● AI Boom Not Bubble, Big Tech Price Shock, Dollar Surge New Normal

2026 Stock Market, Exchange Rates, AI Trends: A High-Quality Summary in “5 Key Questions”

This article summarizes these five topics in “numbers and structure”:

1) Is AI a bubble or not (how it differs from the dot-com bubble).

2) Are Big Tech (M7) stocks truly expensive, and what do we see when we exclude the “Tesla factor”?

3) Will the US stock market rise or fall in 2026: The dynamics of interest rates, liquidity, and fiscal policy moving concurrently.

4) Why recession and inflation risks seem “smaller than anticipated.”

5) Why the 1,400 won exchange rate (USD/KRW) has become the new normal, despite strong exports.

And lastly, we’ll extract the “truly important points” often overlooked by other news/YouTube outlets.

1) Q1. Is AI a bubble? → “Unlike dot-com, demand is already evidenced by performance”

From the original perspective, AI is viewed more as “not a bubble.”

However, one must separate “market price overheating” from “technology/demand fiction.”

1-1. Core difference with the dot-com bubble: ‘Oversupply vs. Real Demand’

During the dot-com bubble, investment in telecommunications infrastructure and demand forecasts were vastly mismatched, and the proliferation of killer apps was slow.

This led to oversupply → price collapse → revenue breakdown → company bankruptcies.

In contrast, AI today has a structure that can be used instantly with just internet access, leading to a different rate of diffusion.

1-2. Where demand is confirmed by ‘data’ rather than ‘feelings’

The original point is this.

Half of American adults already use AI (50%).

Corporations utilize it even more (about 80%), and enterprise adoption (AX) progresses faster in large corporations.

1-3. Genuine demand evident in results: Rebound in cloud growth rates

AI investment demand eventually translates into cloud revenue.

The resurgence in growth rates of cloud leaders like Amazon, Google, and Microsoft serves as evidence despite a “mature market.”

This signals “AI is not just an event burning costs but is reshaping corporate spending structure.”

2) Q2. Are Big Tech (M7) stocks too expensive? → “Excluding Tesla changes the picture”

2-1. Illusion of the valuation premium: Tesla skews averages

One reason M7 valuations seem historically high is that Tesla’s high multiples distort the average.

Excluding Tesla, it can be interpreted as relatively approaching “historical lows.”

2-2. Core logic: “As share prices rise, earnings also grow”

In segments where Big Tech growth rates are more than double the S&P 500 average,

price-to-earnings might seem overvalued, but growth often justifies it.

Thus, from a 2026 perspective, “do not just look at valuations, consider earnings growth rates as well.”

Keywords frequently sought by readers naturally connect in this segment.

Expectations of rate cuts, inflation slowdown, US market outlook, dollar strength, semiconductor industry trends are among them.

3) Q3. Will the US stock market rise or fall in 2026? → “Policy combinations increase ‘bull market probability’”

3-1. The core of 2026 is whether ‘monetary policy + liquidity + fiscal policy’ align

The original text strongly emphasizes this combination.

Possible interest rate cuts (monetary policy) + liquidity provision (balance sheet/QE expectations) + fiscal expansion (government spending tendencies).

These three simultaneously elevate market multiples (valuations).

3-2. Differences between 2023 vs 2025, and the 2026 scenario

2023 was characterized by “valuations leading (expectation), with revenues trailing behind,”

2025 was seen as “earnings driving stock prices.”

And 2026 could see both occurring.

Growth in earnings and a policy environment supporting valuations.

3-3. Big Tech vs. Others: Earnings growth rate disparity remains crucial

In 2026, it’s estimated that Big Tech’s earnings growth rates will continue to surpass the market average,

and as long as that disparity persists, funds are likely to gravitate back to Big Tech.

However, there’s a warning about intensified distinguishing of firms genuinely earning from AI.

4) Q4. What about recession and inflation risks? → “Recession is ‘mild’, inflation ‘stable’ with emphasis”

4-1. Employment slows, consumption remains robust: ‘Gentle slowdown’ scenario

While a rising unemployment rate signals an economic slowdown,

it also gives the Fed “reason” to reduce rates.

The original text perceives this as more aligned with “mild slowdown + defense through rate cuts” than “severe recession.”

4-2. Why inflation is likely to stabilize

It interprets rising oil prices as constrained (production increases, potential oversupply),

and if combined with easing pressures on housing costs,

mentions the high possibility of headlining/core inflation stabilizing in the mid-2% range.

4-3. However, there is a long-term risk if AI rapidly causes unemployment

If AI replaces jobs on a mass scale and unemployment spikes, the scenario could change.

While the original text views this as unlikely in the short term by 2026, it remains a long-term risk.

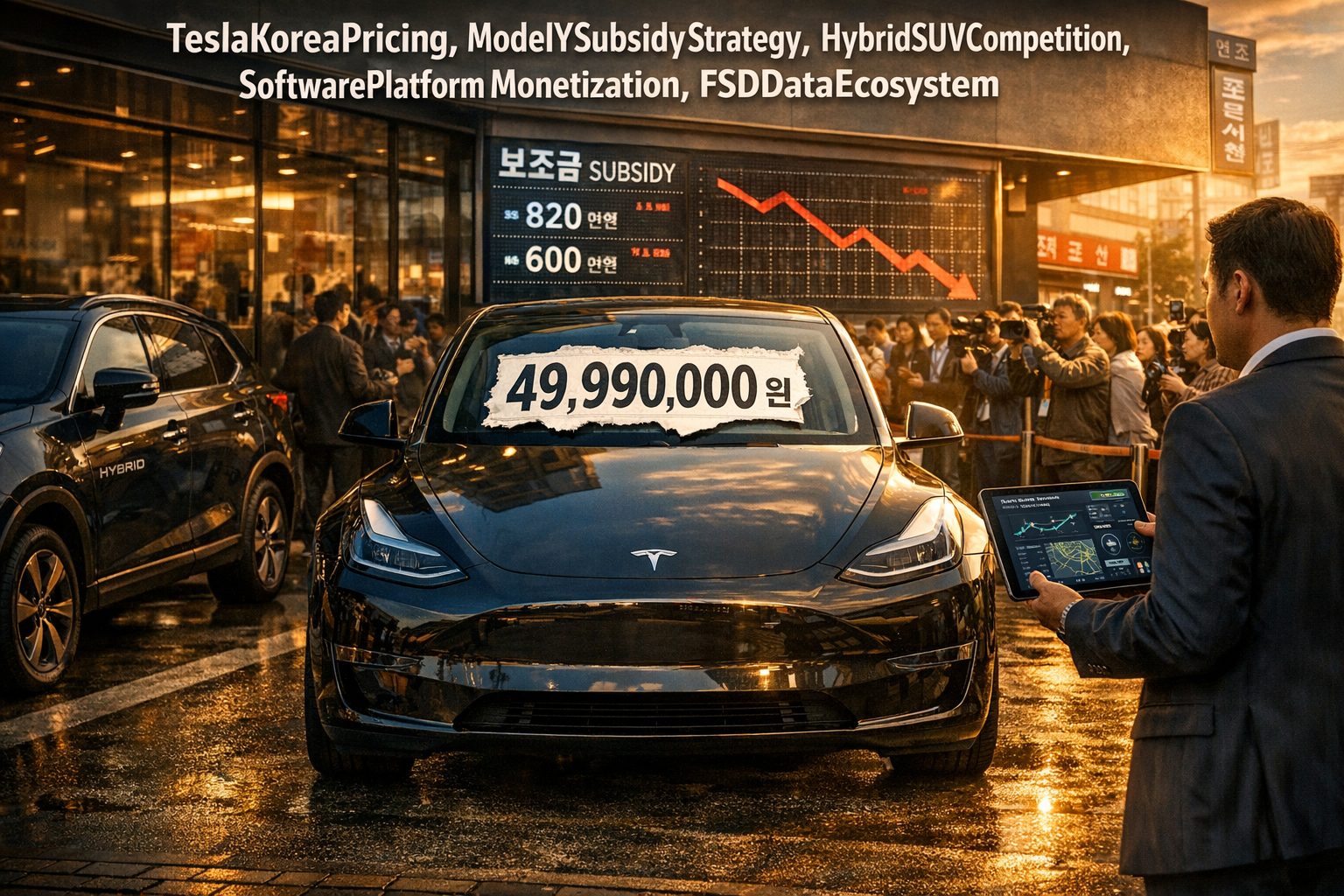

5) Q5. Will the exchange rate (USD/KRW) continue to rise? → “The structural reason why 1,400 won has become the new normal”

5-1. Core to “Why is the won weak when exports are strong?”: Corporate ‘de-wonization’

Usually, an increase in exports brings dollars domestically, converting into won and applying upward pressure on the won.

However, the original text points out the structure where “these dollars rarely convert to won.”

5-2. The mechanism of dollars not returning domestically

1) Expansion of foreign direct investment (FDI): Dollars earned from exports re-outflow via overseas investments.

2) Accumulation of retained earnings in overseas subsidiaries: Profits do not repatriate to Korea but are reinvested locally.

3) US investment/negotiation pressure: The likelihood of structurally maintained dollar demand in the future.

5-3. Conclusion: Exchange rates are more naturally “in the 1,400s range” than the “old 1,100s”

The original text views 1,400 won as the new normal, with likely fluctuations within that range.

Meaning, more so than short-term events (sentiment, supply-demand), the dominant force is “the structure of continuous dollar need.”

6) Important: Three Risk Scenarios That Could Break the Market

6-1. If Big Tech’s in-house chips replace GPU (especially Nvidia) demand

If the GPU supply-demand structure changes, winners in the AI value chain could also change.

6-2. If AI adoption/monetization is delayed longer than expected

If “trying but not profitable” persists, CAPEX might decline.

Moreover, if power bottlenecks (data center power/grid) materialize, growth rates can slow down.

6-3. Technological risks: Rapid rise of Chinese AI or Transformers’ scaling limits

If increasing operations yields dwindling performance improvements, the realization of ‘upside limitations’ could deflate premiums.

This isn’t just simple volatility but a “paradigm reevaluation” with extensive implications.

7) “Truly Important Points” Less Discussed by Other YouTube/News Outlets

7-1. The essence of 2026 is the “AI P/L battle,” not just ‘AI anticipation’

Market questions are distilled into one sentence now.

“Are you profiting from AI?”

2023 was dreams (valuation), 2025 was performance (earnings),

2026 is where ‘policies may open multiples’ but companies without real earnings are likely to face harsher filtering.

7-2. Understanding that ‘capital flow’ over ‘exports’ governs exchange rates is crucial

Individual investors tend to interpret exchange rates by exports/trade balance alone,

but the key takeaway from the original text is “the era when corporate dollars don’t convert to won.”

With this view, one can forecast USD/KRW with much less emotion.

7-3. The flaw in the 2026 bull market logic might be ‘power/infrastructure,’ not ‘prices’

Even if AI demand exists, if power, network, cooling, site, and permits get bottlenecked, supply could be constrained.

This is a variable that explodes in “physical reality” rather than through rate cuts or fiscal expansion.

8) Why CES connects here: The 2026 AI trend quickly emerges from ‘on-site products and partnerships.’

The original text views CES as the “fastest tech trend radar.”

Especially for 2026, AI seeps beyond software demos,

and infiltrates areas like PCs, smartphones, appliances, cars, robots, and healthcare in ‘productized’ forms,

increasing the likelihood of rapid exposure to partnerships (chip-cloud-manufacturing-distribution) at CES.

< Summary >

Unlike the dot-com bubble, AI is now in a phase where real demand is evidenced by indexes and performance.

Controversy over Big Tech’s overvaluation is mitigated when excluding Tesla; the core point is earnings rather than valuation.

The US stock market in 2026 could see combined improvement in multiples and performance due to rate cuts, liquidity, and fiscal expansion.

Recession aligns with mild slowdown, whereas concern over inflation diminishes with stable oil prices and housing costs.

Due to corporate de-wonization and capital flows, the USD/KRW exchange rate structurally trends towards 1,400 won as the new normal.

The real battleground is sorting companies actually profiting from AI in 2026.

[Related Articles…]

- The New Normal in Exchange Rates and Dollar Strength: 2026 Capital Flow Checkpoints

- Core to the AI Bubble Debate: Verified by Real Demand, Cloud, and Semiconductor Conditions

*Source: [ 월텍남 – 월스트리트 테크남 ]

– 숫자로 보여드릴게요 26년 전망 초고퀄 리포트 해석본 10분 요보여

● Real-Time Reality-Check Leadership Wins AI Wars

Qualifications of a Leader in the AI Era: “A Person Who Receives Field Signals in Real-Time” Changes: Organizational Survival Formula Seen Through NVIDIA, Moderna, and Salesforce

This article contains exactly 5 key takeaways.

1) Why NVIDIA collects real-time field information through ‘Weekly 5-Line Emails from All Employees’

2) The ‘Must-Win’ Question Frame Leaders Must Ask First in AI Transformation (AX)

3) The answer to performance management in the AI era: Redesigning KPIs from “sales volume” to “human time secured/value work focus rate”

4) Method to overcome organizational resistance: Designing urgency instead of triggering ‘anxiety’

5) Future Organizational Structure: The end of functional organizations and the shift to full-stack worker/AI agent team operations

1) News Briefing: Reconstructing the Core from a ‘Leadership/Organizational Operations’ Perspective

[Leadership] Why does NVIDIA make “5 things weekly” sent directly to the CEO?

It’s mentioned that NVIDIA employees send “5 important things in my work” emails to Jensen Huang weekly.

Although Jensen Huang cannot read all 30,000 emails, the core point is that they have created a structure where the leader receives real-time voices from the field.

This method is closer to ‘organization design’ to reduce information distortion and reporting omissions rather than mere communication.

[Strategy] The number one question the leader should ask in AI transformation

Instead of asking, “Will we adopt AI?”,

the first question is, “Where do we most need to achieve results with AI (must-win areas)?”

In manufacturing, candidates vary from predictive maintenance, process efficiency, to defect detection,

but in customer contact points, the priorities completely change to contact center automation/personalization.

Thus, while AI seems like an ‘enterprise-wide common task,’ it is actually an ‘industry/process-specific portfolio strategy.’

[Execution] The extent to which leaders use AI becomes a leading indicator of execution capability

The original text mentions how the CEO of Moderna uses ChatGPT 20 times a day as a daily KPI.

This is not just following a trend,

but emphasizes that the leader needs hands-on AI experience to issue practical work redesign in the organization.

[Performance Management] Salesforce has changed KPIs from ‘sales’ to ‘people’s time’

As AI automation increases, spare time emerges.

However, if KPI/reward systems do not change, employees may hide their free time (fearing more work) or simply waste it.

Like in the Salesforce case, KPIs must transition to indicators such as ‘human time secured,’ ‘value work focus rate,’ and ‘depth of customer relations’

to ensure AI’s productivity improvements lead to value creation.

[Resistance/Fear] The point of persuasion is not “My job will disappear” but “Will we survive in 5-10 years?”

Resistance to AI transformation largely starts from personal anxiety,

but the driving force leaders need to create is not individual fear but the organization’s ‘sense of urgency.’

They stated that to reduce resistance, the question “How does the method of working change in the future?” should be repeatedly shared within the organization.

[Organizational Structure] Functional organization (marketing/finance/HR) segmentation breaks, and teams operate with AI agents included

Moderna is integrating IT/HR,

and people plus AI agents are mentioned as being put in one team instead of functional silos.

NVIDIA’s approach of ‘openness (transparent meetings/field participation)’

aims to simultaneously improve decision-making speed and information quality.

[Future of Work] Spread of full-stack workers: The boundaries of planning/development/design are blurring

As AI increasingly handles 80-90%,

planners creating prototype-level outcomes, and designers touching on development is becoming more natural.

Ultimately, the “end of job categories (boundary collapse)” will become reality,

and organizational operations will be restructured not around job functions but ‘domain-centric (problem-centric).’

[Role of Humans] Human unique ability is compressed into ‘meaning assignment’ and ‘decision making’

As creativity and empathy are becoming areas AI excels in,

what remains is the role of defining “what to do and why” (meaning assignment),

and making decisions and taking responsibility in the face of incomplete information (decision making).

2) Grouping: What Leaders Should Change Immediately in the AI Era

A. Strategy: Define the ‘Battlefield to Win with AI’ rather than simply adopting AI

– Narrow down Must-Win areas to 1-3.

– Candidates are quickly organized by breaking down into axes like “customer experience/operational efficiency/risk management/revenue conversion.”

– Especially now, explaining AI investment effectiveness (ROI) to the board/market has become crucial, heightening the importance of prioritization.

B. Execution: The organization only moves when the leader uses AI directly

– If the leader is at a “never used it” state, the field will always be cautious.

– Simple KPIs such as ‘using it several times a day’ may seem outdated but are potent execution mechanisms initially.

– The important aspect isn’t the frequency of tool use, but measuring “how AI has accelerated my work’s decision-making processes.”

C. Performance Management: Shift KPIs from ‘outputs’ to ‘time/relationships/value’

– Human time secured: How much time was created through automation?

– Value work focus rate: Was the secured time used for truly important tasks (planning/customer/risk)?

– Depth of customer relations: Was trust/repeat purchase/loyalty strengthened at customer contact points?

These KPIs need to be in place to connect AI from “work automation show” to “productivity improvement→enterprise value increase.”

D. Organization: A pipeline that brings field signals ‘without distortion’ is competitiveness

– The core of NVIDIA’s email example lies not in communication but in “information quality management.”

– Once middle reporting distorts 60% of information, a leader’s judgment is invariably delayed and skewed.

– The solution is to simplify the rules with “direct field-channel + standard template (5 items),” like in the NVIDIA model.

E. Talent/Skills: The basic configuration is full-stack workers combined with domain expertise

– In the future, “one job for life” will cease; roles will reconfigure around problem units.

– Individuals who understand the domain (industry/customer/regulation/data context) will leverage AI significantly.

– Reskilling is not optional but a condition for job security, and corporate messages, like at Walmart, are changing accordingly.

3) The ‘Truly Important Points’ Not Well Covered in Other YouTube/News

1) “All employees emailing the CEO” is not a communication culture, but creating an ‘information market’

The NVIDIA case is not a touching story,

but a structure making internal information rise competitively.

The statement, “Perhaps the CEO will read it, so write with care,”

is an incentive scheme designed to elevate the quality from the information producers.

So it’s closer to ‘system design’ rather than leadership.

2) The core resistance to AI transformation comes from ‘performance reward systems,’ not ‘technology’

It’s not that people are not using AI,

but rather that there’s no reward for time saved through AI and work only increases, so they conceal it.

Hence, if KPIs are not changed, AI adoption will only amplify internal distrust.

This point is the real bottleneck and also the quickest shortcut.

3) Functional Organization Integration (IT+HR, etc.) is a ‘learning speed’ race, not merely cost-cutting

Many companies understand integration as “slimming down,” but

If people (skills) and systems (data/tools) are separated,

the learning speed slows, eventually trailing in competition.

4) It’s not “Go to the Field” but “Where I Am is the Field” that’s needed

Separating field/headquarters, digital/business increases failure risk like GE Predix.

AI particularly yields results by attaching to processes,

but if the organization is divided, data, responsibility, and improvement are disconnected.

5) Human uniqueness shifts from ‘creativity’ to ‘meaning selection’

In an era where AI executes empathy and coaching fairly well,

what humans uniquely maintain is determining “what goals to set and why they are important.”

Ultimately, the main role of leaders reverts to ‘meaning assigners,’

and this importance has multiplied due to AI.

4) Analysis from an Economic & Business Perspective: Why This Leadership Has Become Important ‘Now’

Recent corporate environments have complicated decision-making due to overlapping interest rate fluctuations, supply chain reconfigurations, and geopolitical risks.

With generative AI redesigning workflows, organizations must move “faster, and more accurately.”

Ultimately, leadership competitiveness is redefined not by intuition,

but by the ability to quickly gather field signals, change behaviors through KPI alteration, and prove investment effectiveness (ROI).

This extends beyond the digital transformation of a company to AI transformation (AX) itself.

5) Practical Checklist: What Our Company Leaders Should Do First

Step 1. Select 3 Must-Win Areas

– Customer: Identify whether ‘counseling/sales/churn prevention’ is the ‘most profitable’

– Operations: Identify whether ‘defects/inventory/delivery’ is the ‘most painful’

– Risk: Identify whether ‘regulation/security/quality’ is the ‘most dangerous’

Step 2. Transition KPIs to Two Levels

– Level 1 (Productivity): Time secured by automation, throughput, lead time reduction

– Level 2 (Value): Customer value created with that time, revenue conversion, quality improvement

Following the Salesforce model, it is crucial to include metrics on “human time.”

Step 3. Establish Field Signal Pipeline (Adapting NVIDIA Method)

– Weekly, employ a company-wide standard template “Top 5 Changes/Risks/Opportunities in My Work”

– Operate a ‘direct’ channel alongside the executive reporting line

– Even if unread, sustainability is ensured through summaries/tagging systems (using AI to summarize)

Step 4. Execute Leader’s ‘Intellectual Honesty’ Operating Rules

– Stating “I don’t know” is not a weakness but rather an update speed.

– Organizations where opposing opinions/uncomfortable data ascend quickly ultimately win.

< Summary >

The essence of the NVIDIA example is not communication but a system to collect ‘field signals without distortion.’

AI transformation (AX) hinges not on technological adoption but on selecting must-win areas and redesigning KPIs.

Like Salesforce, performance indicators should shift from “sales” to “human time/value work/customer relationships” for positive AI ROI.

Reduce organizational resistance by creating urgency rather than fear.

The future organization sees the decline of functional organizations, transitioning to structures where full-stack workers and AI agents operate as a team.

The role of humans in ‘meaning assignment and decision-making’ becomes more crucial.

[Related Articles…]

The Difference in Organizational Operations by NVIDIA and Jensen Huang’s Leadership

Redefining KPI in the AX (AI Transformation) Era: The One Thing More Important Than Productivity

*Source: [ 티타임즈TV ]

– AI시대 리더의 자격은? (변형균 퓨처웨이브 대표)

● Recession Panic, Rate Shock, Market Whiplash

Habits That Could Cause Hair Loss: Worst Hair Washing Practices Summarized: Lukewarm Water, Pre-Wash, Rinsing, Scalp Dryness, Medication/Transplant Explained

Today’s article includes “Shampoo Routine You Can Implement Immediately to Delay Genetic Hair Loss,” “The One Thing That Worsens Scalp Fungus and Inflammation Despite Good Hair Washing,” “The Common Traits of Those for Whom Hair Loss Medication is Ineffective, and Criteria for Choosing Between Medication vs. Hair Transplants,” and, although briefly mentioned in the video, the most important aspect: “Priority Management of Scalp Environment (Inflammation, Humidity, Irritation).” After reading, you’ll change the way you shower tonight.

1) Core News Briefing: “Hair Loss is Genetic, But Daily Habits Determine the Speed”

Hong, a director with 12-13 years of experience in hair transplantation and hair loss treatment, conveys this in one sentence: “Men’s pattern baldness (genetic) can’t be treated just by washing hair, but dirty scalp and inflammation speed up hair loss.”

In short, understanding the structure as genetic causes + daily habits as an accelerator is the clearest approach. This perspective is much like current market discussions on risk management. You can’t change the cause, but you can control the factors that worsen it.

2) Top Worst Hair Washing Habits: “Damaging Points Despite Having Washed Hair”

2-1. Using Hot Water (Over 40°C) to Strip Oil

Hot water might feel refreshing and cleansing, but it can lead to protein denaturation in hair, scalp drying, and excessive sebum production.

Recommendation: Use lukewarm water (about 37-38°C) that feels like body temperature when you touch it.

2-2. Skipping Pre-Wash and Going Straight to Shampooing

Applying shampoo directly on a scalp/hair full of dirt reduces efficiency. Just like washing dishes, soaking and rinsing off residues first helps the shampoo focus on cleaning the scalp.

Recommendation: If there’s a lot of residue, pre-rinse with water for 1 minute. For less residue, at least 30 seconds.

2-3. Scratching with Fingernails (Micro-Scalp Injury → Inflammation Route)

The scalp is more sensitive than you think, and nail pressure can cause injuries leading to inflammation, which can negatively impact hair loss.

Recommendation: Gently massage with your fingertips.

2-4. Leaving Shampoo Lather On + Hasty Rinsing

The saying “what matters is removing shampoo rather than applying it” is quite impactful. Leaving shampoo residues on the scalp can cause chemical irritation leading to inflammation.

Recommendation: Rinse for 1-3 minutes (varies by individual) and press the scalp to remove residue.

2-5. Going to Bed with Wet Hair Due to Laziness in Drying

This is the “heaven for mold” point mentioned in the video. If you only dry your hair and leave the scalp damp, the scalp’s microbial environment worsens, increasing the risk of irritation/inflammation.

Recommendation: Completely dry the scalp. Cool air is relatively safer than hot air.

3) Correct Shampoo Routine: “Follow This Rudimentary Checklist for Better Results”

Here’s a restructured version of the original content in ‘execution order’.

- ① Water temperature: Lukewarm (37-38°C)

- ② Pre-wash rinse: 30 seconds – 1 minute

- ③ Shampoo amount: One pump for men (adjust based on individual hair length)

- ④ Create ample lather, then scalp massage (using fingertips)

- ⑤ Brush: Aids in removing sebum/residue but avoid ‘over-stimulation’

- ⑥ Avoid combing while wet (leads to weakened hair and damage)

- ⑦ Rinse for 1-3 minutes + massage scalp while removing residues

- ⑧ When rinsing, bend head to prevent foam from running onto face (prevents breakouts)

- ⑨ Choose shampoo suited to scalp type (pricey isn’t always better)

- ⑩ Completely dry scalp (preferably using cool air)

4) Dyeing, Bleaching, Perms, Hats: “True Causes vs Misunderstandings” Explained

4-1. Are Dyeing/Perms Directly Causing Hair Loss?

The director’s opinion is clear. Generally okay if done at regular intervals (e.g., perms every 3 months), but excessively frequent bleaching/perms (e.g., every 2 weeks or 2-3 times a month) can strain the scalp/hair.

4-2. Hats Cause Hair Loss?

Hats are not the root cause; poor ventilation/hygiene can deteriorate scalp health, so “occasional ventilation” is key.

5) Key Points on Hair Loss Medication: “Fear of Side Effects is Often a Greater Loss than Simply Not Taking It”

5-1. A Realistic View on the Fear of Side Effects

Commonly feared side effects (reduced libido, decreased ejaculation volume, etc.) are mentioned at “1-2%”. Some might adjust after 1-2 months, or balance out after stopping and restarting.

The key point is this: “If fear of side effects stops you from even trying, you’ll certainly have to bear the cost of progressing hair loss.” This mirrors the current financial environment where delaying long-term investment due to volatilities in interest rates/inflation results in missed opportunities.

5-2. “Do I Have to Take It for Life?” Answered

The director advises, “Start with 6 months.” 6 months → monitor changes/side effects → adjust incrementally every 6 months. In the realm of aesthetics, it’s about managing within what one can handle.

5-3. Medication’s Effect: “It Doesn’t Grow New Hair, Thickens Thinning Hair”

The core point was well-explained. Hair doesn’t suddenly disappear from a thickness level of 10 (healthy) to 0 (bald); it thins from 9→8→7… Medication might not restore 5 to 10 but can ‘recover’ it to 6~7. Conversely, without it, it goes from 1→0.

5-4. The Meaning of “Some People Won’t Benefit from Medication” (in the video context)

The context is that “once follicles are gone, it’s hard for replacements in bald areas (especially forehead/M-shaped hairlines) to grow anew with medication.” In short, if peach fuzz/fine hair remains, medication has a better chance; completely bare lines make medication inefficient.

Keep in mind, personal condition/contraindications are crucial for medication choice, so professional consultation is recommended.

6) Hair Transplant vs. Medication: “Optimal Solutions Vary by Area”

The criteria provided by the director are practical.

- Crown: Medication often proves efficient

- M-shaped/Frontal Hairline: Medication might be less effective, thus surgery could be more efficient

6-1. Two Crucial Points in Transplant Design (Know Before Spending Money)

- “Avoid excessively lowering the hairline” (creating a reasonable line as much as hair has receded)

- “Focus not only on smooth bald areas but also intersperse transplants among existing hair”

This is important because, even if existing hair further thins, transplanted hairs act as cushions, preventing the appearance of distinct separation. In modern terms, it’s like the diversified investment concept in a portfolio.

6-2. Why Medication Is Important Even After Transplant

Transplanting doesn’t act as a “stop button” for genetic hair loss progression. To preserve remaining natural hair, medication must continue alongside the transplant.

7) “The Real Important Content” Often Left Unsaid in Other YouTube/News (My Summary)

The hidden core takeaway from this video isn’t “recommendation of shampoo products,” but maintaining the scalp environment to minimize infection/inflammation incidence.

- The acceleration pedal of hair loss is often ‘humidity+irritation+residues’ → Untreated wet scalp, lack of rinsing, nail irritation function as a team.

- Criteria for Medication/Transplant Choice Is ‘Are There Remaining Hair Follicles (Reversible Zone) vs. Absence of Follicles (Irreversible Zone)’ → People only ponder “Am I bald?”, but doctors assess “Are there still recoverable follicles?”

- The purpose of maintenance is ‘speed regulation’ over ‘complete cure’ → Those who start care in their 20s – 30s appear different in their 40s, which is fundamentally the compound interest concept over time. Like current structural changes in the macroeconomy, it’s ultimately a battle of time.

- Better ROI comes from having a “cleansing-rinsing-drying routine suited to my scalp type” over expensive shampoos → This closely resembles a ‘productivity’ strategy of reducing fixed costs and improving efficiency.

< Summary >

Using lukewarm water (37-38°C), pre-rinse for 30 seconds to 1 minute, massage the scalp with fingertips while shampooing, and rinse thoroughly for 1-3 minutes. Avoiding fingernail irritation, sleeping with wet hair, and leaving the scalp damp are crucial as they may lead to inflammation/trouble. Dyeing/hats are not ‘root causes’ but rather excess frequency and scalp environment are concerns. Medication thickens thinning hair to slow progression, and transplants could be more efficient for follicle-lacking M-shaped/frontal areas.

[Related Articles…]

- Hair Loss Management Routines: Key Insights from Scalp Habits to Medication Choices

- Essential Checklist Before Hair Transplant: Hairline, Density, Post-Operation Care

*Source: [ 지식인사이드 ]

– 없던 탈모도 생기는 최악의 머리감기 습관 (탈모의사 홍원장 1부)