● Job Shock, Tariff Tsunami, Geopolitical Quake

Okay, here’s the English translation of the text, maintaining the original formatting and following all instructions:

[1] Impact of Recent Employment Data Shock and Statistical Revisions

The recent massive downward revision of employment figures is causing a significant shock to the U.S. stock market and global economic outlook.New hiring numbers have decreased by approximately 90% compared to the previous month, shattering the existing narrative of a strong economy.Investors have rapidly reassessed monetary policy and the possibility of interest rate cuts based on this data, which is coinciding with increased stock market volatility.Key Points: Economic outlook, employment statistics, reassessment of monetary policy, global market trends, stock market volatility

[2] Realization of Tariffs and Uncertainty in Global Trade

The U.S. administration’s tariff policies are being implemented in earnest from mid-August, increasing international trade uncertainty.Delays or increased volatility in tariff negotiations between the U.S. and major trading partners could have negative repercussions on the global economy.In particular, the psychological impact of tariff increases and negotiation grace periods on the market could lead to a decline in corporate performance and a contraction in investment sentiment.Key Points: Tariffs, global trade, economic outlook, monetary policy, stock market

[3] Geopolitical Conflicts and Key Variables Between the U.S. and Russia

Geopolitical risks are resurfacing as nuclear tensions between the U.S. and Russia have recently escalated.The Trump administration’s strong statements and the resulting reaction from the international community could act as a short-term stock market correction, as well as a long-term global economic instability factor.In particular, statements related to nuclear security can affect not only the stock market but also monetary policy and investment strategies, so careful attention is needed.Key Points: Geopolitics, economic outlook, global market, monetary policy, stock market

[4] Future Interest Rate Policy and FOMC, and Market Outlook

The Fed (FOMC) is considering variables in its interest rate policy to respond to various adverse factors, such as declining employment figures and tariff issues.The recently announced possibility of interest rate cuts in September and October is creating expectations of liquidity expansion in the market, but at the same time, it is leading to concerns about economic slowdown.Investors need to closely monitor the volatility of interest rate policies and the economic indicator release schedule, carefully adjusting their buy/sell timing.Key Points: Monetary policy, economic outlook, stock market, global market, tariffs

[5] Investment Strategies and Response Measures

The current negative factors, such as employment data shock, tariff pressure, and geopolitical tensions, are further increasing short-term market volatility.However, these complex factors can be transformed into opportunities for adjustment from a long-term investment perspective, so it is important not to be swayed by extreme fear.Since both optimists and pessimists are presenting different outlooks, it is wise to adopt a dollar-cost averaging strategy or take a defensive position in terms of risk management.Key Points: Stock market, economic outlook, investment strategy, global market, monetary policy

[Related Articles…]미국 고용 동향 분석

관세 충격, 글로벌 파장

*YouTube Source: [ 소수몽키 ]

– The atmosphere has shifted due to the unprecedented indicator shock. Will expectations of monetar…

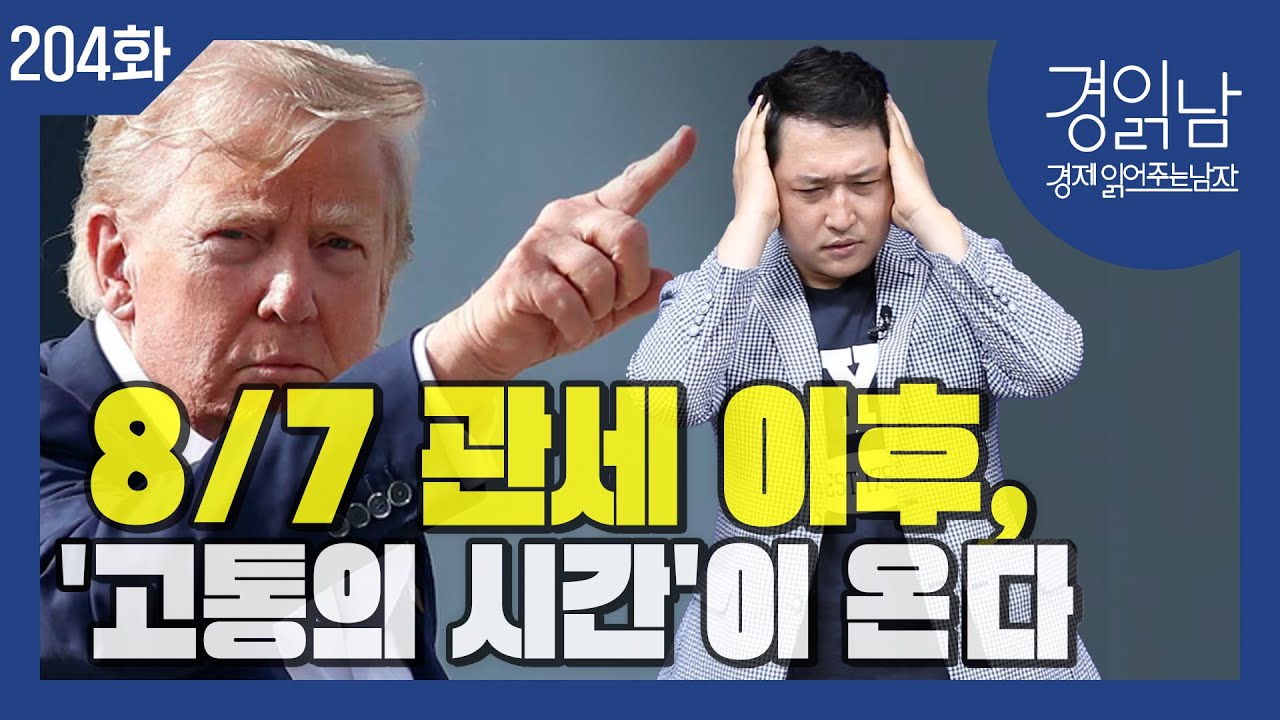

● Tariff Tsunami – Korea’s Economic Apocalypse

Global Economic Outlook and Our Response Strategy After August Tariff Implementation – Key Issues Summary

1. August Tariff Implementation and Immediate Changes

The entire economy is rapidly changing due to the mutual tariff implementation on August 7.A review of the trade agreement between the U.S. and South Korea is inevitable.Global economic uncertainty is increasing, and trade order is expected to be reorganized due to tariff increases.Key SEO keywords to note: global economy, economic outlook, trade strategy, tariff negotiations, market trends.

2. U.S.-Korea Trade Agreement and Comparative Analysis

We examine detailed arguments about the U.S.-Korea trade agreement that other media have not covered in depth.ㆍCriticism is raised that it is unfair for Korea as its tariff rate rises from 0% to 15% compared to the U.S.ㆍWe warn that Korea’s competitiveness may weaken compared to competitors such as Japan and Germany in tariff rate comparisons.ㆍThe U.S. is advocating political justifications such as investment promises and duty-free benefits, but it is uncertain how much of a real benefit it will bring to us.

3. Additional Negotiation Cards – Hidden Strategic Weapons

We propose two major negotiation cards as countermeasures after the tariff implementation.ㆍFirst card: Mineral Resource Development Project – As the U.S. declares independence from rare earth elements, we must also strengthen our mining and refining capabilities. – Our resource companies should form a fund together, and collaborate with the U.S. to secure technological and price competitiveness.ㆍSecond card: Investment Plan Reconsideration – Instead of simply listing already promised investments in the U.S., we must restructure the detailed investment contents to bring real benefits to our economy. – We will develop a plan to simultaneously achieve investment in the U.S. and revitalize the domestic economy by reflecting the strengths of Korean companies in industries such as shipbuilding, semiconductors, secondary batteries, and bio.

4. Impact on Global and Domestic Economy

ㆍGlobal Economic Outlook – The U.S.’s average tariff imposition of nearly 20% will directly impact the exports of countries around the world to the U.S. – There are concerns about economic contraction in production, exports, and employment overall, and this may have a negative impact on the IMF’s 2025 World Economic Outlook.ㆍDomestic Economic Outlook – Since Korea’s exports to the U.S. account for 19% of total exports, there is a high possibility that this will lead to a decrease of approximately 5% in exports. – Export competitiveness is weakening in major industries such as automobiles, machinery, and electronics, which may lead to a slowdown in domestic investment and equipment investment, resulting in negative ripple effects on employment and consumption. – The government and businesses urgently need to develop concrete and sophisticated negotiation strategies.

5. Future Responses and Strategic Tasks

ㆍPolicy Response – The government should not simply rely on tariff negotiations but should carefully prepare negotiation strategies for each item. – Re-negotiate the detailed terms and conditions related to investment in the U.S. to strengthen the real attribution structure of investment returns.ㆍCorporate and Investor Response – Domestic companies need to maintain and expand facility investment in their own country in parallel with investment in the U.S. – We must seek risk diversification and competitiveness enhancement in response to changes in the global investment environment.

Economic forecasts and strategic responses at each stage are expected to have a significant impact on our entire industry and the global economic structure, beyond simple tariff changes.Basically, focusing on SEO key keywords such as trade strategy, market trends, global economy, economic outlook, and tariff negotiations, it is time for all of us to pay attention to this changing trend.

[Related Articles…]

*YouTube Source: [ 경제 읽어주는 남자(김광석TV) ]

– After the August 7th reciprocal tariffs take effect, the economy will completely change: (1) Eval…

● Economic News Titles **Global Economy, Gold Investment, Interest Rate Hikes, Market Turmoil****Economic Tsunami Warning**

Global Economic Outlook and Asset Allocation Strategy: Analysis of Interview with Dr. Hong Chun-Wook

Importance of Gold Investment and Safe Assets

Gold tends to more than double in value during times of crisis.Dr. Hong Chun-Wook mentions instances such as the IT bubble in 2000, the financial crisis in 2008, and the war in 2022, where gold prices significantly increased.Although gold does not pay interest and involves transaction fees, its investment appeal has improved due to recent ETF fee reductions.He advises that holding about 20-30% of total assets in gold as a safe asset is advisable during crises.Such an investment strategy, considering global economic uncertainties, is a key point in terms of economic outlook, stock market analysis, investment strategy, global economy, and interest rate forecasts.

Key Points of Portfolio Composition

Invest only about 40% of total assets in domestic stocks and bonds, and allocate the remainder to gold, foreign stocks, and foreign bonds.To balance domestic and foreign assets, a strategy of investing in U.S. and Japanese stock and bond ETFs along with Korean stock indexes is emphasized.In particular, the ‘Five-Minute Investment Method,’ which aims to achieve an annualized compound return of 8-9% by appropriately combining U.S. Treasury bonds and speculative-grade bonds, is introduced.This portfolio composition is a crucial aspect of an investment strategy for steadily building wealth.

Critical Issues in Dollar Exchange Rate Fluctuations and Interest Rate Forecasts

According to Morgan Stanley’s forecast, interest rates are expected to be cut seven times next year, which could significantly impact interest rate policy avoidance, provocations, and dollar exchange rate fluctuations.Considering that the Korean won-dollar exchange rate is currently high compared to emerging markets, a weaker dollar could positively affect the domestic economy.However, due to the complex interplay of factors such as inflationary pressures, bond prices, and dividend yields, crisis preparedness and risk hedging are important when investing.Paying attention to interest rate forecasts and policy changes is key to adjusting investment positions.

Impact of Policy Changes on the Overall Financial Market

Changes in the Federal Reserve Chair, political variables like Trump, and continuous interest rate fluctuations can cause significant market disruptions.Recalling instances where there were major market corrections in the years when the Federal Reserve Chair was replaced, investors should construct a defensive portfolio through diversification and risk management rather than trying to predict market ups and downs.While new themes such as the AI investment boom can temporarily influence the stock market’s strength, heightened competition and adjustments in value balances will follow, so excessive expectations should be avoided.A diversified investment strategy can help build wealth stably even under uncertain global economic conditions.

Summary

Amid increasing global economic uncertainties, Dr. Hong Chun-Wook presents the role of gold and foreign assets during crises, balanced portfolio composition between domestic and foreign assets, dollar exchange rate, and interest rate forecasts as key investment strategies.Investors should aim for long-term wealth accumulation by paying attention to economic outlook, stock market, investment strategy, global economy, and interest rate forecasts, and through diversification and risk management.

[Related Articles…]Gold Investment Strategy Summary |Interest Rate Forecast Analysis

*YouTube Source: [ Jun’s economy lab ]

– Buy This to Get Rich (ft. Hong Chun-wook, Part 2)

● Musk’s Jackpot, Palantir’s Bubble, Rate Cut Frenzy, US Auto-Tech Paradox, Hong’s Deep Dive.

1. Musk and Tesla Stock Compensation Status

The news that Tesla CEO Elon Musk has been granted approximately 40 trillion won worth of stock carries significance beyond mere numbers. This stock compensation serves as a crucial point in Tesla’s management strategy and risk management within the stock investment market. Considering its impact on the global economic outlook and the U.S. stock market trends, this measure attracts investors’ attention while securing future growth engines. As an economic outlook blog expert, it is necessary to meticulously analyze the background and ripple effects of such a massive stock compensation.

2. Palantir’s Valuation Overheating Warning

Palantir’s valuation has recently been highly appraised, causing investment fever. However, some experts warn that if this overheating continues, a correction phase may occur. Considering Palantir’s core technology, U.S. stock market trends, and stock investment market’s instability factors, investors need a more cautious approach. Analysts advise that the sustainability of future corporate performance and technological innovation should be closely monitored.

3. September Interest Rate Cut Outlook and Financial Trends

According to the latest economic outlook, the probability of a September interest rate cut is as high as 87%. The news of an interest rate cut significantly impacts both the bond and stock markets, providing investors with opportunities to establish various strategies. In particular, in the U.S. stock market and the global economy as a whole, interest rate cuts are considered factors that can promote consumption and investment activities, so attention should be paid to this trend. Continuous monitoring of the economic outlook, financial markets, and interest rate trends will play a decisive role in establishing future investment strategies.

4. U.S. System Without Car Black Boxes and Its Meaning

The fact that the U.S. automotive industry operates without black boxes is drawing attention differently from general safety regulations. This implies technological innovation by automobile manufacturers and flexibility in regulatory aspects. Regarding safety issues, the challenge of balancing consumer protection and corporate technological development remains. This situation is an important issue that requires a close look at the ripple effects on the U.S. stock market and the global stock investment market.

5. Hong Ki-ja’s Daily New York Correspondent Analysis and Implications

Hong Sung-yong, a correspondent for Maeil Business Newspaper, appearing on Hong Ki-ja’s Daily New York program, comprehensively analyzed these economic issues, highlighting Musk’s stock compensation, Palantir’s valuation, the September interest rate cut outlook, and the U.S. car safety system. In particular, he specifically pointed out the time-series flow of each issue and its impact on the market, providing useful information to both investors and general readers. This analysis can serve as an important guideline for future global economic outlook, U.S. stock market, and stock investment strategies.

< Summary >Musk’s Tesla stock compensation has a significant impact on the global economy and the U.S. stock market as a whole, and Palantir’s overheating requires investors to take a cautious approach. In addition, with the probability of a September interest rate cut reaching 87%, it is providing new opportunities to the financial market, and the U.S. system without car black boxes makes us reconsider the balance between regulation and technological development. Through Hong Ki-ja’s Daily New York correspondent analysis, these complex economic issues can be comprehensively understood.

[Related Articles…] Tesla Stock Compensation News | Analysis of September Interest Rate Cut Outlook

*YouTube Source: [ Maeil Business Newspaper ]

– [美개장포인트] 테슬라, 머스크에 40조원 주식 부여ㅣ”팔란티어 밸류 높다” 과열경고ㅣ9월 금리인하 확률 87%ㅣ車블랙박스 없는 나라 미국ㅣ홍키자의 매일뉴욕

● AI-Driven Education Apocalypse, Elite Degrees – WORTHLESS, Silicon Valley Meltdown

The AI Revolution and Educational Transformation Reshape the Global Economic Landscape – Key Insights You Need to Know Now

1. Google’s AI Innovation Announcement and Tension in the Private Education Sector

Google’s unveiling of unprecedented AI technology is causing significant ripples in the private education market.Private education institute directors and instructors are expressing concern about the paradigm shift in education due to the introduction of AI.It is necessary to re-examine the impact of internationally recognized global economic and technological trends on the education sector.Here’s a chronological overview of the AI innovation and changes across the global economy that are easy for working professionals to understand.

2. The AI Era: Fundamental Changes in the Education System

The limitations of the existing education system, established in the 18th century, are becoming apparent.Within the next 10 years, AI agents are expected to lead education,and artificial intelligence is predicted to be within the top 5% in standardized tests like the College Scholastic Ability Test (CSAT), demonstrating educational competitiveness.These changes may lead to a 100% transformation or complete disappearance of private education methods.Artificial intelligence is gaining attention as a core technology driving global economic prospects and educational innovation.

3. Future Jobs and Talent Competition: Re-evaluating Prestigious University Degrees and Advanced Education

The challenging perspective that “degrees from prestigious universities and advanced education are now relics of the past” is being presented.In the age of artificial intelligence, the value of traditional academic credentials and advanced education will diminish,and only ‘specific skills’ that can be immediately applied in real life will be the key to survival.The talent competition related to AI is intense even in Silicon Valley, and companies are focusing all their efforts on securing talent centered on artificial intelligence technology.SEO-optimized keywords such as economic outlook, artificial intelligence, global economy, education innovation, and Silicon Valley support these changes.

4. Silicon Valley’s Turmoil and Economic Repercussions

Silicon Valley is experiencing incredible surges and plunges with the introduction of artificial intelligence technology.While companies are seeking talent with annual salaries of $10 million,there are also forecasts that at least 50,000 additional layoffs will occur by the second half of this year.This overturns existing preconceptions and methods,suggesting a future where human physical capabilities and immediate results will play a greater role.These economic changes are expected to have a significant impact on the global economy and future job market,and attention should be paid to international economic outlooks and the changes brought about by artificial intelligence innovation.

5. Comprehensive Outlook and the Future We Must Prepare For

All of these changes signify not just technological advancements,but a paradigm shift in education, jobs, and society as a whole.With the advancement of artificial intelligence, the global economy will form a completely new order unlike the past.In particular, the restructuring of the education system, talent development methods, and industrial structure will bring about the greatest changes.The key here is to rapidly transform existing infrastructure and systems.The tension in the private education sector, the re-evaluation of degrees from prestigious universities, and the turmoil in Silicon Valley, all witnessed in the field,emphasize the need to prepare for the future with five key keywords: economic outlook, artificial intelligence, global economy, education innovation, and Silicon Valley.

[Related Articles…]Artificial Intelligence Era: The Great Transformation of Industrial StructureEducation Innovation and Future Talent Development Strategies

*YouTube Source: [ 달란트투자 ]

– “Private academy teachers on high alert?” Google’s unprecedented AI reveals a breakthrough that w…