● Currency War, Ripple 3-Second Shock, Stablecoin Tsunami, Korea Bridge Gambit

Shaking Coin Market, Ripple and Stablecoins Reshaping the Global Monetary Order: Korea’s Gamechanger Strategy

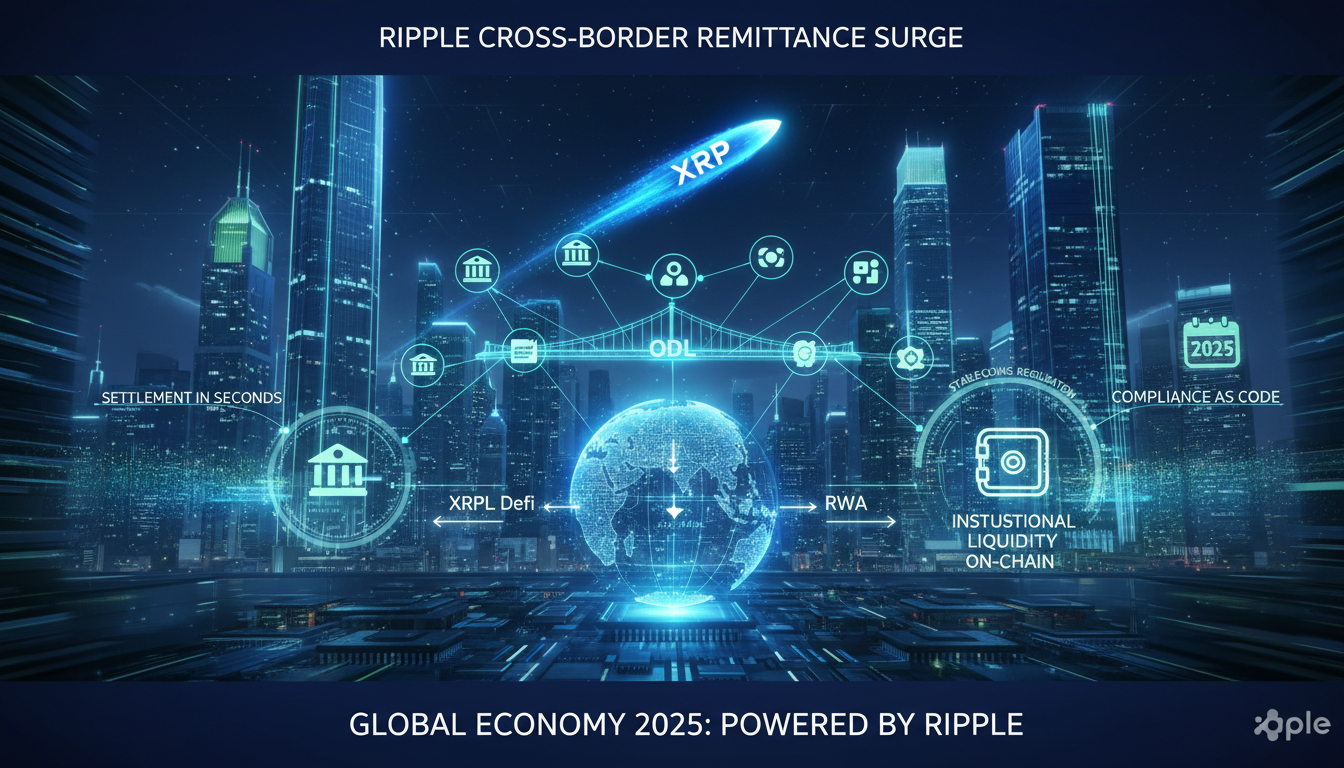

Today’s post covers 3-second remittance and SWIFT’s weakness, the three-pronged battle among stablecoins, CBDCs, and traditional finance, Ripple’s bridge currency strategy with ODL, DeFi and RWA expansion, the correlation between Bitcoin and capital markets, investment and policy signals during inflationary phases, and even a practical roadmap for Korea’s rise as a ‘bi-directional bridge.’

We simplify these complex issues.

Key points are extracted from the perspectives of economic outlook, global finance, digital transformation, inflation, and the cryptocurrency market.

News Summary: What Is Happening Now

• Ripple’s “3-second remittance” is enabled by an on-chain network that combines communication and payment.

• While SWIFT is based on a one-way communication network that incurs delays and high tracking costs, Ripple resolves issues in real-time through bilateral consensus.

• The global currency battle is unfolding in a three-pronged framework: CBDCs (China-led) vs. stablecoins (US-led) vs. an on-chain transformation of SWIFT.

• Ripple structurally lowers conversion and nostro account costs by using XRP as a bridge currency through its ODL (On-Demand Liquidity) framework.

• The XRPL is expanding into areas such as DeFi and RWA with EVM-compatible sidechains and Hooks (smart contracts).

• The expansion of stablecoin supply boosts the liquidity of the cryptocurrency market (serving as a reserve currency), putting upward price pressure on Bitcoin.

• Korea has a strategic opportunity to design a network accommodating both CBDCs and stablecoins, becoming a ‘financial bridge.’

Ripple vs. SWIFT: Why Is 3-Second Remittance Possible?

• SWIFT is a ‘communication network,’ while actual remittance is processed separately by each banks’ network.

• Its one-way messaging means that tracking errors and disputes is slow and expensive.

• Ripple, on the other hand, is an on-chain network that combines communication and payment systems.

• It directly connects the sender and recipient on a distributed network, achieving consensus and finality within 3 seconds.

• Fees are extremely low, significantly reducing the costs of intermediary banks and multi-node chains.

Ripple’s Design Choice: A Trade-off for Speed and Cost

• In the blockchain trilemma (security, decentralization, and scalability), Ripple opts for scalability while compromising on some decentralization.

• By eliminating mining and issuing 100 billion XRP at inception, processing delays are removed.

• The streamlined Unique Node List (UNL) increases consensus speed and reduces fees.

• As a result, it achieves performance and cost-effectiveness suitable for real-world financial applications (cross-border payments and currency exchange).

Ripple’s Expansion: From Remittance to a Financial Infrastructure Platform

• The XRPL, combined with an EVM-compatible sidechain, opens up a smart contract-based DeFi and RWA ecosystem.

• The Hooks protocol (native smart contract) is currently in testing, enhancing on-chain automation and rule-based payments.

• Enterprises can integrate remittance, currency exchange, liquidity management, collateral management, and tokenized asset payments into a single stack via XRPL.

Hegemonic Struggle: CBDCs vs. Stablecoins vs. On-Chain SWIFT

• China-led: Observations indicate that a high-performance retail CBDC, combined with robust encrypted communication infrastructure, will push for external expansion.

• US-led: A stablecoin-centered strategy emphasizing privacy and market innovation has been under discussion, with regulatory frameworks rapidly being refined.

• SWIFT: Through experiments connecting multiple blockchain networks, SWIFT is pursuing an ‘on-chain transition,’ forming a three-sided competitive structure.

• Points raised in discussions include: restrictions on some stablecoins under Europe’s regulatory (MiCA) environment, the reorganization of established powers, and the potential for new entrants from banks and big tech.

• In conclusion, amidst the coexistence and competition of the three, “who is cheaper, faster, and more secure” is the decisive factor.

The Power of ODL (Bridge Currency): Structural Reduction in Currency Exchange and Nostro Costs

• Traditional method: Nostro accounts are built for each currency, followed by currency exchange and settlement.

• ODL: At the moment of remittance, XRP is used as a bridge currency to automatically swap and settle from Currency A → XRP → Currency B.

• Result: Reduction in deposit liquidity, lower currency exchange spreads and operational costs, and near T+0 finality, all contributing to a lower Total Cost of Ownership (TCO).

Stablecoins and Capital Markets: A Partnership with Bitcoin

• Overseas, most cryptocurrency purchases are made using stablecoins.

• The expansion of stablecoin supply increases liquidity in the cryptocurrency market (effectively acting as a reserve currency), exerting upward pressure on Bitcoin’s price.

• The expansion of liquidity gradually influences altcoins (such as Ethereum and Ripple) as well.

• Macroeconomic variables such as inflation, trade wars, and dovish monetary policies stimulate demand for ‘dollar replacement/complementary assets,’ which reinforces the partnership between Bitcoin and gold, potentially triggering a follow-through rally in altcoins.

Scenarios for Banks and Big Tech: Competitors for the Next Round

• Consortium-type stablecoins by banks can rapidly capture market share using their networks, payment systems, and corporate relationships as assets.

• Big tech companies (such as MAANG) have great potential to maximize network effects through the integration of user pools, wallets, and commerce.

• Interest-bearing stablecoins and RWAs can partially function as a replacement for deposits through interest and dividend inflows, potentially disrupting the competitive landscape for bank deposits.

• Regulation points: permissible scope for interest-bearing stablecoins, transparency and compliance for RWAs, anti-money laundering and travel rule adherence, and custody security.

Korea’s ‘Bi-Directional Bridge’ Strategy: Blueprint and Execution Checklist

1) Network Design.

• Build a multi-rail hub capable of incorporating CBDCs, stablecoins, tokenized securities, and RWAs.

• Provide standardized APIs for on-chain modules for payments, securities, FX, and collateral management.

2) Regulation and Governance.

• Clarify the framework for issuing domestic stablecoins (in Korean won) including reserve assets, disclosure, and audit standards.

• Establish interoperable governance jointly by banks, securities firms, fintech companies, and exchanges.

3) International Interoperability.

• Align with global standards and compliance such as ISO 20022, TRISA/Travel Rule, and FATF recommendations.

• Gradually expand pilot corridors such as KR–JP, KR–UAE, and KR–ASEAN.

4) Industry Application.

• Begin with trade, tourism, gaming, and retail payments, and offer export companies a package that reduces FX and remittance costs via ODL.

5) Public Sector.

• Launch an on-chain payment sandbox for public utilities and tax payments, and establish electronic wallet standards.

6) Risk Management.

• Operate a dedicated team for responding to regulatory changes (abroad), conduct liquidity stress tests, and manage diversification strategies for bridge currencies and stablecoins.

7) Workforce and Security.

• Expand human resources specializing in smart contract security, forensics, and regtech, and standardize key management/HSM and MPC.

Practical Checkpoints for Corporations and Institutions

• Payments/Foreign Exchange: Quantify current fees, settlement durations, FX spreads, and nostro sizes, calculating the substitution effect based on TCO.

• Risk: Pre-assess regulatory compliance, accounting (token holdings and classification of interest-bearing stablecoins), cybersecurity, and counterparty risks.

• Technology: Evaluate wallet, custody, and key management systems, chain selection (fees, TPS, performance), and the integration of oracles and KYC.

• Governance: Build monitoring systems linked to on-chain audit logs with compliance and internal control workflows.

Key Points Not Often Highlighted Elsewhere

• Korea’s multi-rail payment network should be designed on the premise of simultaneous interoperability among ‘CBDC + stablecoin + RWA + tokenized securities.’

• Combining XRP ODL with a won-based stablecoin pair can double the savings on FX and settlement costs for export companies compared to traditional methods.

• SWIFT’s on-chain transition may still face inherent limitations regarding messaging-state synchronization and real-time liquidity (approaching T+0).

• Interest-bearing stablecoins and RWAs could create a ‘deposit substitution threshold,’ prompting a reconfiguration of banks’ deposit and ALM strategies.

• The period from 2025 to 2026 is likely to see an intensification in the competition over stablecoin regulation and certification, potentially leading banks, big tech, Ripple, and traditional payment companies to simultaneously battle for market share.

Macroeconomic Variables and Investment Signals (For Informational Purposes)

• Discussions of inflation, tariffs, and dovish monetary policies increase the preference for assets that can replace or complement the dollar.

• The increase in stablecoin supply is favorable for Bitcoin and major altcoins by expanding liquidity in the cryptocurrency market.

• European regulations, US certifications, and policy changes on capital inflows/outflows in major countries may divide the market share of stablecoins and bridge currencies regionally.

• Volatility will increase. The quality of the infrastructure, including decentralization, reserve asset transparency, and custody security, will be the determining factor for success.

One-Line Guide

• Corporations should start piloting ‘on-chain settlements’ now and design architectures connecting ODL, stablecoins, and tokenized securities.

• Policy should go all-in on the ‘bi-directional bridge’ to preemptively secure a global payments and securities hub.

• Individuals should monitor the cycle from liquidity (stablecoins) to Bitcoin to major altcoins, along with regulatory momentum.

< Summary >

• Ripple implements 3-second remittance and low costs with an on-chain network that integrates communication and payment.

• The global currency battle is a three-pronged contest among CBDCs, stablecoins, and an on-chain SWIFT.

• The expansion of stablecoin supply boosts liquidity in the cryptocurrency market, creating upward pressure on Bitcoin and altcoins.

• Ripple’s ODL structurally reduces conversion and nostro costs, lowering the TCO for businesses.

• Korea has an opportunity to become a ‘financial bridge’ by establishing a multi-rail hub that embraces both CBDCs and stablecoins.

[Related Articles…]

Ripple Accelerates the Global Payments Paradigm Shift

Key Checks on Stablecoin Regulation and the 2026 Economic Outlook

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– [풀버전] 흔들리는 코인시장, 리플이 금융 패권을 뒤흔든다. “세계 통화 질서가 재편된다” | 경읽남과 토론합시다 | 홍익희 교수

● Hypersonic Sea Killer, Korea Arms Tsunami, Supply Chain Shock

Revealing the Ultrafast Anti-Ship Missile ‘Haesung‑V’ and Accelerating K-Defense Exports to South America

The article succinctly explains why Korea’s game-changing maritime deterrence has emerged now and why “K-defense exports” are exploding amid global economic outlooks and supply chain restructuring.

It summarizes the performance and significance of Haesung‑V, the move in South America for large-scale acquisition of K2 tanks and K808 armored vehicles, competitive delivery times compared to the US and Europe, responses based on AI-guided and electronic warfare, and risks such as MTCR regulations and production bottlenecks—all at once.

It also separately outlines sensitive points such as “the conditions for achieving actual strike effects (kill chain, ISR, electronic warfare)” and “export version range specification limits” that are rarely discussed on other YouTube channels or news outlets.

Briefing: What Has Happened Now

The video was filmed on November 12, and the context has been updated by compiling information and market responses released thereafter.

Korea unveiled the ultrafast anti-ship missile “Haesung‑V,” firing a signal into the balance of naval power in the Western Pacific.

Its range is estimated to be from at least 200 km to around 500 km, with terminal evasive maneuvers and low-altitude sea-skimming being highlighted as key features.

In South America, reports from local sources and industry indicate that one country is moving forward with and contracting for the acquisition of 46 K2 tanks and 99 K808 armored vehicles, while discussions for additional quantities are underway.

Amid supply delays and delivery uncertainties from American and European firms, interpretations are growing that there is an accelerating trend toward quietly switching to Korean products.

This shift aligns with the huge trends of global supply chain restructuring, expanded defense exports, and accelerated digital transformation in industries.

Haesung‑V: What Has Changed

It is characterized by dramatically reducing interception time through ultrafast flight and enhancing survivability with terminal evasive maneuvers and low-altitude sea-skimming.

The design philosophy appears to secure effectiveness in environments of electronic jamming through multisensor fusion (for instance, supplementing active radar with IR and INS estimations).

The key is the integrated “kill chain” that shortens time from target detection to engagement by linking with the domestically networked strike system.

In practical terms, it significantly raises the cost for an enemy fleet to approach, thereby creating deterrence.

The export version is likely to have differentiated range, warhead, and guidance capabilities considering international regulations (MTCR).

Why It Is Receiving Attention Now: Strategic and Geopolitical Impact

In the Indo-Pacific region, long-range anti-ship capability is directly linked to carrier strike groups, protection of merchant ships, and stability of sea lines of communication (SLOC).

The ultrafast anti-ship missile imposes a composite burden on interception systems (RAM, ESSM, CIWS), tipping the balance of military expenditure in Korea’s favor.

To penetrate layered defenses, the concept of “saturation with multiple salvos, axes, and speeds” is key, and Haesung‑V is interpreted as Korea’s solution in this regard.

Ultimately, the rise in regional deterrence directly translates into expanded diplomatic and economic leverage, enhancing Korea’s strategic industrial premium in the global economic outlook.

What Is Happening in South America: The Rush to Adopt K2 and K808

Local and industry reports continue to indicate that a South American country is moving forward with and contracting for 46 K2 tanks and 99 K808 armored vehicles.

A step-by-step power-up scenario, keeping additional quantities in mind, has been mentioned, and South America is emerging as the “next-generation growth market” for K-defense.

While American and European systems are increasingly uncertain in terms of delivery and budget, Korea has demonstrated strength in production, integration, and training packages as well as lifecycle costs.

Some even describe the competitiveness as “enough to make the US nervous,” but it is more reasonable to see it playing a role as a complement within the allied supply chain.

Economic Impact: Exports, Employment, and Supply Chains

Expanding defense exports simultaneously improves the trade balance, creates regional jobs, and expands a high value-added ecosystem of materials, components, and equipment.

As strategic parts supply chains such as solid propellants, composites, and GaN-based radar modules are localized, technology spillovers are expected to spread into the civilian sector.

Fluctuations in the won exchange rate and the synchronization with related sectors like shipbuilding, aviation, and electronics could influence the volatility of KOSPI and KOSDAQ.

It is highly possible that order backlogs and CAPEX cycles will be reflected in related value chains including HD Hyundai’s shipbuilding, Hanwha Aerospace, LIG Nex1, and Hanwha Ocean.

Digital transformation and the adoption of smart factories define “order quality” itself through improved productivity and reliable delivery performance.

AI Trends: Missiles Now “Perceive”

There is a clear trend in which artificial intelligence models enhance seeker signal processing and sensor fusion in target identification and counter-deception.

Edge AI processing reduces false alarms in jamming and decoy environments and reinforces terminal phase trajectory optimization based on real-time learning.

Digital twins and model-based systems engineering (MBSE) shorten the development, testing, and certification cycle, while continuous software updates steadily enhance performance.

Cyber and electronic warfare responses rely on secure bidirectional data links and LPI/LPD communication designs, and these innovations are expected to extend into the civilian communications and satellite industries.

Don’t Miss Out: Key Points Rarely Mentioned Elsewhere

The “real performance” of Haesung‑V is determined more by the completeness of the kill chain—which includes target detection, identification, command and control, and the electronic warfare environment—than by the missile itself.

Maritime ISR relies on the interconnection of satellite, maritime early warning aircraft, UAVs, and fixed sensor networks, and without a strong link, even speed superiority loses its luster.

The export version is likely to have its range, warhead, and guidance capabilities adjusted according to MTCR regulations, which will directly affect overseas operational performance.

Bottlenecks include high-performance propellants, seeker TR modules, and composite material processing capacity, making diversification of parts supply chains and long-term raw material contracts essential.

The adversary’s response will also be quicker.

As the operational environment dynamically changes with laser CIWS, new seeker kill vehicles, and synthetic electronic warfare patterns, continual software and tactical upgrades are key.

Risk Checklist

If production and delivery risks increase, export reliability will decline, so a multi-facility and multi-line production system is necessary.

Because geopolitical factors heavily influence export approvals, sanctions, and offset negotiations, flexible contract structures are important.

Insufficient maintenance (MRO) and education/training infrastructure can delay operational capability, making packaged follow-up logistics support essential.

Rapid changes in exchange rates and raw material prices hit the cost structure directly, so hedging strategies and long-term procurement are the stabilizers.

Investment Perspective: What to Watch

Key variables include the quality of order backlogs, delivery and cash flow timing, software competitiveness, and positioning within the global supply chain.

Whether AI, sensor, and electronic warfare module companies are included in the value chain will serve as a long-term alpha factor.

This should be understood as a checklist from the perspective of industrial structural changes rather than a recommendation for specific stocks.

What to Watch for in the Next 6–12 Months

Check the scope of the public release of live-fire footage and data of Haesung‑V, as well as the demonstration of its operational concept during combined training.

The final contracts, delivery schedules, additional option volumes, and the scope of local production and maintenance cooperation for South American orders are crucial.

The demonstration of interoperability of the Korean kill chain during multinational exercises will determine export reliability.

News of capacity expansion announcements from domestic parts companies, long-term supply contracts, and the establishment of overseas JV/MRO centers are also big indicators.

One-Line Conclusion

Haesung‑V’s deterrence is created not by “speed” but by “connectivity,” and the acceleration of K-defense exports that started in South America is an economic story built on supply chain reliability.

Defense productivity innovations driven by artificial intelligence and digital transformation will further boost Korea’s strategic premium.

Keyword Snapshot

Global economic outlook.

Supply chain.

Defense exports.

Digital transformation.

Artificial intelligence.

< Summary >

With the unveiling of Haesung‑V, Korea has secured an ultrafast anti-ship deterrent capability, and the decisive factor lies in the integration of the kill chain, ISR, and electronic warfare rather than the missile itself.

In South America, the adoption of K2 and K808 is now on track, and the competitive edge of Korean products in terms of delivery and operational costs has become a clear point of differentiation.

Economically, the expansion of defense exports and localization of supply chains are expected to drive employment, export growth, and technology spillovers.

Innovation in development and operation driven by AI and digital twins will simultaneously enhance performance and delivery reliability.

[Related Articles…]

K-Defense Exports: Global Market Landscape Shift by 2025

The Future of Maritime Deterrence Opened by the Ultrafast Anti-Ship Missile

*Source: [ 달란트투자 ]

– 드디어 공개된 초고속 대함미사일. 전세계가 이제 한국만 쳐다본다 | 김대영 군사평론가 4부 #디펜스뉴스