instability and tensions between the financial and IT sectors are escalating within the U.S. In the global talent war, China’s support for engineering and South Korea’s concentration on medical fields are emerging, increasing the likelihood of a paradigm shift in future technology and industrial competition. Furthermore, the advancement of AI technology, the introduction of new devices, and the innovation of emerging companies are expected to significantly impact domestic and international economics, investment, and global economic trends.

[Related Articles…]Analysis of Gold Inflow into the U.S. |Bitcoin ETF and Investment Trends

*YouTube Source: [ 이효석아카데미 ]

– ‘Why’ Gold, Copper, and Bitcoin Are Flowing into the US [Weekly News]

● Bond-Price-Interest-Rate-Inversion

Here’s an English translation of the provided Korean text, maintaining the original formatting:

1. Basic Concepts and Classification of Bonds

A bond is essentially a certificate representing a right based on a debt relationship. Specifically, a bondholder lends money and receives interest at regular intervals, and also has the right to be repaid the principal at maturity. Bonds are issued by various entities such as governments, local authorities, and corporations, and are mainly classified into government bonds and corporate bonds. This article focuses on the essence and types of bonds, and the differences between government bonds and corporate bonds, from the perspective of global economic outlook and bond investment strategies.

2. Bonds vs. Loans vs. Stocks

A bond is a certificate through which an institution borrows money from investors to raise funds. On the other hand, a loan is an act of borrowing money from financial institutions by individuals or corporations, with different repayment methods. Stocks represent ownership in a company, allowing participation in management and profit distribution, while bonds simply represent a debt relationship. Therefore, bonds guarantee the repayment of principal and fixed interest payments, while stocks offer investors a different risk profile due to price fluctuations.

3. Inverse Relationship Between Bond Prices and Bond Yields

One of the key characteristics of bonds is the inverse relationship where ‘bond prices rise and bond yields fall, and conversely, bond prices fall and bond yields rise.’ For example, suppose you receive ₩1,050,000 at maturity for a bond with a face value of ₩1,000,000. When the bond price is ₩1,000,000, the expected yield is 5%. However, if the bond price rises in the market, for example, trading at ₩1,050,000, the yield decreases relative to the fixed repayment amount. Conversely, if the bond price falls to ₩950,000, the yield increases based on the same maturity repayment conditions. This is a key point that investors must understand when establishing bond trading and bond investment strategies.

4. Impact of Market Interest Rates and Economic Policies on Bond Price Fluctuations

Market interest rate fluctuations directly affect bond prices and yields. For example, if the central bank lowers the base interest rate, bond prices tend to rise along with short-term interest rate declines. Conversely, if a base interest rate hike or economic policies (e.g., passage of a tax cut) cause a fiscal deficit, the issuance of bonds increases, leading to oversupply and price declines. In particular, U.S. Treasury bonds, which symbolize stability and trust in the global financial market, can experience increased price volatility due to issues such as tax cuts, fiscal deficits, and debt limit negotiations. It should also be noted that liquidity supply or increased buying through stablecoins can act as factors that increase bond prices.

5. Investment Strategies Based on Bond Maturity and Type

Bonds are divided into short-term bonds (within 1 year), medium-term bonds (1 to 5 years), and long-term bonds (over 5 years) according to their maturity. U.S. Treasury bonds are classified into T-bills (short-term), T-notes (medium-term), and T-bonds (long-term), each with different investment strategies and risk profiles depending on their maturity characteristics. Investors need to construct appropriate bond portfolios by maturity, considering international economic conditions, global economic outlook, interest rate changes, and national fiscal policies.

6. Conclusion and Future Outlook

The most important aspect of bond investment is to thoroughly understand the inverse relationship between bond prices and bond yields. By understanding the mechanism by which bond prices fluctuate according to market interest rates, policy changes, and economic environments, you can make more informed investment decisions. In particular, it is important to clearly distinguish between Treasury bonds and corporate bonds to establish investment strategies not only in Korea but also in the global financial market. This article has systematically examined everything from the basics of bonds to the differences between loans and stocks, and the mechanism of bond price movements according to interest rate fluctuations. We will continue to provide detailed analyses that reflect the latest economic trends and financial market issues to help you with your investment strategies.

[Related Articles…]Core Principles of Bonds

U.S. Treasury Bond Outlook

*YouTube Source: [ 경제 읽어주는 남자(김광석TV) ]

– Bond Class: Why do bond prices and bond yields move inversely? Why do US Treasury bonds fluctuate…

● Korea’s ETF Market Shipbuilding Soars, Defense Reborn.

Global Perspectives on Korean Shipbuilding and Defense ETF Investment Strategies and Market Outlook

2023: Investment Market Trends and Changes in ETF Fund Flows

In the ever-changing domestic ETF market, 2023 was a period dominated by secondary batteries and semiconductors.However, along with structural changes in the domestic stock market, industry-focused investment trends are changing.Investors have started to pay attention to sector-specific and theme-based ETFs beyond traditional core indices.This trend is attracting great interest from investors interested in global economic and market trends.In particular, discussions on market liquidity and investment strategies have become active amid the global economic crisis and US-China conflict.

2024: Revival of the Shipbuilding Industry and Concentration of ETF Funds

In 2024, the shipbuilding industry came to the fore, and ETF investment funds poured into shipbuilding-related products.After a long period of stagnation, domestic shipbuilders have strengthened their order-winning competitiveness by replacing old ships and leveraging superior technology.Despite global economic uncertainties, the shipbuilding industry presented stable profitability and positive prospects for improved performance.The SOL Korea Top 3 Plus Shipbuilding ETF has led this trend, establishing itself as a representative ETF in the industry.Investors are focusing on establishing sophisticated investment strategies along with structural changes.

2025: Defense ETF Renewal and Export-Led Growth

In 2025, the stock price momentum of defense companies became distinctly apparent.The government’s revision of the Commercial Act, strengthening of dividend policies, and other shareholder return policies positively affected ETF investments.Korean defense stocks have significantly expanded their export share since the Russia-Ukraine war, proving their global weapon export competitiveness.In particular, key indicators such as ATS (Arms Transfer Speed) have attracted investor attention, reflecting high market demand.Defense ETFs are increasing their attractiveness as safe assets amid uncertain geopolitical situations at home and abroad.

Introduction of Leverage ETFs and Utilization of Short-Term Strategies

On July 15, a leveraged version of the SOL Korea Top 3 Plus Shipbuilding ETF was launched, attracting the attention of investors who prefer short-term investments.Leverage ETFs aim to track twice the daily return of the underlying index, but it is difficult to expect long-term cumulative effects.Accordingly, it is important to use them as tactical trading tools during periods of high volatility.Investors should clearly distinguish between short-term strategies and long-term investment strategies when approaching ETF management.This will allow effective utilization of the upward momentum of the shipbuilding industry and defense companies.

ETF Portfolio Composition and Analysis of Representative Stocks

The SOL Korea Top 3 Plus Shipbuilding ETF includes various stocks such as the top 5 shipbuilding companies, fitting companies, LNG containment system companies, and engine companies.Representative stocks include HD Korea Shipbuilding & Offshore Engineering, Hanwha Ocean, Samsung Heavy Industries, Hyundai Heavy Industries, Hyundai Mipo Dockyard, and Marine Solution.In addition, the Defense ETF is composed of key defense companies such as Hanwha Ocean, HD Hyundai Heavy Industries, Hyundai Rotem, Korea Aerospace Industries, and LIG Nex1 Systems.Detailed analysis of company-specific fundamentals and the global economic situation has enabled the construction of a highly reliable portfolio for investors.In particular, strategies have been reorganized with key SEO keywords such as market investment, global economy, shipbuilding industry, defense ETF, and investment strategy at the center.

Future Prospects and Investment Strategy Recommendations

The shipbuilding and defense industries show stable growth momentum despite the uncertainty of the global economy, providing new investment opportunities.The Korean shipbuilding industry is expected to improve profitability by strengthening its competitiveness in eco-friendly ships, special ships, and LNG carriers.Defense companies are expected to further strengthen their position in the global market through the expansion of overseas exports and the advancement of technology.Investors need to proceed with ETF investments with a strategic approach that considers both the long-term perspective and short-term volatility.In addition, it is necessary to understand the characteristics of leverage ETFs and manage risks through a balance of tactical trading and stable asset allocation.This comprehensive analysis will provide useful insights for investors interested in global economic and market trends.

Summary

Along with the changes in the domestic ETF market that have unfolded since 2023, the shipbuilding industry revived in 2024, and funds concentrated in ETFs greatly increased.In 2025, the renewal of the defense ETF and the export-led growth of companies created a positive investment atmosphere.The introduction of leverage ETFs provides new opportunities for short-term strategies, allowing investors to effectively utilize market volatility.Through portfolio composition and analysis of major stocks, it can be confirmed that a balance between long-term investment and short-term trading is important at this time.These trends require a strategic investment approach centered on key SEO keywords such as global economy, market trends, investment, ETF, and shipbuilding industry.

[Related Articles…]Analysis of Shipbuilding ETF Leverage StrategiesDefense ETF Renewal and Global Order Analysis

*YouTube Source: [ Jun’s economy lab ]

– The birth of a new leader! Chosun TOP3 Plus Leverage ETF is out (ft. SOL Chosun TOP3 Plus Leverag…

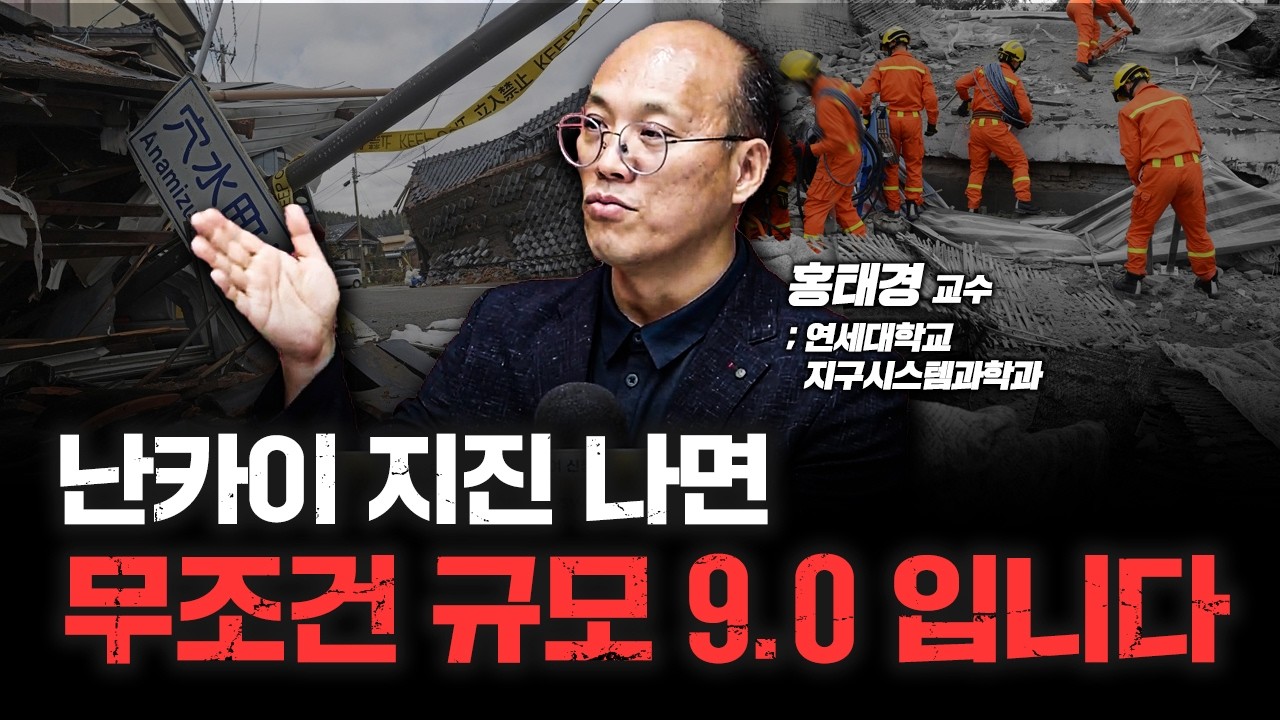

● Nankai Trough Megaquake- Economic Tsunami.

Nankai Trough Megaquake in Japan: Economic Impact and Preparedness Strategies

1. Historical Context and Accumulation of Seismic Energy

According to historical records, earthquakes have occurred off the coasts of Tokyo and Kyushu in Japan approximately every 600 and 500 years, respectively.

The seismic energy accumulated during these long periods of silence is still building up, raising the possibility of a series of smaller earthquakes in the magnitude 7-8 range, as well as the risk of a megaquake reaching magnitude 9.0.

Based on historical data and precedents, the Japanese government and academia are closely analyzing the earthquake cycle in the Nankai Trough region.

Considering the potential impact of such natural disasters on the global economic outlook, financial crises, and economic growth, these risks are also important variables in investment strategies and market analysis.

2. Current Risk Factors and Earthquake Prediction Mechanisms

Recently, the Japanese government and academia have been intensively monitoring the energy accumulation within fault lines and aftershock patterns.

A surge in minor tremors or a sudden decrease in aftershocks is interpreted as a sign just before an earthquake, highlighting the need to establish an early warning system.

In particular, an early warning system that uses differences in seismic wave speeds aims to minimize casualties by providing 10-20 seconds of advance notice.

Along with this, seismic design and building safety assessments must be strengthened, and the impact on related industries and financial markets should be considered when establishing investment strategies.

3. The Importance of Strengthening Seismic Design and Early Warning Systems

Since the Great East Japan Earthquake (2011), the Japanese government has invested heavily in strengthening seismic performance and establishing early warning systems.

Efforts are underway in the domestic and international construction and infrastructure sectors to enhance seismic design to prevent building collapse and secondary disasters.

Considering the 20-30 minute tsunami propagation time after an earthquake, thorough safety inspections of critical infrastructure facilities such as highways, nuclear power plants, and large buildings have become even more important.

In terms of the global economic outlook, these seismic technologies and early warning systems are emerging as important factors in national economic growth, investment strategies, and market analysis, including financial crises.

4. Economic Impact and Long-Term Preparedness Strategies

The occurrence of a megaquake can have a tremendous impact on the regional economy and global financial markets, beyond simple physical damage.

With estimated damages amounting to trillions of dollars, not only Japan but also neighboring countries need structural improvements to prepare for economic growth and financial crises.

Disruptions to industry, declines in tourism revenue, and supply chain disruptions due to earthquake disasters may occur, requiring governments and private investors to review risk management and investment strategies.

From a market analysis perspective, response measures through insurance products or financial derivatives that reflect these risks are being importantly considered.

These comprehensive preparedness strategies will serve as key variables in future global economic outlooks and investment strategy development.

[Related Articles… East Japan Earthquake Reexamined | Nankai Trough Warning]

*YouTube Source: [ 삼프로TV 3PROTV ]

– 14년 전 동일본 대지진이 다시 일어난다 f. 홍태경 연세대학교 지구시스템과학과 교수 [심층인터뷰]

● Russia Threat-AI Hype-US Healthcare Crisis-Wall Street Buzz

US Opening Point Analysis: From Russian Announcements to Premature AI Peak, US Healthcare Costs

1. US Economic and Political Trends and Russian Announcements

Significant announcements from the Russian side are notable in the major US opening points. This announcement could directly impact the geopolitical tensions between the US and Russia, with expected repercussions on the economy and stock market. In particular, these Russia-related news items are linked to global financial markets, including Bitcoin and cryptocurrencies, drawing investor attention. It is necessary to analyze in detail the impact of policy changes and international affairs on the securities and technology stock markets.

2. Goldman Sachs’ AI Peak Prediction and Tech Stock Analysis

Goldman Sachs has stated that it is premature to discuss an AI peak (a concept referring to the pinnacle of technological development). This perspective re-establishes the direction of future tech stock and AI-related investments amidst the current rapid expansion of the AI industry. Tech stock investors should closely examine not only innovations related to AI but also market stability and growth potential. In this process, the association with highly volatile assets such as Bitcoin and cryptocurrencies should also be noted.

3. Rising US Healthcare Costs and the Status of Cold Treatment Costs

In the US healthcare cost issue, it has become a significant problem that treating a single cold can cost up to 400,000 won (approximately $300 USD). High medical costs suggest the need for a review of health policies and social safety nets within the United States, as well as placing a burden on households. This issue is also connected to changes in overall consumption patterns in the economy, which affect the stock market and technology stock investments. Investors should consider the ripple effects of these rising healthcare costs on economic policies, financial markets, and society as a whole.

4. Hong Ki-ja’s Daily New York – The Current State of Wall Street and the New York Stock Exchange

Hong Ki-ja’s Daily New York delivers the latest stock information and New York Stock Exchange trends through the Maekyung Wall Street Wealth program. This program airs on Monday, July 14, 2025, at 10 PM and has become an important channel for global investors to understand the latest trends in securities and technology stocks. The program features vivid reports from Maeil Business Newspaper correspondents, along with analysis of key keywords such as Bitcoin, Russia, cryptocurrencies, tech stocks, and securities. Investors and economic blog readers can gain an in-depth understanding of international economic flows, technological innovation, and financial market changes through this program.

[Related Articles…]US Economy and Russia Issues

AI Technology Trend Analysis

*YouTube Source: [ Maeil Business Newspaper ]

– [美개장포인트] 美 ‘러시아 중대 발표’ㅣ골드만삭스 “AI피크론 시기상조”ㅣ감기 한 번에 40만원 美의료비ㅣ홍키자의 매일뉴욕