● Alleged Big Tech Accounting Scam, GPU Value Crash, Credit Panic

Michael Burry’s Target on “Big Tech Depreciation”, While the Market Bounces Back: Expectations for Shutdown End, Trump’s $2,000 per Capita, U.S.-China Tariff Suspension, and Hidden Credit Risks All in One Read

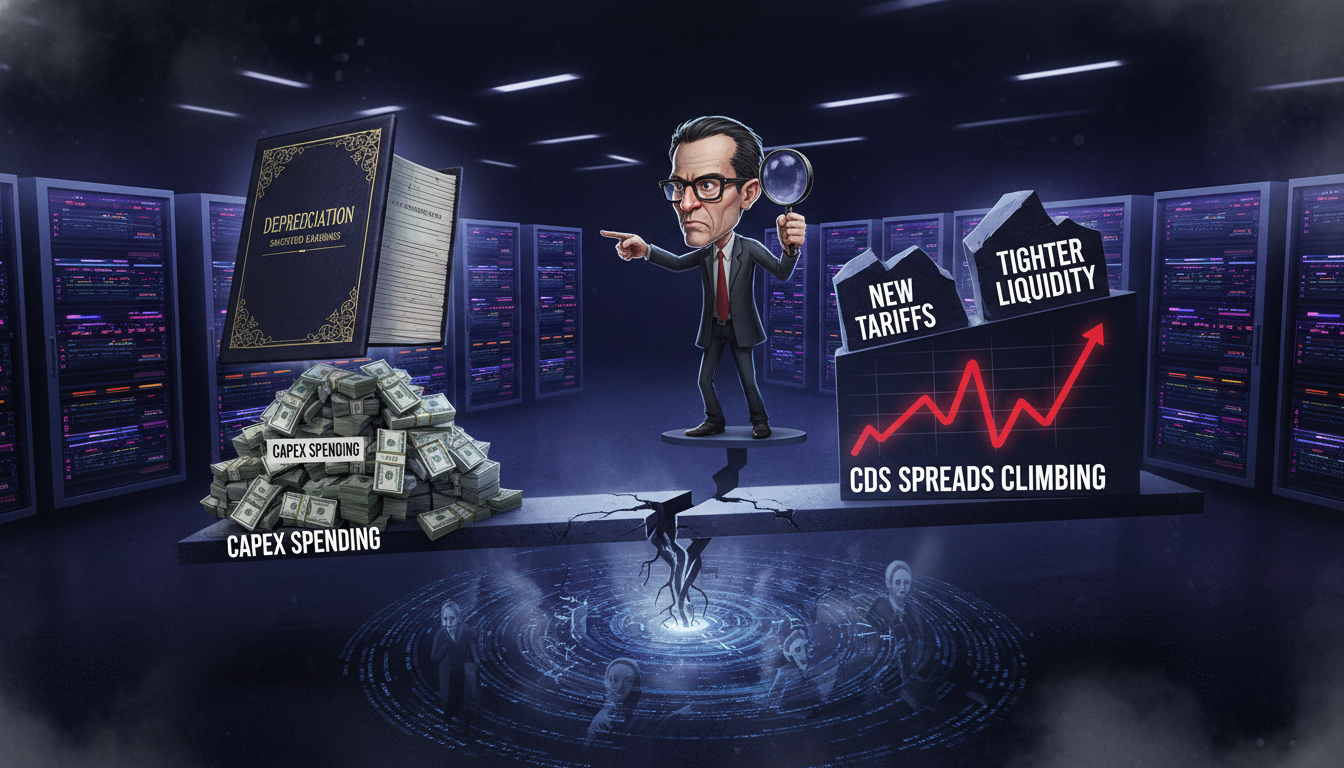

Today’s article covers the three catalysts behind the market rebound, the key points and figures in Michael Burry’s accounting criticism, the real issues behind the GPU lifespan debate, the credit risk indicated by the surge in CDS, and an investment checklist you can immediately apply to your portfolio.We have separately organized the “secondary effects of profit inflation” and “accounting/credit side effects of declining GPU residual value,” which many tend to overlook.

Today’s Market: Semiconductor Lead, Threefold Risk Reduction Package

The Nasdaq rebounded, and buying flowed in, particularly in semiconductors.The upward catalysts can be summarized in three points.First, there is increased weight from the possibility of an end to the U.S. government shutdown.The Senate has shown resolve to end it, alleviating concerns over data blackouts.However, it may be difficult for the backlog of economic indicators to all normalize by the December FOMC.Second, former President Trump reiterated his idea of a $2,000 cash dividend per person.He stated that the funds would be sourced from tariff revenues, with the balance used for paying off national debt.Retail-favored stocks, cryptocurrencies, and gold, among other assets preferred by individuals, responded immediately.Third, the announcement of a one-year suspension of reciprocal punitive tariffs between the U.S. and China has reduced trade risks.Alleviating supply chain frictions serves as a factor that somewhat lowers inflationary pressures and reduces global economic uncertainties.While the path of interest rates experiences a slight easing of hawkish pressure, the gap in data and fiscal variables leaves volatility intact.In the stock market, the reduction in risk premium is favorable, and the trends in AI and semiconductor sectors show relative strength.

Michael Burry’s Warning: “Depreciation Increased to Inflate Profits”

Burry’s central claim is that “big tech is artificially extending the useful lives of computing assets to lower depreciation expenses, thereby overstating their profits.”He argued that between 2006 and 2028, cumulative depreciation expenses may be understated by $176 billion.He further pointed out that by 2028, Oracle’s profits would be overstated by approximately 26.9% and Meta’s by about 20.8%, and he indicated that additional materials would be released on November 25.The key mechanism is simple.If the same asset is depreciated over 6 years instead of 3, the annual expense is reduced and reported profits increase.In the AI cycle, while the replacement cycle for GPUs and AI servers is likely to shorten, Burry takes issue with the extension of the useful life to 5–6 years.There are three investment points.

- Increased accounting sensitivity of margins and EPS.A mere adjustment in useful life can significantly alter profit margins.

- The potential illusion of FCF.Depreciation is non-cash, but the actual cash outflow is Capex.Extending the useful life does not improve cash flows.

- Valuation risk.If the “AI supercycle” expectations are exaggerated by accounting profits, multiple adjustments may pressure the multiples.

GPU Lifespan Debate: 3–4 Years vs 6 Years, What the Data Shows

Amid the AI trend, the useful life of GPUs is a central issue in both accounting and strategy.For reference, older GPUs (about 5 years old) in clouds are still observed to be utilized at meaningful levels.In academic and research settings, older generation GPUs continue to be in use.However, since 2025, GPU rental prices have clearly declined.This indicates a rapid improvement in the performance-to-price ratio and a drop in residual value.In other words, it signals that while they are still used, their value quickly falls.My viewpoint is as follows.

- A 6-year useful life for accounting is not conservative but rather provides a strong incentive to inflate profits.

- Considering the technical half-life, performance leaps, and falling resale values, a 3–4 year period appears to be a realistic range.

- Particularly, if the release tempo for next-generation GPUs quickens, the rate of decline in residual value will accelerate, making a shorter depreciation period more reasonable.

Credit Stress: Surge in CDS for CoreWeave, SoftBank, Oracle

In the past few months, the CDS premiums for CoreWeave, SoftBank, and Oracle have risen in tandem.An increase in CDS premiums indicates that the market is pricing in a higher probability of default for these companies.There are three factors behind this.

- Prolonged high interest rates have sharply increased borrowing costs.

- Increased use of leverage for AI Capex has magnified sensitivity in cash flows.

- Growing uncertainty about GPU residual values has led to more conservative assumptions regarding collateral values and recovery rates.In the global economy and stock markets, the “credit spread” serves as a variable that modulates the pace of the risk-on rally.Particularly, lower-leverage players in the semiconductor and cloud ecosystems may face solvency issues that could become headline news, making monitoring essential.

News-Style Summary

- Expectations for an end to the shutdown have grown, alleviating concerns over data gaps, although normalization of indicators by the December FOMC may be limited.

- Former President Trump’s idea for a $2,000 payout per person prompted a rally in retail-favored stocks, cryptocurrencies, and gold.

- A one-year suspension of U.S.-China reciprocal tariffs has reduced trade risks and somewhat eased inflationary pressures.

- Burry warned that big tech overstated profits by extending the useful lives of assets and understating depreciation.

- A decline in GPU rental prices and weakening residual values challenges the 6-year useful life assumption, strengthening the view that 3–4 years is more realistic.

- The rise in CDS for CoreWeave, SoftBank, and Oracle highlights short-term risks linked to AI Capex and credit leverage.

Key Points Not Covered Elsewhere

- The risk of an accounting reset.If the assumed useful life is shortened by 1–2 years, it could lead to short-term downward adjustments in EPS, a decline in operating margins, revisions to bonus and performance-linked metrics, and in severe cases, the need for restatements of past financial statements.

- The impact of eliminating the FCF illusion.AI Capex involves significant and sustained cash outflows.Extending depreciation does not improve FCF, so the gap between “increased profits vs. stagnant cash flows” could revert as a multiple discount.

- Sensitivity of credit covenants.Even if EBITDA and interest coverage ratios are not directly linked to depreciation, a reduction in the assumed useful life may require simultaneous adjustments in cost structures and investment plans, thereby thinning the covenant cushion.

- Risks of GPU residual value and impairment losses.A sharp drop in rental prices can lead to impairment losses for leasing and hosting businesses, reassessments of collateral values, and increased losses on secondary market sales.This could put additional pressure on CDS spreads.

- The secondary effects of policy.Using tariff revenues for cash payouts has positive effects on short-term liquidity but is close to neutral for structural growth and productivity, and its impact on inflation is limited.If retail liquidity increases, market volatility, particularly the beta of meme stocks and cryptocurrencies, may increase.

- Decision-making distortions due to data gaps.The longer the delay in indicator releases, the more the Fed may rely on high-frequency data and market expectations, which increases uncertainty about the interest rate path.

Investment Checklist and Strategies

- Check public disclosures.Be sure to review changes in depreciation period assumptions, notes on the useful lives of server and network assets, and the impact of changes in accounting policies in 10-K/10-Q filings.

- Evaluate Capex quality.Key factors include the proportion of GPUs in total data center costs, renewal cycles, the ratio of leasing versus owning, and assumptions about resale values.

- Track price and utilization data.Monitoring cloud GPU immediate availability, hourly rental price trends, and queue waiting times on a weekly basis can help gauge supply-demand dynamics ahead of time.

- Monitor credit spreads.Keep an eye on the CDS and corporate bond spreads for entities such as CoreWeave, SoftBank, and Oracle.A narrowing spread signals a potential risk-on reactivation.

- Adjust exposure.For big tech companies with a high degree of depreciation extension, consider temporarily reducing sensitivity away from event-driven positions, while rotating into areas like memory and foundries which are sensitive to demand cycles but have lower accounting risks.

- Play on retail liquidity.When cash payout issues come to the fore, meme stocks and cryptocurrency volatility may increase.However, position sizes should be managed conservatively, assuming a reversal after the news fades.

Timeline: What to Watch Moving Forward

- November 25: Burry is expected to release additional materials.Details on depreciation, Capex, and profit recalibration cases may be revealed.

- December FOMC: Monitor the pace of the release of the accumulated indicators.If data gaps persist, guidance uncertainty will increase.

- One-year U.S.-China Tariff Suspension Period: Track signs of supply chain normalization, semiconductor equipment orders, and recovery signals in Asian exports.

< Summary >

- The market has resumed a risk-on stance with expectations for an end to the shutdown, Trump’s $2,000 proposal, and the U.S.-China tariff suspension.

- Burry warned that big tech is understating depreciation and inflating profits by extending the useful lives of assets.

- A decline in GPU rental prices and weakening residual values calls into question the 6-year useful life assumption, with stronger support for a 3–4 year range.

- The rise in CDS for CoreWeave, SoftBank, and Oracle reveals short-term risks related to AI Capex and credit leverage.

- Investors should systematically monitor accounting notes, Capex quality, GPU price/utilization data, CDS spreads, and signals from retail liquidity.

[Related Articles…]

*Source: [ 내일은 투자왕 – 김단테 ]

– 빅테크의 이익이 조작됐다!? 마이클버리의 경고

● Shutdown Relief Sparks Market Frenzy, Buffett’s Final Warning, Pfizer’s GLP-1 Powergrab, AI Debt Timebomb

Shutdown Reversal Imminent · Buffett’s Final CEO Letter · Pfizer’s ‘Mesera’ Acquisition, and the Real Risks of the AI Investment Cycle All Covered

This article covers the U.S. government shutdown resolution scenario around the 13th, the key topics expected to emerge in Buffett’s final letter as CEO, the significance of Pfizer’s agreement to acquire ‘Mesera’, and the hidden risks and opportunities in the big tech AI investment cycle.

The article organizes the news in terms of the global economic outlook influenced by interest rates and inflation paths, as well as the barometer of the U.S. stock market. It separately highlights the essential points that other media rarely touch upon, delivering only the key insights.

1) Market Briefing: Momentum for Rebound and Key Points to Check

According to broadcast reports, the Nasdaq was up by around 1.5%, the S&P 500 by about 1%, the Dow by 0.5%, and the Russell also rose alongside.

Nvidia regained its leadership with a rise in the 3% range, and Tesla, Google, and Amazon rebounded together.

Palantir bounced back after high-valuation controversies, and coin-related stocks (such as Coinbase) were observed to move in line with Bitcoin’s strength.

In short, the expectation of a shutdown resolution and a rebound in big tech have provided short-term momentum for the U.S. stock market.

- Keywords: global economic outlook, U.S. stock market, interest rates, inflation, AI investment

2) Shutdown: Shutdown Resolution Scenario Around the 13th and Its Impact on Asset Markets

Reports stated that the Senate passed the shutdown resolution procedure with more than 60 votes, clearing the first hurdle.

After this week’s Senate floor proceedings, there is a strong expectation that the House will also pass it.

With the prolonged shutdown causing tangible inconveniences such as disruptions in air traffic control and federal museum operations, public pressure has increased.

Upon resolution, the halted statistical releases will resume, ending the ‘data blackout’ period and restoring macro visibility.

- This week’s focal points: October core CPI, the outcome of the 30-year Treasury auction, and the resumption timeline for the delayed employment indicators

- Historical pattern reference: Although the S&P 500 generally tended to rise during and after shutdown resolutions, it has not always been the same.

- Strategic hint: Immediately after the resolution, a reduction in risk premium could bring valuations down, and beta might spread to small/mid-cap and economically sensitive sectors.

3) AI Investment Cycle: What Big Tech Corporate Bonds and CAPEX Reveal

Megacap big tech companies have been increasing their corporate bond issuances to expand their data centers and accelerate AI investments.

In particular, some companies are showing signs of cash flow pressure as their CAPEX growth rates greatly exceed the historical averages relative to revenue.

Some argue that, in an environment where the credit sensitivity of megacap corporate bonds is increasing, widening credit spreads could amplify stock price volatility.

Nonetheless, there is also a counterargument that expectations of a Fed interest rate cut cycle could serve as a buffer.

- Checklist: FCF/revenue CAPEX ratio, data center ROI, GPU/memory/optical interconnect lead times, power availability/rates, and the pace of switching cooling systems (immersion/ liquid cooling)

- Secondary beneficiaries: ultra-high voltage transformers, switchgears, power distribution equipment, expansion of distribution networks, cooling solutions, optical modules, AI server racks/cabling, and renewable energy PPAs/utilities

- Risks: bottlenecks in power/infrastructure permits, capital procurement costs, cycle adjustments due to short-term demand smoothing, and reliance on specific GPUs

4) Pfizer-‘Mesera’ Acquisition Agreement: A Game Changer in the Obesity Treatment Arena

According to reports, Pfizer has reached a final agreement to acquire ‘Mesera’, while Novo Nordisk’s attempt fell through.

The key point is the potential for formulation and dosing cycle innovation.

If once-weekly injections in the general GLP-1 class can be transformed into a regimen offering once-a-month dosing convenience, it would greatly improve patient compliance and have extensive market impact.

Pfizer, having ceased its own oral candidate, has shifted its strategy toward M&A, aiming to reestablish a significant presence in a market estimated to grow to $1 trillion by 2030.

- To check: consistency of weight loss efficacy, safety (gastrointestinal/cardiovascular), long-term data, production scale-up, and insurance reimbursement

- Secondary effects: the spread of GLP-1 products could impact healthcare cost structures, labor supply, food and beverage demand, and the pathway of healthcare inflation

5) Buffett’s Final CEO Letter Preview: The Sentences We Must Read

News has emerged that Berkshire Hathaway is set to release the final CEO letter from Warren Buffett.

The upcoming shareholder letter is expected to be continued by Vice Chairman Greg Abel, potentially signaling a leadership transition.

Recently, Berkshire Hathaway has maintained a conservative positioning through a net selling stance and a reduction in share repurchases, even as operating income has grown.

This final letter is highly likely to have key paragraphs on the views regarding interest rates/inflation, valuations, the opportunity cost of cash holdings, and the philosophy behind the AI investment cycle.

6) This Week’s Calendar: Inflation Indicators, Auctions, and Earnings Distributions

Macro: The core CPI for October and the 30-year Treasury auction results will directly affect the yield curve.

Earnings/Events (based on broadcast reports): Earnings from growth theme stocks such as Rocket Lab, Regate Computing, and Ocklo could increase volatility.

Upon shutdown resolution, the simultaneous release of delayed indicators may quickly reverse positions taken due to the ‘data gap’, potentially causing simultaneous fluctuations in bonds, stocks, and the dollar.

7) News Summary at a Glance

- Shutdown: Passed the initial Senate hurdle, resolution expected around the 13th, with data resumption and reduced uncertainty upon resolution

- Market: Big tech rebound leads, Nvidia strong, coin-sensitive stocks gain, and a return to risk asset preference

- AI Cycle: Expansion of big tech corporate bonds and CAPEX, monitoring risks in power/infrastructure permits and credit

- Biotech: Pfizer’s agreement to acquire ‘Mesera’ is seen as a pivotal move in altering the GLP-1 competitive landscape

- Buffett: The final CEO letter preview focuses attention on cash management, views on interest rates/valuations, and potential changes in share buyback strategies

8) The ‘Real Core’ Only Highlighted Here

- The bottleneck in AI is not only semiconductors: power infrastructure, large transformers, and permit lead times determine the denominator of data center ROI.

- Megacap credit can prelude stock risks: An expansion in corporate bond spreads could act as a catalyst for valuation deleveraging.

- The shutdown resolution brings a ‘data shock’: The simultaneous release of accumulated statistics could increase interest rate volatility and deliver a short-term impact on growth stock duration.

- The macro impact of GLP-1: The proliferation of weight loss drugs may lead to a slowdown in healthcare inflation, an increase in labor supply, and changes in demand for certain consumer goods.

- Watch the quality of the rally: If there is a significant gap between the market-cap-weighted S&P 500 and the equal-weighted version, the rebound may be driven by a ‘narrow leadership’ group.

9) Practical Checklist and Scenarios

- Shutdown resolution around the 13th: Prepare for expanded Treasury volatility, and check reopening beta in small/mid-cap and economically sensitive stocks

- If core CPI comes in higher than expected: Manage risks from a potential rebound in long-term rates and an adjustment in growth stock valuations

- If AI momentum wavers: Track news regarding GPU supply and power constraints, and diversify across the infrastructure value chain

- If there is GLP-1 news: Monitor updates on the monthly dosing formulation clinical trials and production scale increases, and examine the cross-impact within healthcare and consumer sectors

- Buffett’s letter release: Look out for changes in cash proportions, comments on interest rates/valuations, and shifts in the share buyback stance

< Summary >

- The expectation of a shutdown resolution has encouraged a preference for risk assets, and the resumption of data releases post-shutdown could amplify simultaneous volatility in interest rates and stocks.

- The AI investment cycle is driven by expanded corporate bonds and CAPEX, yet bottlenecks in power/infrastructure permits and credit issues are emerging as new risks.

- Pfizer’s agreement to acquire ‘Mesera’ is a pivotal move in shaking up the GLP-1 competitive landscape, with dosing convenience innovation as the key factor.

- Buffett’s final CEO letter offers a rare opportunity to review views on interest rates, valuations, and cash management strategies.

- It is essential to monitor the quality and breadth of the rally, and manage risks based on the macro event calendar.

[Related Articles…]

U.S. Government Shutdown Resolution Imminent, Market Impact Analysis

AI Investment Cycle and the Increase in Megacap Corporate Bond Issuances

*Source: [ Maeil Business Newspaper ]

– 버핏, CEO로서 마지막 서한 공개ㅣ셧다운 이르면 13일 종료 전망ㅣ화이자, ‘멧세라’ 인수 최종 합의ㅣ홍키자의 매일뉴욕