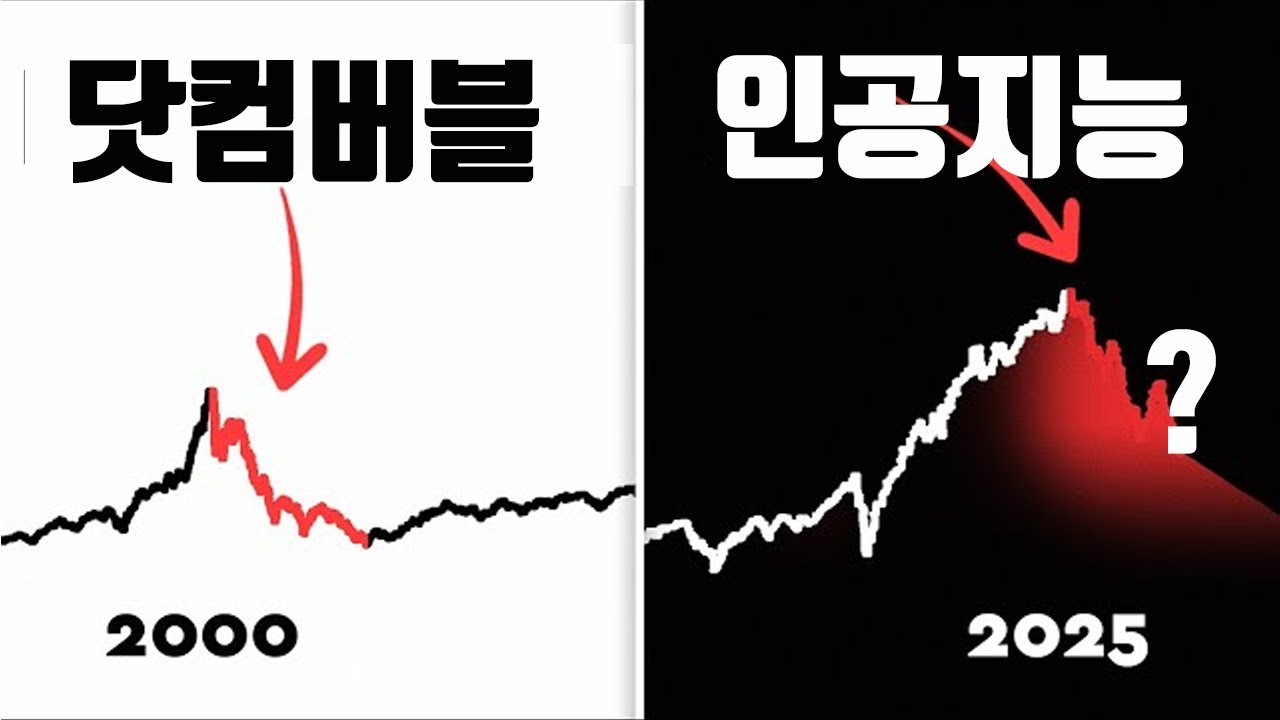

● AI-Fueled Frenzy- Not Dot-Com Doom

<h4>Dot-Com Bubble vs. 2025: Development of Key Events Related to Interest Rates, Technological Setbacks, and Artificial Intelligence Investment</h4><h3>1. Changes in Interest Rates and Economic Cycles</h3>The most noticeable difference from a global economic and investment perspective is interest rate policy.During the dot-com bubble, the Fed cut interest rates due to the LTCM bankruptcy in 1998-1999, followed by a rapid increase.This rapid change in interest rates significantly impacted the overheating of tech stocks and investment sentiment.In contrast, a shift towards an interest rate cut cycle is being observed in 2025.Currently, the U.S. central bank is considering interest rate cuts, conditional on price stability, and is not burdening tech stocks as investors might expect.This perspective aligns with key SEO keywords such as 'interest rates,' 'investment,' and 'global economy.'<h3>2. Technological Setbacks and Shifts in Investment Sentiment</h3>During the dot-com bubble, investment sentiment in tech stocks rapidly contracted due to Microsoft's antitrust lawsuit, among other factors.As negative events occurred for major tech stocks at the time, investors showed caution across the board.In 2025, tech and artificial intelligence (AI)-related companies are showing stable performance in terms of macroeconomic momentum and financing.Major tech and AI companies such as Nvidia, OpenAI, and Claude are maintaining market confidence through funding and valuation increases.Thus, instead of technological setbacks, technological innovation and AI development are driving investment sentiment.<h3>3. Corporate Credit and Current Status of AI Investment</h3>During the dot-com bubble, tech companies faced difficulties in raising capital, leading to stock price declines and bankruptcies.Several representative companies, such as Pets.com and Webvan, shocked the market with poor performance after their IPOs.In contrast, AI and tech companies in 2025 are showing improved cash flow and stable funding.Despite spending $8 billion, OpenAI is consistently attracting investment and maintaining a high valuation.Anthropic is also seeing an increase in corporate value, drawing investor attention.These trends reflect the current economic situation centered around 'investment,' 'tech stocks,' and 'artificial intelligence.'<h3>4. Market Concentration and Sustainability of Bull Market</h3>During the dot-com bubble, there was severe concentration in tech stocks, with a few large tech companies accounting for a large portion of the total market capitalization.This became a factor of instability for the entire market.However, considering that railroad stocks held about 60% market dominance in the late 1800s,the current 30-40% concentration of the Magnificent Seven tech stocks is not a significant threat historically.Also, while U.S. bull markets last an average of 70 months, the current phase is only at the 20-30 month stage.Although the possibility of future corrections exists, it currently provides a stable investment environment.<h3>5. Future Outlook and Comprehensive Investment Strategy</h3>The 2025 outlook suggests that minor glitches in the evolution of artificial intelligence technology, such as GPT-5, and ongoing AI innovation are sending positive signals to the market.Rather than excessive concerns about a bubble burst, it is important for investors to establish a careful investment strategy by comprehensively considering various indicators such as interest rate conditions, the absence of tech stock setbacks, and improved corporate credit.While a market turning point may arrive if disappointing factors accumulate, positive signals supporting AI innovation and global economic recovery are prominent so far.Therefore, it is necessary to establish a wise investment strategy based on this multifaceted analysis.<p><strong>Summary:</strong> Unlike the dot-com bubble, where investment sentiment contracted due to rapid interest rate changes, technological setbacks, and deteriorating corporate credit, 2025 is seeing positive factors such as interest rate cut cycles, AI innovation, and a stable funding environment. Considering economic indicators that have changed since the past, such as tech stock concentration and the duration of the bull market, it is worth noting that this is a time for investors to seek opportunities while being more cautious.</p><p>[Related Articles...] <br><a href="https://nextgeninsight.net/?s=%EB%B2%84%EB%B8%94">Dot-Com Bubble Reexamined</a> <br><a href="https://nextgeninsight.net/?s=%EC%9D%B8%EA%B3%B5%EC%A7%80%EB%8A%A5">Artificial Intelligence Innovation and Investment Strategies</a></p>*YouTube Source: [ 내일은 투자왕 – 김단테 ]

– 닷컴버블 vs 2025

● **Trump’s Tariffs Trigger Tech Triumphs, AI Ascends**

US Reshoring, Trump’s Policies, and the Future Outlook of the AI Revolution – Read Now!

1. Apple’s Tariff Concerns Resolved and US Reshoring Strategy

Pay attention to Apple’s recent surprise announcement as it contains many noteworthy points.

It showcases a large-scale investment plan in the US and a strategy to revive manufacturing, demonstrating proactive efforts to alleviate tariff burdens.

As a result, its partners are also positively impacted, leading to restored confidence in the overall US stock market.

This is a significant shift in the global economic outlook, suggesting that the US reshoring policy is not just about cost reduction but a long-term strategy for securing competitiveness.

2. Rise of Big Tech and the AI Revolution – Stock Price Increase of Palantir and NVIDIA

In addition to Apple, AI cycle leaders such as NVIDIA and Palantir are gaining attention with unexpected earnings surprises.

In particular, Palantir is showing the potential to surpass the existing cloud revolution with word-of-mouth among customers in the AI software sector.

The ‘full package’ system, where customers market themselves, is acting as a strong signal for the US stock market and investors.

This movement is a pillar of the AI revolution and is expected to become one of the key keywords in the global economic outlook.

3. Trade Policy Shift and Tariff Strategy of the Trump Administration

The Trump administration is showing movement to reshape the trade order through aggressive tariff policies.

The recent declaration by the United States Trade Representative (USTR) of the end of the WTO system clearly demonstrates the intention to shift towards tariff protectionism and strengthening domestic manufacturing in the US.

As big tech companies like Apple and NVIDIA promise to expand production in the US, the market is taking this as a positive sign.

In other words, Trump’s policies are interpreted as a long-term strategy closely linked to the US investment boom, rather than a simple trade conflict.

4. Changes in the Fed Personnel and Expectations for Interest Rate Cuts – Impact on the US Stock Market

With personnel changes in the Federal Reserve Board and the strengthening influence of Trump’s closest associates, expectations for future interest rate cuts are increasing.

These changes are expected to positively impact the financial market and the stock market as a whole, amplifying expectations among investors for a liquidity boom and consumer spending boost.

The market assesses that the Trump administration is pursuing aggressive policies to stabilize the asset market and the economy.

5. Investment Strategy and Risk Management – How to Respond to the Stock Market in the Second Half of the Year

Investors need to pay attention to this reshoring policy and the rising trend of big tech.

In particular, the possibility of short-term adjustments should be considered as economic indicators, inflation, and employment indicators related to the US stock market fluctuate.

The special lecture in the second half of the year includes an analysis of the positive and negative factors in the US stock market, as well as promising investment stocks and ETFs, which will be of great help in establishing a practical investment strategy.

Systematic risk management measures should be sought in various fields, from interest rate cuts due to Trump’s policies and changes in Fed personnel, to AI infrastructure investment, and cryptocurrency investment.

6. Other Key Contents and Future Outlook

This week, US tariff revenue rose to a record high, and governments and companies showed close cooperation.

The Trump administration is pursuing aggressive policies in various fields such as trade, construction, and finance, playing a positive role in the stock market and the economy as a whole.

In addition, despite external variables such as geopolitical issues and the US-China trade conflict, signs of economic recovery through domestic consumption and investment booms are being captured in the US.

These multifaceted issues will play a very important role in grasping the global economic outlook and the future direction of the US stock market.

< Summary >

Apple’s reshoring strategy and tariff concern resolution are sending positive signals to the US stock market.

AI revolution leaders such as NVIDIA and Palantir are showing unexpected growth and leading the global economic outlook.

The Trump administration is actively promoting changes in trade policy with the declaration of the end of the WTO system and raising expectations for interest rate cuts through changes in Fed personnel.

Investors should pay attention to systematic investment strategies and risk management in preparation for stock market volatility in the second half of the year.

All these issues are interacting with top keywords such as the global economic outlook, US stock market, Trump’s policies, AI revolution, and cryptocurrency investment, reshaping the future investment environment.

[Related Articles…] Apple Reshoring Case Analysis | Trump Trade Policy Commentary

*YouTube Source: [ 소수몽키 ]

– Trump’s scenario worked? The US is the only beneficiary of the boom.

● Bitcoin Mania, Tariff Tremors, Tech Bubble, Return Chaos.

Unopened Point Analysis: Analyzing the Reality Behind Bitcoin’s Peak Breakthrough and Global Economic Upheaval

1. Bitcoin’s Peak Breakthrough and Cryptocurrency Market Development

As Bitcoin surges towards its all-time high, investors and market experts are closely monitoring its background and future trends.We analyze the impact of Walmart’s price increases and tariffs on both the cryptocurrency and traditional financial markets.The recent increase in ETF inflows and active buying by institutional investors are accelerating the financial institutionalization of Bitcoin, increasing interest in long-term investment strategies.At the same time, institutions that have adopted AI technology predict a synergistic effect on Bitcoin and Ethereum, playing an important role in global economic trends and investment strategy keywords.

2. Impact of Tariff Policy Shift on Consumer Prices

As the U.S. government’s tariff bills begin to materialize, major retailers such as Walmart are likely to raise prices.Economic experts are focusing on analyzing the impact of this tariff policy shift on consumer prices in the United States, going beyond simple trade policy.According to estimates by the Budget Research Institute, the average household in the United States is expected to incur an additional cost of $2,400, with a significant risk of price increases for leather goods, clothing, food, and agricultural products.These changes are expected to be a key variable in global market forecast and stock market analysis.

3. Changes in U.S., China, and Russia Diplomacy and Economic Strategies

Trump and Putin’s divergent strategies are affecting the reshaping of the global economic order, going beyond simple diplomatic conflicts.In particular, the U.S. is using tariff policy as a tool to check China and Russia, and the choice of Alaska as the venue for talks is strategically significant.We consider the impact of U.S. domestic politics and foreign policy on economic structure and market trends, and it serves as a factor for understanding future international economic perspectives.

4. Concerns Over Stock Market and Tech Stock Overvaluation

Currently, the U.S. stock market is showing a strong bullish trend centered on big tech, with stock prices hitting all-time highs.The proportion of tech stocks in the SP 500 has surged, and some are raising concerns about overvaluation.Wall Street investors are discussing the possibility of tech stocks expanding to 70%, and the resulting increase in market capitalization and risk management plans for investors are drawing attention.These trends are deeply related to core SEO keywords such as global economic, stock market, and investment strategy.

5. U.S. Retail Return War: The Hidden Cost of Convenience

As the excessive return culture of consumers in the U.S. retail market is revealed, the negative ripple effects on the overall economy are being emphasized.As of 2024, the total amount of returns by U.S. consumers exceeds the gross domestic product, which is a structure in which all consumers bear additional costs.In particular, the activation of online shopping and the consumption patterns of Generation Z are exacerbating the problem of return abuse, making it a new management challenge for retailers and distributors.These structural changes are emerging as important issues in terms of cost structure restructuring and consumer market dynamics across the economy.

6. Summary of Major Events and Forecasts in Chronological Order

• August 11, 2025: The peak breakthrough of Bitcoin and the cryptocurrency market is conveyed through a Maeil Economic Daily Wall Street report.• Early stage: Concerns about rising consumer prices increase as tariff policies and price increases begin to materialize.• Mid-stage: The strategic background of diplomatic conflicts between the U.S., China, and Russia, and the Alaska talks are revealed.• Late stage: Concerns about overvaluation among investors along with the increase in the proportion of tech stocks and the overheating of the U.S. stock market are raised.• Conclusion: The cost increase effect of the U.S. retail return war and the increase in uncertainty in the global economic environment.As such, economic developments are complex phenomena that appear with various variables and time overlapping, and will be important reference data for establishing investment strategies and predicting future markets.

[Related Posts…]Bitcoin Surge Forecast |Tariff Shock and Economic Volatility

*YouTube Source: [ Maeil Business Newspaper ]

– [美개장포인트] 비트코인 최고치 돌파 초읽기ㅣ월마트 가격인상, 관세 청구서 본격화ㅣ트럼프-푸틴은 동상이몽중ㅣ미국은 반품전쟁: 편리함의 숨은 대가ㅣ홍키자의 매일뉴욕