● Liquidity Tsunami- Asset Bubble Warning

Economic Outlook for the Second Half of the Year and Investment Opportunities for the Next Year: Core Analysis of the Liquidity-Driven Market

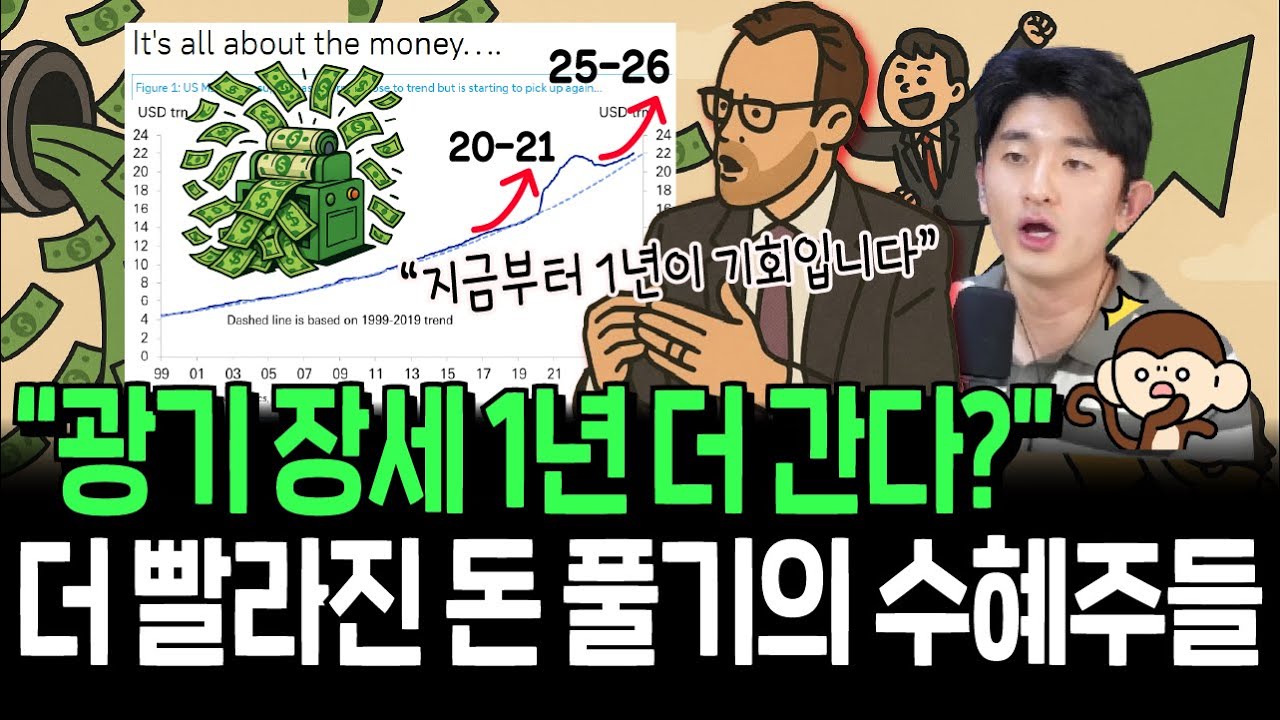

1. Surge in Liquidity and Money Supply: Analysis by Time Period

You can see that the money supply (M2) has been rapidly increasing, especially in the United States, since the COVID-19 pandemic.

In recent months, it has been rising from 1% to the mid-4% range year-over-year, indicating an increase not only in the total amount but also in the ‘speed’ at which money is being released.

Considering the compounding effect, it’s important to note that even a seemingly insignificant increase in liquidity can have a huge impact on asset prices.

Considering various SEO keywords such as global economic outlook, money supply, and economic indicators, it is necessary to carefully observe how current market liquidity is affecting the investment environment.

2. Analysis of Key Beneficiary Assets and Investment Trends

The asset classes most correlated with M2 money supply are Bitcoin, gold, and the U.S. stock market.

Various charts and analyses confirm that Bitcoin is positively affected as the money supply increases.

In particular, stocks that can benefit from the liquidity effect, such as ETFs, growth stocks, and technology stocks, are prominent in asset allocation, which is good to consider in your asset allocation strategy.

In addition, you can specifically analyze the impact of liquidity on the stock and cryptocurrency markets in relation to the global economic outlook, using data from Deutsche Bank and Goldman Sachs reports.

3. Pitfalls of Speculative Assets and Investment Timing

At this point, the surge in liquidity is likely to trigger an influx into speculative assets, increasing short-term returns over 3 months to 1 year.

However, reports indicate that there is a risk of a sharp drop in returns after one year, so it is important to focus not only on high short-term returns but also to keep in mind the importance of long-term investment strategies and portfolio diversification.

In particular, you should pay close attention to the pattern, as seen in the Goldman Sachs report, where the initial investment frenzy subsides over time when liquidity is abundant.

4. Focus on Market Sentiment and IPO Fever

Another phenomenon that occurs when liquidity is abundant is the IPO fever and the speculative sentiment of individual investors.

Generally, there is less interest in IPOs when the market is not good, but when liquidity is abundant, interest in new listings or theme stocks increases.

As seen in the case of Reddit, the largest community in the United States, individual investors are sharing information with each other, leading to an overheated market sentiment.

These changes act as ‘psychological’ factors beyond simple economic indicators and must be considered when establishing investment strategies.

5. Future Outlook and Investment Strategies

Going forward, the U.S. Federal Reserve’s interest rate policy, the potential interest rate cut around September, and the continued liquidity supply will provide important direction for the asset market.

Investors need a strategy to consider appropriate dollar-cost averaging, while keeping a close eye on the high points of speculative assets that were once overheated, as well as beneficiary assets due to the liquidity-driven market.

In addition, it is necessary to establish mid- to long-term investment strategies by systematically analyzing various economic indicators such as global economic outlook, money supply, and asset allocation.

Understanding the liquidity frenzy flowing through the overall market and the resulting volatility, and seizing the right investment timing, will ultimately be the key to successful asset management.

Summary

- Since the COVID-19 pandemic, M2 money supply and liquidity have surged in global markets, including the United States, and both the speed and total amount have a significant impact on investment.

- Bitcoin, gold, and the U.S. stock market are major beneficiary assets of increased liquidity, and asset allocation strategies are being reorganized through this.

- Initial speculative frenzy can generate short-term returns, but there is a risk of a sharp drop if it lasts more than one year, requiring a careful investment strategy.

- IPO fever and overheated sentiment of individual investors are causing significant changes in the outlook along with market sentiment, requiring careful attention.

- It is necessary to closely examine the Fed’s policy changes and liquidity supply situation in the future and focus on establishing diversified investment and long-term strategies.

[Related Posts…]

- Liquidity Analysis and Investment Strategies

- Stock Market Volatility, Overheating Signals, and Response Strategies

*YouTube Source: [ 소수몽키 ]

– Is this the one-year window of opportunity? The biggest beneficiaries of the terrifying monetary …

● **IMF Slams Korea – 0.8 Growth – Crisis Alert**

IMF Economic Outlook Report Immediate Analysis: Global Upgrade, Korean Economy Further Downgraded – Warning of 0.8% Growth Rate

Global Economic Outlook – Upward Adjustments and Coexistence of Uncertainties

The global economy is projected to grow by approximately 3.0% in 2025, showing a slight increase from the previous year, but still faces the problem of entrenched low growth.

Comparing forecasts from major international organizations such as the IMF, World Bank, and OECD, there have been some upward adjustments reflecting eased tariff increases and improved financial conditions, but structural uncertainties remain pronounced.

In particular, factors such as the U.S. tariff reduction, dollar weakening, and fiscal expansion are acting as somewhat positive signals, but geopolitical tensions and trade policy uncertainties are negatively affecting the overall global financial market.

In this situation, the expression “Tenuous” is emphasized, warning that the recovery is fragile and easily undermined.

We will examine the major variables and changes in the global economy in detail, naturally incorporating the best SEO keywords such as financial markets, global trade, economic outlook, interest rate cuts, and IMF.

Korean Economy – Additional Downgrade and Serious Growth Rate Warning

The Korean economy’s growth rate forecast for 2025 was initially lowered from 2.0% to 1.0%, and has recently been further downgraded to 0.8%.

This figure is the same level as during the 2008 Global Financial Crisis, implying a serious structural crisis across the economy.

It suggests that internal political instability and external trade conflicts, especially uncertainties from a Trump-induced tariff war, are having a very negative impact on the Korean economy.

When calculating the average growth rate, it is necessary to emphasize the possibility of prolonged low growth rather than expectations of recovery.

These figures are interpreted as reflecting the lack of structural growth engines and inadequate responses, despite short-term policies for stimulating consumption and fiscal expansion efforts.

In-Depth Analysis by Key Variable – Financial Instability, Trade War, Policy Response

Across the financial markets, the decline in U.S. Treasury yields and the weakening of the dollar are prominent, dampening investment sentiment.

The impact of the global tariff war and the U.S.-China tariff reduction have had a positive effect on some export-led countries, but have had a negative impact on countries with high trade dependence such as Korea.

In addition, the IMF report calls for policy responses such as fiscal expansion and medium-term fiscal plans by each government, and revenue enhancement, emphasizing the need for a predictable trade environment and structural reforms.

As such, the economic outlook report judges that the expansion of uncertainty and the fine-tuning of policies are critical variables for restoring future growth engines.

Comparison of International Organizations’ Forecasts and Our Economy’s Response Tasks

It is important to understand the differences in the growth rate calculation methods of the IMF, OECD, and World Bank.

The IMF and OECD calculate GDP on a Purchasing Power Parity (PPP) basis, while the World Bank uses market exchange rates, so caution is needed when making direct comparisons.

The reason for the further downgrade of the Korean economy is due not only to external shocks, but also to internal policy inadequacies and structural changes in the market.

Accordingly, it is time for the government and businesses to prepare effective countermeasures against the trade war, stimulate consumption, and reorganize the long-term growth base through structural reforms.

A comprehensive analysis by major domestic and international institutions is urgently needed, focusing on keywords such as economic outlook, financial markets, tariff war, global economy, and Korean economy.

The global economy has been slightly upwardly adjusted due to tariff reductions and easing financial conditions, but structural uncertainties and entrenched low growth problems remain serious.

On the other hand, the Korean economy is negatively affected by political instability and tariff wars, with the growth rate forecast for 2025 further declining to 0.8%, revealing a crisis similar to the 2008 crisis level.

It contains risks due to global economic variables such as financial market instability, dollar weakening, and the possibility of tariff increases, as well as policy inadequacies, and it is time for the government and businesses to focus on preparing structural reforms and countermeasures.

[Related Articles…]

In-Depth Analysis of Korean Economic Outlook

*YouTube Source: [ 경제 읽어주는 남자(김광석TV) ]

– [속보] IMF의 경제전망 보고서 즉시분석 : 세계경제는 상향조정, 한국경제는 하향조정. 한국경제 성장률 0.8% 는 ‘2008년 글로벌 금융위기’ 수준 [즉시분석]

● **US Economic Turmoil – Debt, Guns, and Market Swings**

Recent Major Issues Reshaping the U.S. Economy: From Changes in Treasury Issuance Strategy to PayPal’s BNPL Shift, Bitmain Acquisition, and Gun Control Debates

[1] U.S. Treasury Issuance Strategy and FOMC Outlook

The Treasury Department has unveiled a new strategy to adjust the proportion of short- and medium-term Treasury issuances depending on the situation, rather than issuing long-term bonds regularly. This approach prioritizes market timing to address the recent $2 trillion fiscal deficit. While it may reduce short-term borrowing costs, it also carries the risk of increased long-term burden in the event of rising interest rates. Consequently, attention is focused on the impact on the FOMC meeting and the U.S. stock market as a whole, necessitating the development of investment strategies that account for economic and stock market uncertainties. Important points to consider include fluctuations in U.S. trade policies and the feasibility of energy purchase negotiations (valued at $750 billion). Regarding the FOMC, the impact of expected interest rate freezes or slight cuts on the market is something investors must pay close attention to.

[2] Major Corporate Performance and Investment Strategy Changes – PayPal, Bitmain, Novo Nordisk, etc.

PayPal’s recent performance has exceeded consensus in both revenue and EPS, but its stock price is falling in pre-market trading due to weakened Q3 guidance. In particular, PayPal is attempting to shift from its existing platform to a BNPL (Buy Now, Pay Later) model, which will significantly impact future investment strategies. Meanwhile, Ark Invest has shown interest in crypto assets and mining companies by purchasing a large amount of Bitmain stock. Although Bitmain still has unstable performance and numerous issues, Cathie Wood’s portfolio restructuring is being interpreted as an important buy signal. Novo Nordisk’s stock price is under pressure due to recent downward revisions in its Q2 guidance and increased competition (e.g., Eli Lilly), with concerns about declining market share in the GLP-1 market. In addition, the earnings releases of major companies such as Spotify and UnitedHealth are impacting investor sentiment, requiring careful consideration of stock investments and economic outlook.

[3] Global Economy and Socio-Political Issues in the U.S. – Gun Control and Cultural Conflicts

The recent mass shooting in New York reminds us that the United States is the world’s largest gun republic. The Second Amendment to the U.S. Constitution, which guarantees the right to bear arms, and the NRA’s massive lobbying power are encouraging the easing of gun control. The increasing frequency of gun-related incidents is escalating into social costs, healthcare burdens, and political debates, which could significantly impact the overall U.S. economy and investment environment. In particular, the increase in sales in the gun-related industry and regional regulatory differences can act as destabilizing factors in the U.S. stock market, so it is necessary to pay close attention to this issue. At the same time, energy supply and demand, decarbonization policies, and infrastructure investment issues in the U.S. are also analyzed as having a significant impact on the overall economy.

[4] Key Points for Investors to Note

It is important to focus on analyzing the impact of changes in Treasury issuance strategies and the FOMC’s interest rate outlook on short-term funding costs and inflationary pressures. In major corporate performance, PayPal’s BNPL transition, Bitmain’s acquisition trends, and Novo Nordisk’s downward guidance act as significant variables in establishing investment strategies. Gun control and cultural conflicts in the United States are factors that add uncertainty to social stability and the overall economy, and are analyzed as economic risks linked to political and social issues. As such, it is important to systematically organize and understand the multifaceted factors that affect the overall U.S. and global economy. This article, which is concretely and comprehensively analyzed around key SEO keywords such as economy, stocks, investment, U.S. stock market, and FOMC, is structured to allow readers to quickly grasp the key content.

[Related Articles…]PayPal BMPL Transition Analysis |Novo Nordisk Performance Outlook

*YouTube Source: [ Maeil Business Newspaper ]

– [美개장포인트] 페이팔 호실적에도 울상ㅣ돈나무언니 비트마인 매수ㅣ美, 헌법이 정한 총기공화국ㅣ홍키자의 매일뉴욕