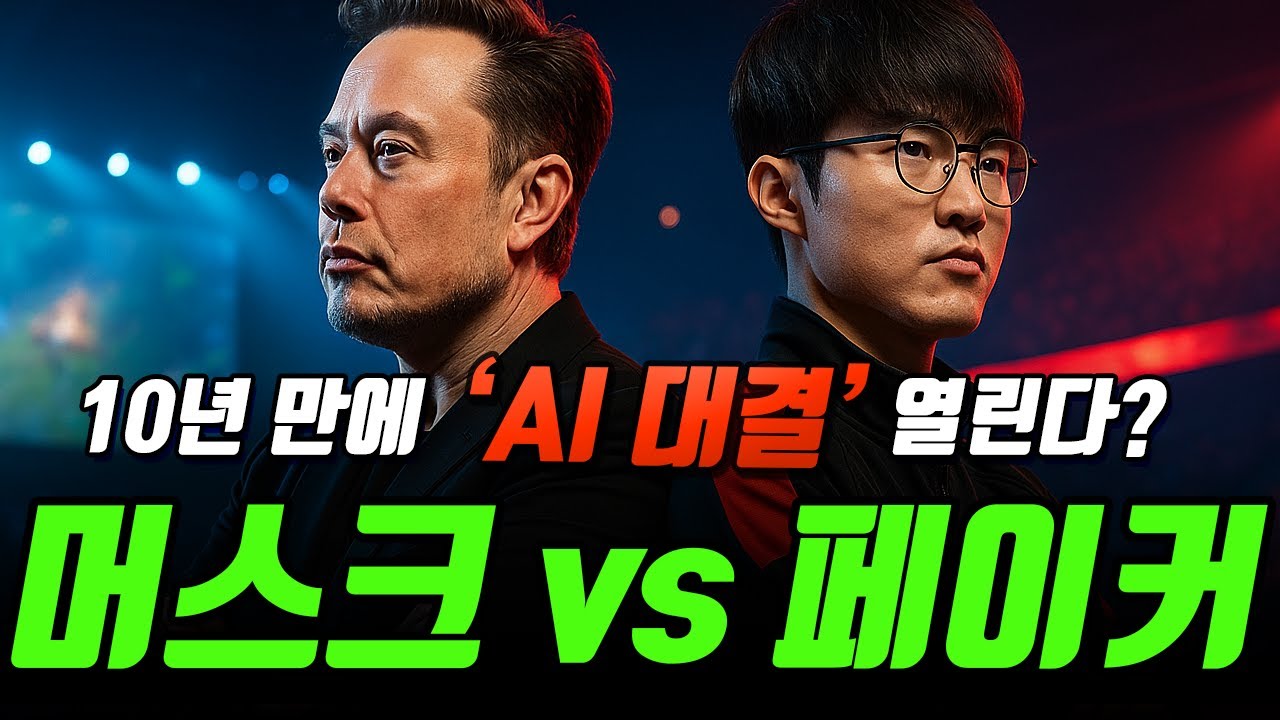

● Grok-5 vs T1 ignites AGI showdown, Tesla camera push triggers robo-taxi profit war

Musk xAI Grok-5 vs T1 Faker, and the True Meaning of the Robotaxi Battle

This article covers 1) why the Grok-5 and T1 showdown serves as a test stage for AGI rather than the “second AlphaGo”, 2) the impact of Tesla Robotaxi’s remote support update for internal camera and microphone on the removal of safety personnel and profitability, 3) the urban expansion race and regulatory strategies between Waymo and Tesla, 4) the ripple effects from the perspective of the global economy, stock market, and investment strategy, and 5) technical variables such as “multi-agent, incomplete information, and latency” that other media overlook.

Headline Briefing

Elon Musk announced his intention for an official showdown between xAI Grok-5 and the world’s strongest LoL team T1, to which T1 responded with a “ready” message.

This battle is proposed under the condition of using screen input only, operating under the same human vision and speed limitations, and unlike AlphaGo, it tests human-like reasoning in an environment of “incomplete information, real-time, and team-based” conditions.

Tesla has begun laying the essential infrastructure for removing safety personnel by adding a remote support option with an “internal camera and microphone” through a Robotaxi app update.

Musk mentioned that he would double the number of Robotaxi vehicles operating in Austin next month.

Waymo is already expanding fully autonomous services in major cities, signaling the onset of data, regulatory, and urban expansion competitions.

The outcomes may lead to a re-evaluation of expectations on the pace of the AI and fourth industrial revolution as well as the AI and self-driving value chains in the stock market and global economic productivity.

Why the LoL Showdown Is Not the “Second AlphaGo” but the “Next Level”

AlphaGo operated in a complete-information, turn-based environment where the entire board was visible at once.

This LoL showdown permits only screen input, incorporating elements such as incomplete information, real-time play, multi-agent (5-person team) dynamics, and abnormal changes in the meta due to patches.

The AI is subject to the same vision and APM (actions per minute) limitations as humans, thereby preventing it from breaking the game through “superhuman reactions”.

Essential skills include visual understanding, scenario prediction, cooperative strategy, role execution, timing in team fights, and risk management—a synthesis of complex decision-making.

In short, it is a stage for comprehensively testing human-like reasoning, team-based decision-making, and POMDP (partially observable Markov decision process) performance under restricted sensor inputs.

Grok-5’s Multimodal Transition and Tesla Synergy

While Grok-4 focused on LLMs, Grok-5 is aimed at becoming a multimodal AI that integrates text, images, and vision.

To achieve AGI, not only language but also vision, sensory, spatial awareness, and action control need to be combined, which implies the necessity of an integrated network that “sees, judges, and acts”.

Tesla has accumulated billions of miles of camera-based road data, and both FSD and Optimus use the same vision-reasoning-action pipeline.

xAI naturally forms a division of labor with the brain (reasoning, language, knowledge) and Tesla’s body (vision, action, sensing).

If visual-based decision-making is proven in LoL, that capability could be transplanted to robotaxi driving decisions and Optimus’s human collaboration skills.

Tesla Robotaxi Update: The Implication of Internal Camera and Microphone Remote Support

The recent app version update now allows access to vehicle “internal camera and microphone” data during remote support.

This lays down the technical foundation to remotely replace on-site safety personnel for identifying passenger issues, emergency responses, and dispute resolution.

The removal of safety personnel signifies a fundamental shift in cost structure.

With labor costs eliminated, variable costs per mile decrease significantly, utilization increases, and the vehicle LTV and profitability are structurally improved.

Tesla emphasizes anonymization and limited connection in special situations, but regulatory compliance with privacy standards and data governance verification is essential.

Waymo vs. Tesla: The Race in Data, Regulations, and Urban Expansion

Waymo is extending fully autonomous commercial services in cities like San Francisco, LA, and Phoenix, seizing regulatory and operational know-how on a per-city basis.

Tesla is aggressively increasing its vehicle count in Austin by doubling it in a short period to rapidly secure real-world data and meet peak demand.

The key competitive points are: 1) speed of approval for autonomous operations, 2) safety record, 3) cost per mile, 4) scale and quality of data, and 5) the number of cities and the density of infrastructure in which they expand.

Since each city has its unique regulatory, union, insurance, parking/charging permit systems, “policy adaptability” will determine the pace of expansion.

Economic Ripple Effects and Investment Strategy Points

The convergence of artificial intelligence and robotics is a core pillar of fourth industrial revolution productivity, and the reduction of variable costs in urban mobility services is redefining platform profitability.

If the removal of safety personnel becomes a reality, operating margins per trip will improve, and higher vehicle turnover and utilization will strengthen fixed cost absorption.

Factors such as component supply, battery lifespan, insurance premiums, and vehicle damage rates are hidden variables that determine true margins.

The stock market could see rising interest in robotaxi TAM re-evaluations, AI semiconductors, edge computing, mapping/labeling, data center cooling, and the value chain for vehicle cameras and sensors.

From a global economic standpoint, if improvements in mobility efficiency and logistics automation help ease service inflation, subtle shifts in interest rates and growth trajectories may occur.

From an investment strategy perspective, concurrently managing momentum events (Grok-5 demo, Austin expansion, regulatory approvals) alongside risks (accidents, regulatory delays) with a basket approach is crucial.

This is a moment to comprehensively examine trends in the global economy, artificial intelligence, the fourth industrial revolution, stock market, and investment strategies from an SEO keyword perspective.

Scenario Outlooks and Timeline Watchpoints

Short-term: Focus on whether the Grok-5 showdown materializes, agreement on demo conditions, and the quality of visual recognition and team collaboration decision-making during the demo.

Mid-term: Key factors include the impact of Tesla’s Austin doubling, pilot tests for removing safety personnel, additional urban expansion plans, and interactions with regulatory agencies.

Long-term: The decisive factor will be how well the outcomes from the LoL test “transfer” to FSD and Optimus, essentially verifying the universality of multimodal learning.

The Most Important Point That Other Media Do Not Mention

The real challenge in multi-agent cooperation is “Theory of Mind (ToM)” reasoning.

You must infer the intentions of both teammates and opponents and supplement unseen information through team chats, pings, and patterns despite limited vision.

Latency budgeting determines performance.

Equalizing end-to-end latency, including server/client/model inference, to human-level limitations ensures fairness, and strategy quality under these constraints reveals the proximity to AGI.

LoL is an “abnormal environment” in which the meta changes with patches.

Fixed strategies do not work, and online learning/adaptability are crucial.

This directly correlates to the ability to respond to distribution changes in real-world road and on-site operations.

The data pipeline is key.

Scaling requires automated labeling, simulation, and replay learning within the closed loop from screen input → visual understanding → decision-making → action → feedback.

Privacy/ethical governance will determine the speed of commercialization.

If compliance design regarding laws, notifications, consent, and retention periods for remote support via internal camera and microphone is lacking, expansion may stall.

The cost of edge versus cloud inference determines unit economics.

The decision to deploy high-performance models onboard or use low-latency cloud inference will affect cost per mile and reliability.

Risk Check

There is a risk of regulatory regression due to safety accidents or malfunctions.

Issues of fairness regarding LoL game rules, API, and violations (macro inputs) may arise.

If the model becomes overfitted to the meta, there is a risk of performance collapse after patches.

Social acceptance issues related to privacy and voice data collection could spread.

Competitors’ demonstrations/releases may precede, causing a loss of narrative leadership.

Investor Checklist

Observe the consistency between screen input and action, the explainability of decision-making, and the quality of team play during model demonstrations.

Track changes in call success rates, utilization, customer NPS, and accident rates following the Austin expansion.

Verify the consistency of guidelines for using data and internal camera/microphone with regulatory agencies.

Compare the number of fully autonomous service cities and service hours between Waymo and competitors.

Check the roadmap for edge inference hardware and guidance on cost per mile.

< Summary >

The Grok-5 vs T1 battle is an AGI litmus test for human-like reasoning under realistic conditions of “screen input, human speed limitations, and team-based” scenarios.

Tesla’s remote support for internal camera and microphone lays the groundwork for removing safety personnel, potentially transforming the unit economics of robotaxi operations.

While Waymo leads in fully autonomous commercialization, Tesla is chasing by combining data with a hardware platform.

In the global economy and stock market, the momentum of artificial intelligence and the fourth industrial revolution could be reignited, making event-risk management the key to investment strategy.

[Related Articles…]

Tesla Robotaxi Commercialization Checkpoints

Key Overview of Grok-5 and the AGI Roadmap

*Source: [ 오늘의 테슬라 뉴스 ]

– 머스크 vs 페이커… 10년 만에 두 번째 알파고? xAI Grok5, T1에 공식 도전 시작됐다

● Tesla RoboTaxi Goldrush, Driverless Profit Tsunami

Tesla Robotaxi Doubles Expansion Circumstances, Signal of “Removal of Safety Monitors,” and Completion of Solar Supercharger – All Summarized in One

Next month, the Austin robotaxi fleet is set to double, indications of eliminating safety monitor (or monitoring personnel) have been observed, and a super-large supercharger based on solar power and batteries will be activated—this summary encompasses the surge in European sales and even political purchases of Tesla.

Key points include the structural differences with Waymo, profitability leverage created by manufacturing cost advantages, massive hiring for FSD in China along with the regulatory timeline, and ripple effects in the global economy, stock market, and interest rate environment.

Additionally, there is a separate summary of the “margin structure of the grid-independent charging infrastructure” and the “non-linear growth created by the removal of the safety monitor” that are rarely highlighted in other YouTube videos or news.

Breaking News Check: Today’s Top 10 News

- The Austin robotaxi fleet is expected to double next month, suggesting an increased scale of pilot testing.

- Preparations for the removal of safety monitors (or monitoring personnel) have been detected in software updates.

- Enhanced in-cabin camera and data sharing options, among other remote monitoring system upgrades, are in progress.

- Compared to Waymo, Tesla’s manufacturing cost and vehicle supply chain advantages are emerging as key points of economic efficiency.

- Tesla China is accelerating its local rollout by massively hiring personnel related to Autopilot and FSD.

- Incident footage issues continue to surface, increasing the importance of autonomous driving safety and recorded data.

- Faraday Future (FF) has officially requested FSD technology cooperation from Tesla, intensifying the licensing competition.

- Large-scale solar and Megapack supercharger at California’s Lost Hills has been completed and activated.

- Tesla’s sales in several major European countries, including Norway, are recovering rapidly.

- There is an emerging trend of Tesla purchases by prominent “sophisticated investors” in American politics.

Austin Robotaxi Doubling: A Signal for Speed Competition

It is unofficially estimated from tracking data that about 90 units in the Bay Area and roughly 30 units in Austin are in operation.

The statement about doubling the Austin fleet next month comes from public conversations rather than official regulatory documents, so the numbers and timing are fluid.

The key factor is not the absolute numbers but the “rate of increase” and the “operational changes (with or without safety monitors).”

Once operational modes shift from having safety monitors on board to operating autonomously, the valuation framework in the stock market is likely to be re-evaluated as software- and platform-based.

Amid the current global economic environment with discussions on peak interest rates, if Tesla expands its network by dispersing fixed costs, the textbook effects of the Fourth Industrial Revolution—namely, reduced unit cost and enhanced productivity—could materialize regardless of inflationary pressures.

The Significance of Removing Safety Monitors: Non-linear Revenue Growth

When safety monitors are removed, the fixed labor cost per vehicle approaches zero, and OPEX is simplified to expenses such as refueling/charging, insurance, maintenance, communications, and remote support.

The more continuously a vehicle operates, nearly 24 hours a day, the faster the per-unit CAPEX recovery becomes exponentially accelerated.

According to community estimates, the additional cost for Tesla vehicles equipped with self-driving hardware runs in the tens of thousands of dollars, while the total cost for a Waymo-specific vehicle is often cited as being significantly higher.

However, the removal of safety monitors must overcome multiple layers of hurdles including regulatory approvals, insurance underwriting, and remote operation standards, and therefore may proceed at different paces depending on the region.

Macroeconomic variables such as policy interest rate paths affect vehicle procurement costs and insurance rate setting, ultimately impacting service fares and market share competition.

FSD Software Update: Enhanced In-Cabin Cameras and Data Sharing

Recent updates have reportedly strengthened the options for in-cabin camera access and data sharing.

This is a crucial preparatory element for the transition to autonomy, addressing passenger safety issues (such as emergency detection and dispute recording) as well as remote customer support and security.

Since these updates involve privacy and data governance issues, they must be accompanied by user consent, de-identification processes, and storage policies in line with compliance standards.

The ability to rapidly meet regulatory agency requirements with software may greatly influence the pace at which FSD is adopted.

Waymo vs. Tesla: The Fundamental Differences Between the Two Models

- Hardware Strategy: Waymo is centered on Lidar and Lidar mapping, whereas Tesla relies on a camera and vision-centered sensor configuration.

- CAPEX/Manufacturing: Tesla benefits from mass production of finished vehicles and internalized supply chains, lowering vehicle costs.

- OPEX/Operations: Waymo is often criticized for high maintenance costs of high-performance sensors and map updates, while Tesla minimizes costs through OTA software updates and the use of common vehicles.

- Scalability: Tesla can rapidly expand its network through FSD activation on vehicles it sells and, once autonomy is approved, can surge market supply via a “software switch.”

In conclusion, from the moment safety monitors are removed, Tesla’s profitability is likely to showcase high leverage derived from its manufacturing costs and software margins.

Manufacturing Cost Competitiveness and Payback Scenarios

Unofficial estimates suggest that the cost for a Tesla-style robotaxi is in the tens of thousands of dollars, while for some competitors, the total input cost per vehicle is said to exceed $100,000.

Based on urban turnover rates, vehicle operating hours, and fare strategies, community models suggest a scenario where the cost per vehicle is recovered within a year; however, this is heavily influenced by regional regulations, insurance, charging costs, and accident rates.

As inflation and the interest rate environment improve, the CAPEX recovery period could shorten, and in the stock market, there may be discussions of multi-plier re-rating focused on platform revenue growth.

China: FSD Hiring and Regulatory Timeline

In cities like Shanghai, hiring for testing engineers related to Autopilot/FSD is expanding.

China enforces strict regulations on map and data export, making localization (maps, voice, regulatory compliance) and internal data storage essential.

Although some public remarks have mentioned the possibility of full approval as early as next year (roughly February to March), no definitive regulatory timeline has been set.

The expansion in local hiring is interpreted as a signal of preparation prior to approval (improving test coverage, ensuring compliance, and enhancing customer support).

Safety and Accidents: The Roles of Dashcams and TeslaVision

In incidents such as side collisions with vehicles running red lights, multi-angle video recordings serve as critical evidence in exonerating accident liabilities.

While there are community-shared cases where robust vehicle structures, airbags, and collision designs have prevented serious injuries, caution is advised against sample bias, and waiting for official statistics is necessary.

Regulatory agencies and insurance companies will use actual accident rates and damage scales to set rates, so the commercialization pace of FSD is proportional to the accumulation of safety data.

FSD Licensing: The Significance of FF’s Cooperation Request

Legacy OEMs are cautious about adopting Tesla’s FSD due to concerns over existing software stacks and brand protection.

Conversely, emerging EV companies have a strong incentive to leverage Tesla’s technology and brand halo for marketing and cost efficiency.

Faraday Future’s public request for cooperation is seen as a symbolic event that heralds the beginning of an “FSD license market.”

Licensing creates a revenue and royalty structure for software, reinforcing network effects in the theme of the Fourth Industrial Revolution.

Energy Business: Grid-Independent, Super-Sized Supercharger with Solar Power

Field reports have emerged confirming that the world’s largest supercharger station has been completed and activated at Lost Hills, California.

It is known (based on unofficial figures) that the station has 164 stalls, a combination of solar power generation and 10 Tesla Megapacks, and an energy storage capacity of approximately 39 MWh.

By reducing dependency on the grid, the station avoids steep peaks in wholesale power prices and risks of blackouts, thereby stabilizing charging margins in the long term.

This structure enhances the predictability of charging costs, strengthening cost control even during inflationary periods.

Sales Trends in Europe and Norway: The Strength After Removing External Effects

Accustomed to changes in subsidies, Europe now offers a clearer view of actual demand trends once external variables are removed.

Daily and weekly data from Norway indicate that Tesla sales are rapidly recovering and expanding.

Given that deliveries tend to concentrate at the end of each quarter, it is highly likely that the pace will accelerate as the fourth quarter progresses.

Political Purchases: A Hint of Information Asymmetry?

Increasing public filings of Tesla purchases by figures noted for their investment performance in U.S. politics are being observed.

This can be interpreted as a signal of heightened sensitivity to policy or regulatory trigger events.

However, individual purchases should not be seen as investment advice, as portfolio risks, durations, and tax conditions vary.

Elon Musk’s Work Pattern, and Updates from Boring Company and Neuralink

Musk’s extremely long working hours underpin a management style that focuses on removing bottlenecks and centralizing on-site decision-making.

The Boring Company aims for an extraordinarily low-cost structure compared to traditional tunneling methods, and growing performance evidence suggests a downward trend in its cost curve.

Neuralink is making strides in realizing computer and smartphone interfaces for paraplegic patients, while accumulating clinical data under medical regulations.

Their progress forms a complementary network with Tesla’s manpower, algorithms, and manufacturing technology.

Investment Checklist and Risks (Linked with Macroeconomics)

- Regulation: The pace at which unmanned operations in cities receive permitting and meet safety/insurance standards.

- Technology: FSD safety metrics (accident rates of the vehicle itself and of other vehicles), handling of uncertain situations, and remote support systems.

- Finance: Borrowing, leasing, and insurance costs influenced by interest rate levels, along with the impact of inflation on parts and wages.

- Competition: Entry, partnerships, and pricing strategies of Waymo, Cruise, and major Chinese tech companies.

- Reputation: Issues related to accidents, recalls, and consumer trust.

As global economic variables shift towards relief, Tesla’s large-scale CAPEX and energy projects could benefit from a lower WACC.

The Most Important Points Rarely Addressed Elsewhere

- Margin Structure Innovation of Grid-Independent Superchargers

Solar power combined with energy storage (Megapack) hedges against fluctuations in wholesale power prices, avoids peak-hour price spikes, and in the long term converts “fuel costs” into semi-fixed costs.

This stabilizes one of the biggest variables in robotaxi OPEX—energy costs—thereby enhancing fare-setting power and competitive advantages in market share battles. - Non-linear Growth Created by the Removal of Safety Monitors

With the cost of safety monitors eliminated, revenue and cash flow per vehicle can shift dramatically overnight.

As algorithms improve via OTA updates, profitability dynamically increases, potentially reclassifying stock market multiples from “manufacturing” to “software platform.” - Regulatory Compliance of the Data Network Effect

In-cabin cameras and data sharing are not merely features; they serve as the “audit, safety, and insurance” layer essential for autonomy.

Establishing a robust data governance system is key to satisfying regulatory requirements and determining the pace of commercialization.

One-Line Conclusion

The doubling of the Austin fleet and indications of the removal of safety monitors lower the threshold to a “scale economy + platform margin” model.

The solar supercharger stabilizes energy costs, locking in robotaxi OPEX.

Macroeconomically, easing interest rates and inflation are supportive of faster CAPEX recovery and re-rating of multiples, while the recovery in European demand underpins this narrative.

< Summary >The Austin robotaxi fleet is set to double and preparations for the removal of safety monitors have been observed.

Enhanced in-cabin cameras and data sharing underpin the safety and compliance needed for full autonomy.

The solar + Megapack supercharger represents a structural change that boosts margins via grid independence.

European sales are recovering, and political purchases signal regulatory/policy momentum.

Key risks include regional regulations, insurance, and safety metrics, while declines in interest rates and inflation provide a favorable backdrop.

[Related Articles…]

- FSD Licensing Battle: Who Will Partner with Tesla First

- Economic Analysis of Solar Superchargers: The Significance of Grid Independence

*Source: [ 허니잼의 테슬라와 일론 ]

– 테슬라, 신규 업데이트에서 안전 요원 제거 가능성 시사! 로보택시 2배 확대 공식 발표!! 이제는 미국 거물 투자 전문 정치인마저 본격 테슬라 매수

● Rate Freeze, Currency Shock, Debt Timebomb

[Breaking News · Immediate Analysis] Bank of Korea Base Rate Held at 2.50%: A Comprehensive Summary of the Real Reasons for Not Raising Rates Despite Exchange Rate Instability, the 2025 Monetary Policy Calendar, the Won Weakness Caused by the M2 Gap, Non-Repatriation of Dollars by Exporters, Increased Overseas Pension Fund Holdings, and Variables in the AI/Semiconductor Cycle

Today’s article covers 1) the core logic behind holding the base rate, 2) the mechanism of why rates cannot be raised despite exchange rate instability, 3) the real background of the Korean won weakness (M2 growth rate gap, export companies not repatriating dollars, increased overseas share of pension funds), 4) the tug-of-war between real estate/household debt risks and rate decisions, 5) key points in the 2025 Korea-US monetary policy calendar along with exchange rate forecast levels, and 6) the impact of the AI server/semiconductor cycle on inflation and exchange rate forecasts.

It provides a consolidated overview covering both the “speed of money” and “liquidity path,” aspects that other news outlets rarely address.

1) Summary of the Decision: Base Rate Held at 2.50% with Revised Outlook

The Bank of Korea’s Monetary Policy Committee decided to hold the base rate at 2.50% in its final meeting of the year.

Although the Korea-US interest rate gap has narrowed due to the Fed’s consecutive rate cuts in September and October, the prevailing interpretation is that further adjustments were postponed in consideration of exchange rate volatility, real estate, and household debt.

Based on the Bank of Korea’s revised outlook (projection), economic growth rates are assumed to be 1.0% for 2025, 1.8% for 2026, and 1.9% for 2027, reflecting a downward trend.

Consumer price inflation is projected to converge around the target (2%) with 2.1% for 2025, 2.1% for 2026, and 2.0% for 2027.

The key themes include global economic slowdown, a held base rate, uncertainty over exchange rate forecasts, cooling inflation, and sluggish economic growth all coexisting.

2) Why Not Raise Rates Despite Exchange Rate Instability: Dissecting the Monetary Policy Mechanism

- Price Stability (Inflation) Aspect

Recent core inflation has been close to the target at approximately 2.2%.

Raising rates could overly suppress demand by further pressuring inflation unnecessarily. - Economic Stability Aspect

With the forecasted growth rate for 2025 at 1.0%, despite improvements in exports and facility investments, domestic consumption remains weak, and a rate hike could adversely affect the economy and employment. - The Dual Nature of Financial Stability

From an exchange rate stability perspective, a rate hike would be beneficial.

However, in Korea, where household debt and real estate leverage are highly sensitive, further hikes could intensify credit crunches and non-performing loan risks.

In conclusion, faced with a dilemma where inflation, growth, and finance send conflicting signals, the Bank of Korea opted for a holding decision as a strategy to buy time.

3) The True Trigger Behind the Won Weakness: Breaking Down External and Domestic Factors

- External Factors: The strong dollar effect is less about the dollar’s absolute strength and more about the relative weakness of the yen and the euro.

The weakness of the yen and the euro drives up the dollar index, thereby transferring weakness pressure to the won/dollar rate. - Domestic Factor 1 — The Changing “Path” of the Dollar (Corporate & Pension Funds)

Despite a current account surplus, there has been an increase in the proportion of export companies (in sectors such as semiconductors and automobiles) that do not immediately repatriate their earned dollars.

Pension funds and other institutions have been actively buying overseas stocks (mostly in the US), structurally increasing the demand for dollars relative to the won.

Frequent net selling of domestic stocks by foreigners has further pushed the exchange rate upward. - Domestic Factor 2 — The “Invisible Interest Rate” of the Liquidity Gap (M2 Growth Rate)

Based on recent figures, South Korea’s M2 growth rate is estimated to be around the 9% level, while that of the United States is around 5%.

Even with a holding of the nominal base rate, if liquidity in the market increases faster in Korea, the “value of money” in Korea gets diluted more quickly.

This gap explains the won weakness far more strongly than the interest rate differential. - One-Line Summary

It is not the interest rate differential but rather the combination of the liquidity speed (M2) + the flow of dollars (non-repatriation & overseas investments) + net foreign stock flows that is the core driver behind the won weakness.

4) Policy Tools Besides Interest Rates: Managing Exchange Rate, Liquidity, and Real Estate Together

- Exchange Rate Stabilization Package

Efforts include verbal intervention, market stabilization (smoothing), policy-driven dollar supply (e.g., via FX swaps with public funds and pension funds), and the use of external bonds and swap lines to mitigate sharp rises. - Liquidity Management

Measures such as the reserve requirement ratio, liquidity coverage ratio (LCR), and repo operations are used to slow down the pace of M2, which can run concurrently with a held rate stance.

Slowing down the pace of money without adjusting rates contributes to exchange rate stability. - Real Estate and Household Debt

Managing LTV, DSR, business loans, monitoring of PF exposures, and linkage measures between new and unsold units work to limit leverage and curb overheating of prices.

These act as auxiliary measures to secure financial stability without raising rates.

5) Key Points in the 2025 “Calendar-Style” Monetary Policy

- Bank of Korea

With 8 regular meetings spread through the year, if the exchange rate stabilizes in the 1,350–1,400 won range prior to the meetings in early January to early February, there is an option for further selective and gradual rate cuts.

Conversely, if the rate breaches the upper limit of 1,450 won and volatility increases, the likelihood is that the rate hold will be prolonged. - Federal Reserve (FOMC)

The Fed holds 8 meetings, which are scheduled for January, March, May, June, July, September, November, and December.

The pace of policy easing and the strength of balance sheet reduction (QT adjustments) by the Fed serve as key variables for dollar liquidity. - Scenario Levels

Base scenario: If the won/dollar stabilizes within the 1,350–1,420 won range, the Bank of Korea’s window for “selective and gradual” rate cuts opens.

Risk scenario: If the rate remains above 1,450 won with continued dollar strength, a prolonged hold with enhanced non-interest rate measures becomes the baseline.

Opportunity scenario: In the case of a recovery in the semiconductor sector and reconfirmation of export growth, exchange rate forecasts could drop to the 1,320–1,350 won range.

6) Real Estate and Household Debt: Why the Rate Hike Option Is Even More Difficult

- Asymmetry in Prices

Commercial properties are experiencing declines and vacancies, while residential prices are rising only in key areas like Seoul, with peripheral and regional areas performing weakly.

Equating overall housing prices directly with inflation makes it difficult to argue that inflation was overestimated. - Sensitivity Issue

Additional rate hikes would directly impact borrowers at the margin of DSR limits, self-employed individuals, and small importers.

The costs of a credit crunch could outweigh the benefits of exchange rate stability, which is a key reason behind the Bank of Korea’s decision to hold rates.

7) Signals from the AI/Semiconductor Cycle on Exchange Rates and Inflation

- Expansions in AI server and HPC investments support semiconductor exports and improve the trade balance, thereby bolstering the won’s strength.

At the same time, increased investments in power, data center infrastructure, and higher energy import demand could create offsetting pressures on inflation and the current account. - In conclusion, the AI super cycle presents a structure where the factors for a stronger won (exports) and a weaker won (energy and facility imports) collide, making volatility management crucial.

8) Key Points Not Frequently Mentioned Elsewhere

- The M2 growth rate gap explains the exchange rate better than the interest rate differential.

If money in Korea grows faster than in the US, even a held nominal base rate will lead to a quicker dilution of its value in Korea. - Even with a current account surplus, the exchange rate can rise due to blocked “return paths” for dollars.

This is caused by export companies not repatriating dollars, increased overseas allocations by pension funds/institutions, and frequent net selling by foreigners, all leaving dollars stranded abroad. - While rate hikes deliver immediate exchange rate stability, in Korea’s leveraged structure, the risk of a credit crisis can escalate rapidly.

Thus, non-interest rate measures to slow the pace of M2 become critical. - Regulatory adjustments for stablecoins and digital dollar frameworks are mid-to-long term variables that can change the global pipeline of dollar liquidity.

Korea needs to update its FX and capital inflow/outflow governance based on data to navigate the era of volatility flexibly.

9) Investment/Business Checklist (For Information Only)

- Import-dependent Small and Medium Enterprises: It is necessary to re-examine hedging policies (partial/divided) when the exchange rate reaches the upper range.

- Exporters: Timing of repatriation and management of the currency basket will be key in influencing performance volatility.

- Households: Managing DSR, sensitivity to variable rates, and maturity structure is a priority.

- Institutions: Re-assessing hedging costs, expected returns/volatility from dollar carry trades is crucial.

10) Conclusion: Holding Rates Is About “Buying Time”

Inflation is near the target level, economic growth is weak, and financial markets are sensitive to both exchange rate and real estate fluctuations.

The Bank of Korea has chosen to manage volatility using non-interest rate measures, planning to open a window for easing when the exchange rate settles in the 1,350–1,400 won range for the sake of both the economy and inflation.

While there remains a possibility for re-entry into the 1,350 won range driven by semiconductor recovery and controlled liquidity speed, a two-track approach is sensible that also accounts for the risk of renewed dollar strength pushing rates towards the upper limit of 1,450 won.

Appendix) Data Bookmark

- Economic Growth Rate & Inflation: Bank of Korea, Statistics Korea, export & semiconductor cycle co-leading indicators

- M2 Growth Rate: Korea-US monetary indicators (monthly), reserve requirement ratio, LCR disclosures

- Market Flows: Net foreign, institutional, and individual stock purchases, pension fund overseas allocation disclosures, corporate repatriation data

< Summary >

- The Bank of Korea holding the base rate at 2.50% reflects a strategy of “buying time” amid the dilemma of stable inflation, slowing growth, and heightened sensitivity in financial markets due to exchange rate and real estate risks.

- The core of exchange rate instability lies not in the interest rate gap but in the M2 growth rate gap, non-repatriation of dollars, increased overseas holdings by pension funds, and foreign market flows.

- Instead of adjusting rates, the policy framework centers on stabilizing the exchange rate, controlling the pace of liquidity, and managing real estate leverage.

- In 2025, if the won/dollar stabilizes within the 1,350–1,420 won box, there will be a selective and gradual easing window; conversely, if the rate repeatedly surpasses 1,450 won, a prolonged rate hold with non-interest rate measures is expected.

- The AI/semiconductor cycle presents a balancing act between export-driven won strength and pressures from increased energy and facility imports, making volatility management a key focus.

[Related Articles…]

Exchange Rate Forecast: 2025 Q1 Key Checkpoints and Box Scenario

Post-Rate Hold: Mapping Out the Risks in Real Estate and Household Debt

*Source: [ 경제 읽어주는 남자(김광석TV) ]

– [속보] 한국은행의 올해 마지막 기준금리 결정. 환율불안에도 금리인상 못하는 이유 [즉시분석]