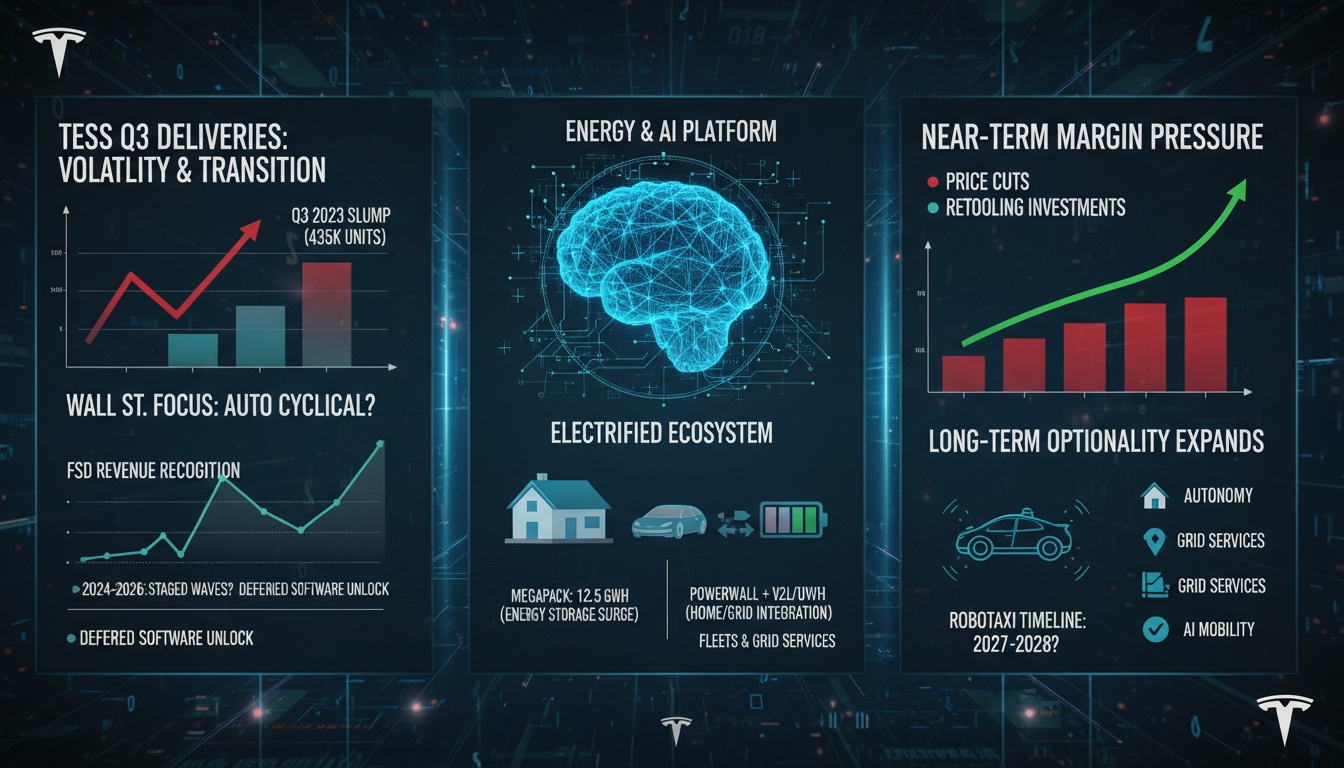

● Tesla Q3 Shock 498k Deliveries 12.5GWh Energy Stock Whipsaw AI Roadmap

Tesla Q3 Earnings Shock Dissection: The Real Meaning of 498,000 Deliveries and 12.5 GWh of Energy, the Details Behind Stock Price Fluctuations, and the Market’s Secret ‘Energy & AI’ Roadmap

This piece covers the essence behind the numeric headlines, including shifts in the profitability structure of the energy business, the timing of software and AI revenue recognition, the regulatory path for robo-taxi, and the vehicle‐grid integration strategy opened up by V2L/V2H.

It is organized in chronological order, addressing points often overlooked by other YouTube channels or news outlets—such as the misunderstanding of the unit “GWh vs GW” for energy storage, the cash flow signals from the gap between deliveries and production, the regional/type distinctions in the debate over expiring tax incentives, and variables like interest rates, inflation, and the global economic outlook.

1) Q3 Fact Check and the Meaning Behind the Numbers

– Header: Official figures summary and unit clarification.

– Details: Vehicle deliveries of 498,000, production of 447,000, energy storage of 12.5 GWh.

– Key Points: In this quarter, Tesla delivered approximately 498,000 vehicles, marking a record for the quarter, while production reached 447,000, exceeding deliveries.

Deliveries exceeding production signals a reduction in inventory or the resolution of logistics bottlenecks, which is favorable for short-term cash flow, though subsequent quarters may require production and inventory rebuilding.

When it comes to energy, the key point is the unit of “energy” rather than “power.”

Despite some confusion in the reports, it is correct to view battery deployments in GWh (storage capacity), and 12.5 GWh is significant as it can simultaneously meet the demands of both power grids and data centers on a quarterly basis.

The automotive segment was driven by the Model 3 and Model Y, with the mix still being centered on “volume + efficiency” as these two models account for 97% of the production.

2) Immediate Stock Surge After the Announcement Followed by a Correction: Why the Rapid Reversal?

– Header: The dynamics behind the price movements.

– Details: Buying on rumors and selling on news, differences in the interpretation of tax effects, macroeconomic variables.

– Key Points: The short-term surge followed by a correction exemplifies the behavior of “buying on rumors and selling on news,” as the excellent performance had already been priced into the stock.

Secondly, adjustments to EV incentives in some regions (including national/state/city programs) have triggered a “last-chance demand” rationale, but the U.S. federal IRA EV credit, legally set with a framework until 2032, necessitates a distinction between regional/program expirations and the federal system.

Thirdly, the interest rate path and the pace of inflation easing in the global economic outlook directly impact valuation multiples through the interest sensitivity of automotive demand.

3) What the Market is Really Watching ① — The Profitability Shift in the Energy Business

– Header: Look beyond the cars to the “power infrastructure.”

– Details: Megapack (grid storage), Powerwall (residential), VPP (virtual power plant), 45X (U.S. manufacturing incentives).

– Key Points: The 12.5 GWh is at a level that can be immediately deployed for grid peak control, frequency regulation, and mitigating the variability of renewable energy, while also capturing demand for data center power backup and peak shaving—a momentum in the “energy transition.”

The U.S. 45X manufacturing incentive serves as a means to structurally reduce the cost of the Megapack, laying the foundation for improved gross margins in the energy segment.

While the order backlog can be volatile due to project-based ASP and lead time fluctuations, if quarterly deployments stabilize in the double-digit GWh range, the energy segment could play a “stabilizer” role in quarterly profits.

The key is that the unit margin is less volatile, thereby diversifying portfolio risks amid fierce vehicle price competition.

4) What the Market is Really Watching ② — Vehicle-Grid Integration: The Commercial Implications of V2L/V2H

– Header: Bidirectional power sharing in the Model Y Performance.

– Details: V2L (vehicle-to-appliance), V2H (vehicle-to-home), integration with Powerwall, participation in demand response.

– Key Points: The V2L/V2H features in the Model Y Performance offer more than just camping convenience.

They enable home backup power, avoidance of peak nighttime rates, and participation in demand response (DR) programs, which together allow for savings on electricity bills and the generation of rebate income.

When integrated with the Powerwall, the combination of “vehicle-home-grid” becomes one energy asset pool that can be operated as a VPP, allowing Tesla to benefit from both software platform fees and hardware sales.

This structure evolves into a utility-like business that can generate stable cash flow even in an environment of high interest rates and inflation.

5) AI & Robo-Taxi: The Timing of Revenue Contributions and the Reality of Regulatory Paths

– Header: The consensus that a turning point awaits post-2027–2028.

– Details: FSD feature maturity, city/country-specific regulations, insurance/liability frameworks, learning costs.

– Key Points: The market discounts robo-taxi as an “option value” rather than a “current value.”

The general view is that significant revenue generation won’t occur until 2027–2028, and until then, attention is focused on expanding FSD subscriptions/licenses and how the energy business fills any profit gaps.

From an AI trend perspective, while the cost of learning computing continues to decline, ensuring inference safety and securing regulatory trust remain bottlenecks.

The gradual commercialization through city-specific sandboxes and limited geofencing is realistic, with implementation speed largely dependent on regulatory allowances and insurance rate structures.

6) 0–12 Month Timeline Checklist

– Header: Chronological sequence of earnings events and KPIs.

– Details: 1) Q3 call and Q&A messages. 2) Q4 pricing and incentive policies. 3) Whether the energy deployment run rate is maintained. 4) FSD feature updates and the timing of deferred revenue recognition. 5) Monetization from opening up the Supercharger network.

– Key Points: D+1 Week: Check indicators on energy gross margin, Megapack expansion, and VPP pilot expansion during the call.

1–3 Months: Monitor demand elasticity in response to year-end promotions and changes in interest rates.

6 Months: Listen for comments on whether quarterly energy deployments remain or increase in the 10 GWh range, as well as feedback on project ASP and lead times.

12 Months: Observe the scale of deferred revenue release following FSD feature updates and check the ARPU from subscriptions.

7) Risk Map and Response Points

– Header: Valuation sensitivity.

– Details: Price competition, raw materials, regulations/recalls, power electronics supply.

– Key Points: Price wars in China and Europe put pressure on the overall automotive gross margin, while volatility in lithium, nickel, and copper increases cost uncertainties.

Autonomous driving regulations and recall issues can disrupt the timing of software revenue recognition, directly impacting valuation multiples.

Constraints in the supply of inverters, semiconductors, and other power electronics can create bottlenecks for energy deployments, making progress in diversifying the supply chain crucial.

8) Number Framework: How to View It (Not Investment Advice)

– Header: Think of it as a “track” rather than a single number.

– Details: Core KPI ranges.

– Key Points: Energy deployment: Whether the quarterly track of 10–15 GWh is maintained.

Energy gross margin: Whether it settles in the mid-double digits.

FSD subscriptions: An upward trend in attachment rates relative to vehicles and the timing of deferred revenue release.

Automotive average selling price (ASP) and price vs. interest rate trends.

An increased share of revenue from the Supercharger and VPP platforms.

If these five pillars steadily trend upward, the market is likely to revalue Tesla not as an “automotive company” but as an “energy & software platform.”

Bonus: The Real Change Brought by Manufacturing Automation

– Header: From Gigacasting to Body Shop—The “Unmanned Flow” and Laser Marking Data.

– Details: Cycle time reduction, reduced process variances, digitized processes.

– Key Points: Process-integrated automation enables higher production and more refined quality with the same CAPEX.

Digital records from laser marking accelerate process improvements, leading to a downward cost curve and stable residual value, thereby contributing to long-term total cost of ownership (TCO) competitiveness.

Summary: What is the Market Focusing On?

– Header: Confirm the automotive numbers; next comes the execution of “energy + AI.”

– Details: From narrative to cash flow.

– Key Points: The record-breaking Q3 deliveries and the 12.5 GWh energy deployment are just the beginning.

The real evaluation depends on whether the energy segment can maintain its margins and run rate over the next 12 months, the visibility of deferred FSD software revenue recognition, and if the interest rate downturn cycle begins.

Automobiles represent volume, energy represents margin stability, and AI represents a long-term call option.

[Related Articles…]

– NextGenInsight.net Latest Articles: Tesla

– NextGenInsight.net Latest Articles: Robo-Taxi

*Source: [ 오늘의 테슬라 뉴스 ]

– 테슬라 Q3 실적 충격: 인도량 49.7만·에너지 12.5GWh! 기록 뒤에 숨은 주가 불안과 시장이 진짜 주목하는 것은?

● Record Deliveries, Shares Plunge – Tesla’s Sell the News Whiplash

Tesla, Record Delivery Numbers Yet Stock Down -5%? The Real Points the Market Missed and the Next Momentum Roadmap

Today’s article covers everything from the reasons behind the decline despite record deliveries, the microstructure of options and liquidity, the true variables of EPS and margins, the event calendar for 2–12 weeks, the hidden catalysts from China, energy, and robo-taxi, to an unwavering investment philosophy.

It dissects the paradox of “delivery beat vs. stock decline” that other YouTube channels or news outlets merely brush over, examining it to its core through the lenses of liquidity, accounting, policies, and product mix.

At the intersection of the global economic outlook, interest rates, inflation, stock markets, and AI trends, it reinterprets Tesla to help you decide your next move.

Timeline 1: T+0 Day (Today) — Record Delivery Numbers vs. -5% Market Reaction

Header.

Immediately after announcing the record quarterly deliveries, the pre-market saw a brief surge, but by the regular session, it turned around to about -5%.

Details.

- The classic “buy on rumors, sell on facts” mechanism was in play.

- A significant event premium had accumulated during September’s strong rally, which evaporated once the results were confirmed.

Main takeaway.

Prices react first to liquidity rather than information.

The same news can have its price impact reversed based on positioning over the previous 4–6 weeks.

Timeline 2: T+0~2 Weeks — 7 Short-Term Liquidity and Options Microstructure Factors Driving the Decline

Header.

What matters more than the news is the positioning and the hedging by options desks.

Details.

1) Event pricing completed. During the September rally, the “delivery surprise” was already priced in.

2) Delta–gamma unwinding. The dealer’s short gamma position, set up to hedge the long stock positions from call option purchases, began to shrink its hedges upon the earnings confirmation, triggering spot selling.

3) IV crush. Immediately after the announcement, an implicit drop in volatility reduced the option values, further fueling the downtrend with additional spot sell-offs.

4) Passive and quant rebalancing. Post-spike, index factors triggered a reduction in weightings. In particular, the rotation between momentum and low-volatility factors creates a temporary overhang.

5) Short-term overbought conditions and technical gaps. The first “not really bad news” triggered profit-taking amid a widening divergence in the 20/50 DMA range.

6) Re-emergence of mix and ASP concerns. Although deliveries are good, the model mix and pricing determine margins, raising questions like “What about the gross margin?”

7) Macro backdrop. Concerns over interest rate fluctuations and a reacceleration of inflation pose a discount on growth stock multiples.

Main takeaway.

While delivery numbers indicate direction, stock prices are driven by the size of positions and the speed of options hedging.

Without understanding the dynamics of liquidity, the disconnect between news and price remains an enduring puzzle.

Pitfalls of Key Numbers: Why a ‘Delivery Beat’ Is Not Equivalent to an ‘EPS Beat’

Header.

These are often the accounting and structural points that market consensus misses.

Details.

- ASP and incentives. Even with identical delivery volumes, price cuts, inventory discounts, and lease mixes can erode margins.

- Options and deferred software revenues. For software sales such as FSD, a portion is not recognized as revenue until the feature is delivered, causing a timing mismatch between quarterly earnings and cash flows.

- Timing of energy business recognition. The Megapack project, which recognizes revenue based on progress, introduces short-term volatility, potentially delaying profit contributions relative to deliveries.

- Factory operations and deferred maintenance. Line upgrades, model transitions, and supply chain switches may lead to temporary cost increases.

- Baseline decline in regulatory credits. While credits are high-margin, their predictability is low, and the market assumes a gradual decrease.

Main takeaway.

Deliveries are about volume, whereas EPS depends on mix, pricing, and the timing of accounting recognition.

As the stock reassesses the expected EPS trajectory, a temporary divergence emerges.

Timeline 3: T+2~4 Weeks — Three Key Points to Watch During Earnings Season

Header.

Earnings should be viewed in the order: “volume → margin → cash flow.”

Details.

- Check if the automotive gross margin (excluding regulatory credits) has bottomed out. Monitor whether post-price-cut cycles show improvements through cost reductions and the recognition of options revenues.

- Operating cash flow and inventory days. In a high-interest rate environment, effective management of working capital defends valuation multiples.

- The contribution of software and energy. Observe how increased recognition of FSD and improved Megapack utilization boost overall margins.

Main takeaway.

This cycle’s stock price hinges on a single sentence: “the margin has pierced the floor.”

Volume has already been demonstrated; now, it’s about how much profit is being retained.

Timeline 4: T+4~8 Weeks — Late Movers in Shareholder Meetings, AI, and Policy

Header.

There are large players who act later than the news.

Details.

- Compensation and governance issues. If management incentive structures are reaffirmed, risk premiums may drop, potentially unlocking the top end of valuation multiples.

- XAI and full-stack in-house AI. Integrating models, computing, and data stacks enhances the credibility of the robo-taxi narrative, although the timing of commercialization remains contingent on regional regulations.

- Year-end demand in China. The Chinese passenger car market often sees delivery momentum in December due to year-end promotions and incentive restructurings. Weekly registration data act as lagging triggers.

Main takeaway.

Policy, governance, and AI narratives are reflected in prices with a delay.

In particular, weekly data from China serve as triggers for momentum traders.

Structural Drivers 2025: 5 Undervalued Points by the Market

Header.

It is crucial to separate short-term noise from long-term signals.

Details.

1) Reassessment of margins in energy storage. Megapack, with higher fixed cost leverage compared to automakers, means that the backlog of orders acts as an early indicator for margin improvements.

2) Software ARPU per vehicle. As FSD, insurance, and connectivity evolve into long-term cash cows across the vehicle fleet, the mix of multiples will change.

3) Capital efficiency in manufacturing processes. Innovations like giga-casting and process simplification boost production relative to depreciation, improving ROIC.

4) The value of compute and data assets. In-house learning clusters and driving data represent both the benefits and challenges of riding the AI trend.

5) Leverage of the interest rate and inflation pivot. In periods of declining real interest rates, growth stock multiples tend to react like a lever.

Main takeaway.

When the portfolio is seen as “energy + software + AI” rather than just an automaker, the basis for valuation changes dramatically.

Risk Checklist: The Boundary Between Optimism and Reality

Header.

It is wise to outline the downsides as clearly as the upsides.

Details.

- Intensified price competition. A renewed price war originating from China could delay margin recovery.

- Regulatory and safety concerns. Regulatory variables in the expansion of autonomous driving functions differ by region, creating timing gaps.

- Raw materials and supply chain issues. Fluctuating battery material prices and geopolitical risks can increase volatility.

- CapEx cycle. Large-scale capacity expansions and investments in AI infrastructure might pressure short-term free cash flow.

Main takeaway.

Risks do not just pull down stock prices; they are factors that can alter the timing of the narrative.

By keeping track of schedules, you can manage fears in advance.

Not About Trading, But the Process: An Unwavering Mindset, Follow-up, and Philosophy

Header.

Long-term returns come not from the volume of information but from consistency.

Details.

- Think with a checklist. Every quarter, review deliveries, margins, cash flow, software revenue recognition, energy backlog, and regulatory momentum in the same order.

- Principles before events. Hold positions that are favorable whether the market moves up or down. Set weightings based on pre-established rules rather than outcomes.

- Document. Record dates, assumptions, and rationales to avoid being late to react and to improve the quality of your decisions.

Main takeaway.

An unwavering mindset is born not of baseless confidence, but from a repeatable process.

Practical Checkpoints: Follow-up Actions You Can Take Right Now

Header.

Separate your actions for the next 10 minutes, the next 10 days, and the next 10 weeks.

Details.

- 10 minutes. Check the near-month gamma positions in the options chain and changes in implied volatility to gauge the short-term volatility regime.

- 10 days. Track analyst margin revision estimates, inventory data, and weekly registration numbers from China.

- 10 weeks. Fix your schedule with the earnings, shareholder meetings, and policy/regulatory calendars, and set pre-determined rules for adjusting positions before and after these events.

Main takeaway.

When you become the operator of your calendar rather than just a consumer of information, the dispersion in returns is reduced.

< Summary >

- Despite a delivery beat, the decline was driven not by news but by liquidity and the structure of options.

- EPS is a function of mix, pricing, and accounting timing rather than merely volume, which creates short-term discrepancies.

- The momentum over 2–8 weeks will be determined by the confirmation of margin bottoms in earnings, shareholder meetings, AI developments, and year-end demand in China.

- The structural upward catalysts for 2025 are energy margins, software ARPU, manufacturing efficiency, AI asset value, and shifts in the interest rate regime.

- An unwavering investment philosophy stems from using checklists, pre-set rules, and diligent record-keeping.

[Related Articles…]

Tesla Energy Business’s Hidden Profit Source

How AI Robo-Taxi Will Transform Transportation Economics

*Source: [ 허니잼의 테슬라와 일론 ]

– 테슬라, 역사상 최대 인도량 발표에도 5% 하락! 왜 이런 것인가?

● Korean Won Stablecoin Wars, Shield or Engine

Global Capital Converges: Korean Won Stablecoin, Domestic Shield or Growth Engine? (2024→2026 Action Plan)

This article contains three key points rarely covered in other YouTube channels or news sources.

First, it presents the actual pathway for the infiltration of dollar stablecoins into Korea’s domestic market and the “salary-tax-circulation” triangle defense strategy that blocks it.

Second, it reveals a revenue-sharing model where the issuer shares interest income with the public, along with sophisticated financial planning that includes a reserve portfolio and foreign exchange hedge.

Third, it outlines a chronological roadmap addressing the system risk scenario of a “repurchase spiral – sharp exchange rate fluctuations – policy transmission failure” by 2026 and the regulatory and technical safety measures to prevent it.

It is composed so that readers can simultaneously grasp the perspective of global capital, domestic defense of the Korean economy, digital asset infrastructure, recovery of monetary sovereignty, and the 2026 economic outlook, and move straight into action.

2024 Q4 — Why Korean Won Stablecoin Now

Dollar stablecoins have already grown to a scale of several hundred trillion won and serve as the basic rails for global capital’s payment and remittance.

In Korea, as institutional discussions have intensified, overseas investors have begun searching for “Korean stablecoin, security, reserve certification startups.”

This situation presents a rare timing for the advancement of Korea’s capital market, enabling the establishment of a domestic shield as well as the creation of a new export-oriented financial business.

The key is not merely improving efficiency but expanding effectiveness, that is, creating entirely new markets and capital inflow channels.

2025 — The Year of Institutional Design and Pilots

An issuance license, reserve regulations, continuous repurchase obligations, bankruptcy isolation structures, and a daily disclosure system need to be legislated.

The reserves should be composed primarily of cash, reserve deposit accounts, and short-term government bonds, with explicit foreign exchange hedge policies and liquidity coverage ratios.

While allowing innovation led by the private sector, revenue sharing and monitoring measures should be implemented to secure public interest and transparency.

It should be integrated with KYC and travel rule linkages with banks, electronic finance, and virtual asset service providers, on-chain PoR (Proof-of-Reserves) standards, and security certification levels.

Pilots should begin with government and local government vouchers, regional currencies, and small business settlements, demonstrating cost reductions and improvements in settlement speed.

2026 — The Main Game of the Stablecoin Battle

The domestic infiltration of dollar stablecoins will be achieved not through payment networks but via super apps, the creator economy, gaming, and cross-border commerce.

The cornerstone of defense is to fix the three domestic pillars—salary, taxes, and circulation—with the Korean Won stablecoin.

In 2026, as the government executes a budget in the 723-trillion-won range, it will create a network effect by disbursing support for vulnerable groups, R&D vouchers, and travel consumption coupons in Korean Won stablecoin.

Large retailers and platforms will lower payment fees and offer D+0 settlements to prevent merchant attrition.

In inter-company transactions, tokenizing delivery payments, settlements, and factoring will reduce working capital turnover days, and in trade, direct settlements between KRW and local currency stablecoins will shorten payment times.

Effectiveness over Efficiency: Korea’s Differentiation Point

While CBDCs or deposit tokens improve efficiency, the effectiveness in terms of global capital inflows and capital market re-rating is faster with private stablecoins.

When Korean Won stablecoins are combined with the tokenization of RWA (government bonds, CP, ABL), they create momentum to resolve a structural discount of Korea’s PBR 1.0.

Tokenizing domestic payment networks will intensify pressure for lowering card MDR, and the cost reduction will translate into improved consumer prices and merchant profitability.

Business Model — Who and How They Make Money

Issuers generate revenue from reserve interest income and B2B API fees charged to corporations and developers.

Although significant interest income is possible with a small team like in the USDT/USDC case, Korea requires revenue sharing based on public interest.

The recommended model is “seigniorage sharing,” whereby a certain percentage of the reserve interest income is reverted to a digital public asset fund.

The ecosystem will rapidly grow in areas such as security certifications, MPC custody, real-time reserve proofs, regulatory compliance oracles, and risk data provision.

Seven Overlooked Risks and Their Solutions

1) There is the risk of a repurchase spiral and sharp exchange rate fluctuations.

If redemptions surge, the selling pressure on KRW will increase, amplifying exchange rate volatility.

The solution is to implement a continuous market-making account, tiered repurchase fees, a backstop linked to the central bank’s swap line, and an upward adjustment of LCR/NSFR.

2) There is the risk of a sudden surge in FX basis and hedge costs.

The hedge policy should be disclosed and the rules for adjusting the hedge ratio under stress conditions announced in advance.

3) There is a risk associated with the reserve framework.

As MMFs and deposit shifting can distort policy transmission, the proportion of BOK reserve deposit accounts should be managed with both upper and lower limits.

4) There is a merchant fee war in on-chain payments.

To avoid conflicts with card networks, MDR reductions should be applied selectively and in phases, differentiating through settlement speed and refund convenience.

5) There is the issue of data sovereignty and linkage with overseas sanctions.

Domestic validator and data residency requirements should be enforced alongside off-chain sanction list synchronization oracles.

6) There is liquidity segmentation between stablecoins and deposit tokens.

A standardized 1:1 bridge gateway between Korean Won stablecoins and deposit tokens should be established.

7) There is the risk of governance capture.

Public interest directors and risk committee members should be included on the board, and emergency switch powers should be legally separated.

Technical Architecture Proposal — Dual Rail Model

The retail rail should be built on a permissioned EVM L2, ensuring domestic validators and data residency.

The wholesale rail should be connected with the banking RTGS to secure finality of large-scale B2B and institutional payments.

Account abstraction will reduce key loss risks and support small offline QR and NFC payments.

Reserve proof will be disclosed daily on-chain by fixing a merkle root along with an audit report hash.

Privacy will be maintained through zk-KYC with restricted disclosure, and tax-related data will only be decrypted under legal requirements.

Policy and Regulatory Roadmap — Realistic Phased Design

Phase 0 opens with guidelines for definition, promotion, and an open testnet.

Phase 1 involves limited licenses centered on the first-tier financial institutions, starting with small government vouchers.

Phase 2 expands the private consortium beyond banks, reinforcing continuous repurchase obligations and bankruptcy isolation.

Phase 3 allows cross-border payments and connections with capital markets, as well as the tokenization of RWAs.

Mandatory provisions include customer asset trust protection, daily reserve disclosures, repurchase SLAs, marketing restrictions, naming regulations, and procedures for temporary suspension in crises.

KPI and Monitoring Indicators

Key indicators include the proportion of domestic payments in Korean Won stablecoins, the proportion of tokenized budgets in government execution, the average MDR, and the D+0 settlement rate.

The composition of reserves in terms of cash, reserve deposits, and short-term government bonds, the 30-day liquidity coverage ratio, and the average time taken for repurchases should be tracked.

The spread between Korean Won and foreign stablecoins and the depth of AMM should be monitored to provide early warnings for pressures of foreign currency inflow and outflow.

Action Plan by Player

The government and regulatory agencies should formalize a private-led plus public oversight model and codify the seigniorage sharing rules.

The Bank of Korea should provide guidelines on access to reserve deposit accounts, emergency swap lines, and finality of payments.

Banks should develop an interexchange gateway between deposit tokens and ensure custody and onboarding.

Large retailers and platforms should combine lower token payment MDR with immediate settlements and tokenization of loyalty points.

Startups should focus on security, PoR, risk data, KYC oracles, and solutions specialized for cross-border payments.

Investors should take positions in stablecoin core infrastructure, RWA tokenization, and companies in the risk and security layers.

Responses to Common Counterarguments

The question of whether CBDCs alone would suffice is met with the argument that innovation speed, openness, and a developer ecosystem are different.

The argument that deposit tokens are sufficient is countered by the limitations in versatility, merchant expansion, and cross-border interoperability.

The notion that dollar stablecoins are cheaper is refuted by pointing out that the loss of monetary sovereignty and the asymmetric transmission of the Federal Reserve’s policies incur greater costs.

Timeline at a Glance

2024 Q4 is the phase of building a consensus on institutionalization, launching a testnet, and establishing pipelines with global capital.

2025 is the phase for pilots, legislation, forming a public-private consortium, and creating a network effect through government voucher execution.

2026 will see the fixation of the three domestic pillars and the expansion of cross-border payments, with growth driven by RWA linkage.

Post-2027, the phase will shift to unified regulation, enhanced revenue sharing, and a re-rating of the capital market.

< Summary >

Korean Won stablecoins can serve as both a domestic shield and a growth engine for the capital market.

The key is to tokenize the salary-tax-circulation triangle to prevent the domestic penetration of dollar stablecoins, while augmenting privately-led innovation with public transparency and revenue sharing.

The pivotal factors are the 2025 pilots and legislation, the large-scale expansion in 2026, risk management, and the dual rail architecture.

From an economic outlook perspective, it becomes a realistic solution for the Korean economy that simultaneously attracts global capital and restores monetary sovereignty.

[Related Articles…]

2026 Stablecoin Regulatory Roadmap at a Glance

Seven Cases of Domestic Payment Innovation with Korean Won Stablecoins

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– 글로벌 자본이 몰린다. 원화 스테이블코인은 한국의 내수 시장 지켜낼 무기인가, 위기인가 | 경읽남과 토론합시다 | 정구태 대표, 박혜진 교수 4편