● Tesla’s Q3 challenge-Lucid, Uber, Nio Robotaxi Alliance, China Model YL’s surge – Key takeaways

Tesla’s Q3 Faces Peak Challenge, Lucid·Uber·NIO Form Robocar Alliance, China’s Model YL Creates a Stir — Key Takeaways from This Article

This article delves into the background and feasibility of the latest Q3 delivery upward revisions by UBS, Wolfe Research, and Deutsche Bank,

the factory automation revolution implied by Tesla’s ‘coordinate-based assembly + high-strength adhesive’ patent,

the strategic implications and data competitiveness posed by the Lucid, Uber, and NIO robocar alliance,

the ripple effects of China’s Model YL segment reshuffling on the EV market,

and critically, points that most news outlets overlook (the significance of shareholder votes on AI/robot dominance, and the industrial externalities arising when coordinate assembly combines with Optimus-type humanoids).

1) Q3 Delivery Upgrades: UBS, Wolfe, Deutsche’s Forecasts and Hidden Variables

UBS has raised its Tesla Q3 delivery forecast to 475,000 units for two primary reasons.

First, the ‘last-minute demand’ effect from the US IRA (Inflation Reduction Act) $7,500 tax credit.

Second, accelerated demand due to the Model Y refresh (Juniper, YL, etc.).

Wolfe Research and Deutsche Bank echo similar sentiments, citing seasonal demand increases in China and the US as their rationale.

However, crucial variables often overlooked by the news include the ‘order-to-delivery lead time (reservation → actual delivery date)’ and the possibility of ‘short-term channel stuffing’.

The regulation allowing tax credit benefits for ‘applications’ submitted by the end of September could lead to some orders being delayed in actual delivery,

creating a risk of Q3 figures being artificially inflated or conversely, deferred to Q4.

2) China’s Model YL Surge — A Signal for Segment Reshuffling

The Model YL launched in China precisely targeted family demand by positioning itself as a long-wheelbase, 6-seater vehicle.

Deutsche Bank’s data indicates that the surge in expected September deliveries to 72,000 units is driven by the initial popularity and delivery backlogs of this model.

Success in the Chinese market directly impacts global sales mix (ASP, Average Selling Price) and margins.

A key point is that in the competitive landscape against low-cost offerings from local rivals like BYD, a ‘segment upsell’ strategy like the Model YL can serve as Tesla’s price defense mechanism.

3) Tesla’s Manufacturing Patent — Implications of Coordinate-Based Assembly and Adhesives

Tesla’s patent application proposes abandoning the conventional ‘step-by-step assembly of parts’ in favor of directly aligning all components to ‘factory-based coordinates’.

This method reduces the need for self-correcting manual labor and enables concurrent operations on the assembly line.

Specifically, designing with high-strength adhesives instead of welding enhances the flexibility of the joining process and prevents the line from halting while robots quickly attach parts.

While many media outlets focus on ‘productivity improvements,’ my core insight is the creation of an ‘infrastructure for complete collaboration with robots (especially humanoids).’

Coordinate-based assembly provides clear target coordinates for robots, enabling large-scale robotic operations without requiring sophisticated vision and sensor systems.

In essence, this lays the groundwork for humanoids like Optimus to replace a significant portion of human labor.

4) The Robocar Front: Strategic Significance of the Lucid·Uber·NIO Alliance

Lucid’s integration of Uber-specific engineering vehicles with NIO’s (Neuro?) autonomous systems and their first delivery in New York signals not just a pilot program, but the full-scale commencement of a B2B strategy.

The critical point is that this alliance aims for a ‘platform effect’.

Uber combines demand (passengers), while Lucid and NIO combine supply (vehicles and autonomous software) to rapidly accumulate real-world data.

The speed of data accumulation is a decisive asset in robocar competition.

Compared to Tesla and Waymo, the Lucid alliance has the potential to engage more quickly in ‘urban commercial operations’,

which will also influence the timing of robocar market monetization and regulatory adaptation.

5) Shareholder Vote and Musk’s Influence — Securing Control Over AI and Robot Strategy

Elon Musk’s appeal to shareholders goes beyond a simple vote on his compensation package; it aims to secure ‘control over future core assets (robots and AI).’

Musk’s concern is the structure where external advisors and institutional investors wield significant influence over decision-making.

The outcome of this vote could directly impact the speed and scope of Tesla’s future AI trend strategy implementation.

6) Risks and Macro Impact — A Triple Risk of Supply, Price, and Demand

Short-term risks: Battery material procurement, fluctuations in raw material prices like lithium, and intensified price competition due to BYD’s low-cost strategy.

Medium-term risks: Potential for a sharp decline in demand after the IRA’s expiration, and the deferral effect into Q4 potentially weakening earnings momentum.

Long-term risks: Delays in robocar commercialization, regulatory and safety issues, and competitors’ data acquisition strategies.

From a global economic perspective, fluctuations in EV and battery demand can disrupt the supply of related raw materials, impacting inflation and trade balances.

7) A ‘Microscope’ List for Investors and Industry Professionals to Check Right Now

- Verify discrepancies between Tesla’s regional ‘insurance registration figures’ and actual ‘delivery reports’.

- Track announcements of ‘coordinate transition’ in production lines or news of pilot operations.

- Monitor the order backlog (build slot) for the Model YL and ASP (Average Selling Price) fluctuations by region.

- Note the timing of the release of pilot data (driving hours, failure rates, cost structure) from Lucid-Uber-NIO.

- Examine subsequent IRA regulations (e.g., changes in the application-to-delivery timing rules) and conditions for tax benefit deferral.

8) My Key Perspective, ‘Overlooked by Other Media’ — Focus on Intangible Competitiveness

Much of the coverage centers on simple metrics (deliveries, orders), but the true game-changer is the ‘data network effect’ and the ‘manufacturing platform transformation’.

Coordinate-based assembly + adhesives + large-scale robot collaboration is not just about cost reduction but about creating a ‘universal product manufacturing platform’.

On this platform, disparate products like EVs, energy storage systems, and robots can be efficiently produced on the same line.

Ultimately, this can justify the reinterpretation of Tesla’s stock valuation not as a ‘car company’ but as an ‘AI, robotics, and manufacturing platform company’.

Furthermore, the Lucid-Uber-NIO alliance demonstrates how the combination with ‘mobility service providers’ can rapidly reshape the market beyond traditional OEM competition.

9) Conclusion — Investment and Strategic Implications

In the short term, the upward revisions by UBS and Wolfe will provide positive momentum and increase stock volatility around the Q3 earnings announcement.

In the medium to long term, Tesla’s patent and production method transition can fundamentally impact product cost structures and scalability.

The robocar war will ultimately be a battle of platforms, data, and scale, not just vehicles, so it’s crucial to closely watch the partnerships, data disclosures, and demonstration results of related companies.

From a global economic perspective, seasonal and policy-driven shocks in EV demand can ripple through raw material markets, inflation, and trade flows.

< Summary >

Institutions like UBS have significantly raised Tesla’s Q3 delivery forecasts, driven by last-minute IRA demand and the Model Y refresh.

Tesla’s coordinate-based assembly patent signifies a manufacturing platform transformation, enabling robot and humanoid collaboration beyond mere productivity improvements.

The Lucid-Uber-NIO robocar alliance possesses a distinct competitive edge through platform-based data accumulation.

China’s Model YL is poised to trigger segment reshuffling, potentially impacting the EV market’s pricing and revenue structure.

Investors should closely monitor the gap between ‘actual deliveries vs. applications,’ news regarding production process transitions, robocar demonstration data, and subsequent IRA regulations.

[Related Articles…]

Tesla’s Production Revolution: Cost Reduction and Automation Driven by Coordinate-Based Assembly

Robocar Wars: A Strategic Comparison of Waymo, Lucid, and Uber

*Source: [ 오늘의 테슬라 뉴스 ]

– 테슬라 Q3 사상 최대 전망! 루시드-우버-뉴로 연합 로보택시 출격, 中 모델 Y L 돌풍·신호탄?

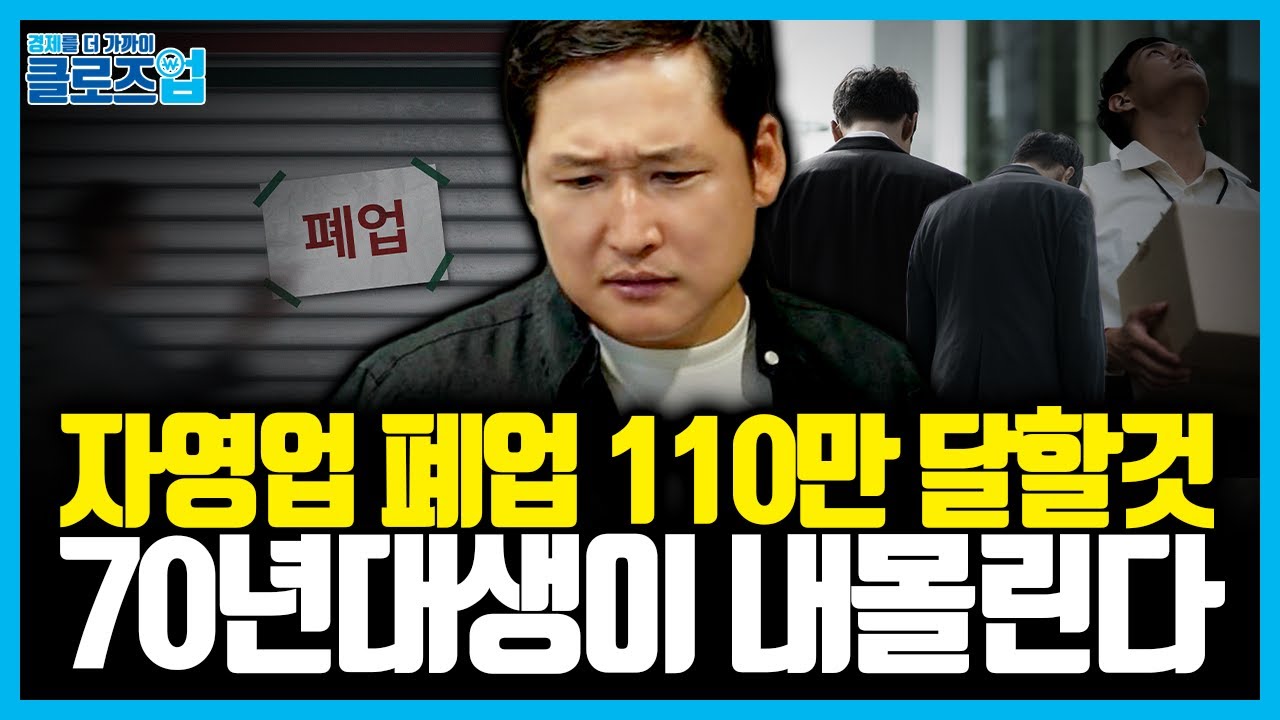

● 1 Million Closures Korea’s Small Business Collapse, Big Business Exodus, and Your Survival Guide

The Era of 1 Million Business Closures in 2026 — The Reality of Slumping Domestic Demand, Big Corporations Shifting to Overseas Investment, and Solutions You Never Knew Existed

This article delves into the vicious cycle of retirement, entrepreneurship, and business closure, explains how big corporations’ overseas equipment investments are dismantling self-employment and supply chains, explores the roles of gold, Bitcoin, and stablecoins in a liquidity-driven market, and presents concrete strategies for surviving real-world entrepreneurship with AI.It covers practical indicators, policies, and business alternatives often overlooked by the news.After reading, you’ll have a ready-to-check personal entrepreneurship checklist and a clear understanding of priorities for local governments and financial policies.

2024→2025: What Has Already Happened — Key Facts and Empirical Indicators

The fact that self-employment business closures approached 1 million cases annually in 2024 is not just a statistic but a structural signal.While the number of new businesses remains high, closures are increasing at a faster rate, indicating a net decrease.The decline in non-wage workers (self-employed, etc.) is evidence of weakened new job creation.Big corporations’ equipment investments have shifted to the US, leading to a contraction in domestic equipment and construction investments.Key real economic indicators to watch include declining manufacturing operating rates, stagnant POS sales in regional retail, business registration and closure numbers, and a decrease in VAT (including simplified taxation) revenue.During this period, a combination of a preference for safe-haven assets (gold) due to global geopolitical shocks (tariffs, war concerns) and demand for digital assets (Bitcoin) coexisted.

2026 Outlook: A Liquidity-Driven Market with Numerous ‘Downside Risks’

While liquidity will be injected, it’s not guaranteed to flow into domestic consumption.Interest rate cuts and monetary easing will fuel asset price increases (stocks, bonds, crypto, real estate), but alternating geopolitical shocks, renewed inflation spikes, and corporate earnings shocks will lead to rapid rebalancing.Key variables for the Korean economic outlook are overseas (US) equipment investment scale, domestic corporate operating rates, household real income, and regional retail sales.The real estate market is expected to become increasingly ‘fragmented’ — suppressed by regulations in Seoul, with opportunities likely concentrated in regions targeted for balanced regional development.In a liquidity-driven market, those seeking high returns flock to Bitcoin and new technology stocks, but volatility is extremely high.

Why Are Startups Numerous but Closures Faster? — The Structural Mechanism

The surge in early retirements among Baby Boomers and Gen X has led to a sharp increase in ‘survival-driven entrepreneurship.’The problem is that when supply (number of stores) increases in a market with limited demand, individual revenues are divided – the ‘demand fragmentation effect.’For example, if a total of 6 million won in dining revenue is fixed for a particular alley, increasing the number of stores reduces the revenue per store.When big corporations invest overseas, domestic employment and operating rates decline, reducing consumption flowing into local economies, which directly shrinks the revenue for self-employed businesses.Consequently, hasty entrepreneurship without adequate preparation (lack of experience, unverified market demand) significantly increases the risk of closure.

Big Corporations’ Overseas Equipment Investment → Impact on Domestic Supply Chains and Local Economies

Increased overseas CAPEX by corporations leads to a reduction in domestic factory operating rates.Reduced factory operations propagate to decreased sales for parts and material suppliers. The decrease in local consumption by the employees of these suppliers directly leads to reduced sales for neighboring self-employed businesses.Indicators showing the ripple effect down the supply chain in real-time include: corporate equipment investment plans, operating rates by industry, manufacturing shipments and orders, and POS sales in regional commercial districts.From a policy perspective, a focus solely on ‘attracting big corporate investment’ is insufficient; complementary policies (subsidies for small and medium-sized suppliers, transition support) are needed to protect the supply chain.

Asset Allocation Perspective: Gold, Bitcoin, Stablecoins, Real Estate, Stocks

Liquidity-driven markets tend to see capital inflow into risk assets (stocks, crypto), but during geopolitical instability, this shifts to a preference for safe-haven assets (gold).Bitcoin, while still a highly volatile risk asset, is undergoing a process of ‘partial safe-haven assetization’ through institutionalization (pension fund and institutional investment approvals, etc.).Stablecoins are digital assets targeting monetary functions (payment and remittance) and have a completely different nature from Bitcoin.Real estate requires a segmented approach based on region and asset class (Seoul vs. provincial areas), and risks associated with vacancies and income-generating properties should be monitored.Investment point: Simultaneously monitor interest rates (expectations of rate cuts), liquidity, geopolitical risks, and asset volatility (risk) as macro variables.

AI Trends and Entrepreneurship Opportunities — Practical Proposals

AI can serve as a tool to partially mitigate the structural failures in self-employment.AI-based demand forecasting and inventory management SaaS can improve the profit and loss structures of small restaurants and shops.AI-driven automated kiosks, robot serving, and kitchen automation can compensate for rising labor costs and productivity issues faced by older entrepreneurs.The ‘AI-based Micro-Franchise’ model: This model, which standardizes verified recipes and operational manuals using AI and sells small operating rights to retiring entrepreneurs, is effective.Regional Demand Matching Platforms: Collaborating with local governments, these platforms connect consumption vouchers and notification services tailored to low-demand regions to boost sales for small and medium-sized businesses.Data infrastructure (anonymized and shared POS data from small and medium-sized businesses) is essential for local government commercial district policies and private sector entrepreneurship guidance.

Policy Proposals — Solutions Rarely Covered by the News

1) Mandated support for ‘Pre-Entrepreneurship Internships’: Support for practical internships and unpaid pilot operations by industry for retirees.2) Regional Demand-Supply Big Data Platform: Anonymize POS and electronic receipt data to guide new business entries.3) Micro-Franchise Certification and Fund: Certify verified small-scale franchise models and provide initial capital support.4) Supply Chain Linkage Subsidies: Incentives for supplier transitions and reinvestment to fill domestic demand gaps created by overseas CAPEX.5) Entrepreneurship ‘Failure Insurance’ and Reskilling Vouchers: Reduce initial business risks and expand opportunities for second attempts.These policies are more effective when focused on structural protection and data-driven guidance rather than simple cash handouts.

For Individuals (Prospective Entrepreneurs) — A 10-Step Checklist for ‘Prepared Entrepreneurship’

1) Gain 3-6 months of hands-on experience by working in the industry (unpaid or paid internship).2) Analyze demand at the alley level: Assess POS data, foot traffic, and competitive density.3) Verify sales, pricing, and costs through a pilot (pop-up store) for 2-3 months.4) Calculate Unit Economics: Determine profit contribution per customer and break-even point.5) Implement digital POS and data analysis to optimize inventory and menus.6) Integrate AI-based demand forecasting tools (external SaaS) to reduce waste and costs.7) Workforce Plan: For entrepreneurs who are seniors or retirees, design a combination of automation and part-time staff.8) Check regional and industry saturation: Utilize local government commercial district data.9) Finance and Insurance: Secure 6-12 months of initial operating expenses + consider failure insurance.10) Establish a clear Exit Plan or conditions for franchise conversion.

Monitoring Indicators for Immediate Use in the Field (Priority Order)

New Business Registrations and Closures (Monthly)Regional POS Sales (Weekly/Monthly)Manufacturing Operating Rates and Equipment Investment Plans (Quarterly)Household Real Income and Consumption Expenditure (Monthly)Interest Rates and Liquidity Indicators (Libor, Treasury Bonds, Central Bank Liquidity Supply)Bitcoin and Gold Prices (Volatility Monitoring)Combining these indicators allows for early detection of the intensity of ‘domestic demand pressure’ and turning points for entrepreneurship and closures.

< Summary >The era of 1 million self-employment closures is not merely an economic fluctuation but a complex outcome of demographic structure, big corporations’ overseas investments, and stagnant domestic demand.In a liquidity-driven market where capital flows into both risk and safe-haven assets, asset allocation must be redesigned around risk and volatility.Entrepreneurship should be a ‘prepared choice’ rather than an ‘urgent decision,’ with AI-driven automation and data services increasing survival rates.Policies should invest in supply chain protection, data infrastructure, micro-franchises, and failure mitigation mechanisms rather than one-off cash injections for effectiveness.Individuals must undergo industry practical experience, pilot verification, unit economics confirmation, and the adoption of AI and digital tools.

[Related Articles…]Korean Self-Employment Crisis: Survival Strategies for 2026The Stablecoin War and Korea’s Financial Choices

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– 은퇴 후 창업, 악순환에 빠졌다. ‘100만 폐업 시대’ 내수 위축의 현실 | 클로즈업 – 2026년의 ‘머니 트렌드’ 6편

● US Market Summary Alibaba Soars 8, Micron Dip – Opportunity, Intel Courts Apple – Global Economy, AI Trends

Last Night in the US? Alibaba Soars 8%, Is Micron’s Decline an Opportunity? Intel Courts Apple — Global Economy & AI Trends in One Go

Key takeaways from today’s article: South Korea’s “demand for practical benefits” through large-scale South Korea-US investment negotiations (visas, currency swaps), what Wall Street’s rejection of the Nvidia-OpenAI deal signifies, the asymmetric risk of Micron’s earnings and the AI bubble, the implications of Intel reaching out to Apple (supply chain, foundry scenarios), strategic insights from the Alibaba-Nvidia collaboration, Oracle’s massive spending plans and the cloud war, the quiet return of the energy sector, the Trump administration’s Section 232 investigation and Korean export risks, and investment strategies (short-term, medium-term) – all summarized.

1. South Korea-US Negotiations — What South Korea’s “Demand for Practical Benefits” Tied to $480 Trillion Investment Signifies

Prime Minister Han Duck-soo announced that South Korea would defer a large-scale US investment (approximately $350 billion, or about 480 trillion won) under the conditions of “resolving visa issues” and establishing a “South Korea-US currency swap.”

This is not merely a policy announcement.

It represents a sophisticated negotiation strategy by the South Korean government, leveraging investment attraction to simultaneously secure diplomatic and financial safety nets.

Key Impact: The demand for a currency swap agreement implies a short-term reduction in won volatility and an enhancement of foreign exchange liquidity.

However, practically speaking, this matter involves the Fed’s approval, political calculations, and the US Congress’s scrutiny, making a difficult negotiation highly probable.

What to watch on the ground: If a currency swap agreement is reached, the immediate reduction in dollar liquidity risk for South Korean financial stocks (banks, central bank-related), and export stocks (semiconductors, large manufacturers) will be significant.

A crucial point often overlooked in other news: The visa issue (restricting the movement of high-skilled talent) is not just about the movement of people; it could fundamentally alter the structure of manufacturing partnerships by leading to the localization (or inability to move) of semiconductor and advanced talent.

2. New York Market Summary (Chronological Order): “Breather” in the AI Party and Stock-Specific Turning Points

1) Overall Market: The Dow fell 0.37%, the Nasdaq -0.33%, and the S&P 500 -0.28%, marking a slight decline.

2) Nvidia: Despite the announcement of a large-scale “internal fund” investment in OpenAI, concerns about “demand distortion” grew on Wall Street.

Key Point: It’s crucial to clearly distinguish whether Nvidia’s internal investment is creating genuine demand or simply circular demand (to maintain its own ecosystem).

3) Micron: While earnings were strong, the stock price fell by over 3%.

Implication: This signals that expectations for AI have already reached an extreme, making it difficult for short-term earnings surprises to sustain the stock price.

4) Intel: The stock surged over 6% on rumors of investment requests from Apple.

Significance: Intel’s “comeback story” has the potential to change the game, moving beyond simple product competition to securing strategic partners like Apple, Nvidia, and SoftBank.

Unique Aspect (Less Covered by Other Media): If Apple invests in Intel, a “collaboration-division of labor” model could emerge between the M-chip ecosystem and Intel’s manufacturing capabilities, which can be interpreted as a signal of Apple’s supply chain diversification.

5) Alibaba: The stock surged up to 8% following news of a software partnership with Nvidia.

Important Point: In the context of US semiconductor sanctions against China, the key will be how Chinese AI companies collaborate with US companies (software, tools, non-disruptive utilization).

6) Oracle: Announced plans for massive capital investment and infrastructure spending.

This is a signal heralding the “next phase of competition” in the cloud market.

7) Energy Sector, Tesla, Housing: The energy sector showed signs of recovery, and Tesla rose on anticipation.

US new home sales (800,000 units) significantly exceeded expectations, acting as a direct positive catalyst for consumption, purchasing power, and construction-related sectors.

3. In-Depth Sector Analysis and Investment Strategies

Semiconductors (Including Memory)

Key Takeaway: AI demand has the potential to skyrocket demand for memory and high-performance computing, but the timing of supply cycles and large capital expenditures is critical.

Strategy: While exercising caution regarding short-term volatility with Micron, a dollar-cost averaging strategy is effective if long-term structural demand is certain.

Intel-Related

Key Takeaway: The possibility of an Apple-Intel partnership signifies a potential rebuilding of Intel’s technology credibility and a redesign of its foundry strategy.

Strategy: Until the confirmation of substantial partnerships for Intel (including investments from Apple and Nvidia), manage risk through options or small positions.

Cloud & AI Infrastructure (Oracle, Google, Microsoft, AWS)

Key Takeaway: Oracle’s aggressive spending will ignite price competition in the infrastructure market and a battle for customer acquisition.

Strategy: Infrastructure equipment (servers, networking) and data center REITs offer upside potential, while increased competition among cloud service providers presents margin pressure risks.

AI Software & Services

Key Takeaway: Companies like ServiceNow that leverage AI for business automation are likely to have stable subscription revenue and high cash generation potential.

Strategy: Recommended to include software companies demonstrating both growth and cash flow in mid-term portfolios.

Energy

Key Takeaway: The energy sector has quietly turned bullish this quarter.

Strategy: Focus on large integrated energy companies and energy infrastructure, rather than cyclical stocks. Significant upside potential exists if oil prices and demand recover.

China & Alibaba

Key Takeaway: Alibaba’s collaboration with Nvidia demonstrates the possibility of circumventing technology restrictions.

Strategy: Position sizing must consider Chinese regulatory risks, and confirmation of the practical revenue contribution from AI partnerships is essential.

Housing & PropTech (OpenDoor)

Key Takeaway: The surge in US housing sales offers short-term opportunities in related themes (construction, building materials, proptech).

Strategy: For companies like OpenDoor, which are highly volatile, enter only after confirming the continuation of supportive signals (sales volume, rising housing prices).

4. Macro Risk Checklist

Interest Rates & Federal Reserve: The “audition” for the next Fed Chair is acting as a political variable.

Implication: A potential shift in the Fed’s stance can lead to increased volatility in interest rates, the dollar, and the US stock market.

Exchange Rates & Currency Swaps: The South Korea-US currency swap negotiations can stabilize the won and reduce the risk of foreign capital outflows.

Trade & Export Risks: The Trump administration’s Section 232 investigation (medical and industrial goods) poses a direct threat to Korean exports.

Geopolitics (US-China): The technology hegemony race is altering the supply and demand dynamics of semiconductors and AI equipment, as well as corporate collaboration patterns.

5. Practical Investment Checkpoints (Short and Clear)

1) Short-Term: React sensitively to signs of overheating in AI-related sectors (excessive valuations, news of internal fund injections).

2) Medium-Term: Recommended to employ a dollar-cost averaging strategy for semiconductors (especially memory and materials) and cloud infrastructure equipment, based on structural demand.

3) Geopolitical & Policy Risks: Consider some rebalancing towards defensive sectors (healthcare, technology services, domestic consumption) when news momentum arises from events like South Korea-US currency swaps or Section 232 investigations.

4) Risk Management: During periods of increased volatility, reducing position sizes, hedging with options, and increasing cash holdings are effective strategies.

6. “Hidden Issues” Not Well Covered Elsewhere — What to Check Immediately

1) The practical impact of visa issues can lead to “restrictions on the movement of technical talent,” potentially causing short-term hiring delays and project postponements.

2) Nvidia’s structure of injecting funds into its own ecosystem strengthens “ecosystem lock-in” but carries the risk of distorting external demand, making it a potential target for regulation and scrutiny.

3) Oracle’s substantial borrowing and spending could imply short-term growth in the cloud competition but potentially lead to profitability pressure in the long run.

4) Trump’s Section 232 investigation is not merely a tariff debate but a structural risk that could trigger supply chain realignments and the reshoring (nearshoring) of overseas industries.

Conclusion — Signals to Check Right Now

1) Monitor real-time news on the South Korea-US currency swap negotiations and their terms (scale, duration).

2) Differentiate the specifics of collaborations involving Nvidia, OpenAI, and Nvidia-Alibaba (hardware vs. software).

3) Micron’s next quarter guidance and confirmation of customer demand (data centers, AI companies) could serve as buy signals.

4) Review the list of items subject to the Trump administration’s Section 232 investigation and identify those with a significant export share from Korea.

< Summary >

The $480 trillion-class investment negotiations between South Korea and the US are a sophisticated maneuver seeking practical benefits through demands for visas and currency swaps. Agreement is expected to stabilize the won and benefit financial stocks.

The New York market is undergoing an AI overheating correction, with Nvidia’s internal funding controversy, Micron’s earnings anomalies, and Intel’s courtship of Apple serving as key variables.

The Alibaba-Nvidia collaboration signals a potential workaround for Chinese companies to engage in technological cooperation, while Oracle’s massive spending heralds a shift in the landscape of the cloud war.

Investment strategies should bet on the medium-term structural demand for semiconductors and cloud infrastructure, while also preparing for policy and geopolitical risks by diversifying positions and hedging.

[Related Articles…]

US Stock Market Turning Point Analysis: Summary of 3 Scenarios Driven by AI-Gold Conflict

AI Investment Strategy 2025: Where to Allocate Funds Among Semiconductors, Cloud, and Software

*Source: [ Jun’s economy lab ]

– [ 어젯밤 미국은?] 알리바바 +8% 이상 폭등! / 마이크론…지금의 하락이 기회인가? / 인텔의 구원요청 ‘애플’ / 김민석 총리 “비자 문제 해결까지 미국 투자 어려워 “

● Intel surges on Apple rumors- hope-driven premium, M2 record highs signal liquidity, inflation risks, oil rally reignites long-term rate fears, Fed’s ‘flexible inflation target’ debate shifts policy outlook, low cash positions amplify market volatility, AI chip race Intel’s gamble, caution urged.

Intel’s Surge, M2 at All-Time High, and the Fed’s ‘Inflation Target Rethink’ Debate — Key Points Covered in This Article

This article covers the following important topics:

The reality behind Intel’s stock surge and the investment implications of a potential Apple partnership scenario.Why U.S. M2 has surpassed $22 trillion and its implications for asset markets, inflation, and policy.The potential restoration of correlation between rising oil prices and long-term interest rates (especially 30-year bonds).The ‘real signal’ to be read from recent remarks by Fed officials – the discussion around a range for inflation targets and its meaning.How the ultralow (cash) allocation of fund managers and retail investors heightens market sensitivity.Intel’s opportunities and risks from an AI/semiconductor perspective, including investment strategy recommendations.

All of this is organized chronologically (recent issues → policy responses → asset market impact → investment strategy).Keywords: U.S. Stock Market, Interest Rates, Inflation, M2, AI

1) Recent Market Summary (Daily Fact Check)

Indices closed with a slight decline.The lingering effects of Powell’s remarks from the previous day were evident.Significant differentiation among individual large-cap stocks was observed, such as Tesla and Intel.Investor sentiment is in a state of being ‘more sensitive to negative news due to high valuations.’

2) Intel’s Surge — Reasons and Implications

Event Overview: Intel’s stock surged on expectations stemming from early reports of discussions with Apple.Fact Check: The reports are in their initial stages, with no concrete contracts or product announcements yet being the key takeaway.Psychological Factor: The market structure is such that news of involvement with a major platform like Apple amplifies expectations of ‘expanding AI and semiconductor demand.’Strategic Interpretation (Differentiated Perspective):

- If there is substantial cooperation with Apple, Intel could expand its role beyond simple CPU supply to become a partner in AI accelerators, packaging, or server/edge computing.

- However, Apple is a company strong in its own design (Apple Silicon), so the scope of collaboration is likely to be limited.

- Therefore, the current stock reaction is closer to a ‘hope-driven premium’ than ‘real fundamentals.’Investment Signal: For short-term trades, exposure to momentum is possible. For medium to long term, risk management (staggered buying, option hedging) is recommended until actual contracts and revenue conversion are confirmed.

3) U.S. M2 Liquidity — Status and Hidden Meanings

Data: M2 reached another all-time high of approximately $22.2 trillion.Surface Interpretation: Abundant market liquidity maintains upward pressure on asset prices (stocks, real estate, cryptocurrencies, etc.).Deeper Interpretation (Key Point Often Missed by Other Media):

- The composition of M2’s increase is crucial. Recent M2 growth is a mix of structural changes in deposits, money market funds, and liquid instruments, so it cannot be solely interpreted as ‘cash being injected.’

- However, prolonged liquidity expansion is likely to exert gradual pressure on asset bubbles, consumption, and wages, acting as an upward factor for inflation.

- Notably, even if monetary policy normalizes from tightening, the speed of balance sheet reduction (quantitative tightening) and the recovery speed of real demand for market liquidity (bank lending, etc.) differ, making the time lag and intensity between M2 and real inflation more complex than predicted.Investment Implication: Consider the possibility of continued liquidity expansion and review the proportion of inflation hedges (real assets, commodities, inflation-linked bonds) in your asset allocation.

4) Rising Oil Prices and Long-Term Interest Rates (30-Year) Correlation — Why Be Sensitive?

Observation: Brent crude oil is nearing $70 per barrel and resuming its upward trend.Correlation: In the past (especially around 2008), long-term bond yields and oil prices showed a strong co-movement.Recent Change: While that correlation has weakened somewhat, a further surge in oil prices has a high potential to trigger a rebound in long-term yields.Implication: Rising long-term yields put pressure on valuations (especially for growth stocks) and can lead to sharp declines in interest-rate sensitive assets.Investment Point: Consider managing portfolio duration (reducing long-term bond exposure or hedging) in conjunction with oil prices, energy sector risks, and inflation hedges.

5) Fed Internal Discussions: Sticking to 2% or Expanding the Tolerance Range?

Key Remarks:

- Peter Krus (Aperture) argues: Persistent low inflation since the 2008 financial crisis is ‘abnormal,’ and viewing the inflation target closer to 3% is closer to historical norms.

- Bostic (Atlanta Fed President): Proposes setting the Fed’s inflation target as a range, such as 1.75-2.25%, rather than a single 2%.

- Daly (San Francisco Fed President): Suggests the possibility of further policy adjustments if necessary (in a principled and flexible tone).Implication (Important Point Readers May Not Hear):

- Even if the Fed does not officially declare ‘abandoning 2%,’ moving towards a ‘de facto tolerance range’ in policy operations is likely to be interpreted by the market as a signal of accepting higher inflation.

- In this scenario, the interest rate path might be less aggressive, but if real inflation expectations rise, long-term yields and real asset prices could become more unstable.Investment Strategy: Policy uncertainty increases short-term volatility, so strengthen risk diversification with options, cash buffers, real assets, and commodities.

6) Funding Positions: Signals from Fund Manager and Retail Investor Behavior

Data:

- Global fund managers’ average cash allocation is 3.9% (historically low).

- U.S. retail investors’ cash allocation is approximately 16.5%, and stock allocation is around 67.3%.Interpretation: This signifies that market participants have a ‘low cash allocation and are overexposed to risk assets.’Important Observation (Differentiated Insight):

- Simultaneous leverage and low-cash positions tend to lead to ‘panic selling’ when a trend reverses.

- In other words, a situation where positive news elicited an exaggerated reaction is now more likely to be shaken by negative news.Investment Recommendation: Maintain a defensive cash/hedged position at a certain level, and enter through staggered buying when opportunities arise.

7) AI Trends and Semiconductor Perspective — Intel’s Position and Investment Ideas

AI Demand Perspective: Demand for cloud, data center, and edge AI continues to expand.Semiconductor Competitive Landscape: Nvidia leads the GPU market, while Intel is targeting niches with CPUs, AI accelerators, and packaging.Implications of the Intel-Apple Rumor:

- If practical cooperation (design, packaging, server supply) materializes, it would be a significant momentum for Intel.

- However, considering Apple’s vertical integration strategy, collaboration might be limited, and it is risky to view it as ‘ 확정적 수익 (confirmed profit).’Investment Ideas (Practical):

- Consider diversified investments in companies exposed to AI demand (data center equipment, AI accelerator supply chains, supply chain materials/equipment).

- Bet on the sector through semiconductor-related ETFs, but diversify individual company risks (single contracts, customer dependency).

- Actively consider risk adjustment using options (e.g., call spreads or puts for downside protection).

8) Practical Investment Checklist (By Priority)

1) Short-term: Reduce positions, secure some cash allocation (e.g., 5-10%).2) Medium-term: Include some inflation hedges (commodities, inflation-linked bonds).3) Tech/AI Bets: Invest diversely in data centers, AI infrastructure, and semiconductor equipment.4) Interest Rate Risk Management: Consider shortening duration or hedging interest rates (interest rate options/futures).5) Risk Management: Set pre-determined profit-taking rules for individual momentum stocks that surge rapidly (e.g., partial profit-taking on a 15-30% rise).

< Summary >Intel’s surge is a speculative price based on the ‘Apple rumor’ and carries high risk until tangible contracts are confirmed.With M2 at an all-time high, liquidity remains abundant, but a mix of compositional and monetary policy variables creates a blend of inflation and asset bubble risks.Rising oil prices may increase the possibility of a rebound in long-term yields, putting pressure on growth stocks.The discussion within the Fed about a range for inflation targets could be a signal of effectively widening the scope for accepting inflation.Both fund managers and retail investors have low cash ratios, making them vulnerable to market volatility; therefore, ensure diversification, hedging, and cash buffers.The AI/semiconductor trend is a valid medium to long-term theme, but a cautious approach is necessary for surges driven by rumor-based news in individual companies (as seen with Intel).

[Related Articles…]U.S. Interest Rate Outlook and Investment Strategy SummaryThe Direction of AI Semiconductor Competition: Nvidia vs. Intel Analysis

*Source: [ Maeil Business Newspaper ]

– [홍장원의 불앤베어] 애플 등에 업고 주가 급등한 인텔. 미국 M2 유동성, 그 끝은 어디인가.

● Bitcoin Supercycle Exit Strategy Now – 2026 Peak – Rate-Liquidity-On-Chain Signals

Bitcoin Supercycle: What You Need to Know — When to Start Staggered Selling? A 2026 Peak Strategy Informed by Interest Rates, Liquidity, and On-Chain Indicators

We’re getting straight to the point. This article covers: (1) the “mechanism of liquidity delay extending the cycle,” which is rarely discussed in other news; (2) concrete conditions (MVRV, Monthly RSI Trendline, Crowd Sentiment Indicator) and timing for practically implementing staggered selling; (3) projected peak prices for 2026 and realistic price scenarios; (4) strategies for rebalancing and DCA across cycles; and (5) the practical impact of AI trends on the cryptocurrency investment structure. By reading this article to the end, you’ll gain a comprehensive understanding of when and why to start staggered selling, post-sale asset reallocation strategies, and the interplay between Bitcoin and financial markets from an AI and Fourth Industrial Revolution perspective.

1) Key Signals to Know Right Now (Short-term to Months)

Changes in liquidity flow due to interest rate cuts will lead to a phased movement across asset classes. The sequence is typically: Safe Havens (Gold, Bonds) → Medium Risk (Stocks) → High Risk (Bitcoin, Altcoins), with a delay. Therefore, do not expect an immediate surge in Bitcoin even after an interest rate cut is announced. Seasonality (by week) is also a strong signal. Historically, from the 40th week (around the first or second week of October) to the end of the year, there has been an average strong upward trend, repeatedly observed in data from 2011-2024. For a short-term view, remember the pattern of weakness around the 38th week and strength from the 40th week onwards. On-chain demand signals are also key checkpoints. The speed at which Bitcoin absorbs macroeconomic liquidity is slow. Liquidity first flows into safe assets before transiting to risk assets due to a time lag. Hence, ‘interest rate cut announcement’ does not equal ‘immediate BTC new all-time high.’

2) Structural Differences in Supercycles (3 Contrasts with the Past)

Market Cap Expansion: Bitcoin’s current market capitalization is significantly larger than in the past, requiring more capital for substantial movements. Consequently, the amplitude of price swings (both up and down) is likely to decrease, favoring a more gradual, stair-step ascent.Institutional Participation: The substantial increase in institutional participation has led to reduced volatility and concurrent hedging positions, diminishing the likelihood of extreme spikes and crashes.Liquidity Cycle Delay: The delayed interest rate cuts by the US have pushed back the timing of demand inflow, effectively extending the traditional 4-year cycle (linked to halving). The result is a scenario where “supply (halving) arrived, but demand followed later,” leading to a prolonged supercycle.

3) Staggered Selling (Partial Selling) — When and How to Start

Core Rule: Begin staggered selling only when “three indicators confirm simultaneously.”Indicator 1: MVRV (Market Value to Realized Value Ratio). When MVRV enters the approximately 4x to 5x range, it signals a potential cycle top (consistent with past peak patterns). Currently around 2.5x, there is room for further upside.Indicator 2: Monthly RSI Trendline Touch. Touching the downward trendline of the Monthly RSI, connecting the cycle tops, serves as a peak signal. This trendline has consistently acted as a signal regardless of news or sector-specific catalysts.Indicator 3: Sentiment Indicator (Popularity Index). When non-expert Bitcoin investors (relatives, friends unfamiliar with finance) begin to broadly enter the market with sentiments like “if I don’t buy now, I’ll miss out,” it indicates a late-stage bubble.Practical Timing Rule:First Staggered Sell: Sell 20-30% of your holdings when any one of the above indicators strongly confirms.Second Staggered Sell: Sell an additional 30-40% when MVRV reaches 4x AND the Monthly RSI trendline is touched.Final Exit Sell: Sell the remaining 30-50% when crowd sentiment becomes overheated (when media, infomercials, and communities indicate “everyone is in”).Risk Management: Adjust each staggered sale flexibly relative to your target price, but adhere to pre-determined targets (e.g., sell 15%, 30%, 50%) and avoid emotional decisions.

4) Practical Guide to On-Chain and Technical Indicators

MVRV: Represents the ratio of the current market price to the average purchase price of long-term holders. Historically, the 4x-5x range has repeatedly signaled cycle tops.Monthly RSI Trend: The point at which the Monthly RSI touches the line connecting all past cycle tops is a consistent peak signal.Volume & Wallet Activity: A surge in trading volume coupled with an increase in new addresses indicates a “crowd inflow” signal.Exchange Inflow: Large volumes entering exchanges can exert short-term selling pressure.Automated alerts using AI-powered tools for on-chain data can reduce human emotional bias and improve timing accuracy.

5) 2026 Peak Price Outlook and Realistic Scenarios

Conservative Scenario: Around $200,000 (average of many institutional/expert predictions), assuming a reduced halving effect.Moderate Scenario: $260,000 – $300,000 is possible if institutional funds and liquidity inflows align.Optimistic (Bubble) Scenario: Exceeding $300,000 cannot be ruled out if AI, financial markets, and global risk mitigation occur simultaneously.Practical Tip: Instead of setting a single target price, segment your selling plan (e.g., sell portions at $200k, $260k, $350k) to prevent emotional responses.

6) Investment Principles and DCA & Rebalancing Strategies

DCA (Dollar-Cost Averaging) is a proven method to lower average entry prices in uncertain markets. Fixed periodic investments (e.g., every 100 days or 6 months) reduce volatility risk. Post-Cycle Rebalancing: After a cycle ends, avoid rushing into other volatile assets. Hold a portion in cash or short-term bonds to preserve capital for the next cycle’s entry. Principles: Emotional Control → Adhere to Pre-defined Profit-Taking Rules → Prioritize Reinvestment (Compounding).

7) Bitcoin from the Perspective of AI Trends and the Fourth Industrial Revolution

AI investment cycles influence the stock market through demand for semiconductors and cloud computing, which in turn leads to adjustments in institutional portfolios. The rally in Nvidia and semiconductors boosts the stock market, ultimately rekindling institutional interest in risk assets. The combination of Blockchain and AI: The introduction of AI in interpreting on-chain data enhances the accuracy of predicting trading timing and liquidity flows. AI-based on-chain analysis can integrate signals like MVRV, RSI, and exchange inflows in real-time to provide alerts, thereby improving staggered selling entry timing. Furthermore, AI-driven financial products (e.g., algorithmic trading funds) are likely to accelerate institutional participation, a factor that will increase the speed of Bitcoin liquidity absorption.

8) Practical Checklist — 8 Things to Do Today

Reconfirm your Bitcoin allocation within your portfolio and document your staggered selling rules (percentages, price points).Set MVRV alerts to receive automatic notifications for the 3.5x, 4x, and 5x ranges.Save a graph of the Monthly RSI trendline and check it monthly.Monitor surrounding sentiment (investment inquiries from non-experts) to detect “popularization” signals.Create a DCA schedule and utilize the auto-buy feature.Check weekly exchange inflows and new wallet increases.Prepare your post-cycle rebalancing plan (cash allocation, short-term bonds).Experiment with AI-based on-chain tools (free trials if available) and establish an alert system.

9) Key Points Not Often Covered Elsewhere (Remember These)

Emphasizing that “the time lag in liquidity inflow” is the core mechanism extending the cycle.The likelihood of reduced explosive volatility compared to the past due to institutional hedging (long/short parallel positions).The “true” start of staggered selling occurs when MVRV above 4x, Monthly RSI trendline touch, and crowd sentiment overheating confirm simultaneously.As AI is fully integrated into on-chain analysis, it will precisely re-evaluate the historical relationship between halving and liquidity, increasing the role of quant and algorithmic traders.Seasonality (strength from the 40th week) remains a valid “statistical edge” signal.

[Related Articles…]Bitcoin Supercycle Analysis and Selling Timing SummaryInterest Rate Cuts and Asset Markets: Key Takeaways on the Return of Liquidity

*Source: [ 경제한방 ]

– “비트코인 슈퍼사이클 이것만 보세요” 분할 매도는 언제부터? / 신민철 작가